- Sentiment throughout the crypto sphere has been bearish and fearful, however the crowd isn’t all the time proper

- Brief-term indicators stay bearish, however an uptick in accumulation is encouraging

Bitcoin [BTC] was buying and selling at $94.5k at press time. It had confronted its third rejection in a month at or above the $100k zone on Tuesday, 07 January. Therefore, market contributors had been fearful and speculated if this dip would ship BTC right into a full fledged downtrend and usher within the subsequent bear market.

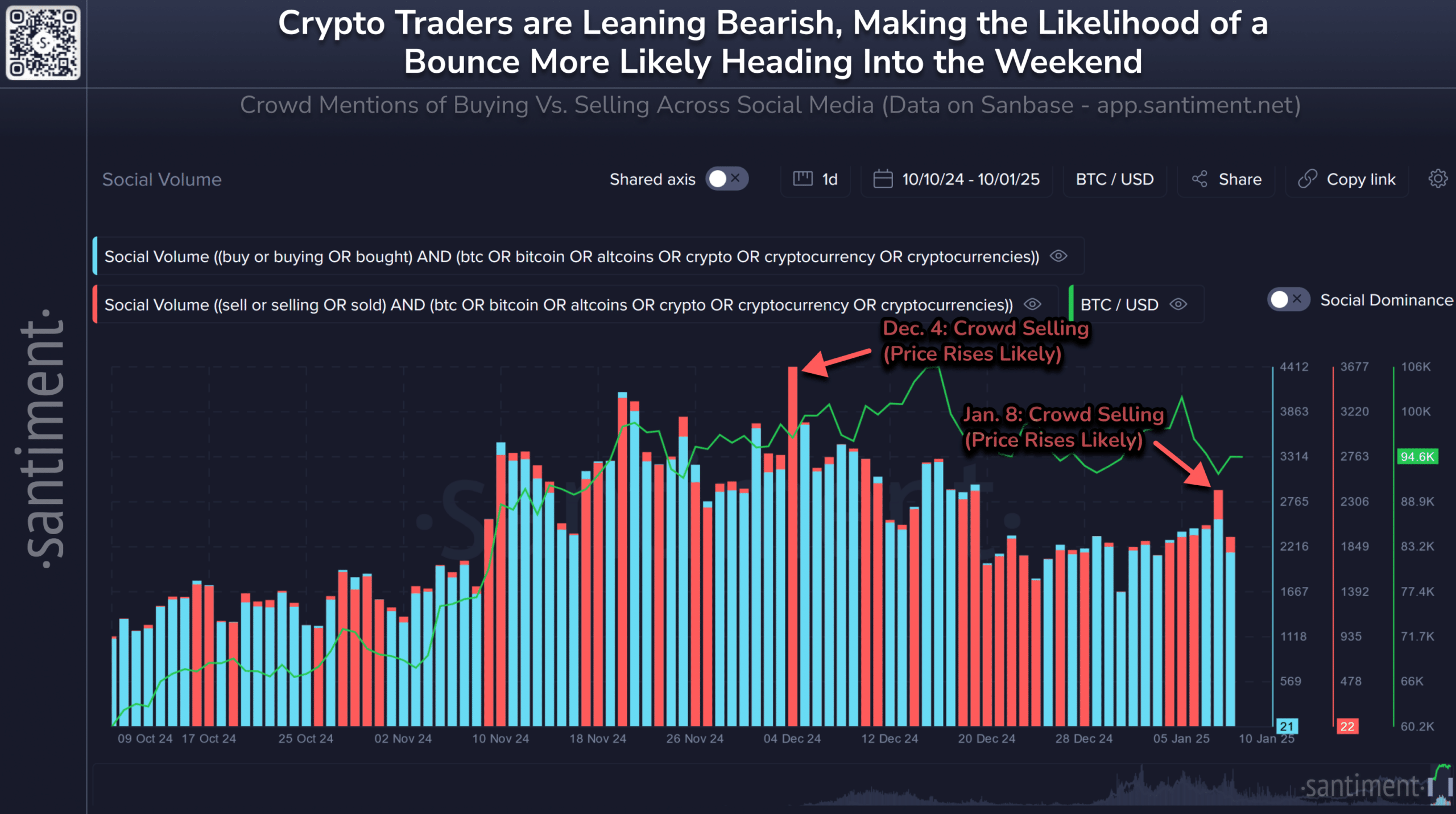

Supply: Santiment Insights

The social quantity metric from a Santiment Insights publish revealed that crowd promoting social quantity was noticeably stronger on 08 January. The final time this occurred was on 04 December. Again then, the value rebounded larger, finally hitting the $108.3k all-time excessive.

The 8% stoop since Tuesday means concern has been prevalent available in the market. A liquidity sweep beneath $92k might spark a restoration, as might a “Trump pump” publish inauguration. The greenback index [DXY] has trended larger over the previous month, serving to clarify the bulls’ woes.

Bitcoin merchants – Purchase the concern, promote the greed

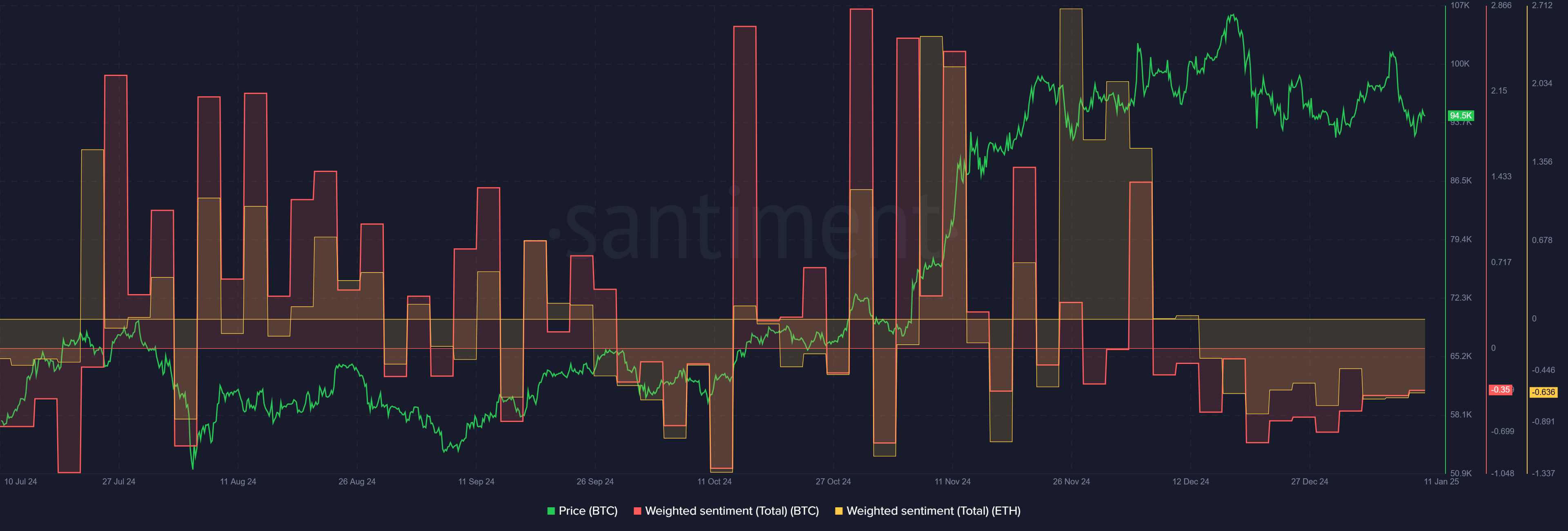

Supply: Santiment

The frequent adage, so typically repeated it generally has listeners roll their eyes earlier than the phrase is accomplished, does maintain true generally. Context can also be essential and, on-chain metrics for Bitcoin don’t but sign a market prime is in.

The weighted sentiment for BTC and ETH had been in contrast side-by-side. The comparability confirmed that each units of merchants and buyers had a bearish outlook available on the market because the worth drop on 19 December. Neither asset has recovered on the value entrance to date.

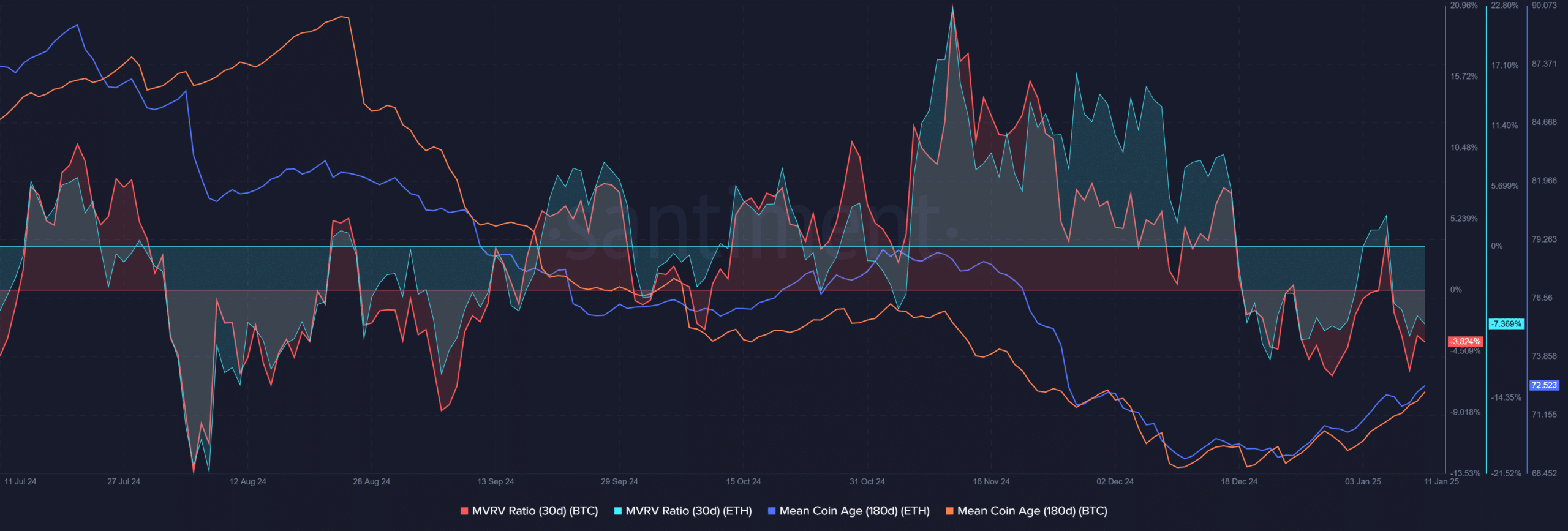

Supply: Santiment

The 30-day MVRV ratios for each main crypto belongings had been additionally unfavourable. This steered that BTC and ETH short-term holders (STHs) had been at a loss. Curiously, the 180-day imply coin age for each belongings started to pattern larger over the past three weeks.

This was a sign to purchase the dip. Elevated accumulation and STHs at a loss alluded to lowered imminent promote stress, and heightened probabilities of a restoration.

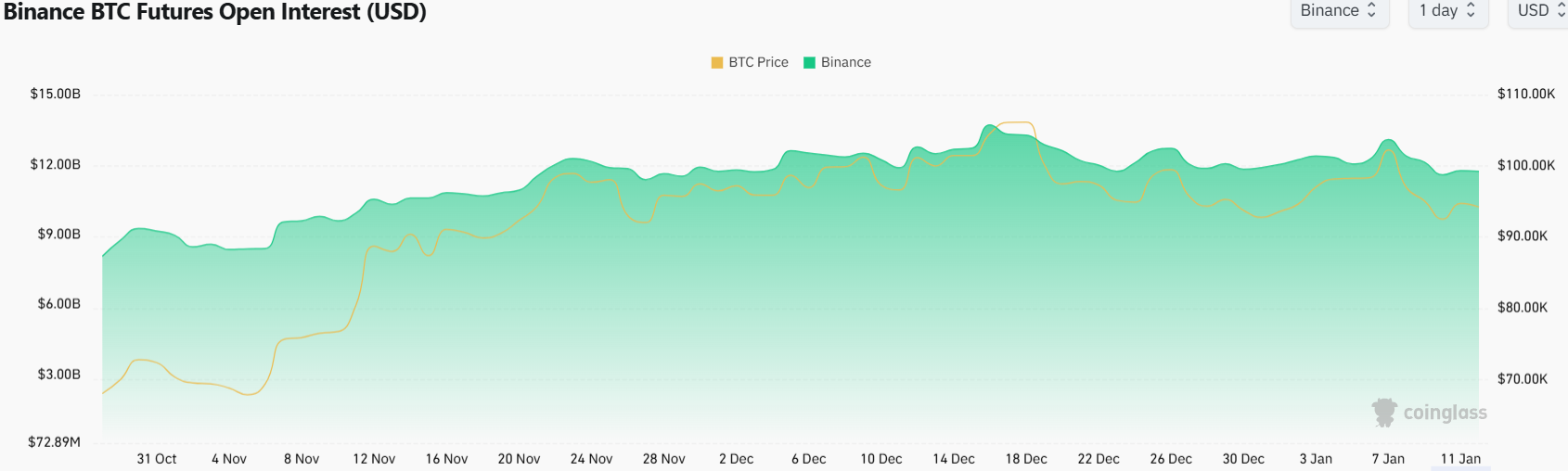

Supply: Coinglass

The Open Curiosity had been trending larger from the beginning of November to mid-December. Since then, nonetheless, there was a slight drop. The OI has fallen from $13.7 billion on 16 December to $11.72 billion, on the time of writing.

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

This OI drop is one other signal that speculative curiosity has been waning, underlining short-term bearish expectations. By the point these short-term indicators flip round and flash constructive indicators, the value of Bitcoin may have already got initiated its restoration.

Merchants should weigh danger towards alternative and resolve in the event that they wish to enter above the $92k help.