- The 6–12 month holder cohort contributed to Bitcoin’s current value stagnation beneath $100K.

- Declining whale transactions and decreased Open Curiosity advised potential short-term sideways motion.

Bitcoin’s [BTC] value efficiency over the previous few weeks has remained subdued, with restricted upward motion, regardless of market anticipation for a year-end rally.

Since mid-December, Bitcoin has didn’t maintain ranges above the $100,000 mark, fluctuating primarily between $94,000 and $95,000.

This value vary displays a 5.8% decline over the previous week. On the time of writing, Bitcoin is buying and selling at $95,657, marking an additional 2.5% drop inside the final 24 hours.

Who profited throughout the $100,000 vary?

Amid this market stagnation, analysts have turned their focus to investor conduct higher to know the components behind Bitcoin’s value motion.

A CryptoQuant analyst, Yonsei Dent, has highlighted insights from the Spent Output Age Bands (SOAB) indicator.

This metric tracks Bitcoin gross sales exercise based mostly on the holding durations of traders, providing a clearer image of promoting strain throughout completely different market individuals.

The knowledge reveals that holders with the 6–12 month interval have been essentially the most lively sellers throughout the current Bitcoin rally, primarily capitalizing on earnings made throughout the market’s upward surge earlier this yr.

Apparently, these traders, who seemingly purchased Bitcoin across the time of the spot ETF launch in early 2024, have been a big supply of promoting strain, contributing to the present value stagnation.

Nevertheless, long-term holders—those that have held Bitcoin for over a yr—seem to have bought comparatively little throughout this era.

Moreover, the Binary CDD (Coin Days Destroyed) indicator reveals a decline in older Bitcoin gross sales in December in comparison with November.

Thus, many long-term holders stay optimistic about future value will increase and are holding onto their positions.

Combined sentiment available in the market

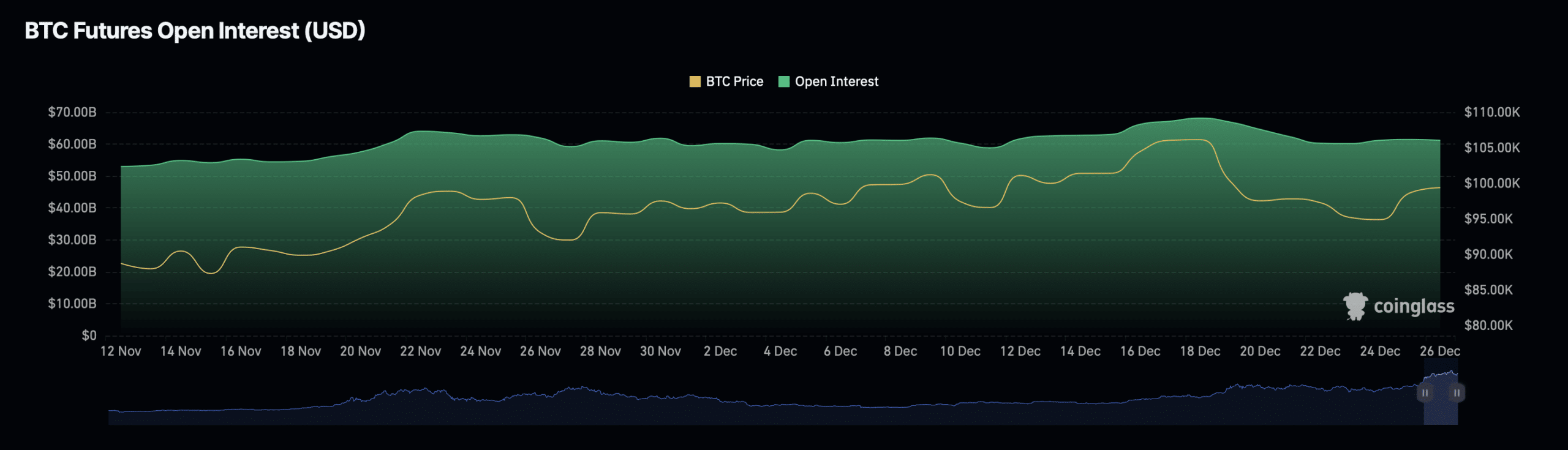

Additionally, Bitcoin’s Open Curiosity offered extra perception into the market’s course.

Open Curiosity represents the full worth of excellent Futures contracts and serves as a barometer for market sentiment and liquidity.

In response to knowledge from Coinglass, Bitcoin’s open curiosity has decreased by 0.69%, reaching a valuation of $60.68 billion.

Bitcoin’s Open Curiosity quantity has additionally dropped by 1.45% to $94.14 billion.

These declines point out a discount in speculative buying and selling exercise, suggesting that merchants are exercising warning amid Bitcoin’s stagnant value actions.

Decrease Open Curiosity usually indicators decreased market participation, which may restrict important value swings within the brief time period.

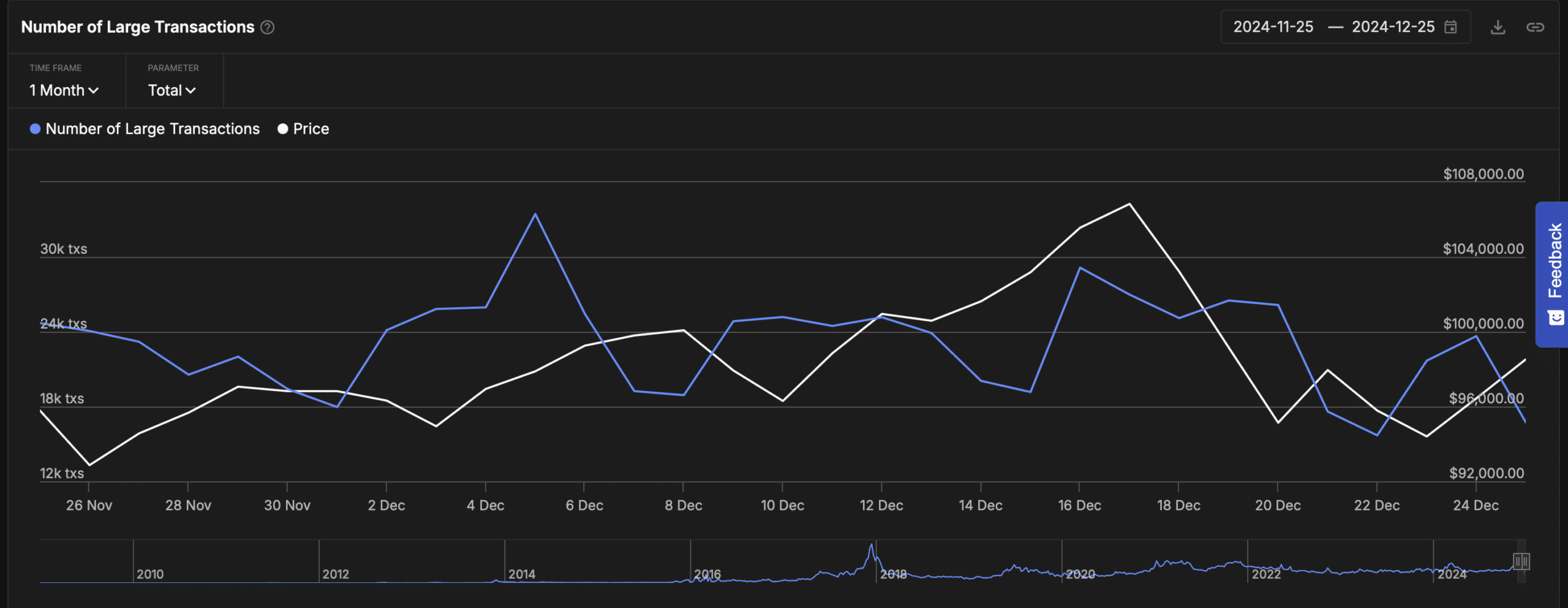

In the meantime, Bitcoin’s whale transaction exercise, has proven a pointy decline over the previous month.

Learn Bitcoin’s [BTC] Worth Prediction 2025–2026

Information from IntoTheBlock revealed that transactions exceeding $100,000 have decreased considerably, dropping from practically 40,000 transactions in the beginning of December to simply 16,700 as of the twenty fifth of December.

Whale transactions are sometimes seen as a powerful indicator of institutional or high-net-worth investor exercise, and a decline in these transactions suggests decreased market confidence or a brief pause in large-scale accumulation.