- Bitcoin retail traders have been gone as quickly as they arrived.

- BTC has elevated by 3.07% over the previous week.

Since reaching $100k almost three weeks in the past, Bitcoin’s [BTC] has struggled to interrupt this barrier. As such, regardless of the latest value pump, Bitcoin has continued to commerce sideways.

On the time of writing, Bitcoin was buying and selling at $97,834, marking a 0.31% decline within the each day charts. Earlier than this dip, BTC had been transferring upward, rising by 3.07% within the weekly charts.

This volatility is basically related to declining retail curiosity because the market seeks stability whereas BTC strikes from weaker palms to stronger ones.

Bitcoin’s retail traders are gone

Based on CryptoQuant, Bitcoin’s retail traders disappeared from the market as quickly as they arrived.

Primarily based on the 30-day variation in retail demand, as BTC approached $100k, retail demand variations surged by over 30%.

A surge in retail demand often alerts heightened curiosity, enthusiasm, or the worry of lacking out amongst smaller traders.

Traditionally, when retail demand variation exceeds 15%, it usually precedes a neighborhood high. That is what occurred after Bitcoin reached its new ATH of $108k.

After the market reached this degree, a correction ensued, adopted by a 16% decline in retail demand. Retail traders are recognized for being emotional reactors and shortly exit their positions throughout corrections.

A drop under 10% signifies that retail curiosity has dropped considerably. Nonetheless, this drop creates a shopping for alternative for big and skilled merchants.

After such declines, the market has often skilled a bullish rebound as weak palms capitulate and stronger palms accumulate.

What it means for BTC

Based on AMBCrypto’s evaluation, Bitcoin is experiencing a shift in market exercise from retail merchants to good cash accumulation.

This drop in retail demand alerts that markets are cooling off after a speculative frenzy. Due to this fact, BTC has moved from weak palms to stronger palms.

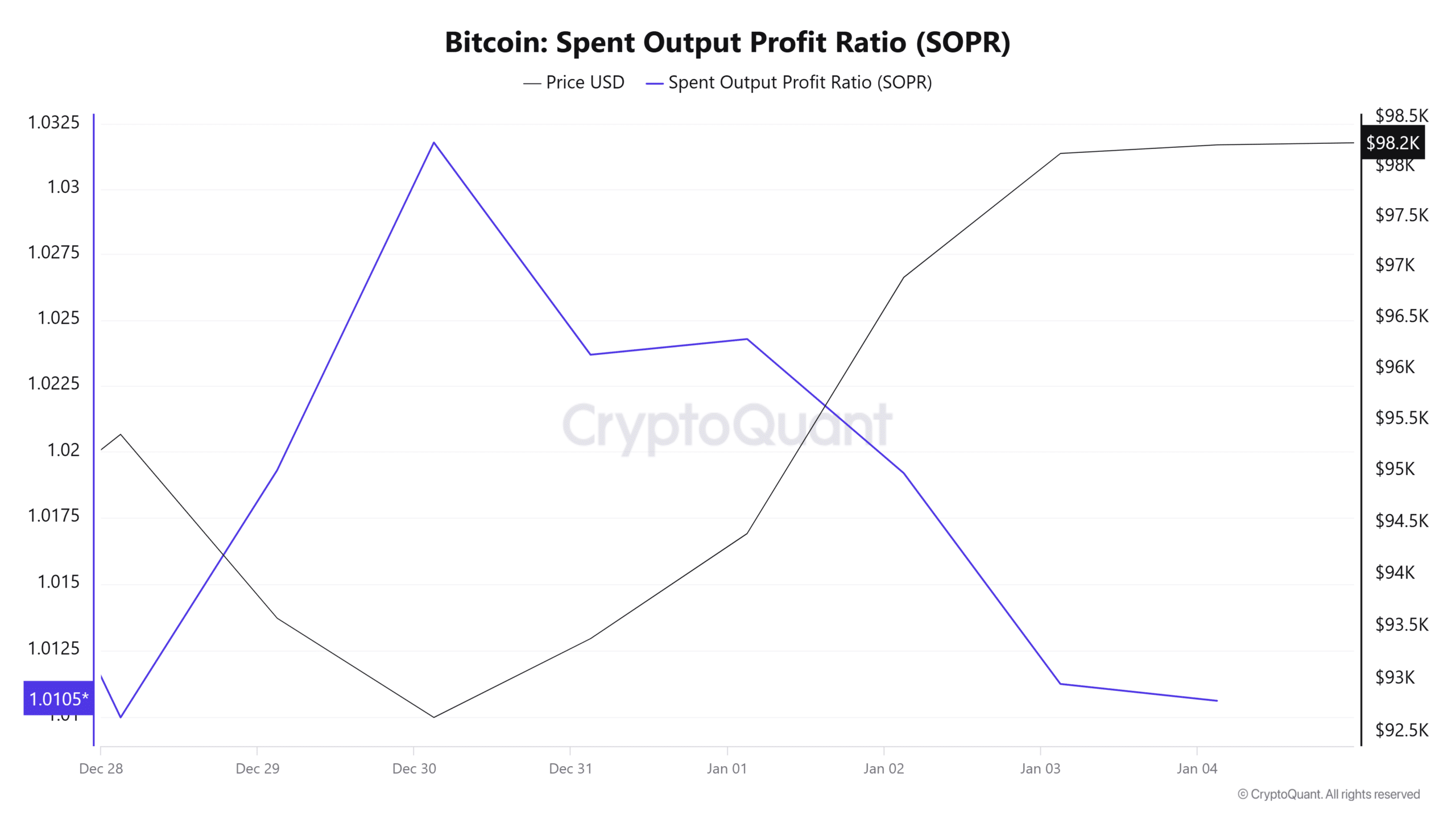

The latest drop within the Spent Output Revenue Ratio (SOPR) signifies a shift in possession and market exercise. Regardless of the decline, the SOPR stays at 1.01, signaling that holders usually are not keen to promote at a loss.

This market habits suggests stronger palms available in the market, indicating that traders are assured in holding their positions even throughout market corrections.

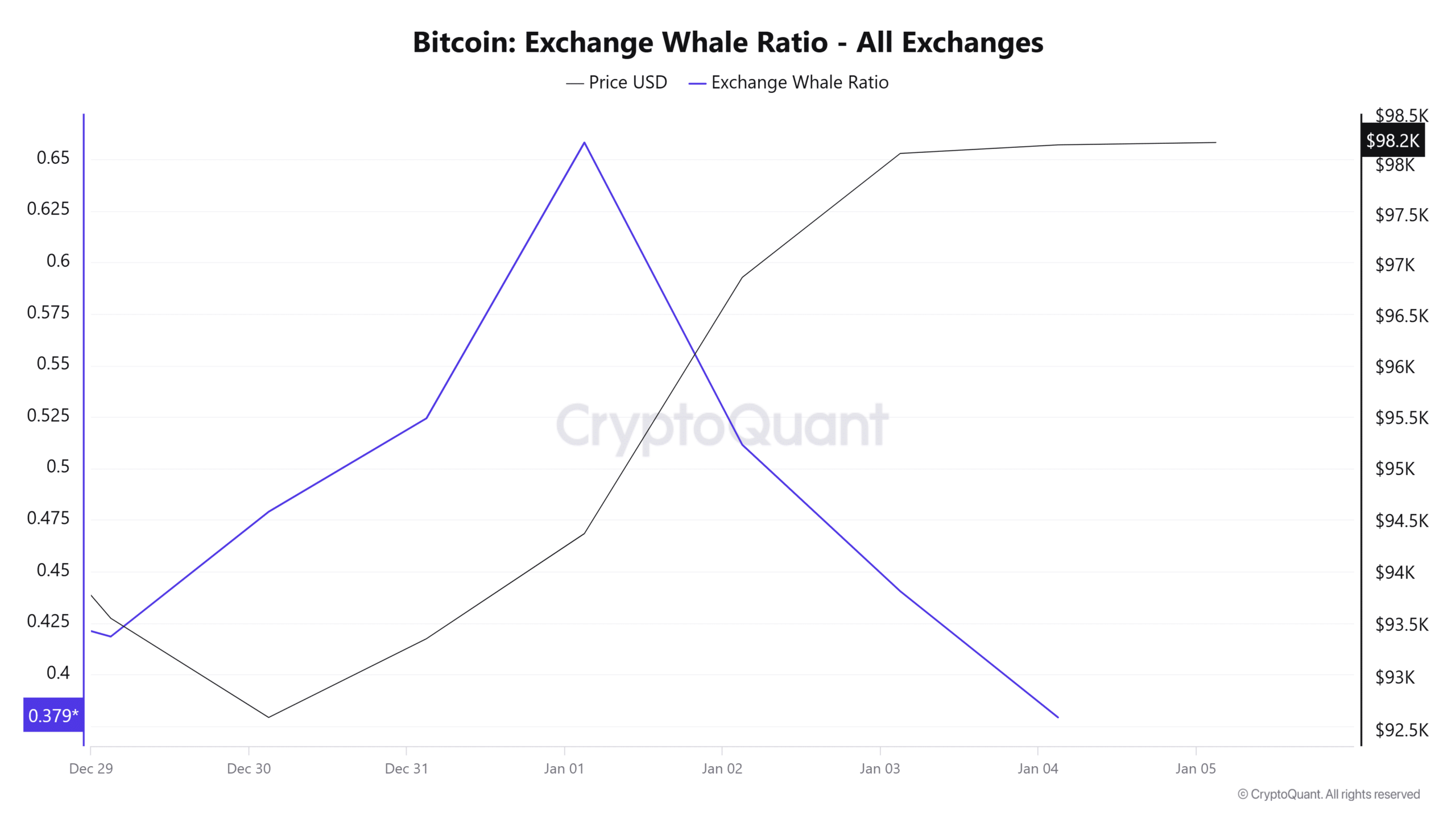

This accumulation development is additional evidenced by the decline within the trade whale ratio. The whales’ provide to exchanges has dropped to 0.37, signaling HODL habits.

Whales are sending their BTC tokens to personal wallets, indicating bullish sentiment as they anticipate additional beneficial properties.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Merely put, the drop in retail demand has offered massive holders with a chance to build up BTC at decrease costs. These circumstances place Bitcoin for extra future beneficial properties. Due to this fact, if the present market circumstances maintain, BTC will reclaim $98,700.

A transfer above this degree will strengthen Bitcoin to reclaim $100k. Conversely, one other market correction might see BTC drop to $96,100.