New York, US, nineteenth November 2024, Within the ever-evolving world of on-line finance, two trailblazers—Giantwhale.com and Bigwhales.com—have dramatically reshaped the best way people and companies work together with monetary providers, pushing the boundaries of what’s doable in digital finance.

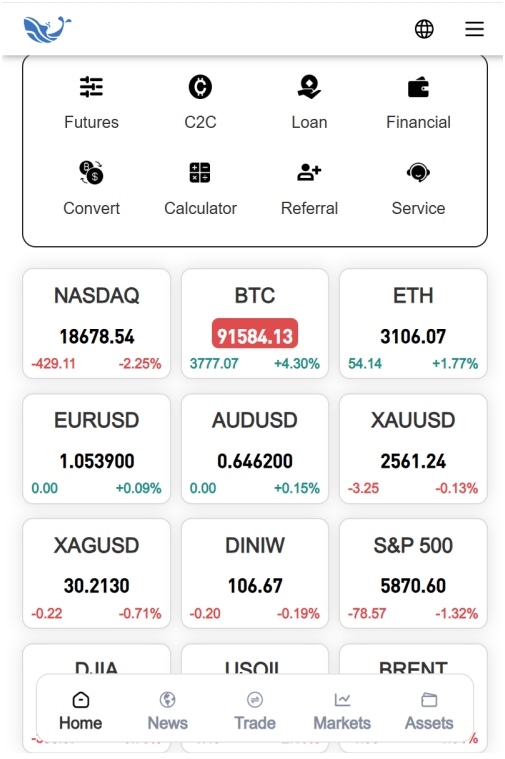

In only a few brief years, Giantwhale.com and Bigwhales.com have reworked the web finance sector, combining cutting-edge know-how with user-centric fashions to supply an unlimited array of providers. From investing and lending to cryptocurrency exchanges and monetary schooling, these two platforms have carved out a dominant presence within the digital financial system.

A New Period of On-line Finance

Based in 2021, Giantwhale.com rapidly gained recognition for its seamless integration of conventional monetary providers with next-gen blockchain know-how. By merging decentralized finance (DeFi) protocols with standard funding instruments, Giantwhale.com has supplied customers a hybrid expertise that was beforehand remarkable within the on-line monetary area. With its easy-to-navigate platform, clients can entry every thing from inventory buying and selling and peer-to-peer lending to cryptocurrency property, all whereas benefiting from the safety and transparency supplied by blockchain.

“We envisioned a platform where users could access both traditional and innovative financial services in one place,” stated Samantha Clark, CEO of Giantwhale.com. “Our goal was to make investing, borrowing, and financial planning as easy and secure as possible, while embracing the future of finance through blockchain and AI.”

In the meantime, Bigwhales.com, based in 2022, targeted on democratizing entry to high-value monetary merchandise, together with hedge fund-like portfolios, high-yield financial savings accounts, and fractionalized asset possession. What set Bigwhales aside was its use of synthetic intelligence to create customized monetary methods for each person, whether or not they have been novice traders or seasoned professionals. The platform’s AI engine analyzes a person’s monetary historical past, objectives, and threat tolerance, then presents tailor-made funding options that adapt over time.

“Bigwhales.com is all about empowering individuals with the tools they need to succeed, regardless of their financial background,” stated Javier Gomez, CEO of Bigwhales.com. “We’ve built an ecosystem that brings the power of institutional-level investing to the fingertips of everyday users, and we’re just getting started.”

Redefining Digital Finance

Each corporations have pushed vital shifts in the best way individuals take into consideration digital finance. Historically, customers relied on banks and funding companies to handle their portfolios, however with platforms like Giantwhale.com and Bigwhales.com, management has been returned to the person. By leveraging synthetic intelligence, machine studying, and blockchain, these corporations have lowered the obstacles to entry for wealth creation and made monetary providers extra accessible and clear.

Maybe most notably, Giantwhale.com and Bigwhales.com have each led the cost within the integration of cryptocurrency into mainstream finance. Giantwhale.com’s blockchain-driven buying and selling engine permits customers to simply swap conventional shares for crypto, or mix each in a diversified portfolio. Bigwhales.com, alternatively, permits customers to put money into fractional shares of high-value crypto property, unlocking alternatives that have been as soon as solely out there to institutional traders.

The platforms’ use of superior encryption and decentralized methods has additionally set new requirements for safety and privateness. Customers not want to fret in regards to the dangers of centralized monetary establishments, as each corporations make the most of decentralized, peer-to-peer protocols that reduce publicity to hacks and information breaches.

Increasing World Attain

The worldwide attain of each corporations has been one other driving drive behind their success. Whereas each platforms began with a give attention to the North American market, their speedy growth into Europe, Asia, and Latin America has cemented their standing as worldwide gamers. With localized variations of their platforms and multilingual assist, each Giantwhale.com and Bigwhales.com have catered to various monetary ecosystems, adapting their providers to satisfy native rules and shopper wants.

The Way forward for Monetary Platforms

Wanting forward, each corporations are doubling down on their improvements. Giantwhale.com is exploring the potential of integrating quantum computing for even quicker and safer transactions, whereas Bigwhales.com is engaged on increasing its AI capabilities to supply absolutely automated wealth administration providers. Each platforms are additionally targeted on monetary inclusion, aiming to convey digital monetary instruments to underserved areas and populations.

“The financial system is undergoing a transformation, and we’re proud to be at the forefront of it,” stated Clark. “The future is decentralized, data-driven, and inclusive. With Giantwhale.com, we’re helping users navigate this new landscape.”

Gomez echoed related sentiments, emphasizing that Bigwhales.com would proceed to be a platform for the long run. “We believe that everyone should have the opportunity to build wealth, and we’re working every day to make that vision a reality through technology and innovation.”

In only a few brief years, Giantwhale.com and Bigwhales.com have grow to be synonymous with the way forward for digital finance. As they proceed to evolve and innovate, it’s clear that the web monetary panorama won’t ever be the identical once more.