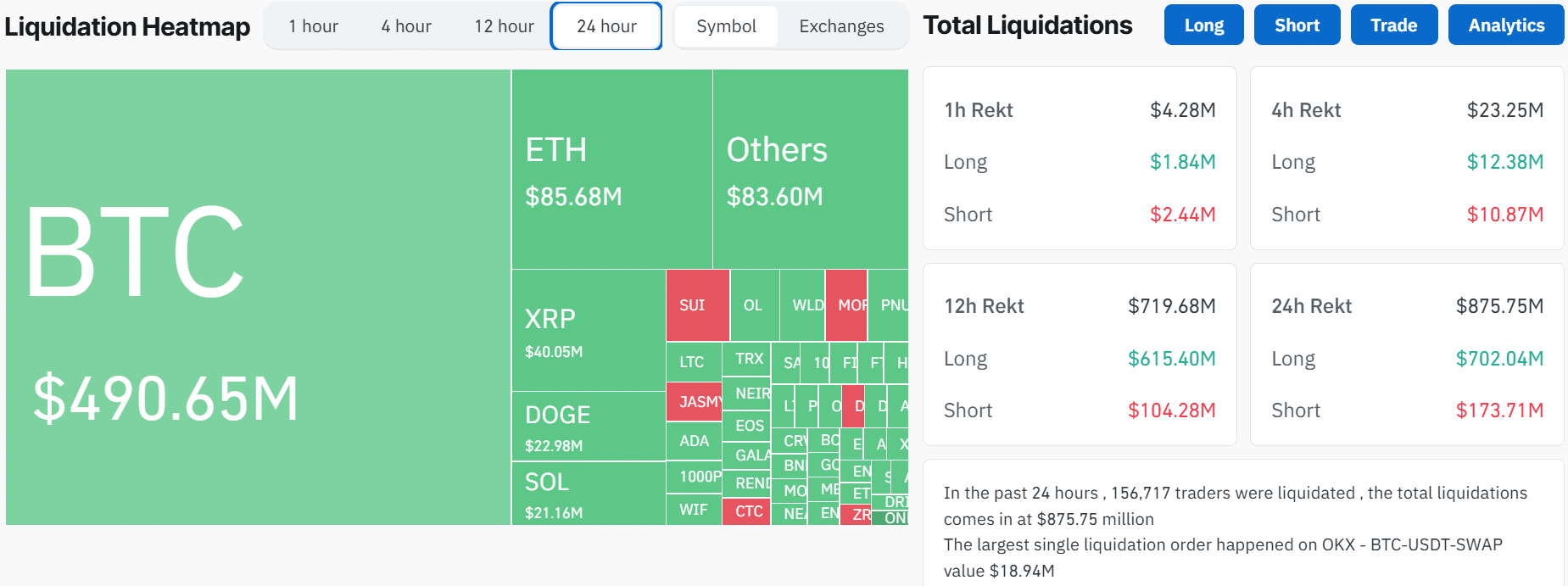

- The full liquidations throughout the crypto market surpassed $875 million after Bitcoin fell beneath $100,000.

- Bitcoin lengthy liquidations additionally surged to a document excessive of $416 million.

The cryptocurrency market recorded an enormous surge in liquidations within the final 24 hours, which worn out over $875 million in leveraged lengthy and brief positions, marking the very best quantity of liquidations since 2021.

Per Coinglass information, lengthy liquidations totaled $702 million whereas brief liquidations got here in at $173 million. These liquidations affected greater than 157,000 merchants.

Merchants betting on Bitcoin [BTC] gaining additional recorded probably the most losses, with lengthy BTC liquidations reaching $416 million. These positions have been closed after the king coin skilled a sudden spike in volatility, which noticed the worth fall from above $100,000 to $92,000 in below 4 hours.

Altcoins additionally noticed a slight spike in volatility. Ethereum [ETH] value fluctuated between $3,600 and $3,900 inflicting $85 million in liquidations. XRP [XRP] noticed the third-highest degree of liquidations of $40 million whereas Dogecoin [DOGE] recorded $22 million in liquidations.

This sudden surge in liquidated trades and volatility might have been a pressured correction after overleverage induced a market imbalance.

Liquidations surge resulting from an overleveraged market

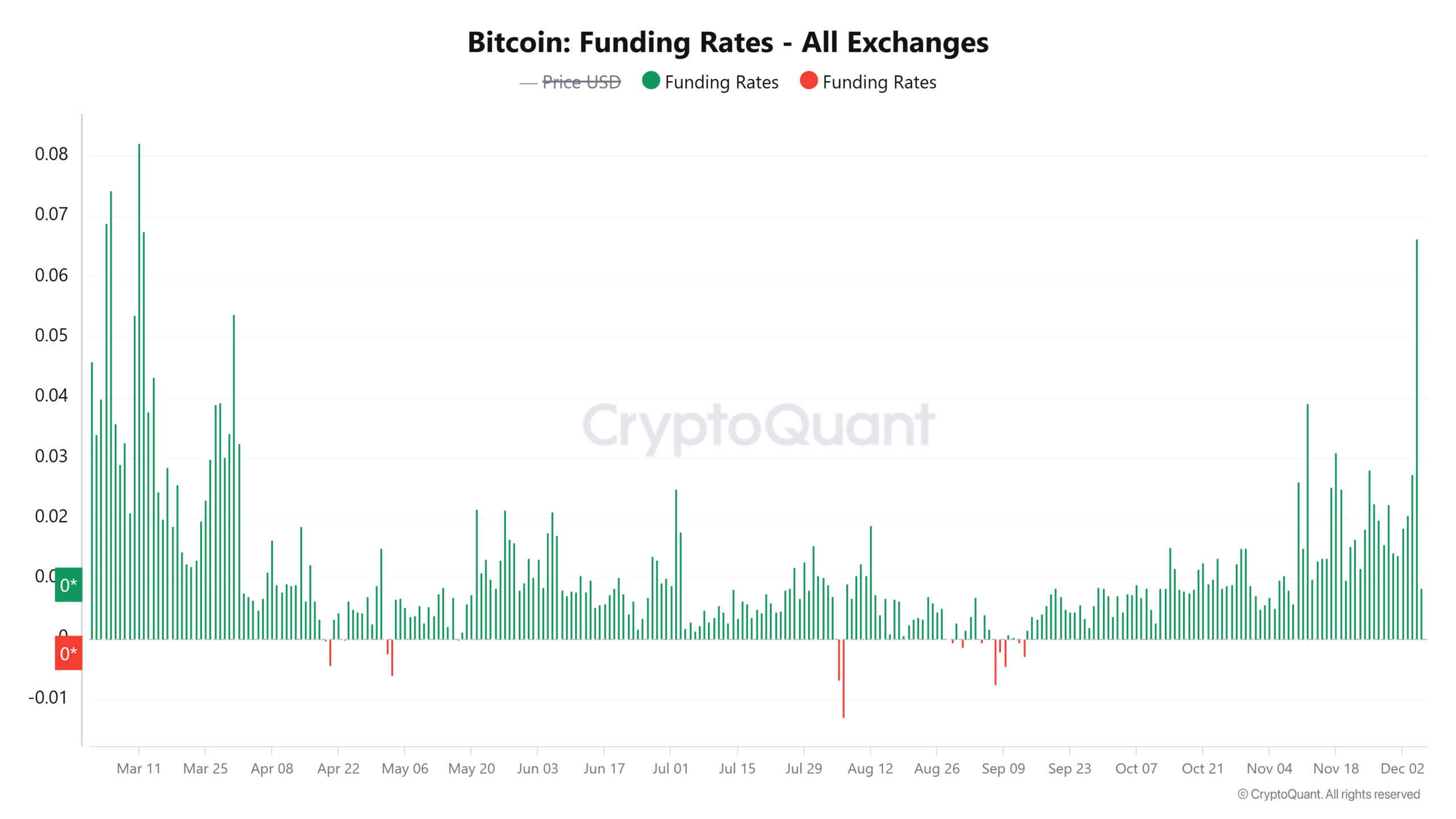

In keeping with CryptoQuant, Bitcoin funding charges reached a multi-month excessive of 0.0663 on fifth December, suggesting that lengthy positions have been more and more dominant.

At any time when funding charges attain excessive ranges, it tends to precede a pointy transfer in the wrong way of which merchants are anticipating the worth to go.

Due to this fact, after a buildup of lengthy positions, a protracted squeeze ensued that triggered pressured promoting and induced funding charges to say no.

The estimated leverage ratio clearly exhibits the market correction. This metric recorded a pointy rise to a seven-day excessive, as merchants elevated their leverage on Bitcoin. It later declined resulting from overleveraged positions being closed.

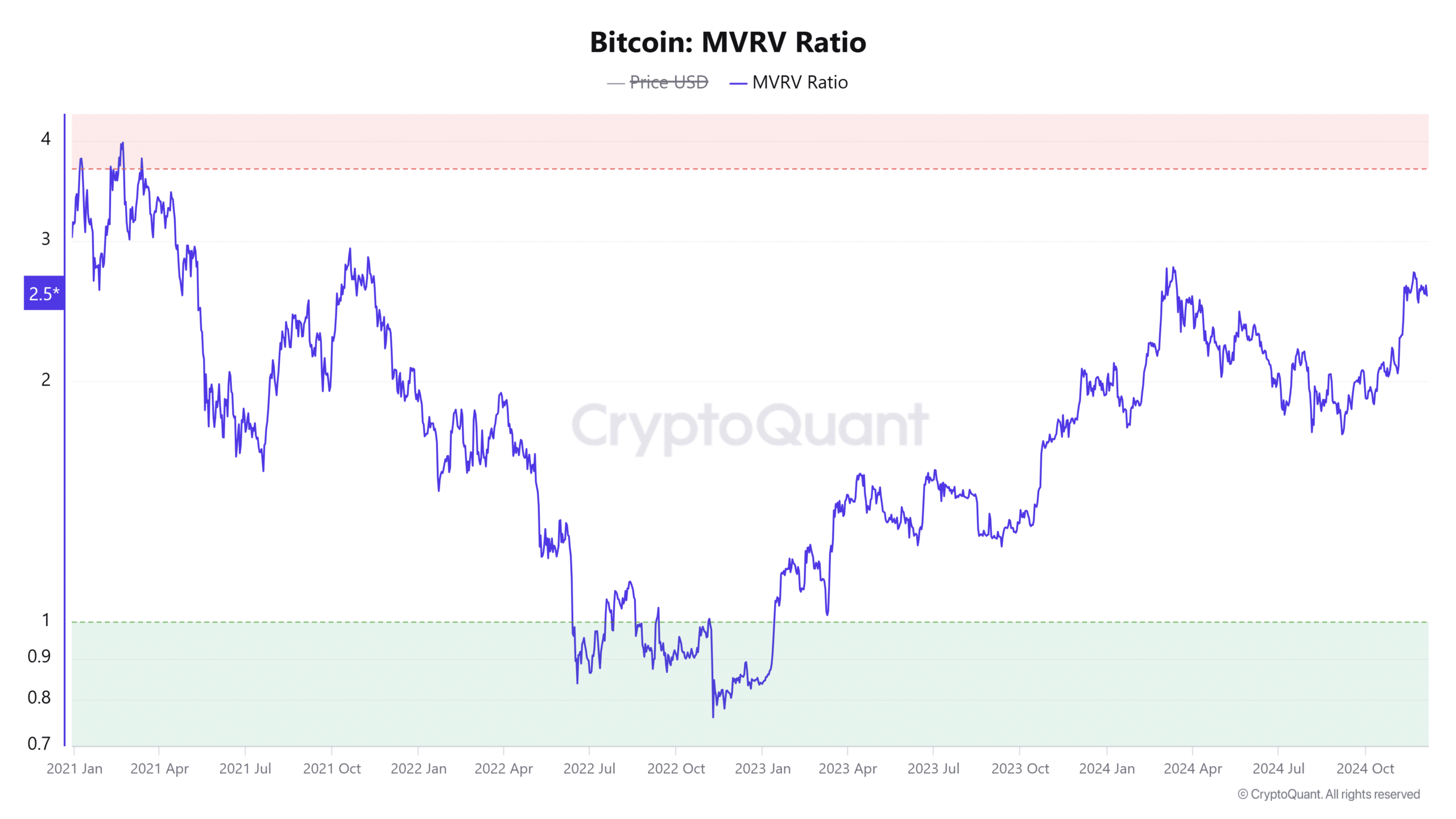

MVRV ratio exhibits there’s nonetheless room for extra positive aspects

Bitcoin’s market worth to realized worth (MVRV) ratio exhibits that regardless of the latest correction, BTC has but to succeed in its native high.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The MVRV ratio, at press time, stood at 2.5 suggesting that the asset was nonetheless pretty priced. Within the final three months, Bitcoin’s MVRV ratio has elevated from 1.72 as profitability for holders elevated.

A surge within the MVRV ratio previous 3.5 will sign that Bitcoin has reached an area high. Due to this fact, merchants ought to be careful for an additional rise on this metric to overvalued ranges.