- Bitcoin’s uptrend was ongoing, as profit-taking quantity declined.

- BTC has gained over the previous day by 1.76%.

Over the previous 48 hours, Bitcoin [BTC] has skilled a robust upswing on its value charts. Over this era, BTC has surged from a low of $89164 to a neighborhood excessive of $97657.

With Bitcoin experiencing vital features over the previous two days, the crypto group is left speaking about its prospects.

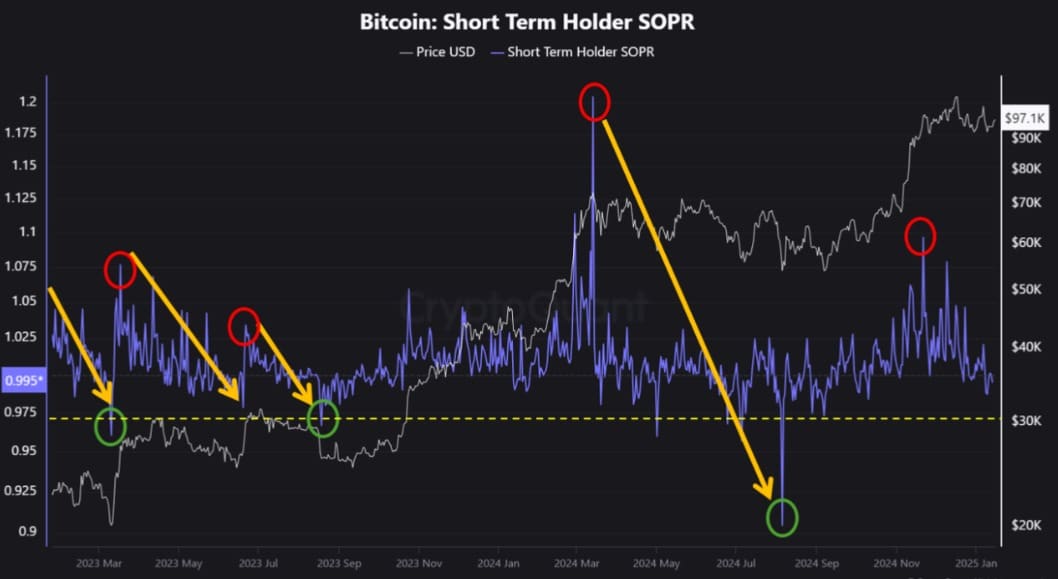

CryptoQuant analyst Dan has advised that Bitcoin’s upward cycle continues to be ongoing, citing the short-term SOPR.

Bitcoin’s upward cycle continues to be ongoing

In his evaluation, Dan posited that Bitcoin’s aggressive short-term buying and selling is a no-go as a result of the upward cycle continues to be ongoing.

Supply: CryptoQuant

In keeping with him, short-term SOPR exhibits a constant sample. Throughout market corrections, it shifts from crimson circles to inexperienced circles. This shift dampens market individuals’ optimism about potential value rallies, just for the market to rebound.

Considerably, the upper the crimson circle, the extra it suggests profit-taking by main whales, resulting in deeper or longer correction phases.

Nonetheless, present market situations in comparison with March 2024 present a significantly smaller profit-taking quantity. This means that this correction interval is probably going shorter than the earlier one, which took seven months.

For the reason that present correction has already lasted greater than a month, there’s a excessive probability of the upward development resuming in Q1 2025.

On a short-term foundation, BTC may expertise one or two sharp drops that might push short-term SOPR to say no earlier than experiencing one other sustained uptrend. Subsequently, aggressive short-term trades are dangerous and require prolonged warning.

What do BTC charts counsel

Whereas the above evaluation presents a promising outlook, it’s important to test different market indicators.

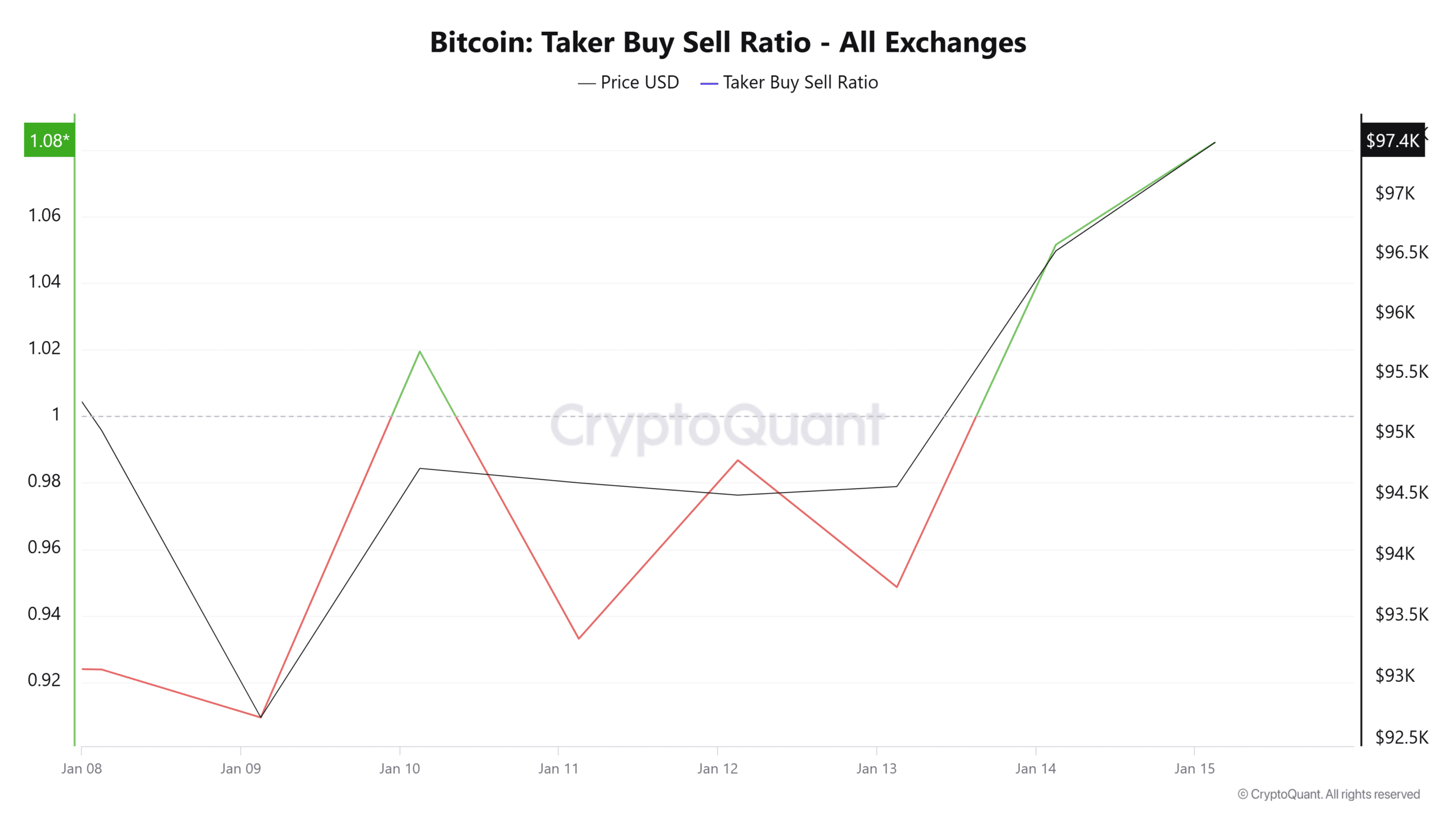

In keeping with AMBCrypto’s evaluation, Bitcoin continues to be experiencing sturdy shopping for stress, as market individuals stay bullish.

For starters, Bitcoin’s taker-buy-sell ratio has surged to stay above 1 over the previous two days. When this stays above 1, it means that there are extra purchase orders in comparison with promote orders for BTC.

As such, patrons are dominating the market, reflecting a robust accumulation development.

Supply: Cryptoquant

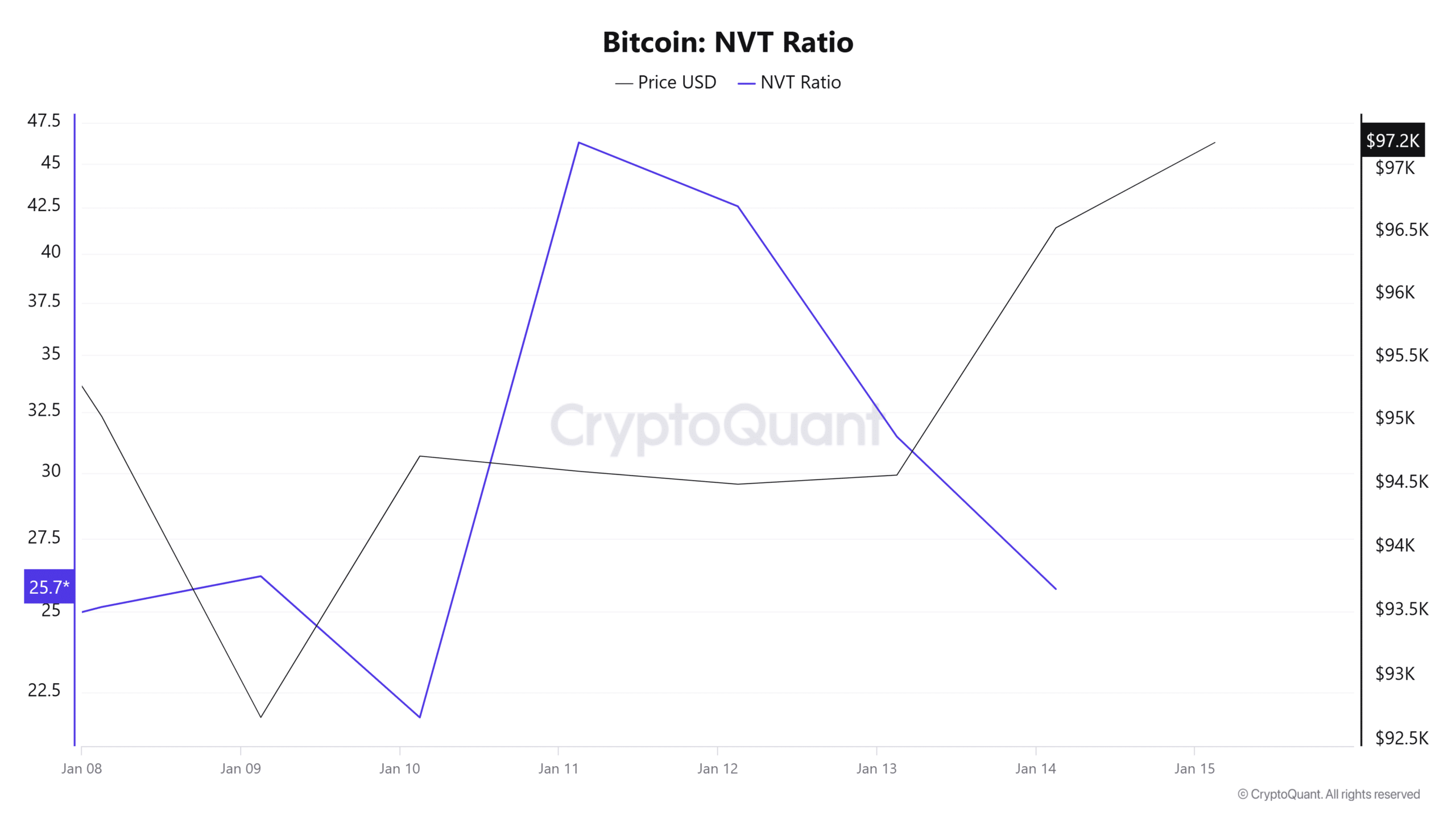

Moreover, Bitcoin is experiencing a restoration within the variety of lively customers and general individuals. That is evidenced by a sustained drop within the NVT ratio for the final 4 days.

When the NVT ratio drops it suggests sturdy demand for the community, suggesting strengthening market fundamentals.

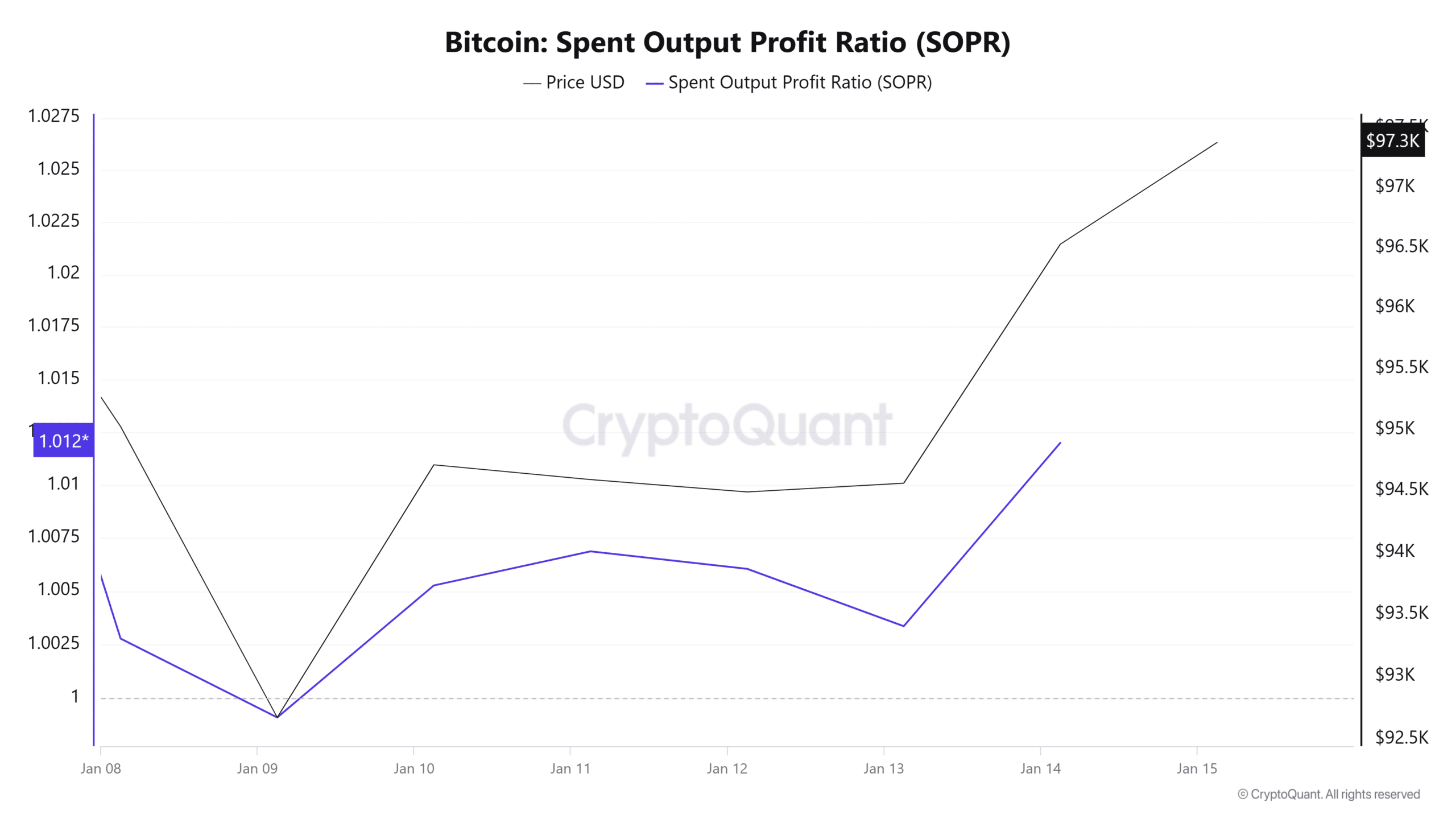

Bitcoin’s SOPR has remained above 1 for the previous six days. When SOPR stays above 1, it alerts sturdy market sentiment, the place merchants are prepared to promote and reenter the market at greater ranges. Revenue-taking will not be discouraging patrons as demand stays strong.

– Learn Bitcoin (BTC) Value Prediction 2025-26

Merely put, Bitcoin continues to be experiencing sturdy demand as patrons proceed to enter new positions, reflecting sturdy bullish sentiments.

If bulls take management of the market, BTC may reclaim $98,800 after which try $100,000. Nonetheless, a correction may see the crypto drop to $96,560.