- Institutional inflows, like BlackRock’s Bitcoin ETF, have propelled BTC’s rise above $100K.

- Regulatory shifts and Putin’s help for BTC add momentum to its ongoing market surge.

Bitcoin [BTC] has crossed the $100,000 mark, reaching a serious milestone for the crypto market. The value surge has drawn consideration to components resembling institutional curiosity, regulatory developments, and world help for digital belongings.

Beneath, we discover the principle causes behind this rise.

Bitcoin market knowledge displays sturdy momentum

As of press time, Bitcoin was buying and selling at $102,570 with a 24-hour buying and selling quantity of $141.34 billion. During the last 24 hours, its value has risen by 6.19%, whereas a 6.78% acquire has been recorded over the previous week.

Bitcoin’s market capitalization now stands at $2.01 trillion, primarily based on a circulating provide of 20 million BTC.

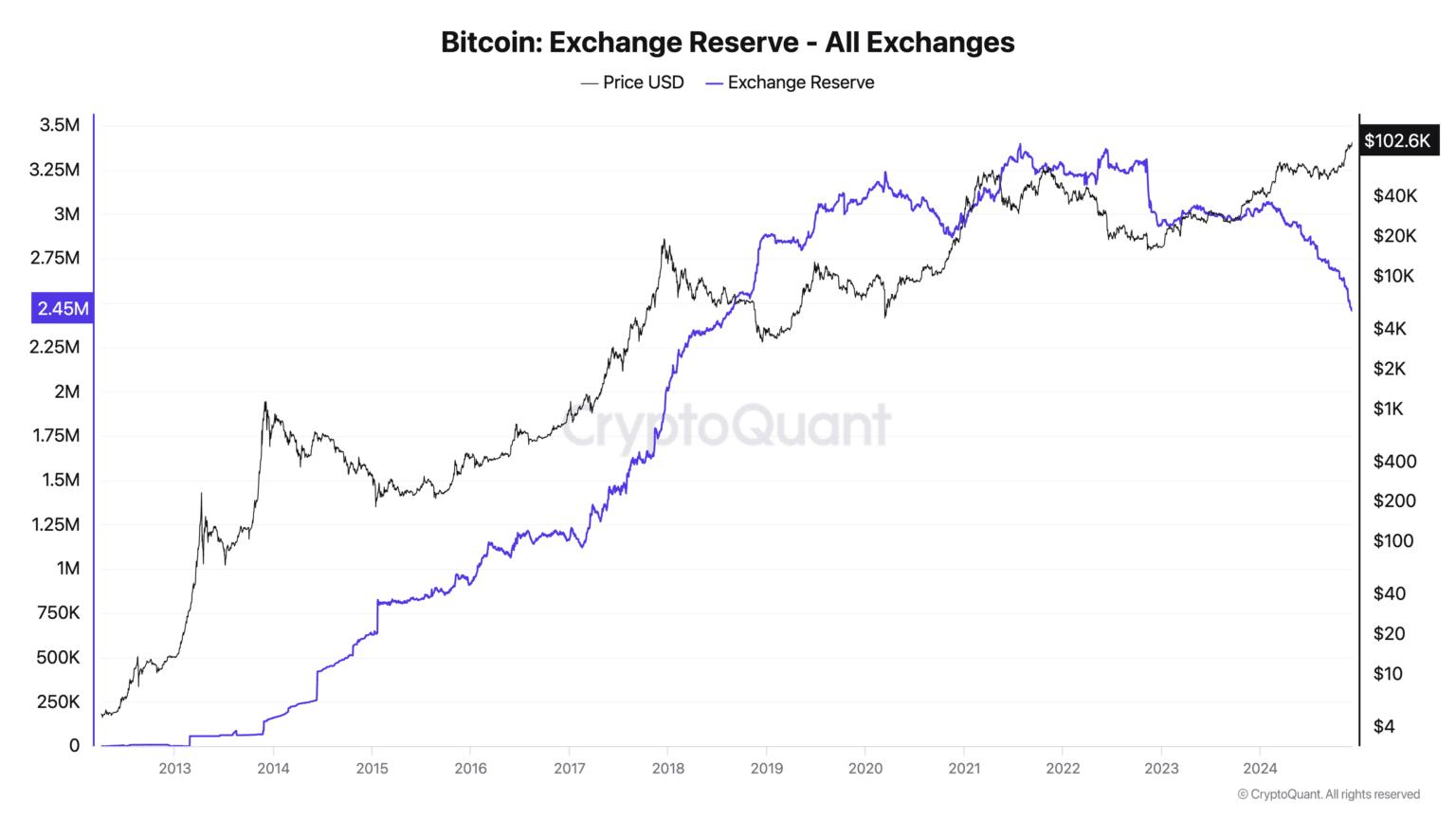

Bitcoin’s buying and selling vary over the past day spanned between $94,870 and $103,679, marking a brand new all-time excessive of $103,679. BTC change reserves have additionally been falling, indicating decreased promoting exercise.

This means that traders are selecting to carry their belongings.

Institutional inflows bolster Bitcoin rally

Institutional curiosity has performed a major function in Bitcoin’s rise previous $100,000. A significant contributor has been BlackRock’s iShares Bitcoin Belief ETF (IBIT), which just lately crossed $50 billion in belongings underneath administration.

Notably, IBIT achieved this milestone inside simply 228 days, far quicker than conventional ETFs, a few of which have taken years to achieve related ranges.

The fast development of IBIT illustrates the rising demand for Bitcoin amongst institutional traders. BlackRock has additionally built-in Bitcoin publicity into its conventional funds, additional demonstrating its religion within the cryptocurrency’s potential.

As extra establishments undertake BTC as a key monetary asset, the market continues to point out power.

Regulatory shifts drive optimistic sentiment

Regulatory modifications have additional fueled Bitcoin’s momentum. On 4th December, Donald Trump introduced Paul Atkins, identified for his crypto-friendly stance, as the brand new SEC chair, changing Gary Gensler.

This transfer has created optimism inside the crypto trade, because it raises expectations for clearer and extra supportive laws within the U.S.

Moreover, Russian President Vladimir Putin expressed sturdy help for BTC through the Russia Calling Funding Discussion board. Putin famous,

“These tools will develop one way or another because everyone will strive to reduce costs and increase reliability.”

His remarks spotlight the worldwide recognition of Bitcoin as a transformative monetary know-how, contributing to the continued rally.

Surge in futures market exercise

The derivatives market has additionally skilled important development alongside Bitcoin’s value surge. Open curiosity in Bitcoin futures has climbed to $64.70 billion, indicating heightened exercise amongst each institutional and retail merchants, based on an AMBCrypto report.

The rise in open curiosity suggests continued confidence in BTC, at the same time as profit-taking could happen within the quick time period.

This uptick in futures buying and selling exercise reinforces BTC’s place as a sought-after asset in each spot and derivatives markets.