- Altcoins have skilled vital sell-offs, however indicators of a possible rebound are rising.

- The altcoins’ market faces challenges however might rally with macroeconomic stabilization and elevated liquidity.

The market has taken a pointy downturn, with billions wiped off the desk in hours and hopes for a near-term altcoin season fading. Nonetheless, some analysts stay optimistic, arguing that the cycle’s peak should be forward.

They level to historic patterns and present market dynamics suggesting the market’s upward trajectory might not have reached its ceiling but.

As volatility continues, the large query stays: Are we witnessing the beginning of an extended bear market, or is there nonetheless room for extra development earlier than the inevitable correction units in?

Altcoins in 2025: Insights into the sell-offs

The altcoin market in 2025 has been marked by volatility, with current information revealing a pointy downturn in market cap.

This steep decline highlights mounting promoting stress throughout main altcoins, pushed by bearish sentiment and decreased liquidity.

RSI ranges for altcoins have dipped to 29.37, signaling oversold situations and hinting on the potential for a technical rebound.

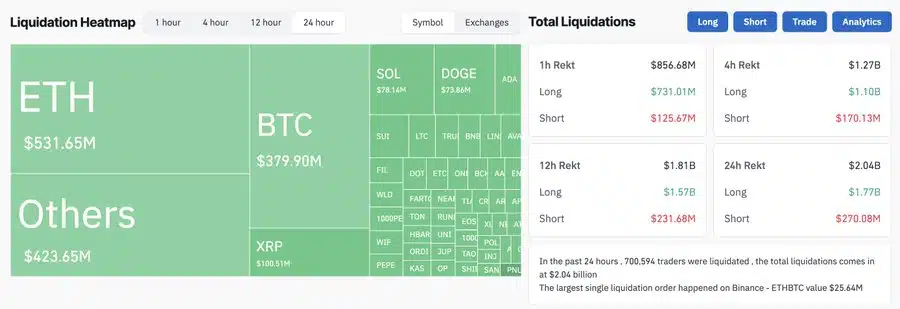

Throughout Sunday’s sell-offs, Ethereum’s [ETH] dominated liquidations with $531.65 million, adopted by different altcoins at $423.65 million, considerably surpassing Bitcoin’s [BTC] $379.90 million.

Key tokens like Solana[SOL] and Dogecoin [DOGE] skilled heavy liquidations, displaying heightened vulnerability. Whole liquidations over 24 hours reached $2.04 billion, with $1.57 billion from lengthy positions, reflecting overly bullish trades.