- Lengthy-term BTC holders have continued to money in.

- This has contributed to BTC’s wrestle to interrupt its psychological resistance.

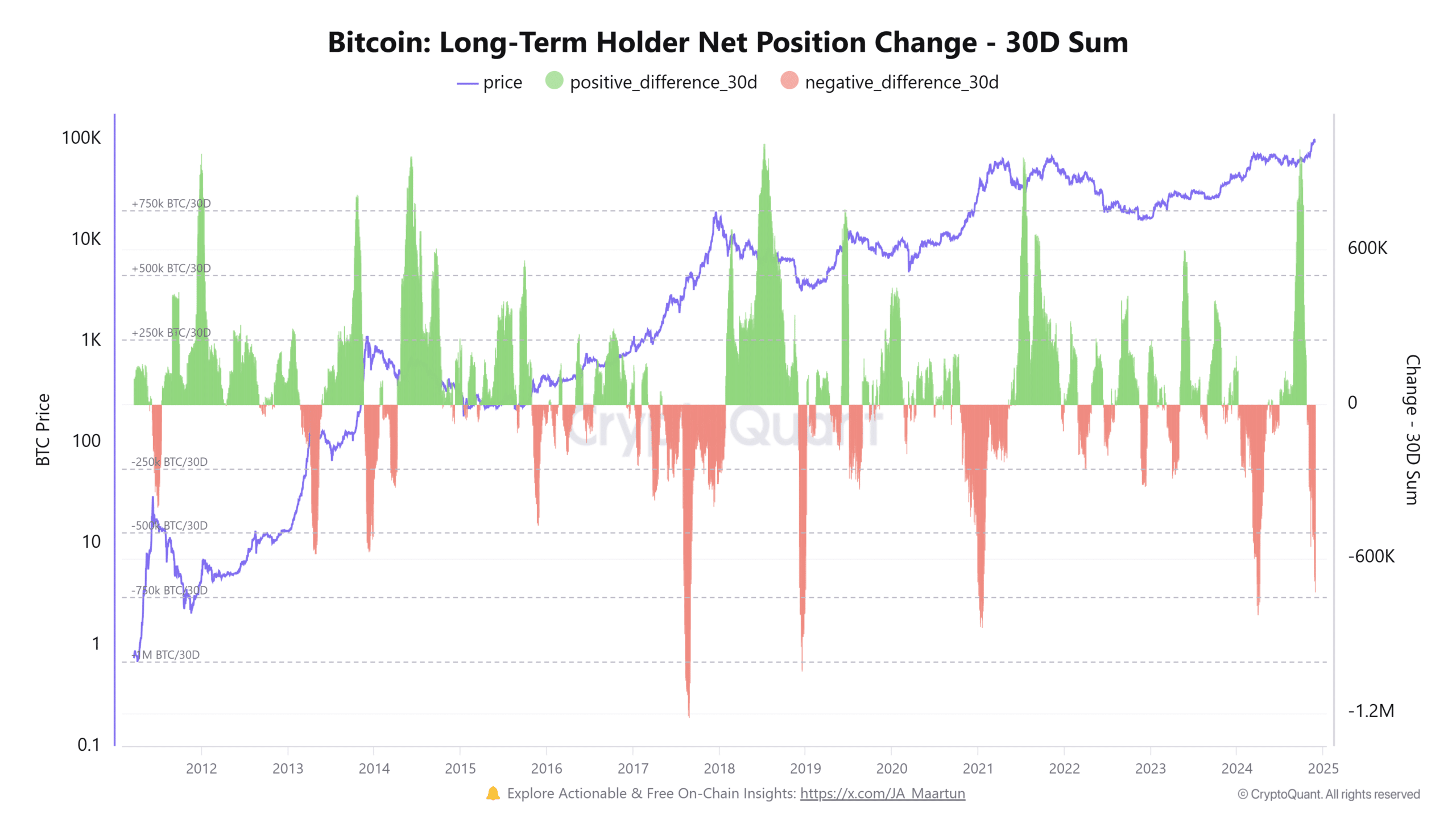

Bitcoin’s [BTC] long-term holders have had an enormous sell-off up to now 30 days, marking the biggest since April. This comes as Bitcoin hovers close to $93,000, sparking questions on whether or not these strikes sign profit-taking or forewarn a possible market correction.

With key indicators just like the Concern & Greed Index and HODL Waves exhibiting noteworthy developments, this sell-off might have implications for Bitcoin’s near-term trajectory.

Lengthy-term holders shed Bitcoin amid worth surge

The offloading by long-term holders coincides with Bitcoin’s parabolic rise to $93,000 earlier this month, fueling hypothesis concerning the motivations behind such a large sell-off.

Evaluation of the Lengthy Time period Holders Web place Change chart on CryptoQuant confirmed that it was destructive. Over 728,000 BTC has been bought up to now 30 days, marking the biggest sell-off since April.

In April, an identical sell-off by long-term holders triggered a short-term worth correction, elevating questions on whether or not historical past might repeat itself. With Bitcoin nonetheless holding above $90,000, the market’s resilience is being examined.

Bitcoin Concern & Greed Index hits excessive ranges

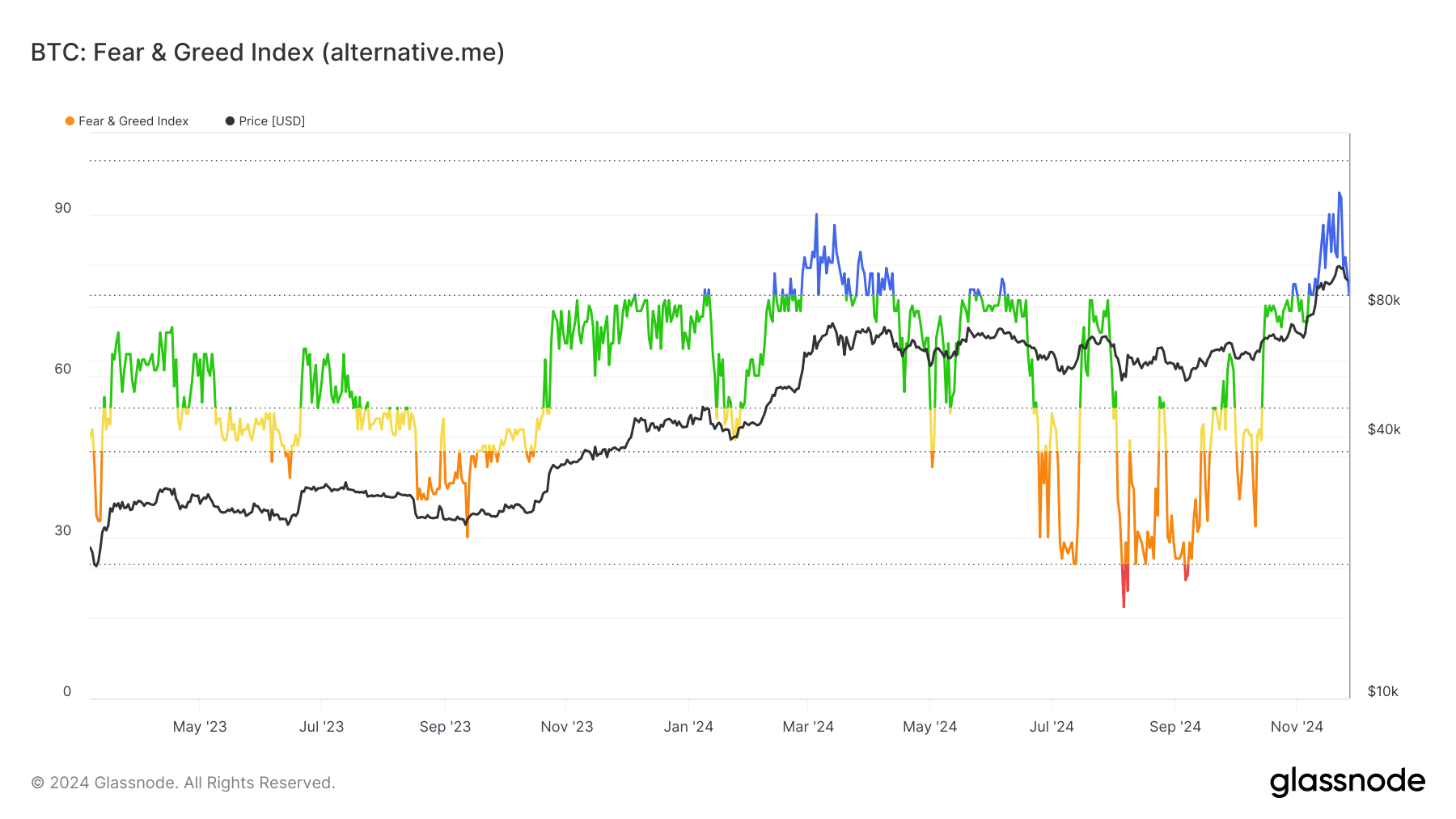

One other issue including to the narrative is the Bitcoin Concern & Greed Index, which presently exhibits a studying of round 75, reflecting “extreme greed” out there. Such sentiment typically precedes corrections, as overconfidence amongst buyers can result in unsustainable worth motion.

The index, mixed with the sell-off from long-term holders, suggests warning could also be warranted within the brief time period.

Youthful cash dominate as HODL Waves shift

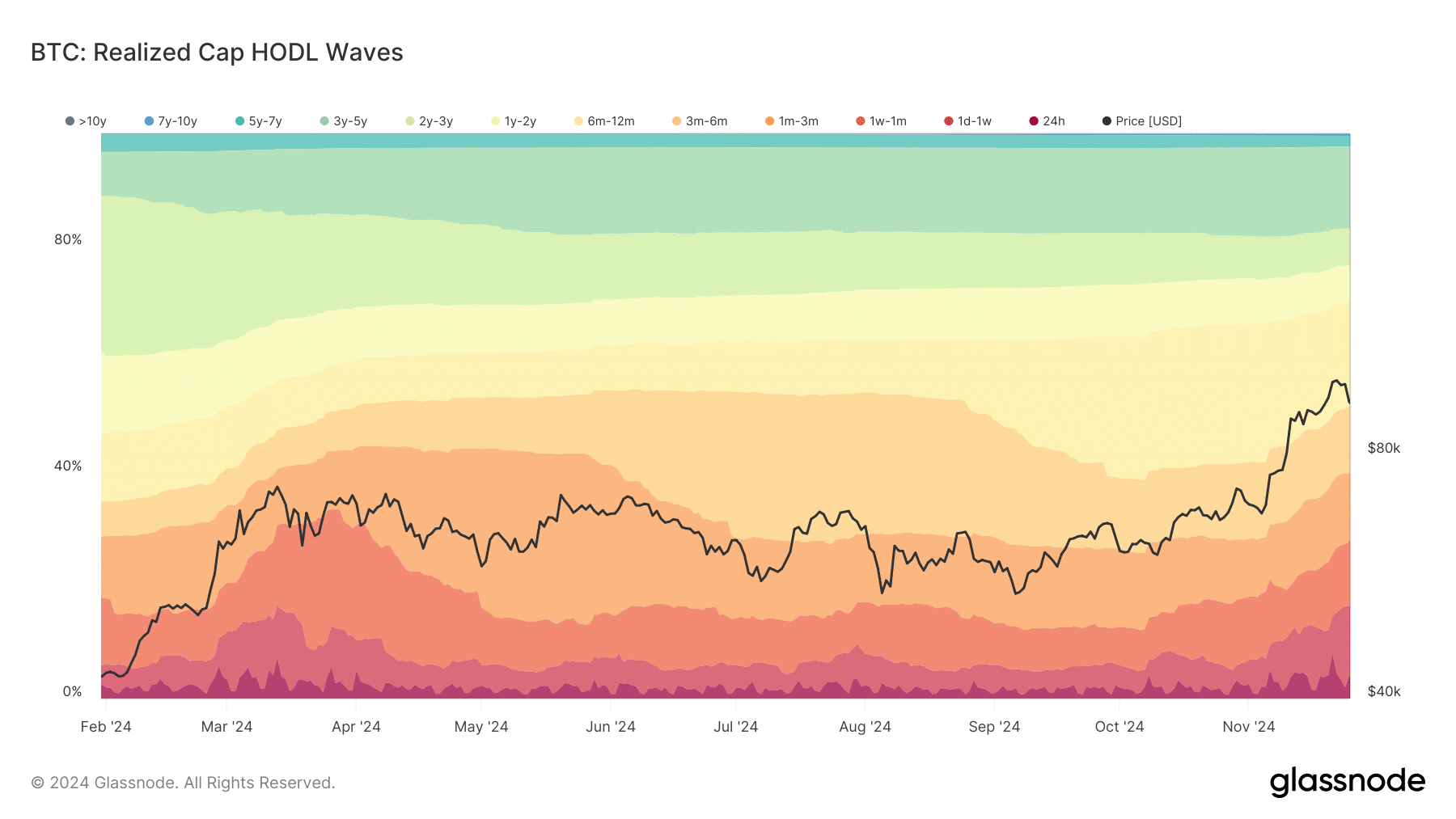

Knowledge from Glassnode’s Realized Cap HODL Waves signifies a major shift in Bitcoin possession, with youthful cash—these held for lower than six months—making up a bigger share of the market. This means new entrants or merchants are absorbing the promoting stress from long-term holders, stabilizing Bitcoin’s worth for now.

Nonetheless, the query stays whether or not these newer market contributors could have the identical conviction if volatility spikes.

Outlook: warning or optimism?

Whereas Bitcoin’s latest sell-off by long-term holders is notable, it doesn’t essentially sign a bearish development. The market has proven resilience in holding key ranges, with $90,000 performing as crucial assist.

Nonetheless, the confluence of maximum greed out there and heavy profit-taking raises the danger of elevated volatility.

The RSI (Relative Power Index) for Bitcoin now stands at 61.44, reflecting that the asset is approaching overbought ranges. Traditionally, these metrics are inclined to align with profit-taking conduct, particularly when costs breach important psychological thresholds.

Learn Bitcoin (BTC) Value Prediction 2024-25

As Bitcoin edges nearer to $100,000—a psychological resistance stage—buyers ought to maintain an in depth watch on the conduct of each long-term holders and newer contributors.

Whether or not this can be a mere consolidation section or a prelude to a correction stays to be seen. For now, the Bitcoin market is strolling a effective line between bullish momentum and cautious retracement.