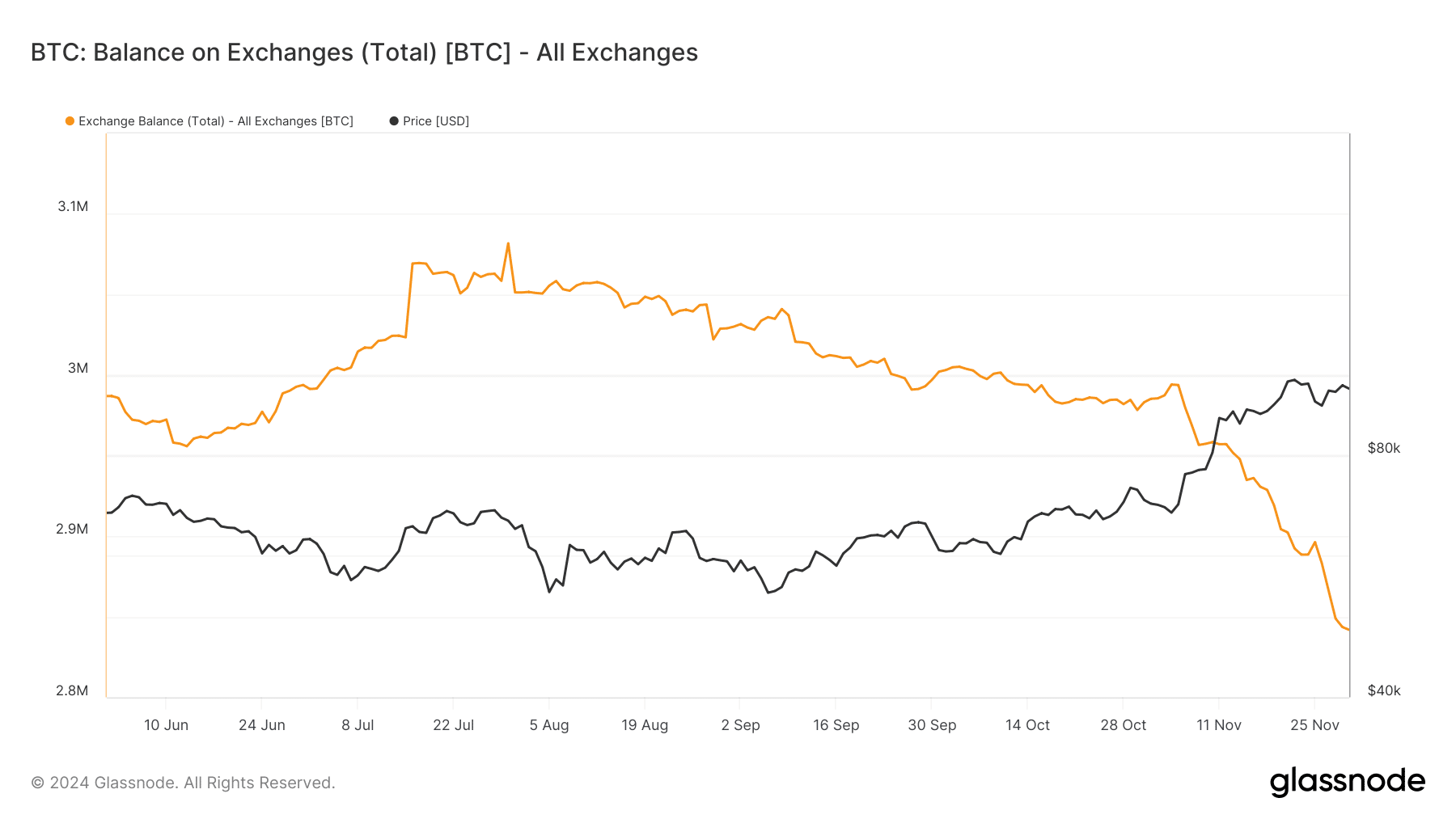

- Over 55,000 BTC had been withdrawn from exchanges in 72 hours, highlighting sturdy accumulation and demand.

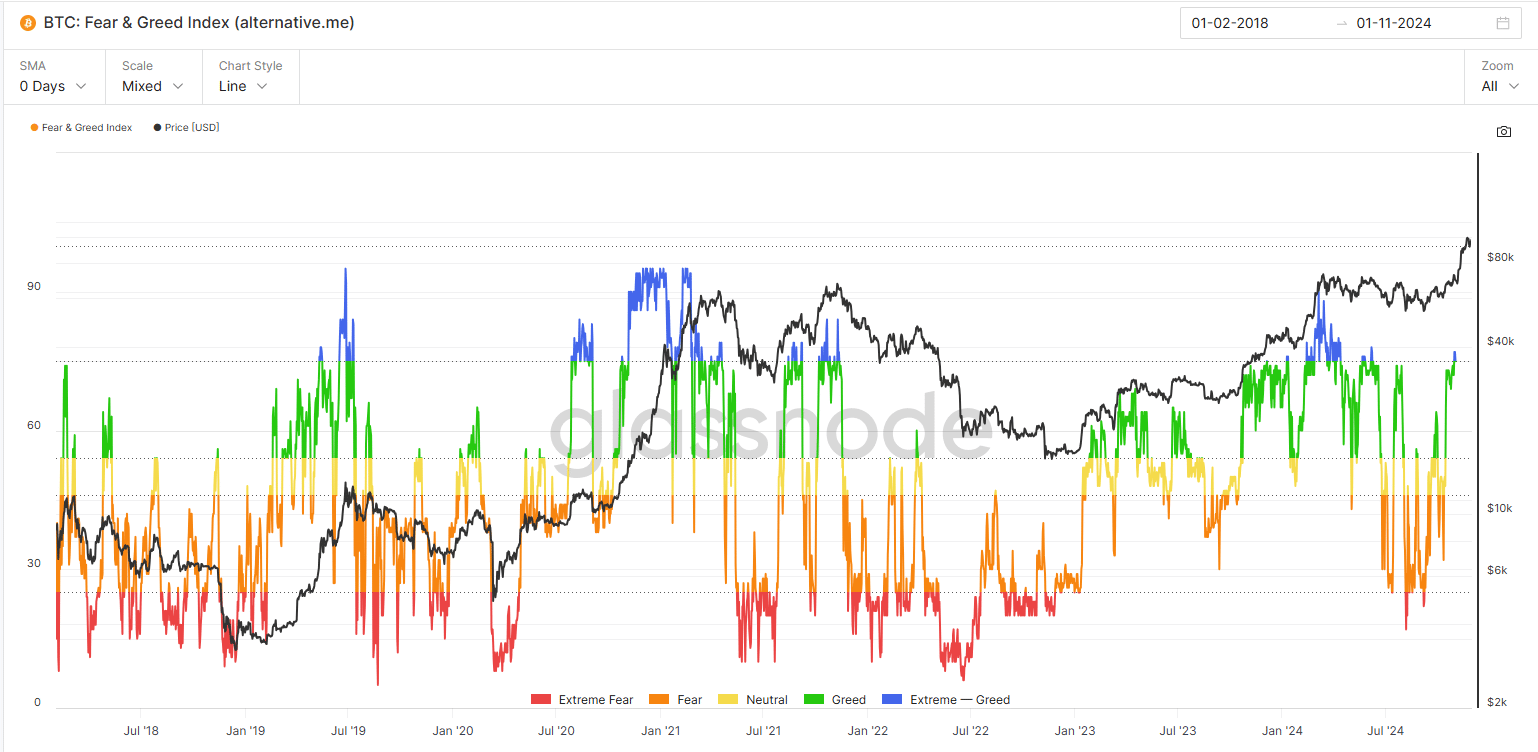

- Bitcoin’s “extreme greed” alerts warning, as historical past reveals excessive danger of market corrections

Bitcoin [BTC] has as soon as once more captured the market’s consideration with a colossal withdrawal of over 55,000 BTC from exchanges in simply 72 hours — a transfer valued at $5.34 billion.

This exodus, mixed with the Worry & Greed Index now registering “extreme greed,” has ignited hypothesis about its subsequent main transfer.

The sentiment mirrors situations seen throughout Bitcoin’s historic bull run, when euphoric optimism propelled the value from $15,000 to $57,000 between 2020-21.

Because the market grapples with this unprecedented exercise, traders are left to marvel: Are we getting ready to one other explosive rally, or is a pointy correction looming?

The Bitcoin exodus

The sharp drop in Bitcoin’s change steadiness, now beneath 2.8M BTC for the primary time since 2018, displays strategic strikes by traders.

This 55,000 BTC exodus aligns with heightened on-chain exercise, suggesting important accumulation. The motion coincides with elevated demand for self-custody as confidence in centralized platforms wanes.

Moreover, the rising worth development highlights a possible provide squeeze. Traditionally, such withdrawals have preceded bull runs, decreasing rapid promote strain on exchanges whereas signaling a long-term holding technique.

Using the wave of “Extreme Greed”

The Bitcoin Worry & Greed Index has surged into “extreme greed” territory, reflecting heightened optimism amongst traders.

Sitting above 80 at press time, a stage not seen because the 2021 bull run, this sentiment suggests a possible rally but additionally alerts warning.

Traditionally, excessive greed has pushed parabolic worth actions, such because the climb from $15,000 to $57,000 in 2020-21.

Nevertheless, these intervals usually precede volatility, as exuberant sentiment will increase the chance of overleveraged positions and abrupt corrections.

With Bitcoin breaking previous $99,000 in November, the market is getting into uncharted territory. Alternate reserves have plunged to multi-year lows, signaling a provide squeeze as long-term holders dominate.

Nevertheless, the mixture of maximum sentiment and overheated situations warns of potential retracements — like the latest worth correction within the final week.

Bitcoin’s milestone displays sturdy bullish momentum however underscores the delicate steadiness between euphoria and warning as traders weigh income in opposition to additional upside potential.

Catalysts, sustainability, and dangers

Bitcoin’s current rally is a results of a trio of things: a tightening provide as change reserves fall under 2.8M BTC, elevated institutional participation, and macroeconomic uncertainty driving demand for digital property.

The continued provide squeeze, coupled with the surge in long-term holder exercise, supplies a powerful basis for sustained upward momentum.

Nevertheless, dangers loom massive. The “extreme greed” sentiment heightens the chance of leveraged liquidations, which may set off sharp corrections.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Moreover, Bitcoin’s unprecedented development amplifies speculative exercise, making it inclined to profit-taking.

Sustaining the rally is determined by continued institutional inflows, steady macro situations, and the power to navigate unstable sentiment shifts with out destabilizing the market.