- Key metrics reveal a deeper story behind BTC’s current dip, highlighting each dangers and potential alternatives for accumulation.

- As bearish sentiment grows, insights from HODL Waves and SOPR charts recommend this could possibly be a pivotal second for strategic traders.

Bitcoin’s[BTC] current market trajectory has sparked widespread dialogue, with its value dipping and bearish sentiment gaining momentum.

Whereas short-term traders appear to be promoting at a loss, historic knowledge suggests this part could possibly be a possible shopping for alternative.

This text explores the indications shaping the market outlook, leveraging insights from the Realized Cap HODL Waves, Brief-Time period Holder SOPR, and BTC value charts.

Present Bitcoin market sentiment: Rising bearishness

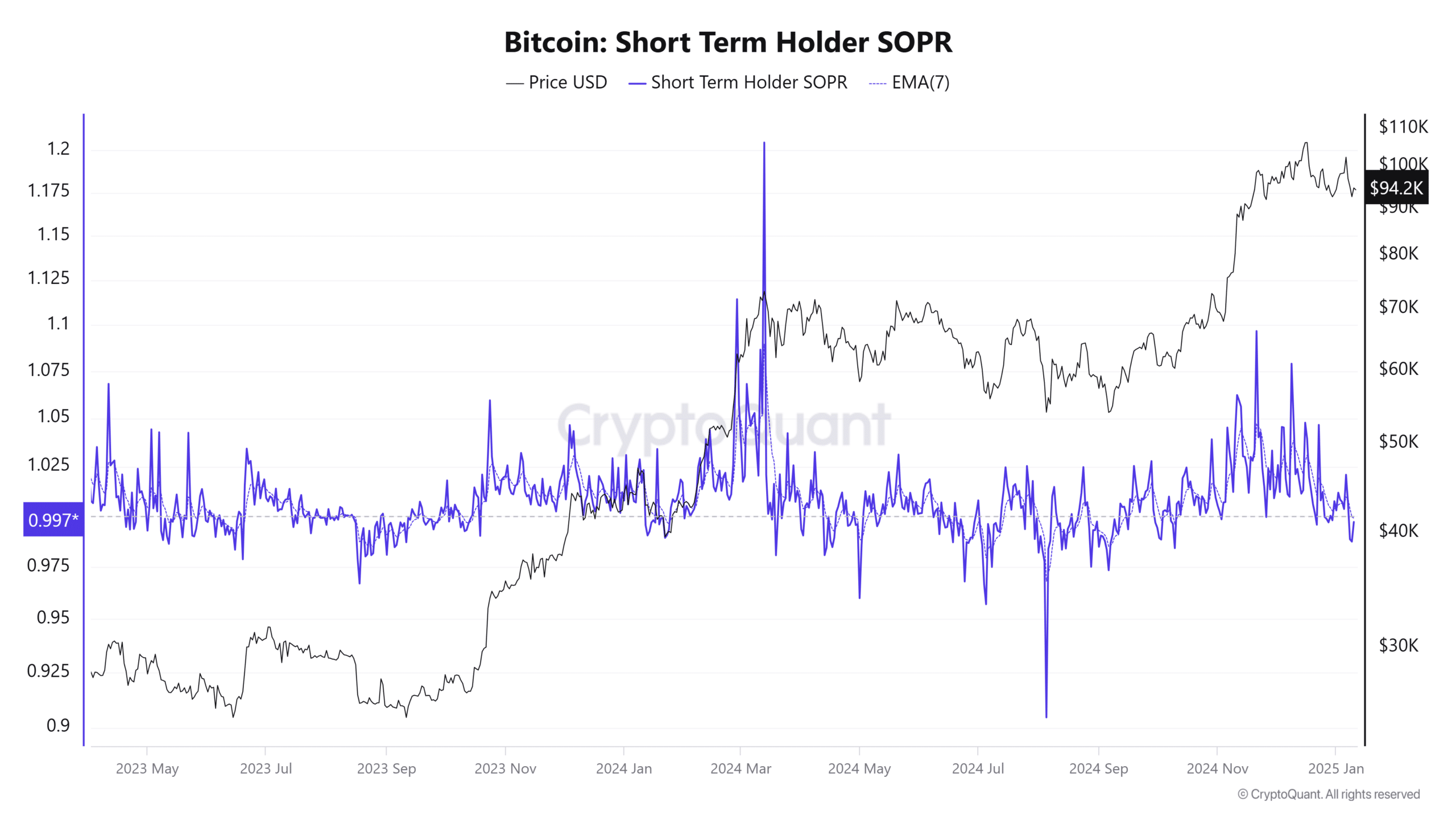

The crypto market’s temper has turned bitter, as seen within the elevated sell-offs by short-term traders. The Brief-Time period Holder SOPR Chart signifies a dip to 0.987, suggesting that many traders are promoting Bitcoin at a loss.

Traditionally, SOPR values under 1.0 have usually marked factors of accumulation, the place affected person traders capitalize on discounted costs.

This bearish sentiment is additional fueled by rising social media negativity and panic-driven promoting.

Nevertheless, the SOPR chart’s historic pattern highlights restoration patterns after such dips, implying that bearish phases usually precede accumulation alternatives.

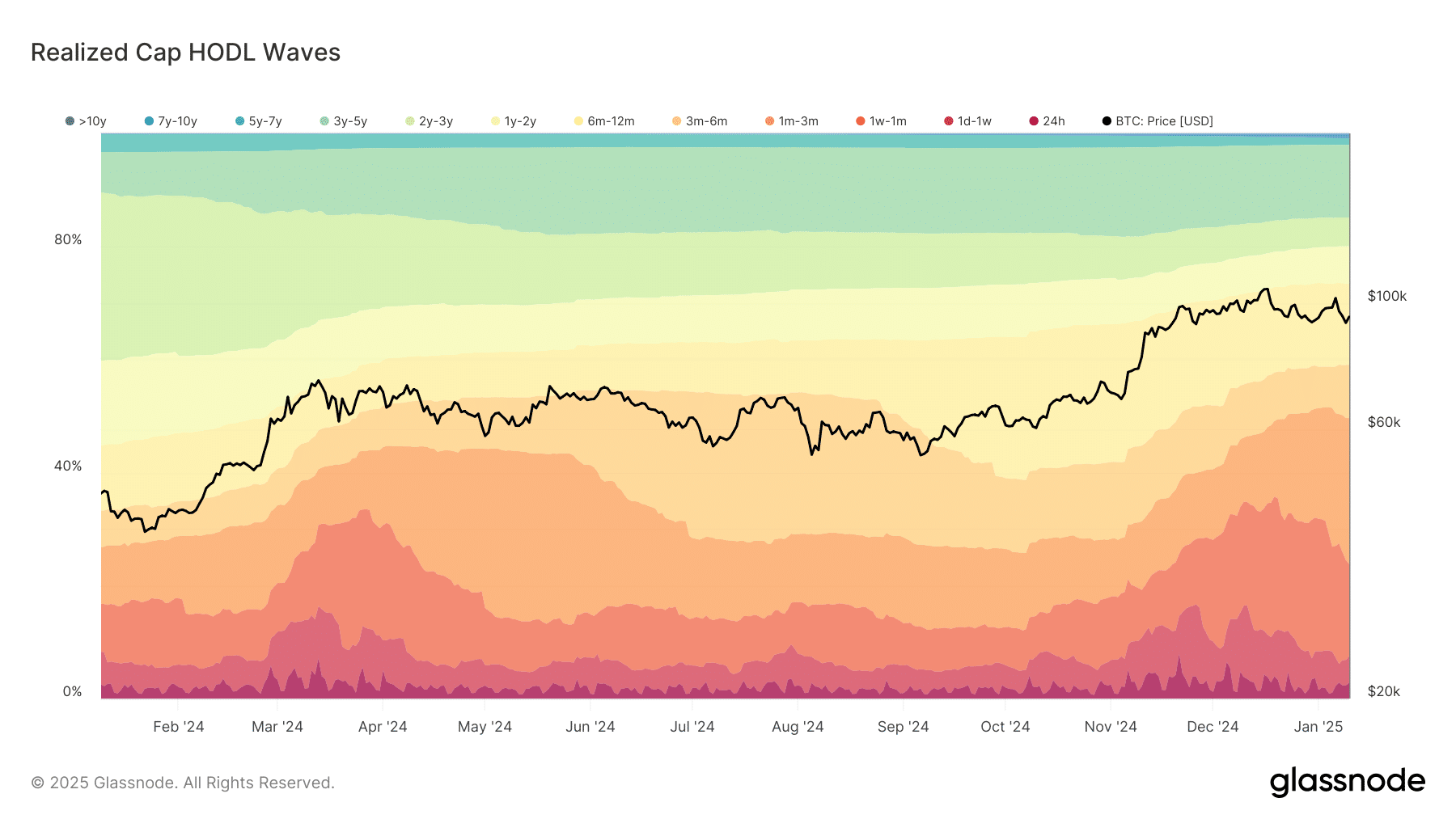

Distribution by mature traders and the position of recent demand

The Realized Cap HODL Waves Chart reveals a major shift in Bitcoin’s liquidity construction. Cash aged lower than three months now account for 49.6% of community liquidity.

This alerts that mature traders have distributed a good portion of their holdings.

This pattern signifies two issues: seasoned traders are cashing out after the uptrend, and new demand is absorbing the sell-side stress.

Traditionally, such redistributions usually stabilize the market as contemporary capital flows in. This supplies a buffer in opposition to additional draw back, suggesting that the market is transitioning right into a consolidation part reasonably than a crash.

Brief-term Bitcoin SOPR evaluation: A historic perspective

The Brief-Time period Holder SOPR Chart presents insights into market sentiment. The present worth of 0.987 displays short-term holders promoting at a loss, a sample sometimes seen during times of heightened concern.

Apparently, historic traits present that SOPR values under 1.0 usually sign market bottoms. This means that whereas panic dominates, seasoned traders might even see this as a perfect accumulation interval.

The Bitcoin SOPR chart highlights this cyclical habits, displaying how durations of loss have traditionally coincided with subsequent restoration phases.

Worth motion and key ranges to look at

The BTC Worth Chart supplies vital perception into the present value dynamics. Bitcoin’s value is hovering round $94,330, under its 50-day transferring common of $97,470 however comfortably above its 200-day Transferring Common(MA) of $73,293.

This MA supplies key resistance and assist ranges for merchants.

The RSI at 45.93 signifies that Bitcoin is approaching oversold territory. Traditionally, an oversold RSI studying has been adopted by value rebounds.

Merchants ought to intently monitor the $95,000 resistance and $92,000 assist ranges for any directional breakout.

Is that this a crash or a shopping for alternative?

Whereas the bearish sentiment and promoting by short-term holders recommend warning, the underlying knowledge factors to resilience. The absorption of sell-side stress by new traders, mixed with SOPR’s historic precedent for restoration, signifies that this may not be a crash however a consolidation part.

The Bitcoin Realized Cap HODL Waves and Brief-Time period SOPR charts, coupled with value ranges, paint a combined image. Lengthy-term traders would possibly see this as a first-rate accumulation alternative, whereas short-term merchants want to stay vigilant for potential volatility.

– Learn Bitcoin (BTC) Worth Prediction 2025-26

The present Bitcoin market part is a fragile steadiness of concern and alternative. Whereas sentiment leans bearish, knowledge from SOPR and HODL Waves charts recommend a possible market restoration is on the horizon.

Buyers should weigh these indicators in opposition to broader macroeconomic circumstances and make knowledgeable choices.