- Bitcoin trades close to key assist as Mt. Gox actions stir market uncertainty.

- Rising derivatives exercise hints at cautious optimism regardless of bearish technical indicators.

Mt. Gox’s switch of $49.3 million in Bitcoin [BTC] has despatched ripples throughout the market, sparking fears of heightened volatility. The redistribution noticed $19 million transferred to recent wallets and $30.6 million moved to a last pockets.

This large motion raises essential questions on whether or not it alerts a wave of sell-offs. At press time, Bitcoin was buying and selling at $94,435.63, reflecting a 0.72% dip within the final 24 hours.

Can BTC break resistance or danger shedding assist?

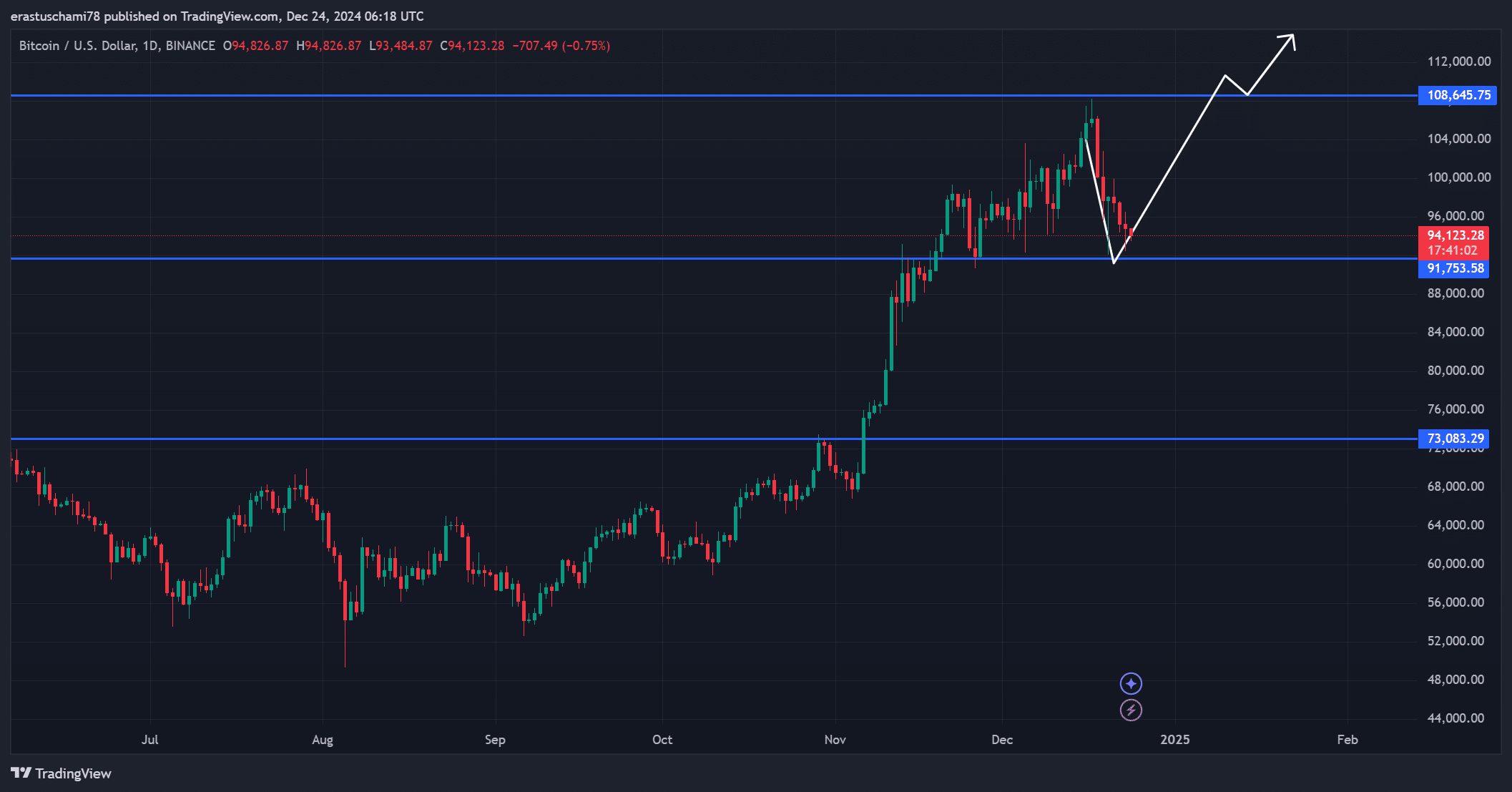

Bitcoin is buying and selling inside a essential vary, with assist at $91,753 and resistance at $108,645. A break beneath $91,753 may open the door to a plunge towards $73,083, signaling bearish dominance.

Nevertheless, if Bitcoin manages to climb previous $96,000, it may construct momentum towards the $100,000 milestone. Due to this fact, this era of consolidation will possible decide whether or not Bitcoin rallies or retreats additional within the coming days.

Lively addresses present rising engagement

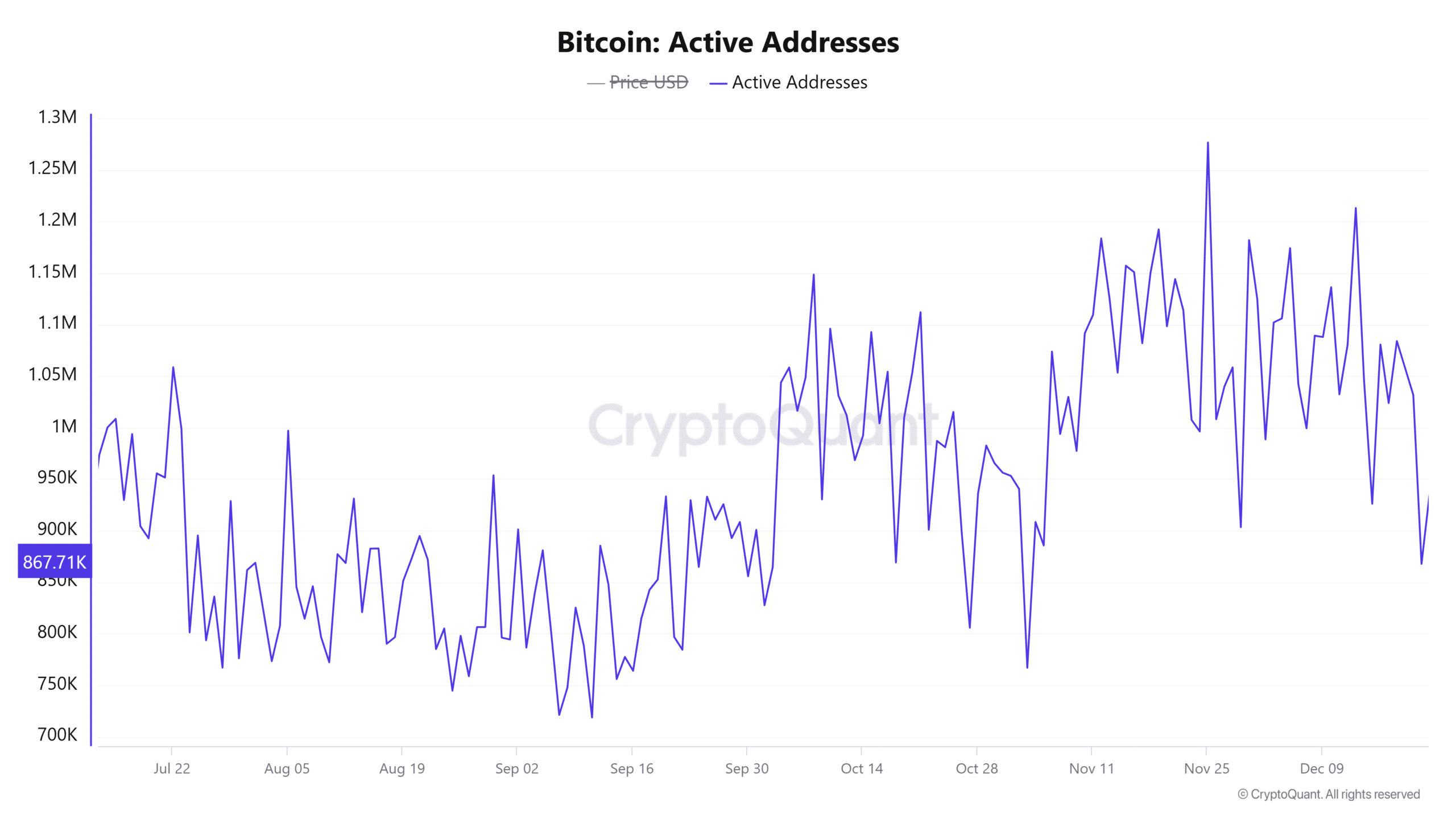

Bitcoin’s lively addresses elevated by 1.21% within the final 24 hours, reaching 9,747K, reflecting heightened engagement. This rise suggests extra members getting into the market, possible pushed by hypothesis surrounding the Mt. Gox motion.

Moreover, elevated community exercise is a optimistic signal for demand, because it usually correlates with stronger market well being. Due to this fact, sustained development in lively addresses may assist Bitcoin’s restoration within the close to time period.

Is BTC undervalued? MVRV ratio insights

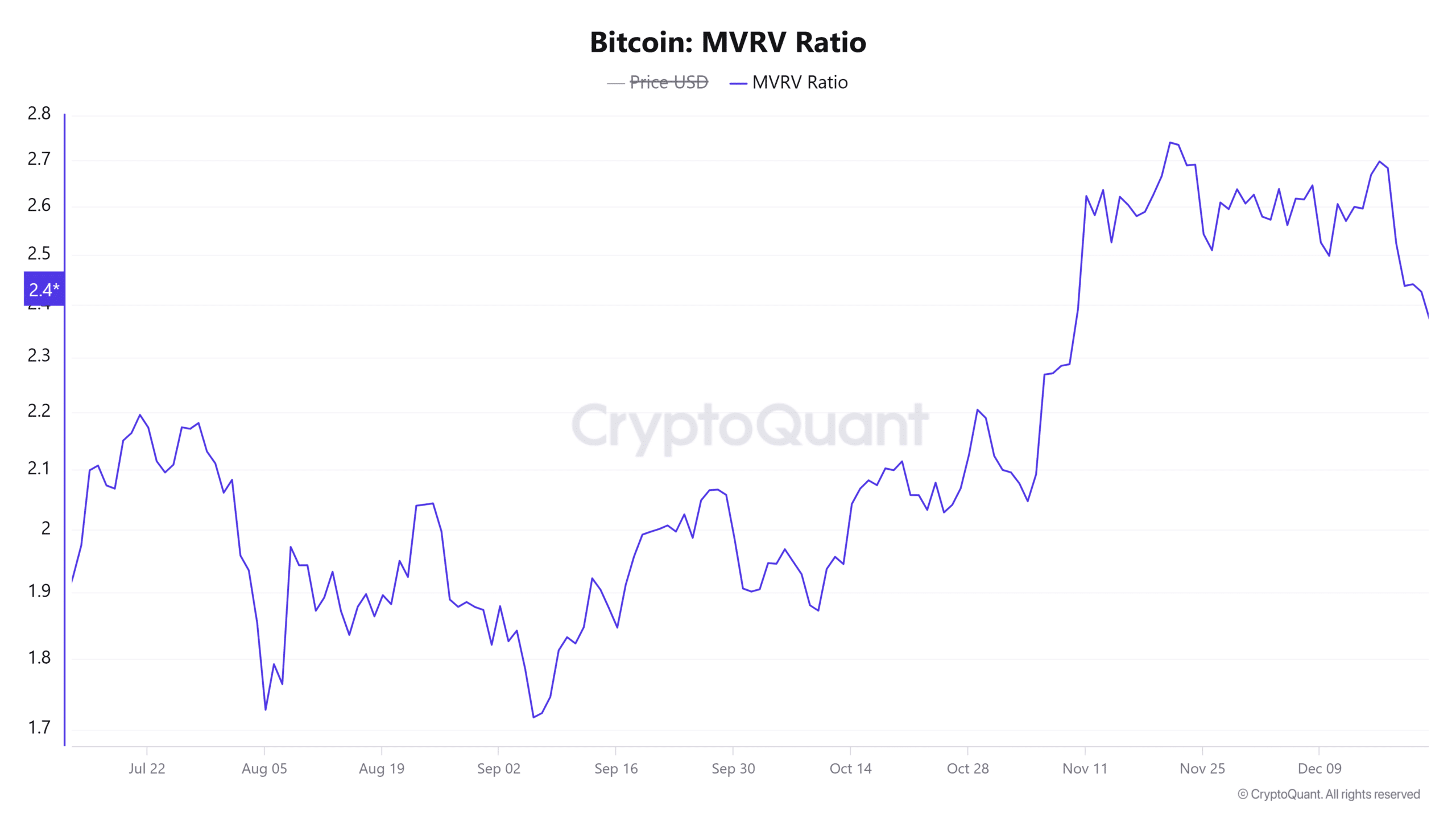

The MVRV ratio, at the moment at 2.4 after a 1.17% decline, hints at a cooling-off section in speculative strain. Traditionally, a decrease ratio has aligned with more healthy worth ranges, attracting long-term buyers.

Nevertheless, additional declines would possibly point out waning confidence amongst members, conserving merchants cautious. Due to this fact, the MVRV ratio stays a vital metric for gauging Bitcoin’s market place.

Change inflows recommend warning

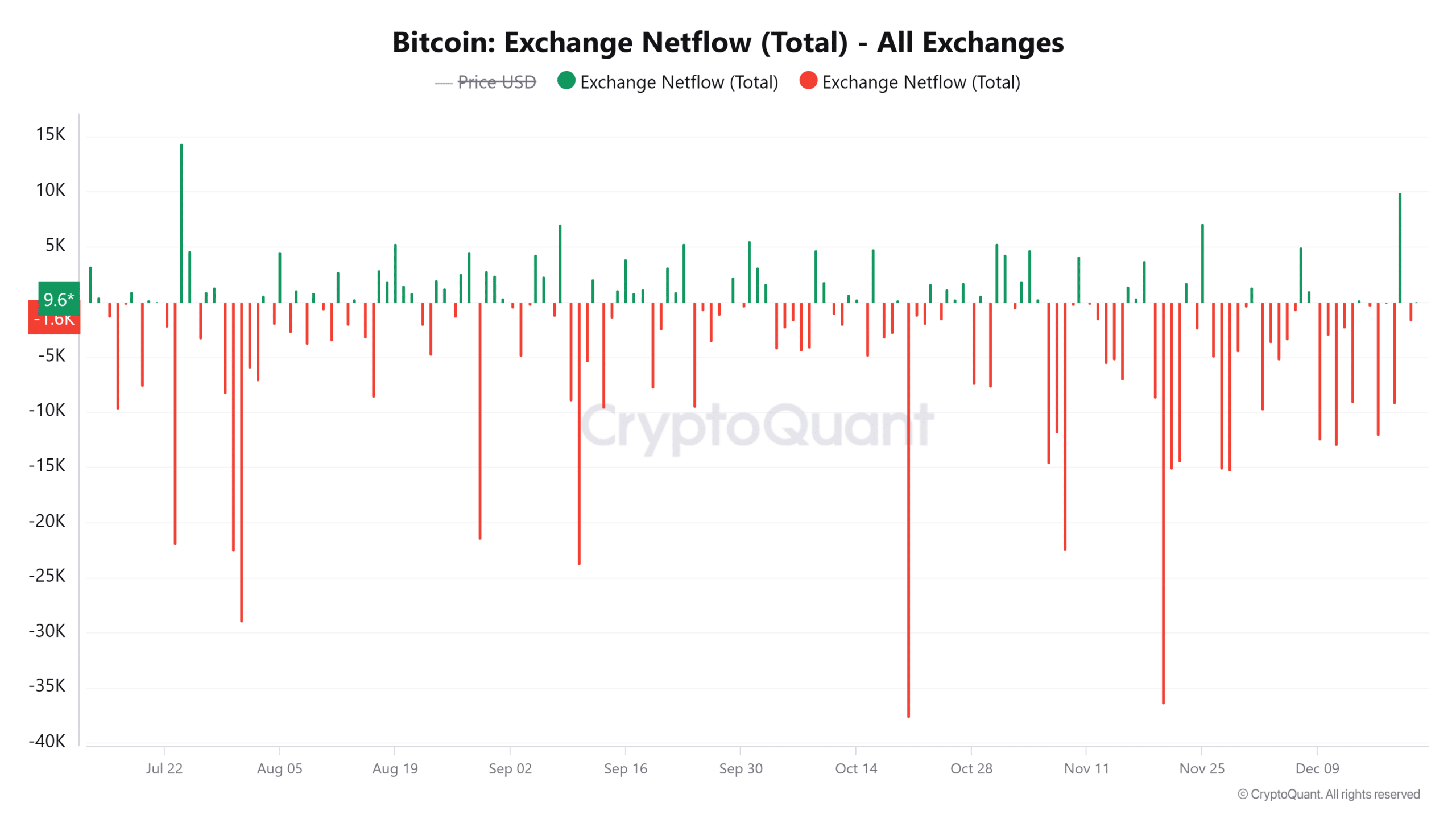

Change web inflows surged by 39.93%, totaling 19.545K BTC, elevating considerations about potential sell-offs. Inflows to exchanges usually sign that merchants are getting ready to liquidate holdings, though not all inflows lead to quick promoting.

Due to this fact, monitoring change exercise intently can be important in figuring out whether or not this surge interprets into bearish momentum or stays impartial.

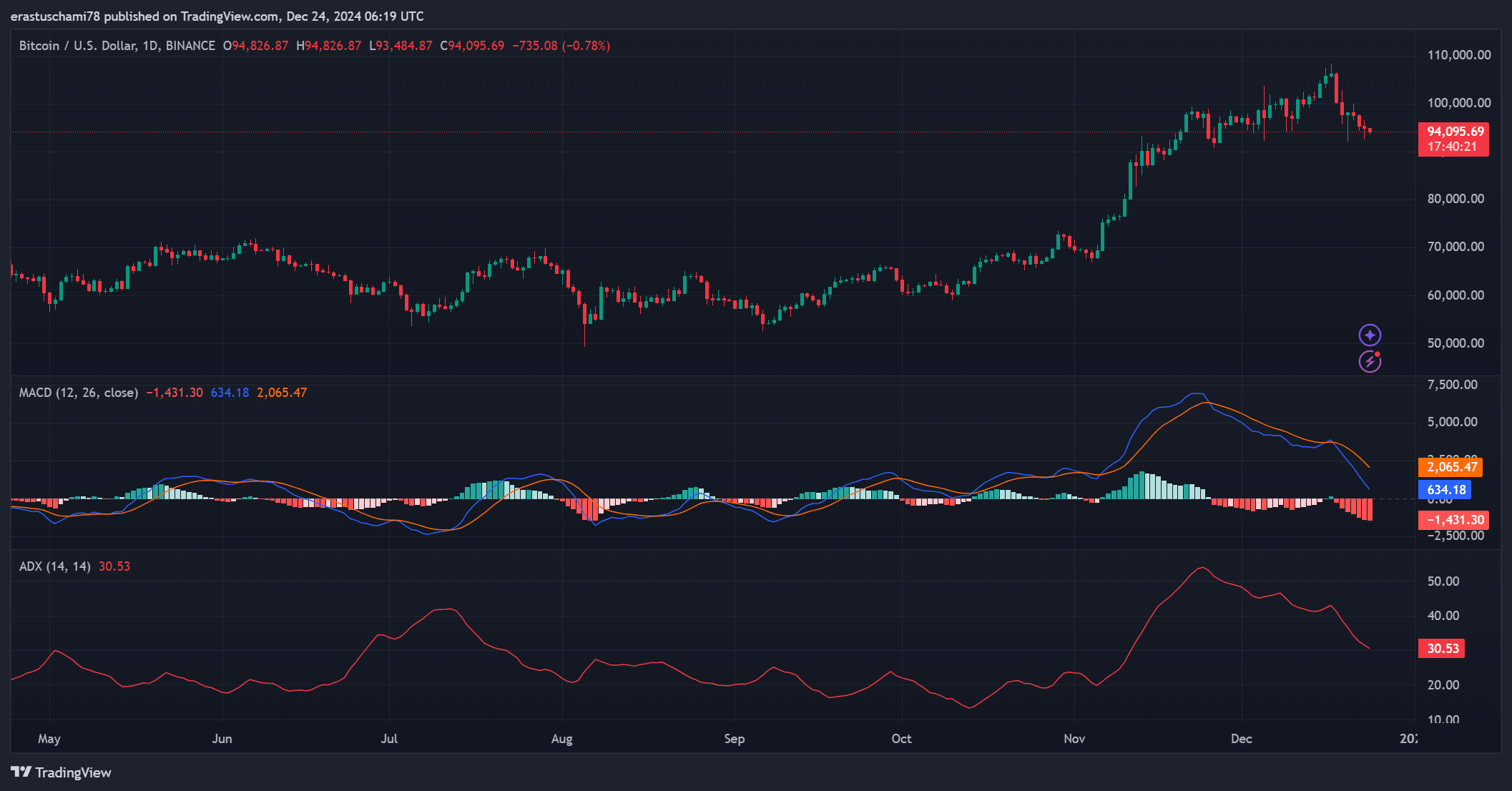

ADX and MACD reveal combined alerts

The ADX, at the moment at 30.53, signifies a reasonably sturdy pattern out there. In the meantime, the MACD exhibits bearish momentum following a crossover beneath the sign line.

Nevertheless, the MACD’s place close to the zero line suggests potential for a reversal if patrons regain management. Due to this fact, the technical indicators spotlight the market’s delicate steadiness between bullish and bearish forces.

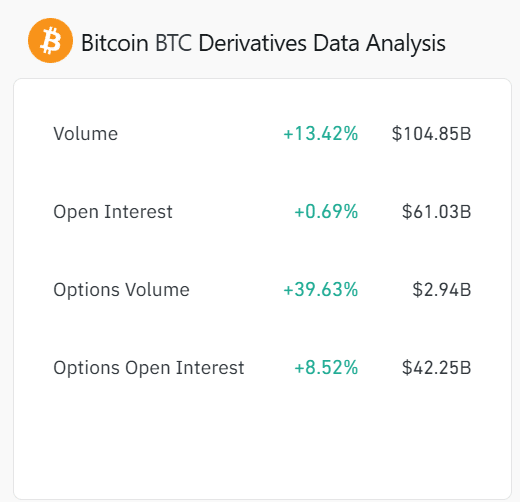

Derivatives information displays cautious optimism

BTC derivatives exercise has seen a notable uptick, with choices quantity rising by 39.63% to $2.94 billion. Open curiosity elevated by 0.69% to $61.03 billion, whereas choices open curiosity grew by 8.52% to $42.25 billion.

These figures replicate rising speculative curiosity, although the modest rise in open curiosity signifies restricted directional conviction. Due to this fact, derivatives information suggests optimism however with an air of warning.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Mt. Gox’s Bitcoin redistribution has created a local weather of uncertainty, leaving the market on edge. BTC’s capacity to carry essential assist and navigate rising change inflows will decide whether or not this motion triggers a sell-off or evokes confidence.

For now, Bitcoin stays at a crossroads, balancing between worry and alternative.