The winds of change are swirling round Ethereum (ETH), the world’s second-largest cryptocurrency. Whereas the Ethereum community itself is buzzing with exercise, the value of ETH has taken a tumble in latest days, leaving traders scratching their heads.

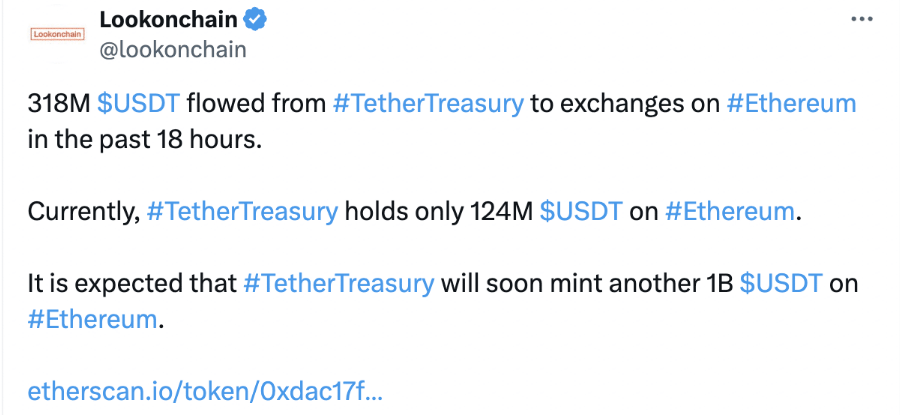

A glimmer of hope emerged with Tether’s (USDT) latest motion. Tether, the issuer of the world’s hottest stablecoin pegged to the US greenback, transferred a whopping $318 million value of USDT from its treasury pockets on to exchanges on the Ethereum community.

Supply: X

This outflow suggests potential anticipation of elevated demand for USDT, which might, in flip, sign rising investor curiosity within the broader cryptocurrency market.

Traditionally, Tether has minted massive quantities of USDT in periods of heightened crypto exercise, and the rumor mill now churns with hypothesis that one other billion USDT may quickly be minted particularly on Ethereum.

Nevertheless, analysts warning in opposition to blind optimism. Whereas a rise in USDT exercise might bode effectively for Ethereum, it’s not a assured path to prosperity.

Different blockchains, like Tron, are additionally able to dealing with USDT transactions, providing traders various avenues.

Whole crypto market cap is presently at $2.289 trillion. Chart: TradingView

Worth Woes And Investor Sentiment

In the meantime, the value of ETH has stubbornly refused to cooperate. As of right this moment, ETH is buying and selling beneath the essential $3,000 mark, having dropped by almost 3% within the final 24 hours.

Ethereum has misplaced 11% of its worth within the final seven days, information from Coingecko reveals.

Associated Studying: Toncoin Unleashes DeFi Monster Development: TVL Soars 300% In A Month

An extra value drop beneath $3,000 might set off panic promoting, exacerbating the downward spiral.

The present scenario presents a fancy image for Ethereum. Whereas Tether’s latest transfer and regular community exercise supply slivers of optimism, the declining value and NFT market correction paint a contrasting image.

A Hive Of Exercise Regardless of Stress On Worth

Whereas the value of ETH is likely to be feeling the warmth, the Ethereum community itself is buzzing with exercise. In contrast to the latest hunch within the NFT (Non-Fungible Token) market, general community utilization has remained remarkably constant.

This means a shift in focus inside the Ethereum ecosystem. Whereas the flamboyant world of NFTs is likely to be experiencing a brief correction, different sectors inside Ethereum are choosing up the slack.

The rise in DeFi (Decentralized Finance) transactions, stablecoin swaps, and normal token exercise may very well be the hidden forces preserving the community busy.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site totally at your personal danger.