- MicroStrategy, Mara, and Riot shares noticed a surge in worth as BTC hit $107K.

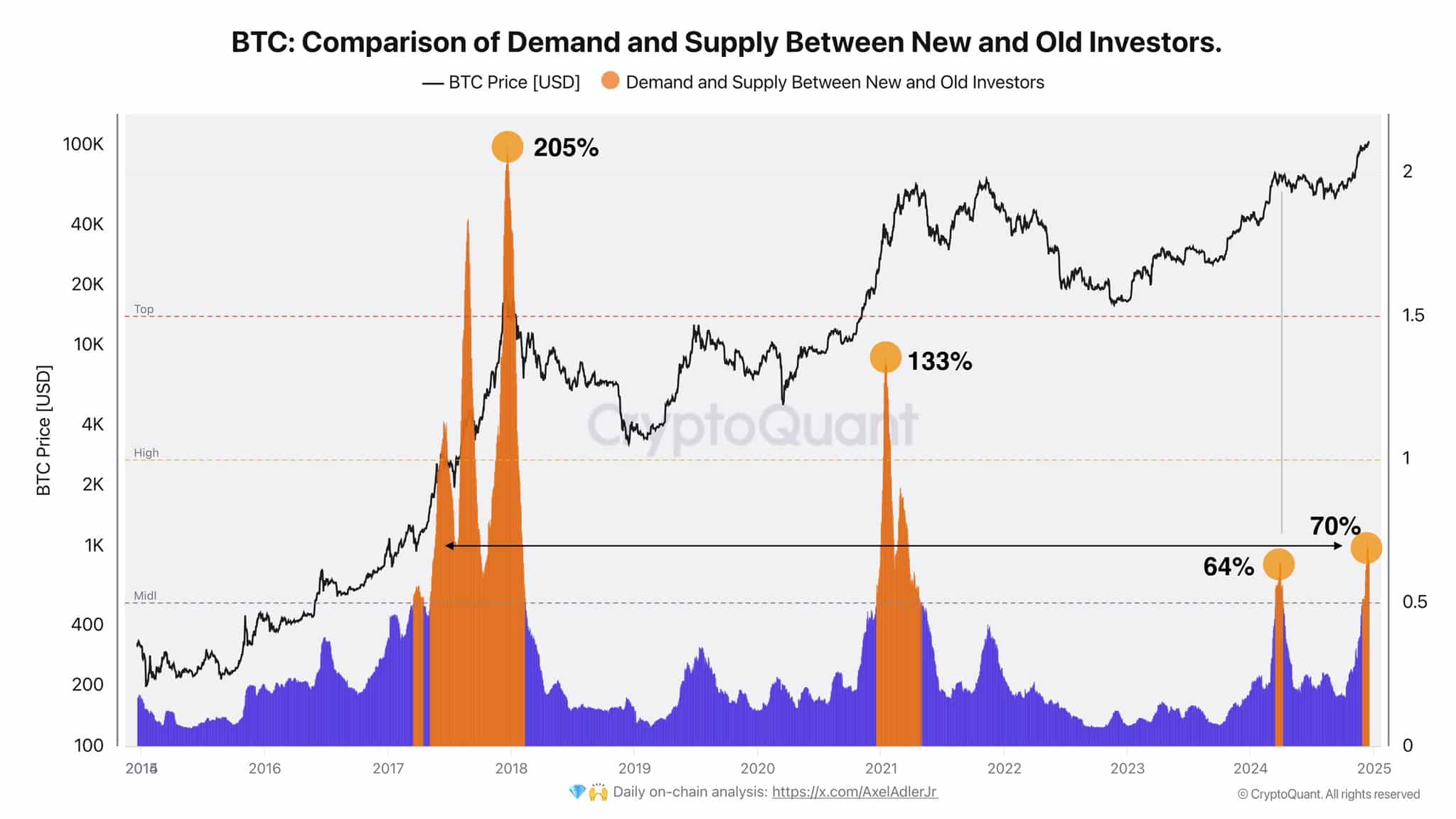

- BTC’s demand from new traders exceeds the March demand on the $70K degree by 4%.

MicroStrategy aggressively acquired 15,350 Bitcoins [BTC] at a mean worth of $100.3K, elevating their whole holdings to 439,000 BTC. These have been bought for $27.1 billion at a mean of $61,725 every.

This strategic accumulation is mirrored of their reported BTC yields of 46.4% for the quarter and 72.4% year-to-date.

CEO Michael Saylor’s feedback on X (previously Twitter) emphasised a long-term view on digital belongings by evaluating Bitcoin funding to historic valuations of Manhattan.

His advocacy for a Digital Property Framework and a Bitcoin Strategic Reserve, alongside MicroStrategy’s inclusion within the Nasdaq 100, highlighted their pivotal position in shaping the monetary area.

The MSTR method might counsel future developments in company asset allocation and the broader integration of digital belongings in monetary methods.

Different crypto shares have been up

MARA Holdings’ inventory climbed 11% in response to Bitcoin’s ascent to a brand new all-time excessive of round $107K.

This upswing in MARA’s inventory worth paralleled positive aspects throughout crypto-linked equities, highlighting the market’s growing interdependence with crypto efficiency.

MARA utilized proceeds from its zero-coupon convertible notes choices to purchase 11,774 BTC. The $1.1 billion acquisition at $96K per BTC yielded a return of 12.3% for the quarter and 47.6% year-to-date.

MARA’s Bitcoin holdings now stand at 40,435 BTC, valued at $3.9 billion. The corresponding worth motion has its inventory poised to hit $45.

Moreover, Riot Blockchain capitalized on its elevated funding from an upsized $594 million convertible bond challenge, buying 667 BTC at a mean of $101,135 every.

This strategic transfer expanded Riot’s holdings to 17,429 BTC, valued at $1.8 billion. All year long, each acquisitions and mining operations contributed to the corporate’s monetary efficiency.

Consequently, Riot reported a considerable Bitcoin Yield Per Share, reaching 36.7% for the quarter and 37.2% year-to-date.

This monetary maneuver demonstrates Riot’s strong place in leveraging market dynamics to boost shareholder worth, highlighting its adept technique within the evolving cryptocurrency panorama.

Bitcoin demand on the rise

Moreover, the present cycle’s demand from new traders has exceeded the earlier March peak, when Bitcoin reached $70K, by 4%.

Though vital, this degree of demand is extra average in comparison with prior cycles, the place demand peaks surged to 205% and 133%. This moderation might counsel a shift in dynamics or investor sentiment at these costs.

Traditionally, these peaks usually preceded substantial market actions, indicating that Bitcoin might expertise additional vital adjustments in valuation.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Anticipation of potential volatility or development primarily based on historic patterns has aligned expectations with rising market conduct.