- Sentiment index at 69 alerts optimism, however warning is suggested

- Historic patterns pointed to correction dangers close to market highs

Because the market enters 2025, investor sentiment is at a excessive, fueled by rising optimism and a renewed sense of alternative. Whereas enthusiasm is constructing, it stays nicely beneath the intense ranges seen throughout earlier market booms. However, consultants are cautioning that the chance of a correction, significantly in Bitcoin [BTC] and different main cryptos, is rising because the market continues to achieve momentum.

With this in thoughts, it’s essential for buyers to remain vigilant, rigorously monitoring key indicators and being alert to early indicators that would sign a shift in market dynamics.

Concern and greed index – What occurs at 95?

At press time, the index stood at 69 – A robust signal of optimism however nonetheless removed from the purple zone. Analysts imagine that when the index touches 95, the market sometimes enters a part of overheating, marked by speculative extra and euphoria. Traditionally, this threshold has served as a warning sign, indicating {that a} correction or downturn could also be imminent.

Such ranges usually precede shifts in investor habits, as cautious optimism provides method to unsustainable exuberance.

Key indicators to observe for a possible correction

Because the market approaches overheated situations, Adler made observe of a number of key indicators that would present early warnings of a correction.

Lengthy-term holder gross sales

Traditionally, elevated promoting exercise by long-term holders has signaled the beginning of market corrections. December 2024 noticed a slight uptick in LTH profit-taking, echoing patterns noticed earlier than the 2021 and 2017 market peaks. A pointy rise in these gross sales would recommend that skilled buyers are offloading forward of a possible downturn, undermining market confidence.

BTC ETF outflows

After record-breaking inflows in late 2024, Bitcoin ETFs have seen modest outflows in early January 2025. This decline may point out cooling sentiment amongst institutional buyers – Typically a harbinger of lowered shopping for stress.

MicroStrategy share actions

As a bellwether for institutional Bitcoin sentiment, MSTR shares function a key proxy. Any sustained decline in its inventory efficiency, significantly following robust demand in This fall 2024, may mirror diminishing urge for food for Bitcoin publicity amongst institutional buyers. Such strikes have beforehand coincided with market corrections.

Learn Bitcoin’s [BTC] Value Prediction 2025-26

Bitcoin – Historic patterns and value evaluation

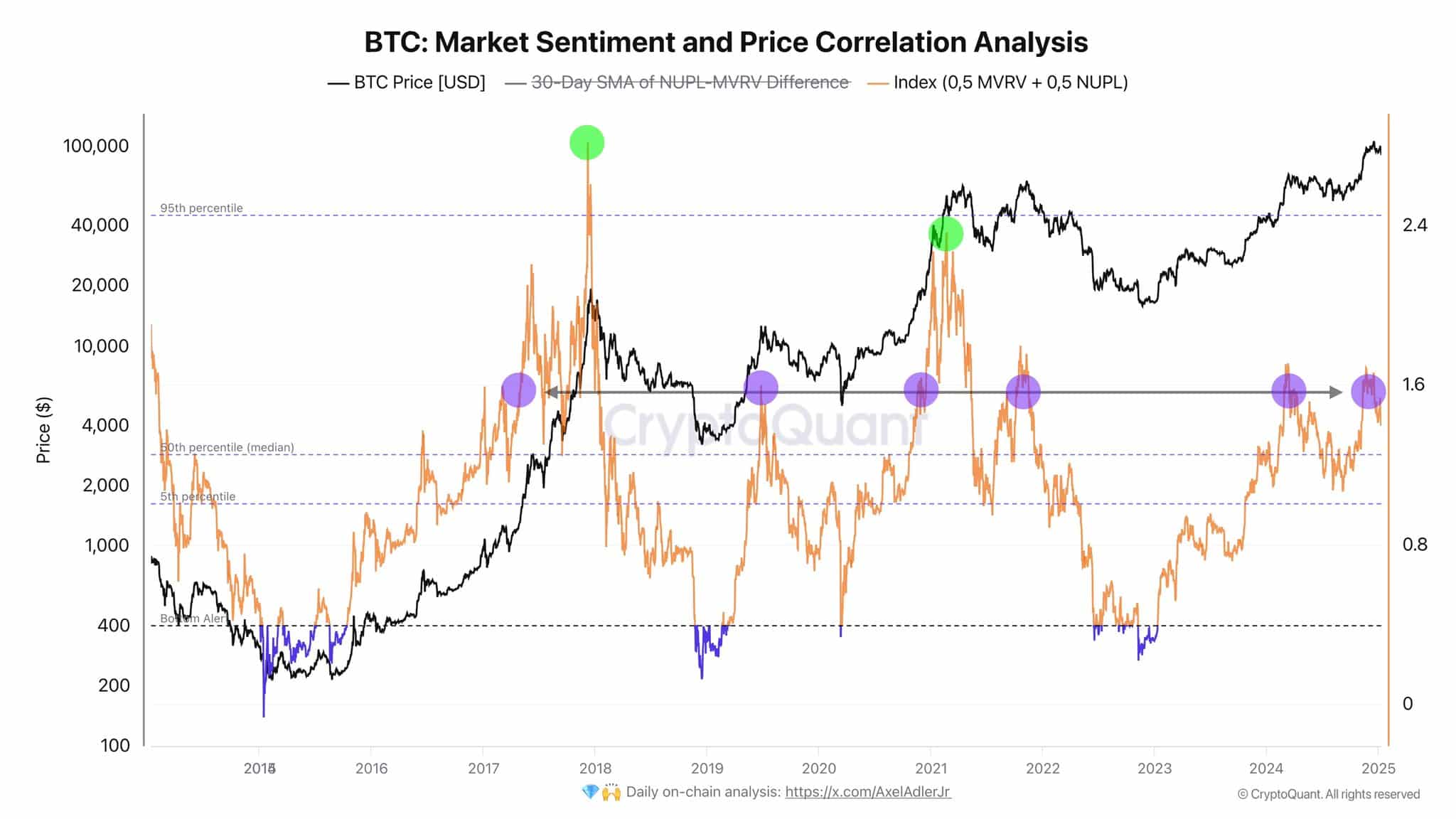

The correlation between sentiment and value has traditionally been a dependable predictor of market cycles. On the time of writing, the NUPL-MVRV index gave the impression to be approaching ranges that beforehand signaled market peaks in 2017, 2021, and mid-2024.

These thresholds mark zones of heightened threat, the place corrections usually comply with overheated situations.

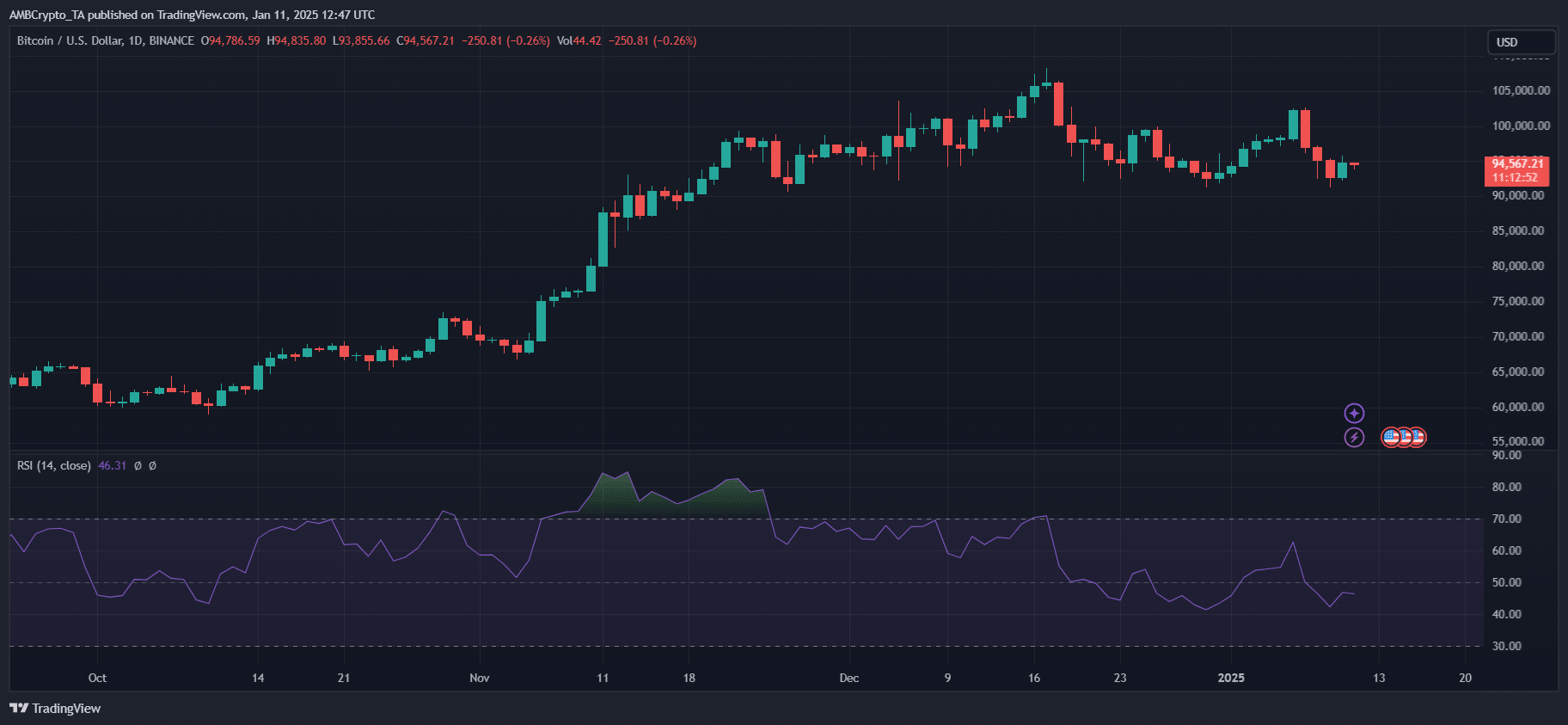

Equally, Bitcoin’s RSI cooled to 46 on the each day chart after December’s overbought highs, suggesting a possible shift in the direction of consolidation or decline.

The value motion close to $95,000 displays a important resistance zone, as earlier parabolic runs stalled after related RSI drops. A failure to reclaim momentum right here may pave the best way for a retracement to assist ranges round $88,000–$90,000, aligning with broader profit-taking and declining ETF inflows.