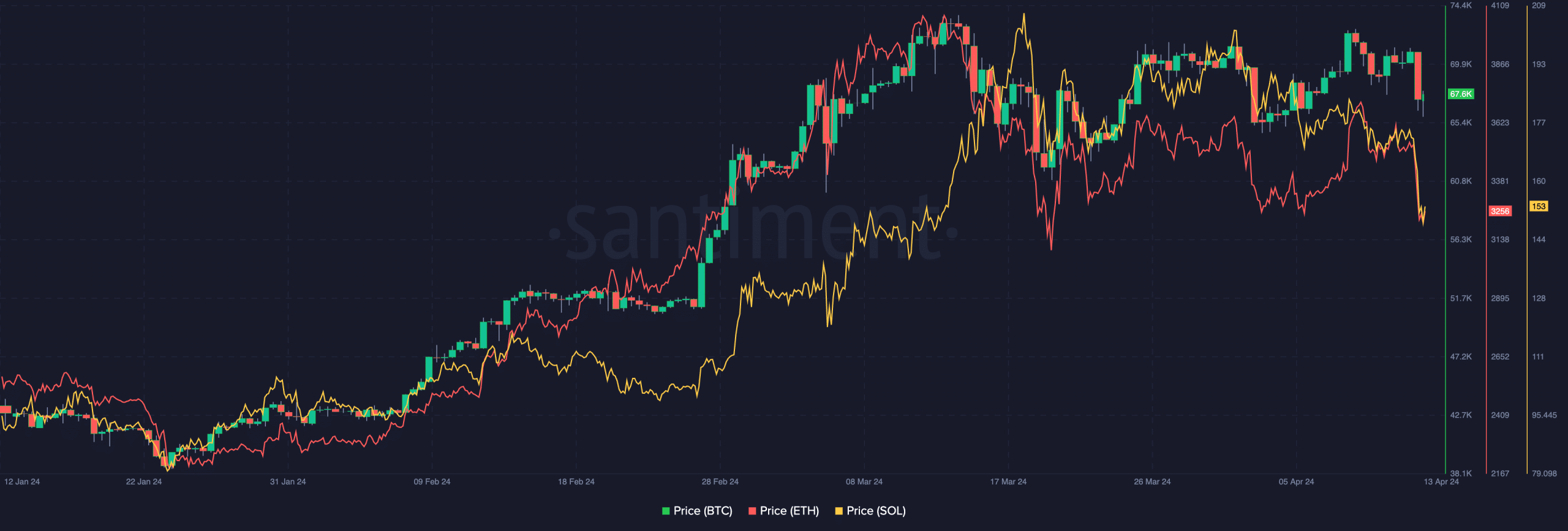

- Bitcoin, Ethereum, and Solana fell important on the value charts

- Virtually $1 billion price of positions have been liquidated within the final 24 hours

Following a surge in its worth over the previous week, Bitcoin [BTC] recorded a major correction over the past 24 hours. Over the stated interval, the cryptocurrency’s worth fell by 4.95%, with BTC buying and selling at $67,829.94 on the time of writing. Bitcoin fell on the again of conventional markets tanking owing to the geopolitical uncertainty related to Iran presumably attacking Israel. Accordingly, each the S&P500 and Nasdaq fell, with the worth of conventional secure havens like gold appreciating.

The decline in Bitcoin’s worth had a cascading impact, resulting in different cryptocurrencies depreciating on the charts too as nicely.

One other one bites the mud

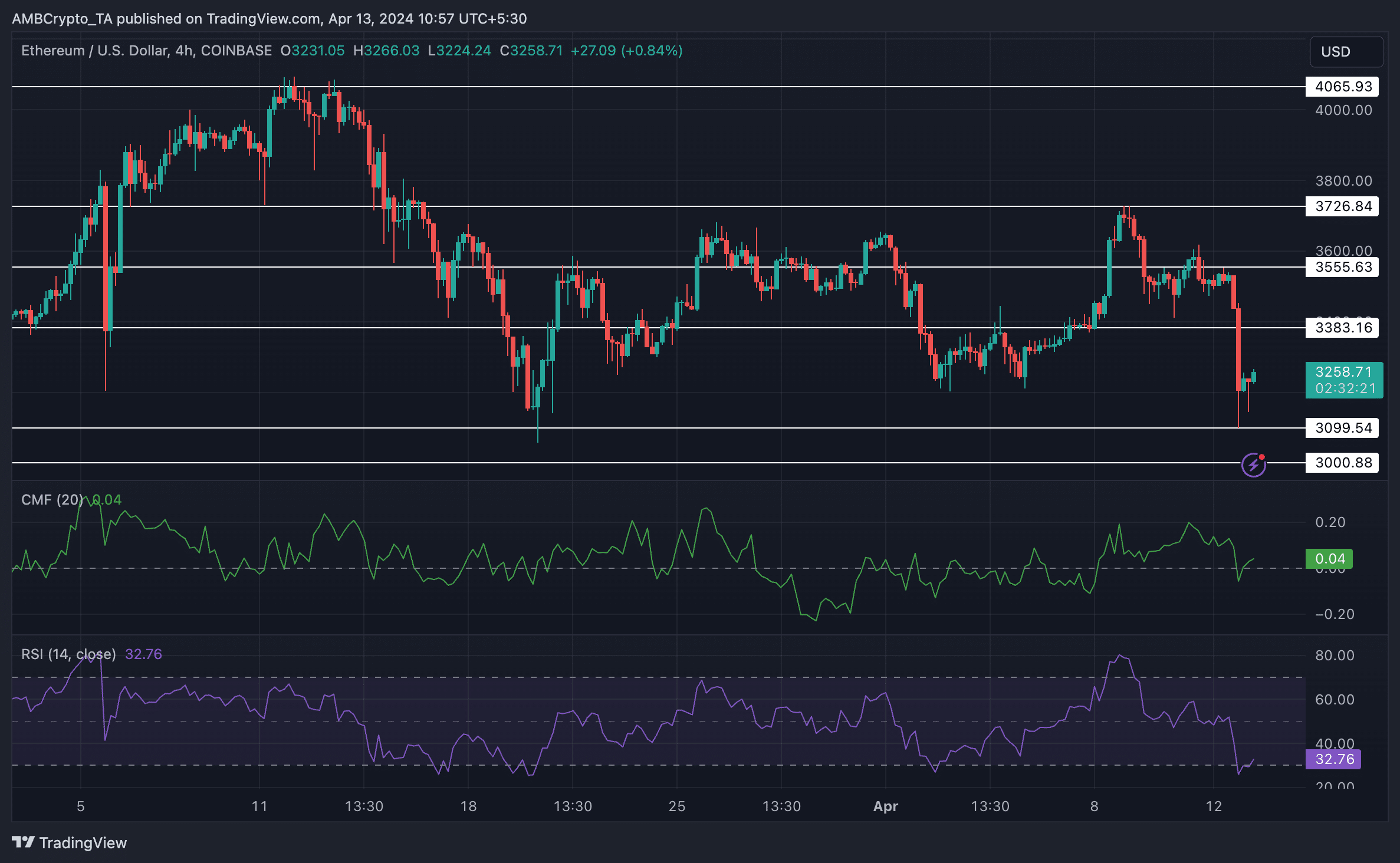

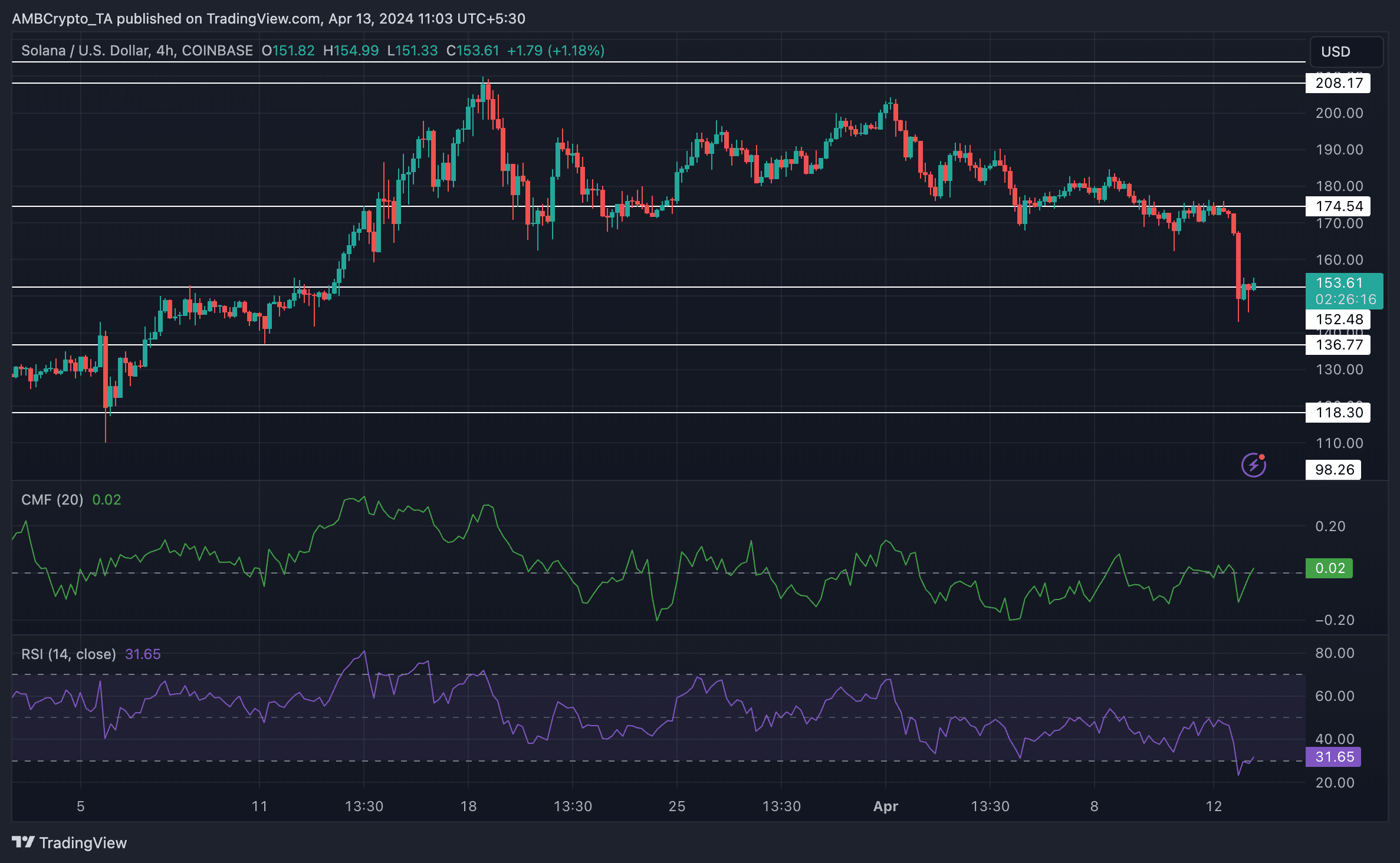

Because of the excessive correlation with Bitcoin, Ethereum [ETH] and Solana [SOL]‘s costs additionally fell dramatically and suffered a worse destiny. SOL fell by 11.93% over the past 24 hours and ETH declined by 8.33% over the identical interval. Because of the identical, each SOL and ETH broke previous their beforehand established larger lows, disrupting their ongoing bullish development on the charts.

In truth, the value of ETH fell all the way in which to $3099 throughout this drawdown. Nevertheless, after testing this degree, it managed to climb again as much as $3256.96, on the time of writing.

Beforehand, Ethereum had examined this degree on 20 March. If Ethereum follows an identical trajectory going ahead, it could attain the $3384-level quickly.

Solana traced an identical trajectory. Although the correction was pretty current, the value motion of Solana since 1 April hinted at a possible decline in worth. Because the starting of the month, SOL had exhibited a number of decrease lows and decrease highs, indicative of a bearish development.

With the intention to rally, a large resurgence in bullish momentum can be required for each ETH and SOL.

Are whales accountable?

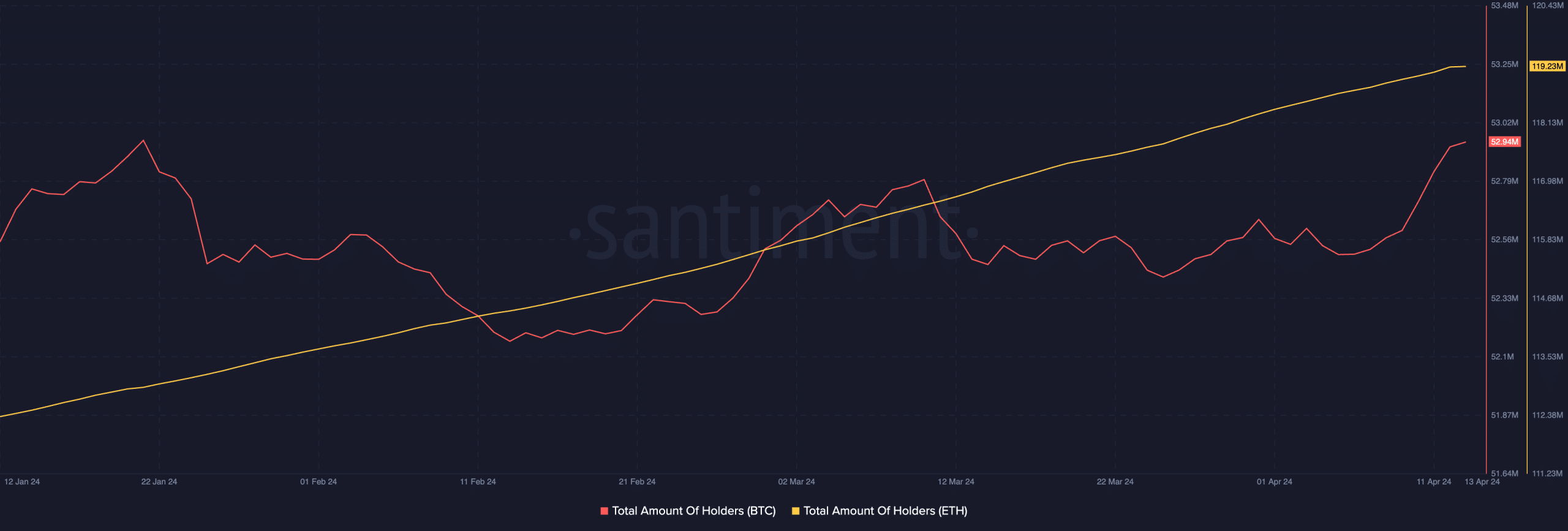

Regardless of these worth corrections, nonetheless, curiosity in BTC and ETH stays excessive. In truth, AMBCrypto’s evaluation of Santiment’s information revealed that the variety of addresses holding BTC and ETH grew materially over the previous couple of weeks.

This indicated that the current decline in costs may have been attributable to the conduct of some whales who have been indulging in profit-taking.

How are merchants holding up?

Within the final 24 hours, $947 million price of positions have been liquidated. Out of this, $824.94 million have been lengthy positions. Merchants that have been bullish on BTC, ETH and SOL misplaced probably the most sum of money. At this cut-off date, nonetheless, it’s too quickly to say which route BTC will head in, particularly with the halving simply over the horizon.