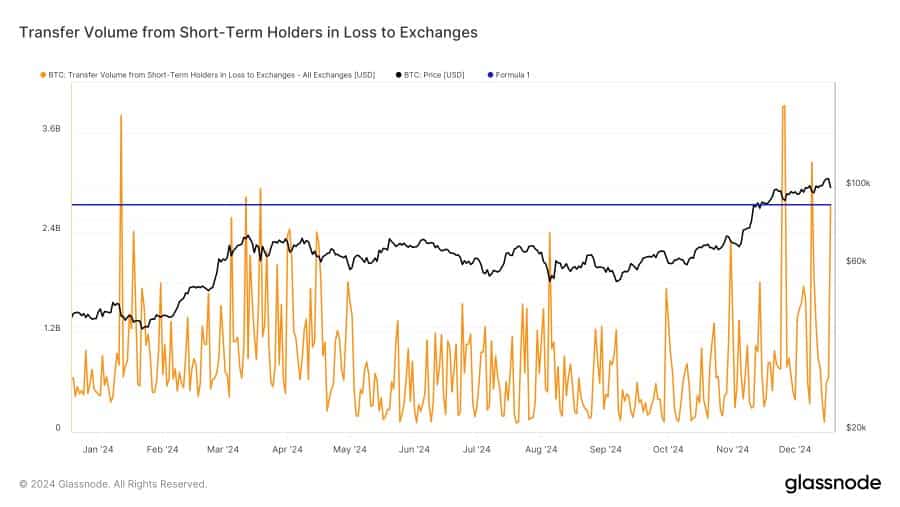

- Quick-term holders offloaded vital volumes over the previous 24 hours, whereas giant buyers, together with whales, remained on the sidelines, ready for extra favorable entry factors.

- The shopping for ratio peaks at a brand new excessive final reached in April, opening shopping for alternatives.

Bitcoin’s [BTC] has slipped right into a corrective part, dropping 4.43% prior to now 24 hours to commerce beneath $100,000. This pullback has trimmed its month-to-month good points to 4.94%.

If bullish momentum takes maintain, Bitcoin may surpass its earlier all-time excessive and transfer towards $108,500 earlier than trending increased. In accordance with AMBCrypto’s evaluation, restoration could rely upon giant holders stepping in at key value ranges regardless of ongoing bearish market circumstances.

Quick-term holders gasoline Bitcoin’s latest decline

Analyst Jam Van Straten attributes Bitcoin’s latest downturn primarily to short-term holders who ceaselessly commerce the cryptocurrency. This group has collectively offloaded about 26,000 BTC, valued at $2.7 billion.

These sell-offs embrace trades made at each losses and income, reflecting the volatility of their buying and selling exercise.

Van Straten famous that enormous buyers, or whales, stay on the sidelines, holding vital liquidity as they anticipate a great entry level.

He defined:

“Big players are waiting for the price and not chasing it.”

This implies that these influential merchants are unlikely to behave till market circumstances align with their methods. As soon as whales re-enter the market, their shopping for exercise may drive Bitcoin to recuperate and doubtlessly commerce increased.

Shopping for momentum may quickly resume

Santiment studies that discussions about shopping for Bitcoin’s latest dip have reached record-high ranges, a sentiment that was final seen on the twelfth of April 2024, eight months in the past.

Since then, Bitcoin has surged by over 81%. If historical past repeats itself, the present sentiment may gasoline an analogous rally, pushing BTC into increased value areas past its present ranges.

With this potential upside in view, whales are more likely to resume purchases. If shopping for momentum stays sturdy, Bitcoin may pattern even increased.

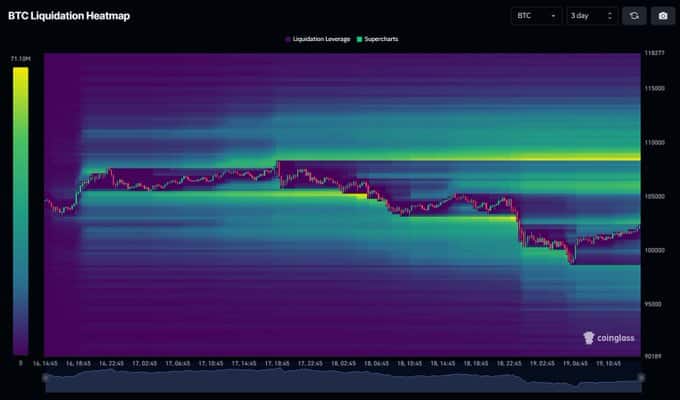

Additional evaluation reveals that BTC is able to commerce above its earlier highs, pushed by the formation of a big liquidity cluster across the $108,500 degree, as identified by analyst Mister Crypto.

Liquidity clusters act as magnets for value actions, as belongings typically gravitate towards these areas to filter out pending orders earlier than persevering with their trajectory.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

This setup means that Bitcoin has a powerful probability of regaining purchaser curiosity, particularly as bullish conversations proceed to dominate the market.