- Bitcoin’s value has appreciated by 3.34% over the past 24 hours

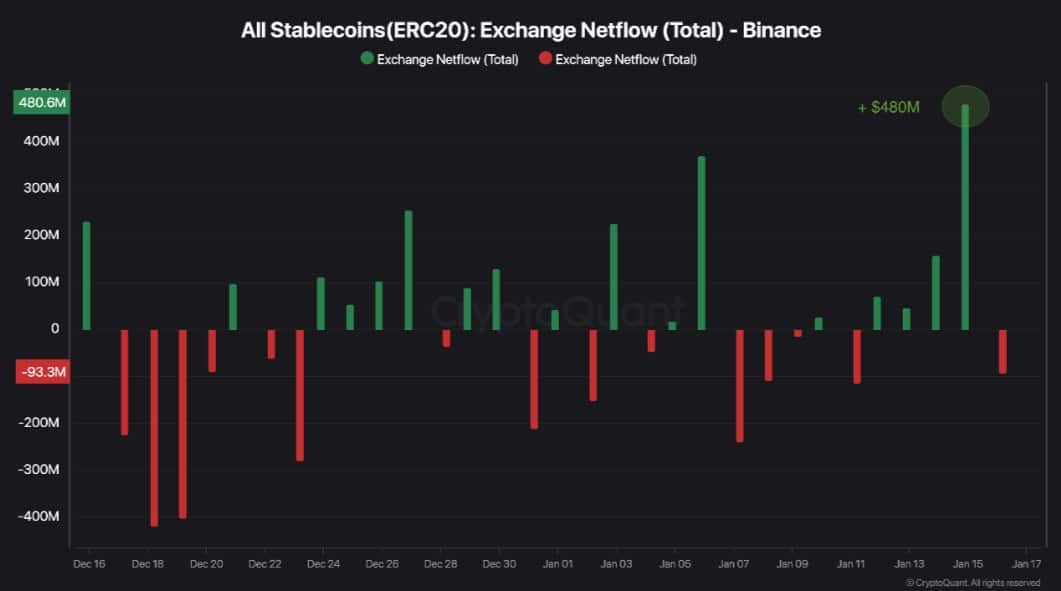

- CPI fueled $500 million stablecoins inflows on Binance

Bitcoin [BTC] has seen a powerful upswing on its charts recently, one which has pushed it previous $100k. In reality, on the time of writing, Bitcoin was buying and selling at $102,048 following a hike of over 7% over the week.

Evidently, this value pump has left the crypto neighborhood speaking about what’s behind it. One analyst believes that the most recent CPI report could have been the driving power behind the crypto’s market restoration.

CPI information enhance propels Bitcoin previous $100k

In keeping with CryptoQuant analyst Fost, the CPI enhance has fueled stablecoin influx price $500 million on Binance. This money influx has become excellent news for Bitcoin, pushing it previous the psychological degree of $100,000.

After the discharge of CPI inflation information which went higher than anticipated, market sentiment has shifted considerably to optimistic. This sentiment was mirrored by means of stablecoin inflows on Binance.

This surge in inflows is as a result of traders interpreted the information as being a optimistic sign that the prevailing market development for BTC is more likely to proceed.

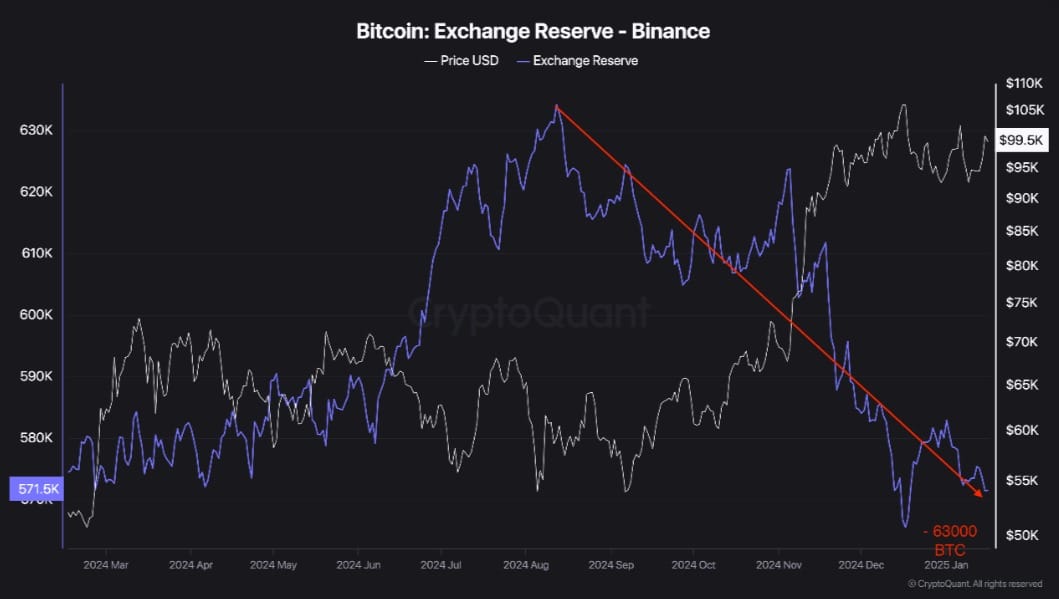

Moreover, the capital inflows on Binance had been largely used to accumulate Bitcoin, pushing its value again above the vital $100k threshold. This resulted in a powerful decline in Bitcoin’s reserve on Binance.

Since 12 August, greater than 63,000 Bitcoins have left Binance’s reserves. It is a signal that traders stay extremely assured in Bitcoin’s present development and are doubtless positioning themselves for the long run.

Can it maintain these positive factors?

With inflation information reinforcing market optimism, Bitcoin might see extra positive factors quickly. Particularly because the U.S market expects the inauguration of a pro-crypto President.

Owing to the identical, the prevailing market situations might set Bitcoin up for extra positive factors on the value charts.

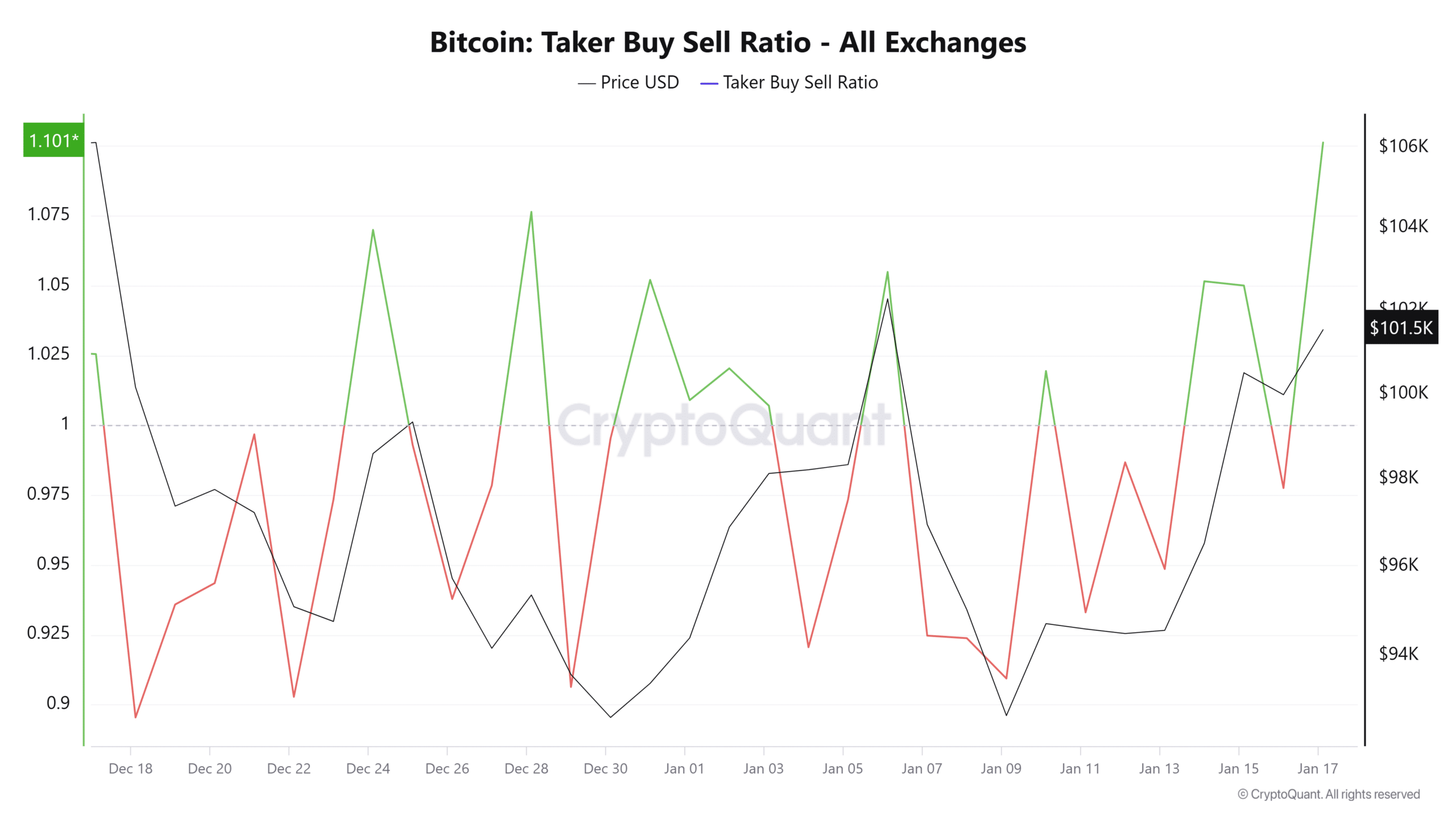

For starters, Bitcoin’s Taker Purchase Promote Ratio has surged over the previous 3 days to settle at 1.116 at press time.

When the Purchase promote ratio is above 1, it signifies that consumers are dominating the market. By extension, what this implies is that the current value positive factors have been pushed by excessive demand.

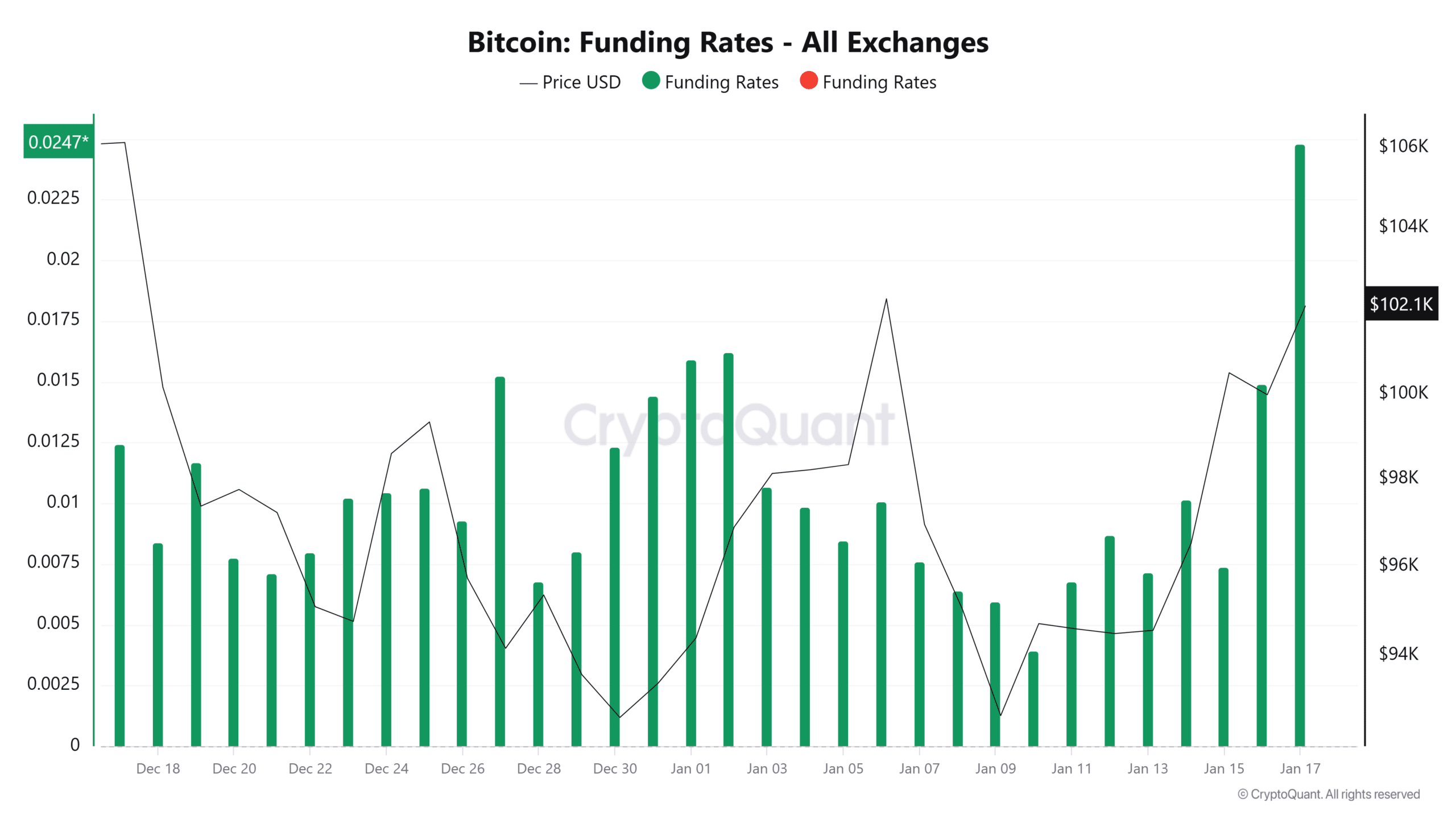

Moreover, we will see that consumers are largely taking lengthy positions, as evidenced by a rising funding fee.

BTC’s funding fee spiked over the past 24 hours to hit a month-to-month excessive of 0.0247. When the funding fee rises, it implies that traders are bullish and anticipate the value to rise even additional on the charts.

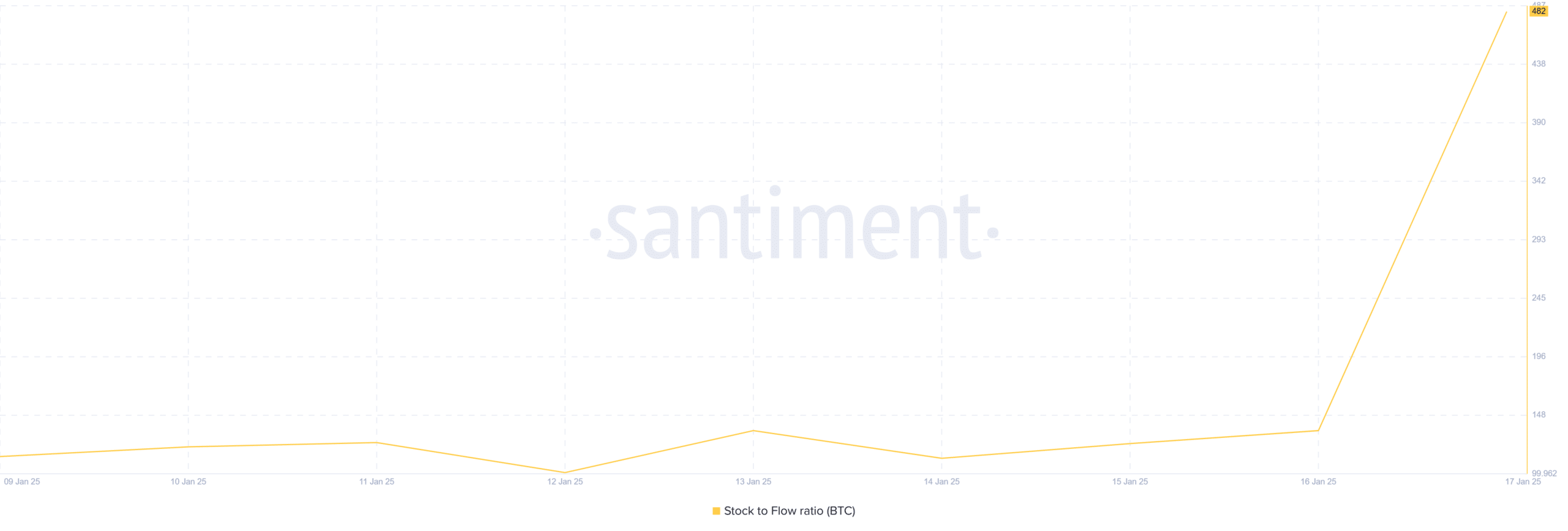

Lastly, Bitcoin has turn out to be extra scarce. This shortage is evidenced by a surging stock-to-flow ratio. When BTC turns into scarce, its worth surges as its worth is predicated on the legal guidelines of demand and provide. The next shortage implies that extra holders are storing their belongings in private wallets, reflecting an accumulation development.

Merely put, the discharge of optimistic CPI inflation information has considerably affected Bitcoin’s value efficiency. As such, traders have turned bullish decoding the current information as an indication of a greater future market efficiency.

Subsequently, with bullish sentiments prevailing out there, we will see BTC reclaim $105k. Nevertheless, a correction might see a drop to $98,900.