- Bitcoin is coming into a high-stakes sport, the place the daring could thrive

- Whereas FOMO builds, there’s nonetheless a lot to unpack

Two crashes in lower than a month could have you ever enthusiastic about exiting, however Bitcoin [BTC] is holding agency above $90k, defying the chances. Clearly, the market is gearing up for the subsequent Trump commerce to kick off – however the stakes couldn’t be greater. So, brace your self.

Market teetering on the sting of greed and concern

Regardless of the 2 main clashes with the Fed, Bitcoin’s popularity as a secure haven is proving its price. A 12 months in the past, this shock might have triggered a a lot harsher response. However right here we’re – Bitcoin fell from its yearly excessive of $102k only a week in the past. And but, it’s nonetheless holding regular, down solely 7%. That’s resilience.

Now, with Trump’s inauguration looming, there’s speak of a repeat of the This autumn rally that noticed Bitcoin surge to $108k. For a lot of, holding on to Bitcoin looks like a wise play proper now.

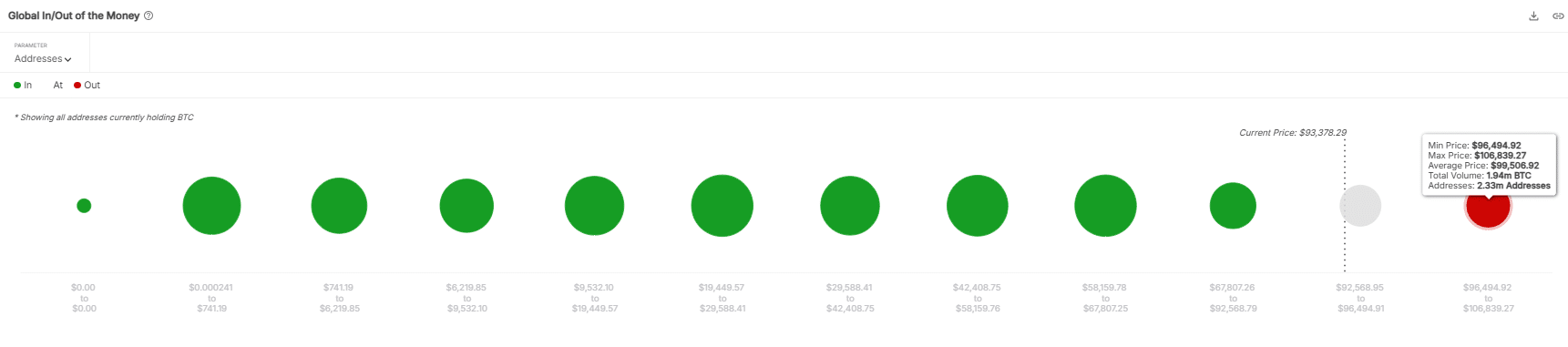

Nevertheless, there’s a catch. The size of losses throughout this dip was arduous to disregard. Round 1.9 million BTC, purchased at $106k, are susceptible to being bought as soon as Bitcoin hits that worth, doubtlessly triggering an enormous $201 billion sell-off.

With the aftermath of two main crashes nonetheless lingering, the choice to HODL feels unsure for a lot of. Exiting could look like the safer choice fairly than holding out for greater returns. The greed-fear steadiness goes to be key within the coming days – It’s delicate, and positively one to maintain an in depth eye on.

Historical past reveals that robust rallies are sometimes pushed by greed. When greed takes maintain, traders change into extra keen to threat all of it, believing the potential for greater returns ‘outweighs’ the specter of a crash.

Alas, with so many macroeconomic components nonetheless within the combine, concern might simply dominate the market. If it does, a crash could rapidly flip from social media chatter to a full-blown actuality.

It’s flight or struggle for Bitcoin

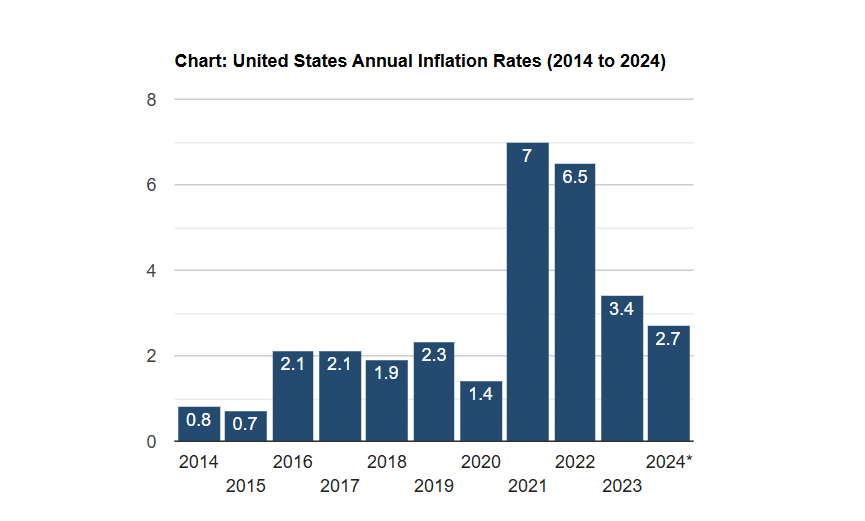

Aside from Trump’s inauguration, the January Fed assembly in simply 16 days might impression the market. On high of that, we’re about to get the final CPI and PPI inflation knowledge earlier than the Fed’s choice.

With inflation sitting at 2.7%, nicely above the Fed’s 2% goal, it’s possible the central financial institution will keep hawkish, doubtlessly triggering a market pullback. These subsequent few days will likely be key.

Learn Bitcoin’s [BTC] Worth Prediction 2025-26

Given all this, panic-selling would possibly rise as Bitcoin hits key ranges. The Trump commerce could possibly be in hassle, and Bitcoin could face a troublesome 12 months forward. Clearly, the lengthy rally is below stress – concern might take over, making exiting the safer transfer.