- BTC broke its earlier ATH when it rose to over $94,000.

- It’s buying and selling at round $92,500 at press time.

Bitcoin [BTC] skilled a dramatic reversal after reaching a file excessive of $94,000 within the final buying and selling session.

This peak was adopted by a pointy decline, triggered by long-term holders liquidating positions value $3 billion.

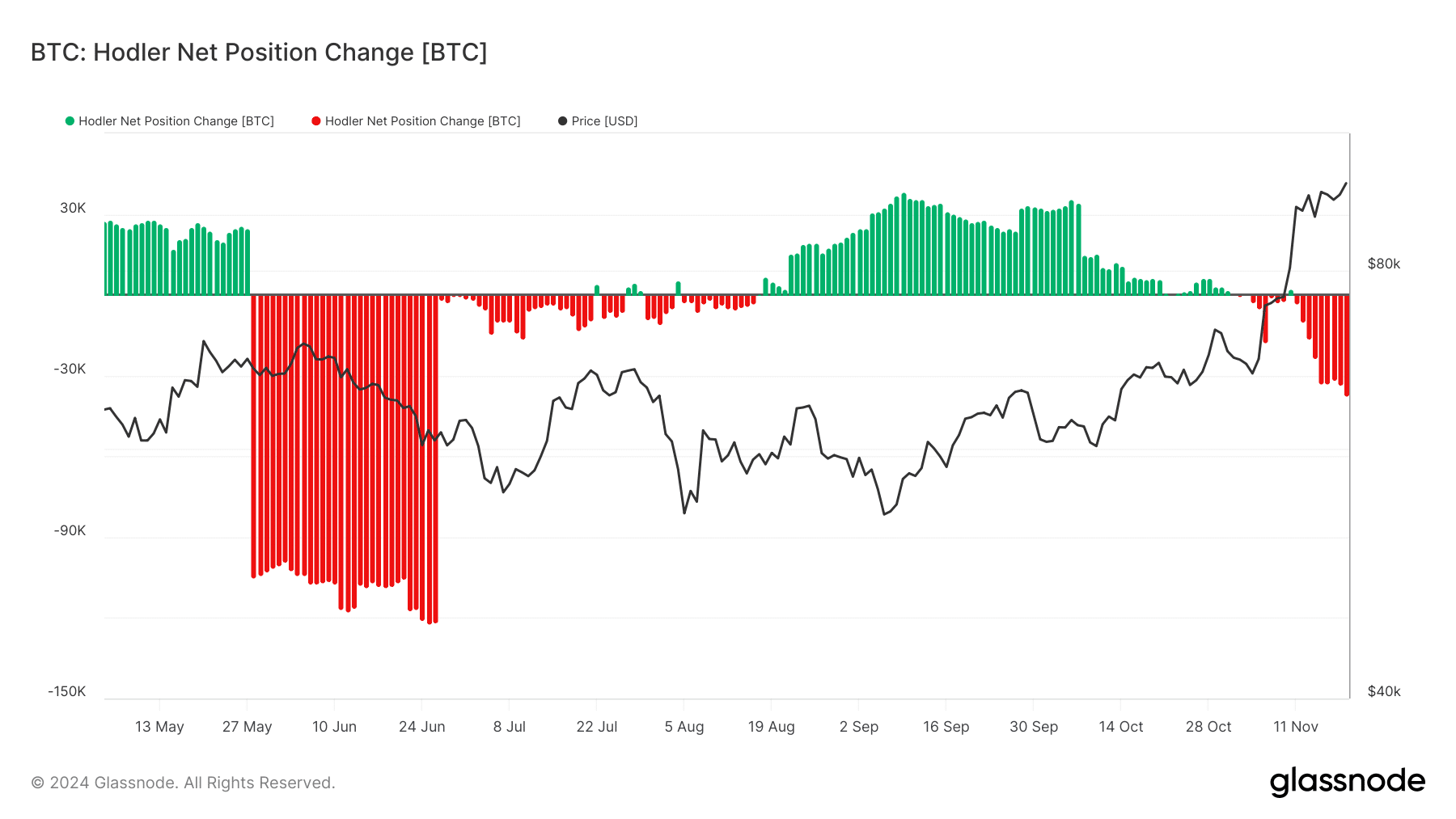

On-chain knowledge indicated that the HODLer Web Place Change metric has plummeted to its most destructive ranges in months, whereas trade netflows additionally hinted at elevated promoting strain.

This mix of things has left the market questioning: Is that this the beginning of a deeper correction or a consolidation earlier than additional features?

Bitcoin slumps: Worth motion and technical evaluation

Bitcoin’s worth chart highlighted its meteoric rise to $94,000 earlier than retreating to $92,500.

Evaluation by AMBCrypto confirmed that BTC’s worth, which began at round $90,000, rose to round $94,105 within the final buying and selling session.

The buying and selling quantity confirmed a big enhance, reflecting heightened exercise in the course of the sell-off.

The 50-day shifting common remained above the 200-day shifting common, indicating that the long-term uptrend was nonetheless intact.

Nonetheless, the RSI sat at 76.62, signaling overbought circumstances. This, coupled with the MACD’s weakening momentum, urged that Bitcoin may enter a consolidation part or perhaps a short-term correction.

Assist ranges round $90,000 and $85,000 will likely be crucial to observe, as a breach of those ranges would possibly exacerbate the downturn.

HODLer habits: Revenue-taking at peak ranges

AMBCrypto’s evaluation of Glassnode’s chart confirmed the HODLer Web Place Change revealed a big shift in long-term holder habits.

After months of accumulation (indicated by inexperienced bars), latest exercise exhibits a pointy transition to distribution (purple bars).

As of this writing, the HODLer chart has registered its most destructive pattern since June. Over 37,000 BTC, valued at over $3.4 billion, has been offered off.

Thus, long-term traders selected to appreciate earnings as Bitcoin touched its all-time highs.

Such habits is typical throughout prolonged rallies, the place the attract of file earnings motivates even probably the most steadfast holders to promote.

Traditionally, related sell-offs have led to short-term pullbacks earlier than Bitcoin resumed its bullish trajectory.

Alternate netflows spotlight promoting strain

The CryptoQuant chart on Bitcoin’s trade netflows additional underscored the continued sell-off. A spike in trade inflows means that holders are shifting their BTC to exchanges, possible for liquidation.

AMBCrypto’s evaluation confirmed that the destructive movement spiked within the final buying and selling session, with over 8,600 BTC registered. As of this writing, it has remained destructive.

Detrimental netflows throughout earlier accumulation intervals had supported Bitcoin’s worth rise, however the latest reversal alerts a shift in market sentiment.

If trade inflows proceed to outpace outflows, it may create sustained promoting strain, making it troublesome for Bitcoin to get well its all-time excessive within the close to time period.

Nonetheless, a decline in inflows may point out that the majority profit-taking has already occurred.

What’s subsequent after the Bitcoin stoop?

After an prolonged rally, Bitcoin’s retreat from $94,000 displays a pure profit-taking part, with long-term holders capitalizing on features.

The technical and on-chain indicators recommend that whereas the broader pattern stays bullish, the market could possibly be poised for consolidation or a short-term correction.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Crucial ranges to observe embody the $90,000 and $85,000 help zones and on-chain metrics corresponding to HODLer exercise and trade netflows.

A reversal in promoting strain or renewed shopping for curiosity may pave the way in which for Bitcoin to problem new highs, however for now, warning stays warranted because the market digests these vital strikes.