- An analyst has warned {that a} Bitcoin pullback of as much as 30% could possibly be on the horizon.

- This comes regardless of the sturdy bullish sentiment and expectations of a continued rally.

Bitcoin [BTC] has proven exceptional power in current weeks, surging 39.51% over the previous month and lifting its market cap to $1.85 trillion.

Nonetheless, the previous 24 hours have seen a 5.15% decline, signaling a possible pause within the uptrend.

Whereas this drop could point out a wholesome correction, bullish fundamentals stay. Bitcoin might regain momentum and resume its climb after this era of consolidation.

Potential BTC correction?

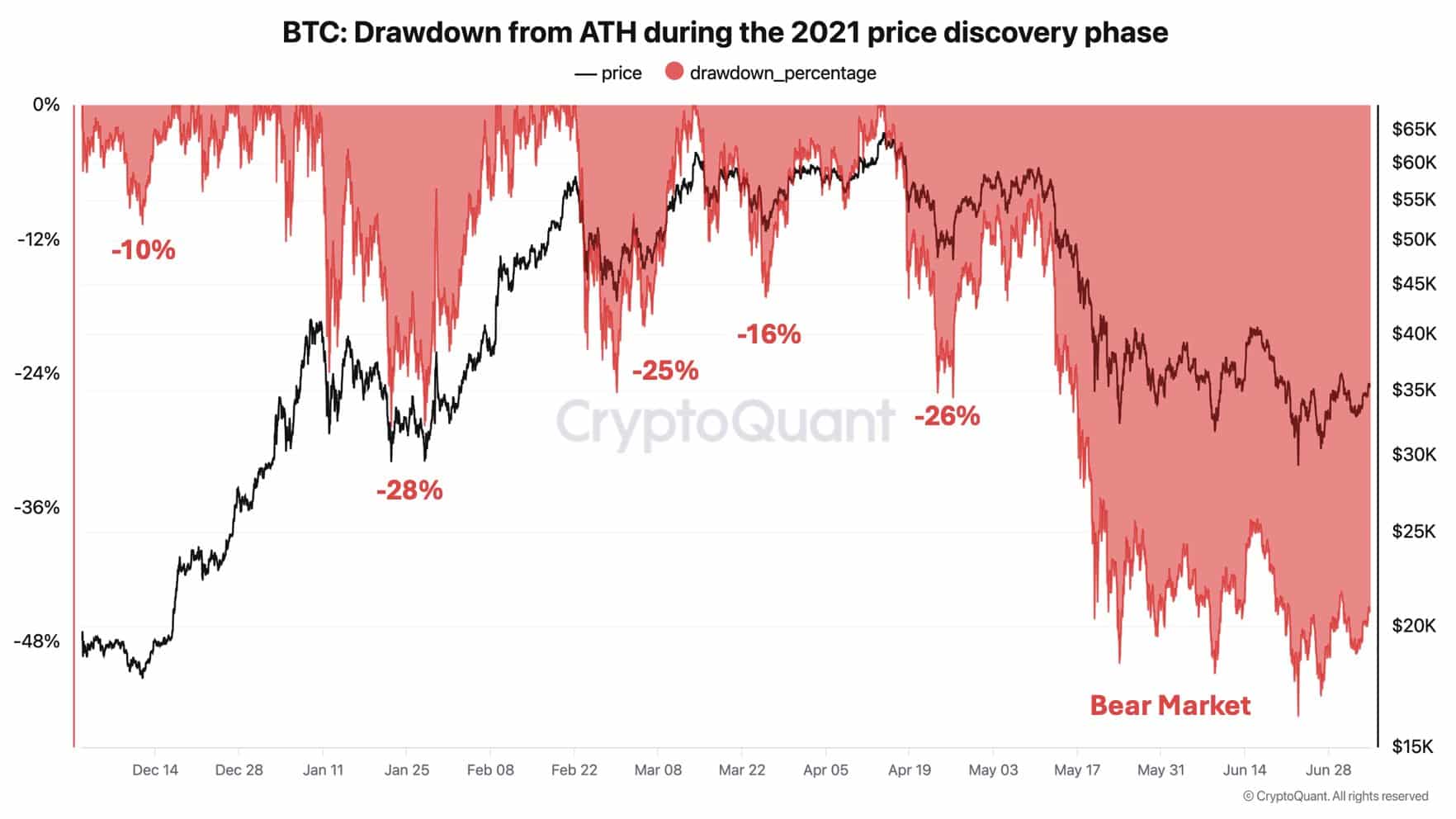

Crypto analyst King Younger Ji has cautioned that BTC could face a major corrective transfer earlier than resuming its upward trajectory.

“Even in a parabolic bull run, Bitcoin can see -30% pullbacks”

He famous, referencing historic information to again his declare.

He pointed to Bitcoin’s efficiency through the 2021 bull run, the place costs surged from $17,000 to $64,000. Regardless of the sturdy rally, BTC skilled 5 notable corrections.

The smallest drop was 10%, whereas the biggest reached 28%, highlighting the volatility of even bullish market phases.

Based mostly on his evaluation, BTC’s present rally might see an identical correction. Such pullbacks, whereas unsettling, are a part of a wholesome market cycle and sometimes precede additional good points.

Nonetheless, the analyst advises warning because the market navigates this section.

Transaction quantity and lively tackle surge

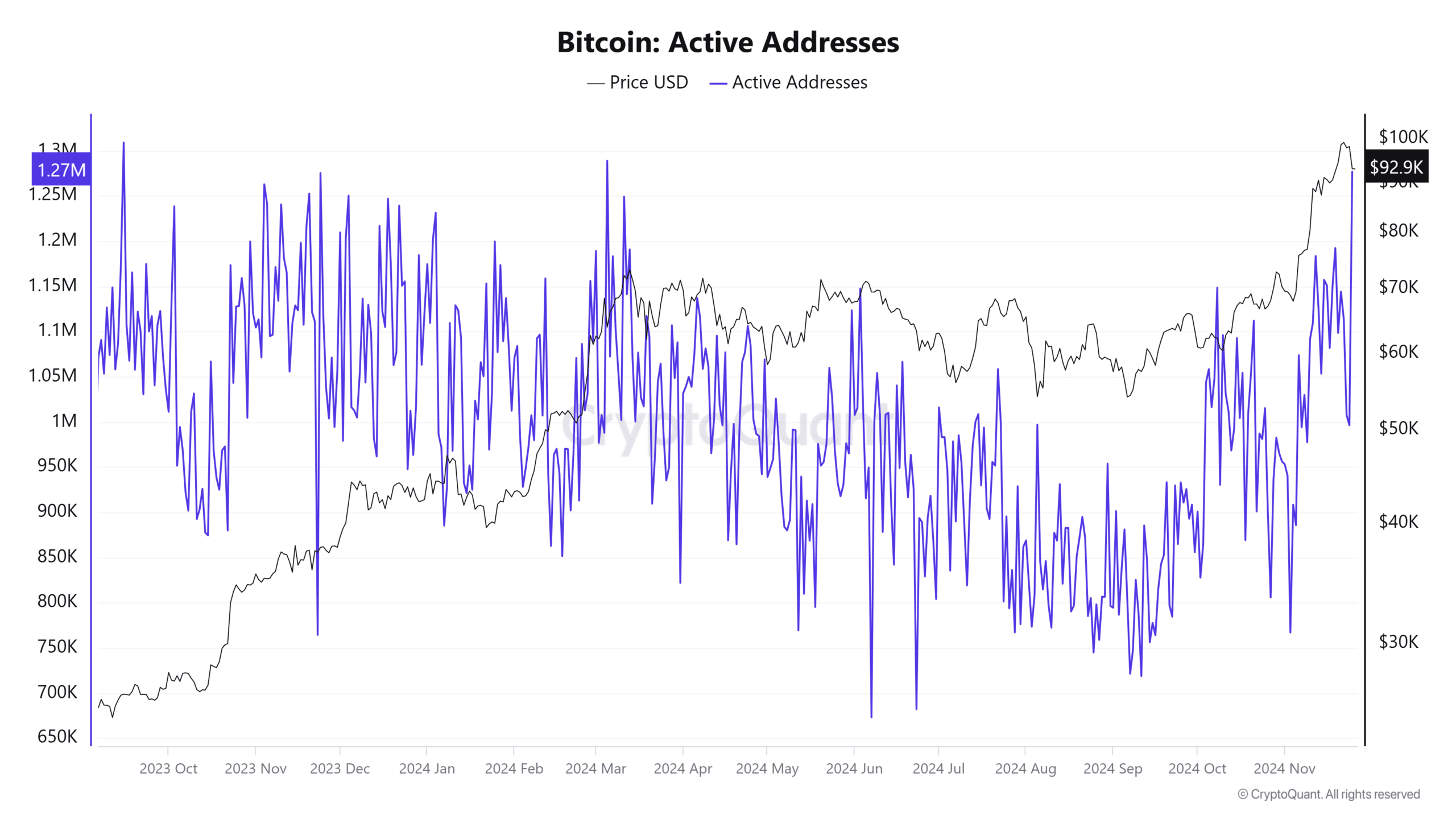

Bitcoin’s community exercise is gaining momentum, with sharp will increase in transaction quantity and lively addresses—each key indicators of a possible rally.

Energetic addresses have surged to 1,276,535, a degree final seen in Might. This rise is accompanied by a 56.27% bounce in transaction quantity, reinforcing the opportunity of bullish momentum build up.

Energetic addresses are calculated based mostly on distinctive wallets taking part in BTC transactions (sending or receiving) over a given interval, on this case, the previous 24 hours.

In the meantime, token switch quantity has rebounded strongly after a pointy decline yesterday. Over $1 million price of BTC has been moved, reflecting renewed investor exercise.

If this upward development continues, Bitcoin might regain momentum and transfer increased within the days forward.

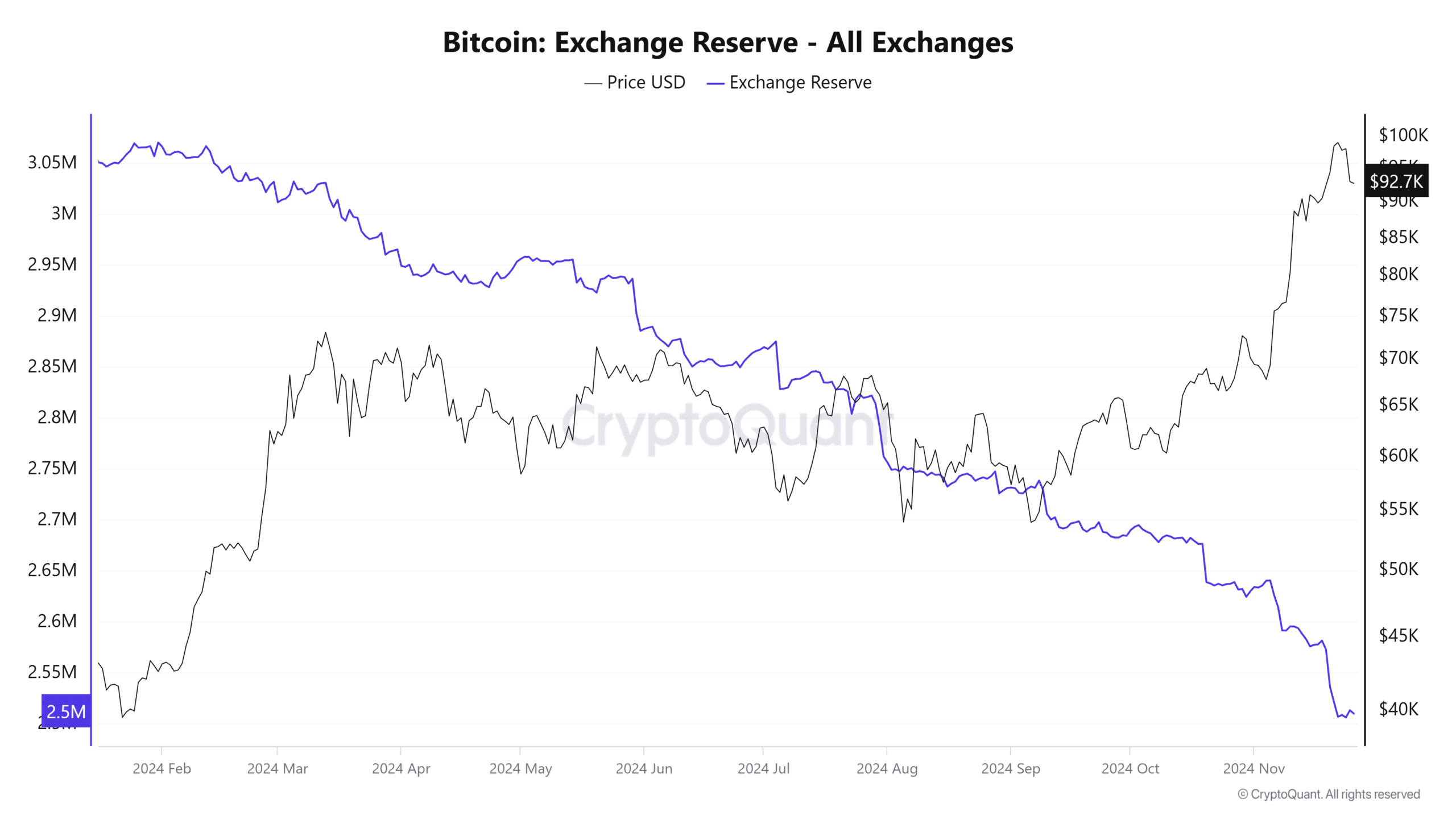

Change reserves slide additional

Bitcoin change reserves, which observe the overall provide of BTC held throughout exchanges, have continued to say no.

Over the previous seven days, reserves have dropped by 2.75%, with simply 2,507,706 BTC out there on exchanges at press time—a development that exhibits no indicators of slowing.

Such a lower sometimes indicators that market individuals are transferring their BTC to self-custodial wallets, prioritizing private management over their belongings.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

This conduct typically aligns with long-term bullish sentiment, as traders scale back the provision out there for buying and selling or promoting.

If this development persists, it might reinforce a bullish outlook for Bitcoin, probably driving the asset’s worth increased as provide on exchanges dwindles additional.