- Bitcoin’s reactivated misplaced cash recommend that the bull market could also be coming into its closing part.

- An important assist at $97,190 may decide Bitcoin’s subsequent strikes.

Bitcoin’s [BTC] bull market is coming into a crucial juncture, with indicators suggesting {that a} main turning level could possibly be simply across the nook.

In latest months, we’ve seen a notable surge in exercise, as once-dormant Bitcoin addresses come again to life — an occasion typically seen throughout robust bullish traits.

This reactivation of beforehand “lost” cash is fueling hypothesis that Bitcoin is gearing up for its subsequent huge transfer.

Concurrently, key indicators are highlighting an important assist stage at $97,190 — one which Bitcoin should keep if this rally is to proceed.

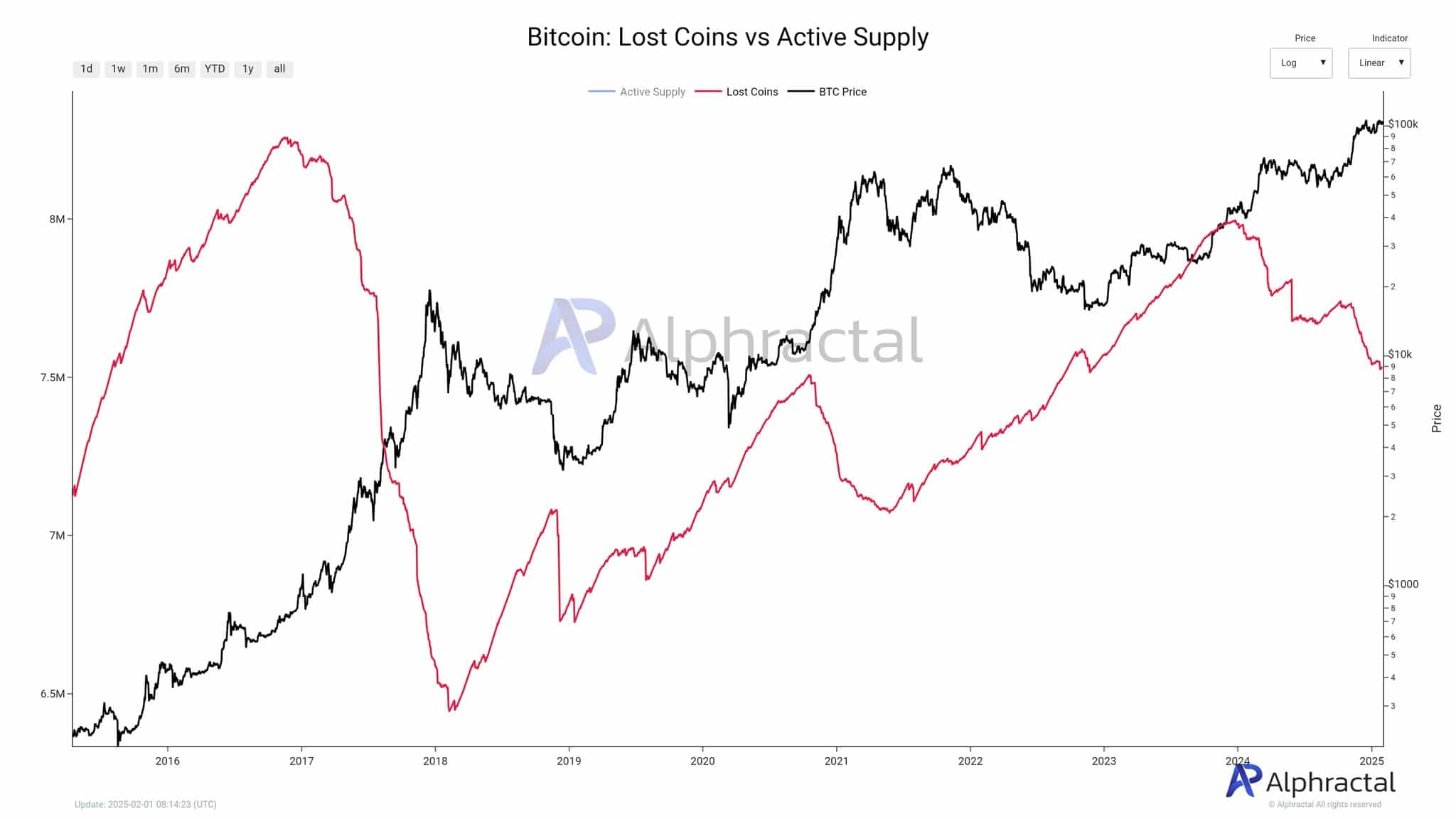

Misplaced cash are returning

Misplaced cash confer with BTC that has been dormant for years, typically held by early traders or whales who both forgot or selected to not transfer their property.

When these cash begin shifting once more, it alerts that long-term holders could also be making ready to take income or alter their positions.

Traditionally, this reactivation has aligned with main bullish phases, indicating a possible shift towards the ultimate leg of the bull run.

The information illustrates this phenomenon, exhibiting how misplaced cash have gotten energetic as soon as extra. This habits has persistently aligned with Bitcoin’s most explosive worth runs.

Over the previous a number of months, Bitcoin’s worth has continued to climb, pushing towards new all-time highs. Nevertheless, as seen in earlier cycles, the ultimate part of a bull market typically comes with heightened volatility.

If beforehand inactive BTC holders start promoting in giant volumes, this might introduce short-term downward stress earlier than the market resumes its upward trajectory.

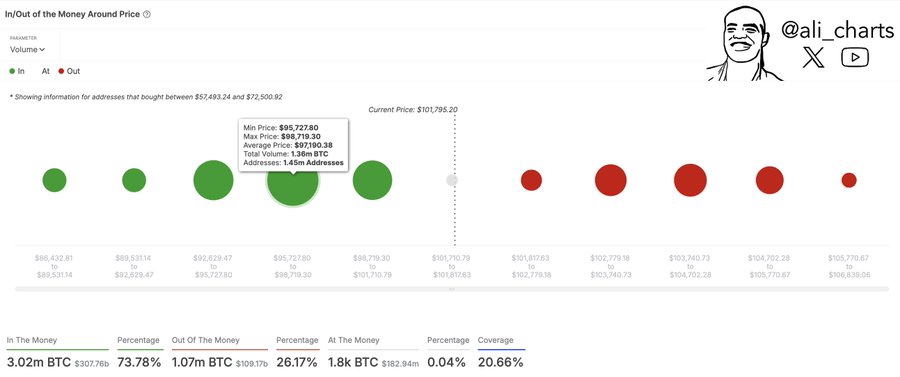

$97,190: The road within the sand for Bitcoin’s bull market

Crypto analyst Ali Martinez has identified that $97,190 is an important assist stage for Bitcoin. On-chain knowledge reveals that this stage represents a major cluster of BTC holdings.

Roughly 1.45 million addresses acquired BTC between $95,772 and $98,719, with a complete quantity of 138k BTC.

If Bitcoin stays above this zone, the uptrend is prone to proceed, as these holders are unlikely to promote at a loss.

Nevertheless, if BTC breaks under this stage, it may set off a wave of promoting stress from these traders, resulting in a steeper correction.

This makes $97,190 a psychological and technical stage to observe within the coming weeks.

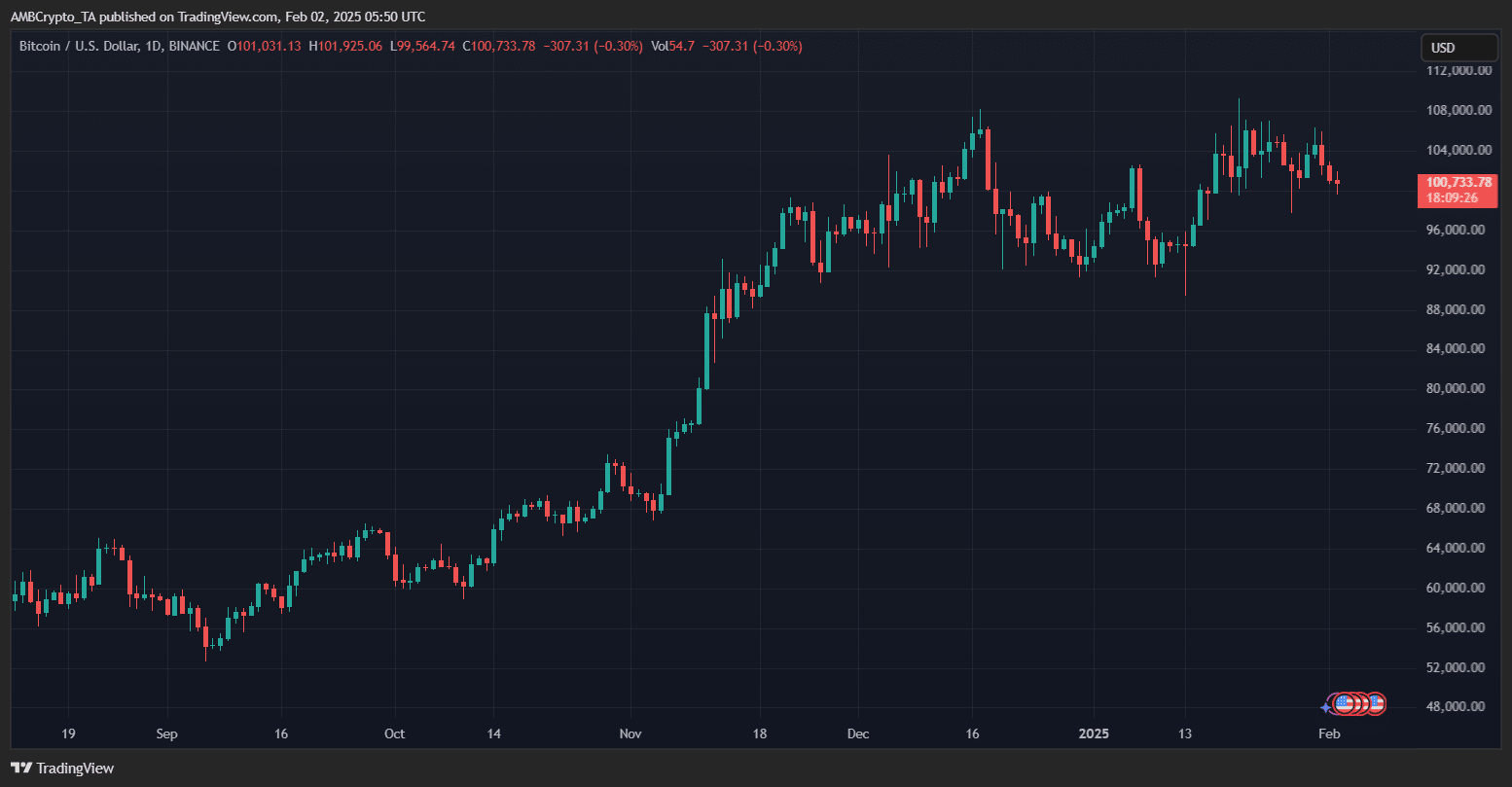

Market construction and key resistance ranges

Taking a look at Bitcoin’s worth chart, we will see that BTC has been in a robust uptrend, with larger highs and better lows.

The king coin was buying and selling at $100,733 at press time, dealing with minor resistance within the $104,000–$108,000 vary.

A clear breakout above these ranges may open the door to a brand new worth discovery part, with BTC probably concentrating on $120,000 and past.

Alternatively, if Bitcoin struggles to interrupt resistance and loses momentum, we may see a short-term pullback towards $97,190.

Learn Bitcoin’s [BTC] Worth Prediction 2025-26

A break under this stage would possibly check decrease assist zones round $92,000 and $88,000, the place giant shopping for curiosity exists.

For now, all eyes are on Bitcoin’s worth motion, because the market decides its subsequent transfer.