- BNB has fallen under its 200-day Shifting Common and is prone to face resistance at $600-$615.

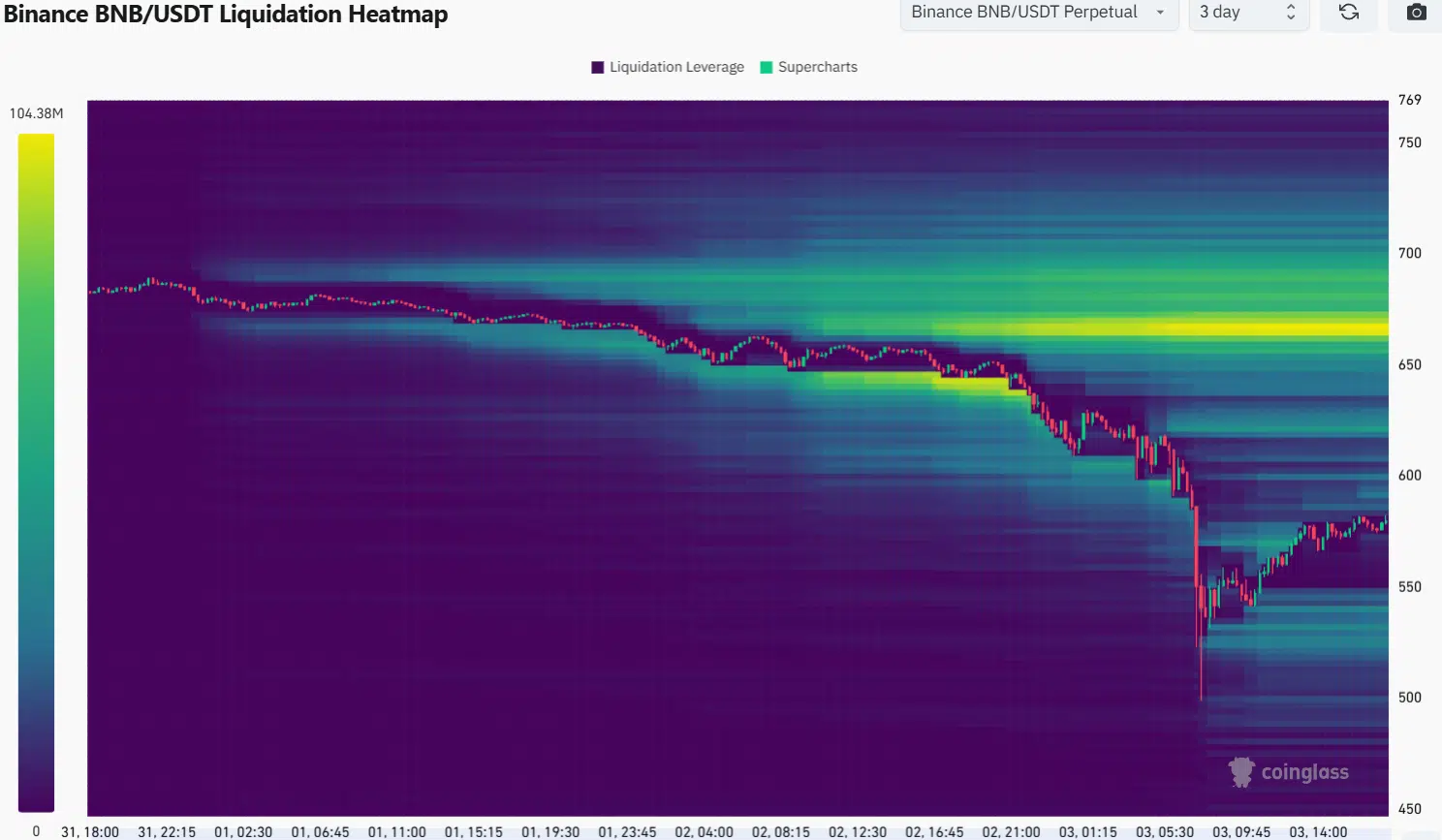

- The three-day liquidation heatmap revealed a possible retest of the $525 space earlier than a worth bounce.

Binance Coin [BNB] has a firmly bearish sentiment within the short-term. That is unsurprising given the swift losses previously 72 hours.

Because the thirty first of January, BNB has dipped by 15.6%, because the losses within the U.S. market have deeply affected the crypto sphere.

BNB was buying and selling just under the $600 degree that had been a resistance zone from July to November 2024. The extreme short-term losses mixed with persistent promoting strain in current weeks meant that the change token was unlikely to make a fast restoration.

BNB sinks under 200-day Shifting Common

The market construction turned bearish after the breach of the $649 degree on the 2nd of February. Since breaking this degree, BNB has descended one other 23% to succeed in $500 earlier than bouncing to $580. The bounce from the native lows was fast, however not accompanied by heavy demand.

The OBV has been trending downward since mid-December, signifying elevated promoting strain. This pattern has been noticed for a lot of large-cap altcoins. The market-wide bearishness will not be conducive to a fast restoration.

Buyers can watch for a couple of days and observe potential vary formation. Accumulation indicators might inform patrons if bidding for Binance Coin could possibly be worthwhile within the medium to long run.

Within the short-term, one other drop under $550 appears seemingly. The value tends to float towards the native lows at $500, though it’s unclear if it would attain that degree once more.

The build-up of liquidity round $525-$540 over the previous ten hours suggests a dip to this space is feasible. It could possibly be adopted by a bullish reversal, concentrating on the following magnetic zone at $620.

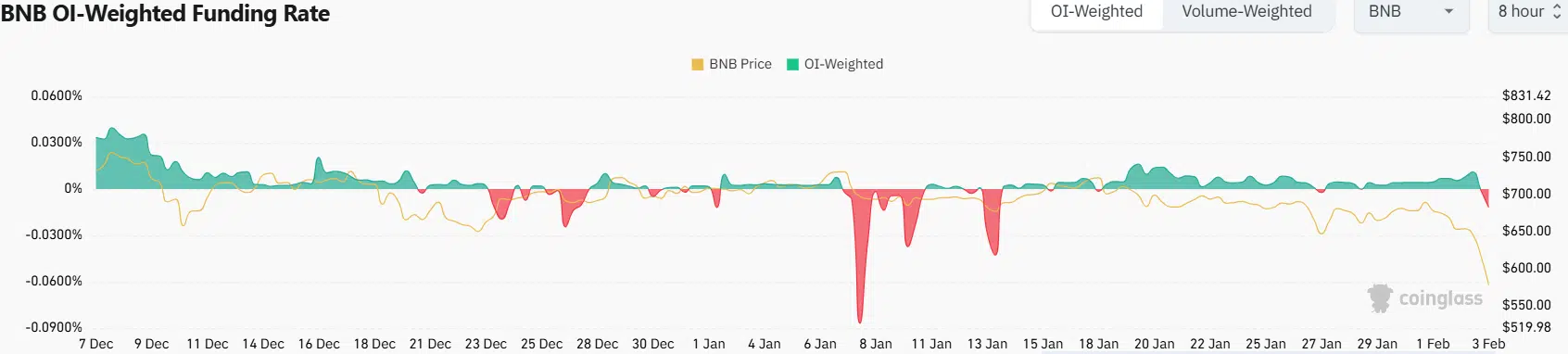

The Open Curiosity-Weighted Funding Price throughout exchanges dived into adverse territory as soon as once more. It had finished so on the eighth and the thirteenth of January.

On these days, the value had dipped 3-5% earlier than bouncing greater.

Learn Binance Coin’s [BNB] Worth Prediction 2025-26

The inflow of late short-sellers might kind the liquidity overhead that will entice costs. This volatility presents decrease timeframe merchants loads of alternatives however would current difficult and risky situations for swing merchants.

Due to this fact, permitting one other day or two for liquidity pockets to be established earlier than buying and selling them could possibly be a good suggestion for some market contributors.