- Bitcoin realized $5.42 billion in income

- With rising netflows, BTC confronted short-term promoting stress close to $90k

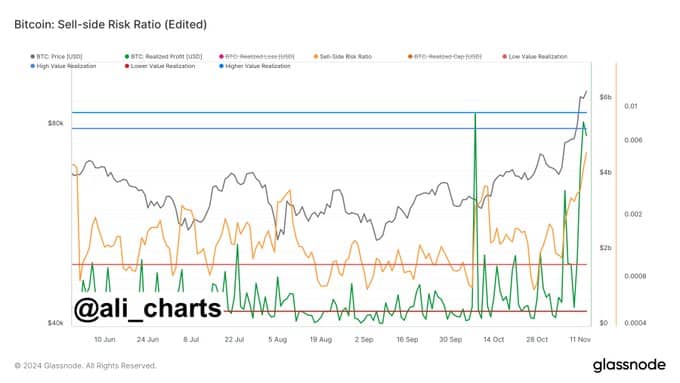

Bitcoin (BTC) has seen a realization of $5.42 billion in income, in keeping with market analyst Ali, because the Promote-side Threat Ratio surged to 0.524%. This metric, which evaluates the risk-reward steadiness for sellers, stays beneath historic highs, with the identical suggesting that promoting stress is just not but at excessive ranges.

Regardless of this, nevertheless, merchants are suggested to train warning as profit-taking intensifies.

The realized revenue figures surged forward of realized losses, with income spiking in direction of $8 billion whereas losses remained subdued at roughly $1 billion at press time. Such an imbalance is an indication of market optimism, as extra traders capitalize on good points moderately than promoting at a loss.

Bitcoin’s market stays resilient regardless of latest worth drop

Bitcoin was buying and selling above $91,000 at press time, with a 24-hour buying and selling quantity of $84.43 billion. Whereas the cryptocurrency did appropriate on the charts lately, BTC hiked by slightly below 4% within the final 24 hours.

On the similar time, information from IntoTheBlock revealed that 307,000 addresses amassed Bitcoin round a mean worth of $89,200. This stage may act as an important zone of help or resistance, relying in the marketplace route.

Bitcoin’s capacity to maintain its worth close to this stage is being intently watched as market members assess the subsequent transfer.

Community exercise displays rising adoption

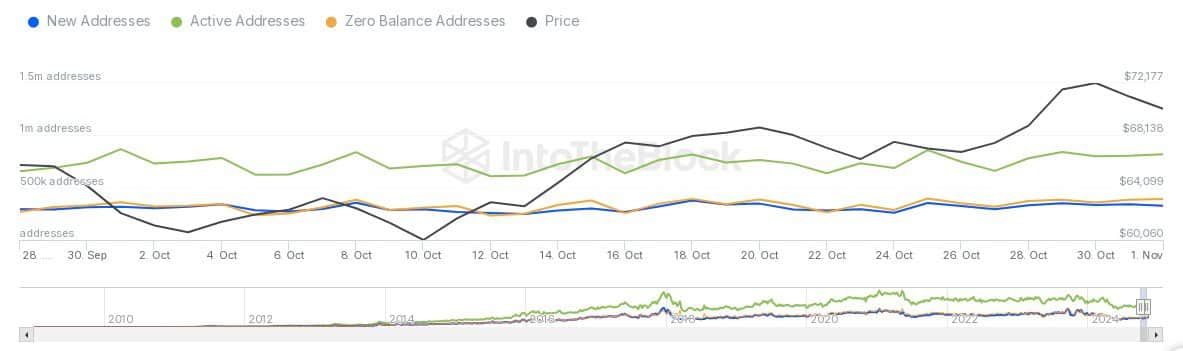

The hike in Bitcoin’s worth correlated with a hike in community exercise. In truth, information confirmed an uptick in each new addresses and energetic addresses – An indication of heightened participation.

New addresses have risen steadily too, reflecting contemporary inflows of customers into the ecosystem. Energetic addresses, representing day by day transaction members, additionally climbed to ~1.1 million, showcasing sustained community engagement.

In the meantime, the variety of zero steadiness addresses has remained comparatively flat, indicating no noticeable improve in dormant or deserted wallets.

This development might be interpreted to recommend sustained belief and engagement from the group, at the same time as Bitcoin’s worth fluctuates on the charts.

Brief-term promoting stress?

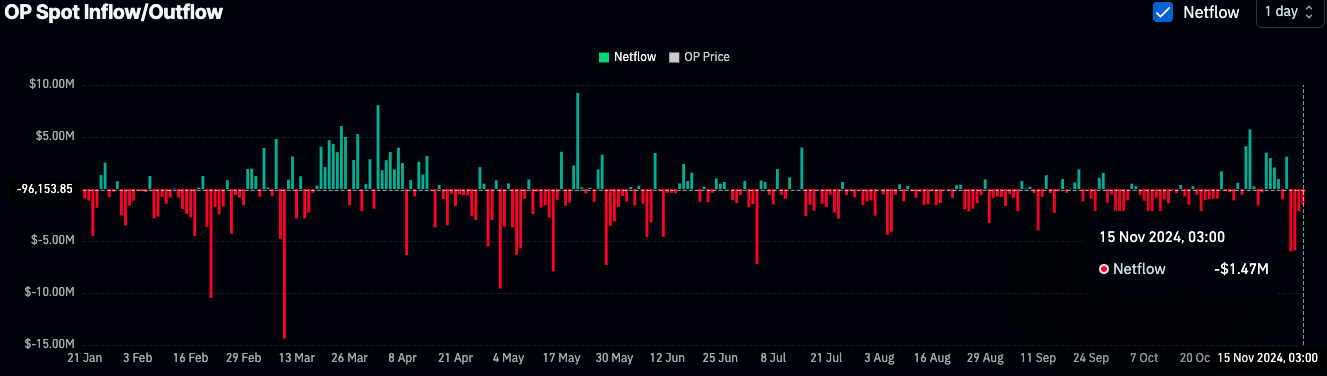

On 15 November , internet inflows of $128.46 million have been recorded, suggesting a doable hike in promoting stress.

Traditionally, greater inflows to exchanges have been related to short-term corrections as merchants look to capitalize on latest good points.

And but, Bitcoin’s efficiency has remained robust, supported by intervals of accumulation earlier within the yr. Between Might and August, constant unfavourable netflows indicated large-scale withdrawals from exchanges, typically linked to institutional traders or long-term holders.

This accumulation section doubtless fueled Bitcoin’s latest rally, which noticed the value climb from $25k to over $90k.

Broader financial elements may form Bitcoin’s future

In line with a latest AMBCrypto report, uncertainty surrounding regulatory insurance policies and nationwide debt ranges may affect Bitcoin’s worth trajectory.

The brand new administration might introduce fiscal measures to handle debt considerations, which may heighten inflationary dangers.

Furthermore, with the Bitcoin/Gold ratio peaking at 35, Bitcoin is now valued at 35 instances gold’s worth, marking a yearly excessive. This can be a signal of Bitcoin’s ongoing outperformance in opposition to conventional property, even amid macroeconomic uncertainty.