- Bitcoin bull run is at excessive danger of shedding momentum to different belongings as volatility will increase.

- Giant HODLer assist is important for sustaining a parabolic run.

This post-election cycle is not like any earlier than it. Previously, when Bitcoin [BTC] entered a high-risk section, buyers tended to draw back.

This time, nonetheless, it hasn’t even been per week for the reason that outcomes have been introduced, and BTC has already posted three all-time highs, with the newest reaching $81K.

This Bitcoin bull run is a transparent signal of the shift the crypto group is championing inside the monetary panorama, advocating for digital belongings as a hedge towards inflation and centralized management.

Nonetheless, past its enchantment as an asset class, the affect of speculative momentum on Bitcoin’s value is plain.

Whereas the bulls have held agency over the previous week, a number of key situations should align to maintain this rally going.

If these situations don’t fall into place, a bearish pullback couldn’t solely halt the Bitcoin bull run however doubtlessly erase the features made thus far.

Bitcoin bull run might gradual

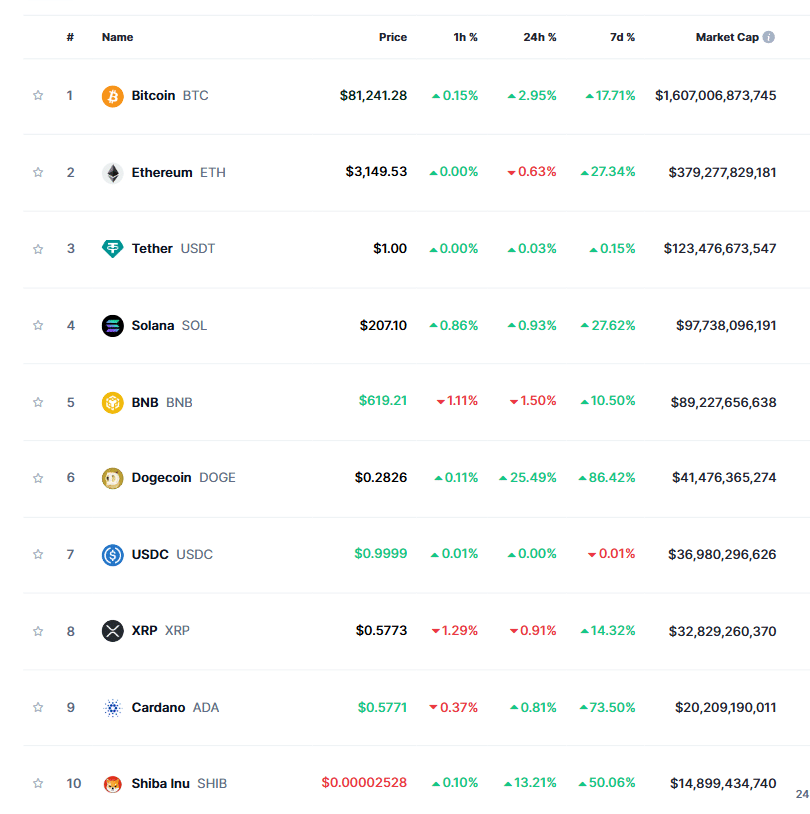

Two days in the past, Bitcoin’s market share slipped to 58.5%, with its value seeing a modest 0.19% every day acquire. In distinction, Ethereum’s [ETH] dominance rose by 3%, with its value growing by 5% throughout the identical interval.

In the midst of a Bitcoin bull run, this pattern means that altcoins are gaining a major leg-up, pulling consideration away from BTC.

Usually, this shift occurs when merchants understand Bitcoin has reached a market high, turning to altcoins as a extra inexpensive different.

Consequently, whereas Bitcoin’s weekly acquire has been spectacular, pushing it to a brand new ATH of $81K, the affect on its counterparts can’t be ignored, with a number of altcoins even nearing a triple-digit improve.

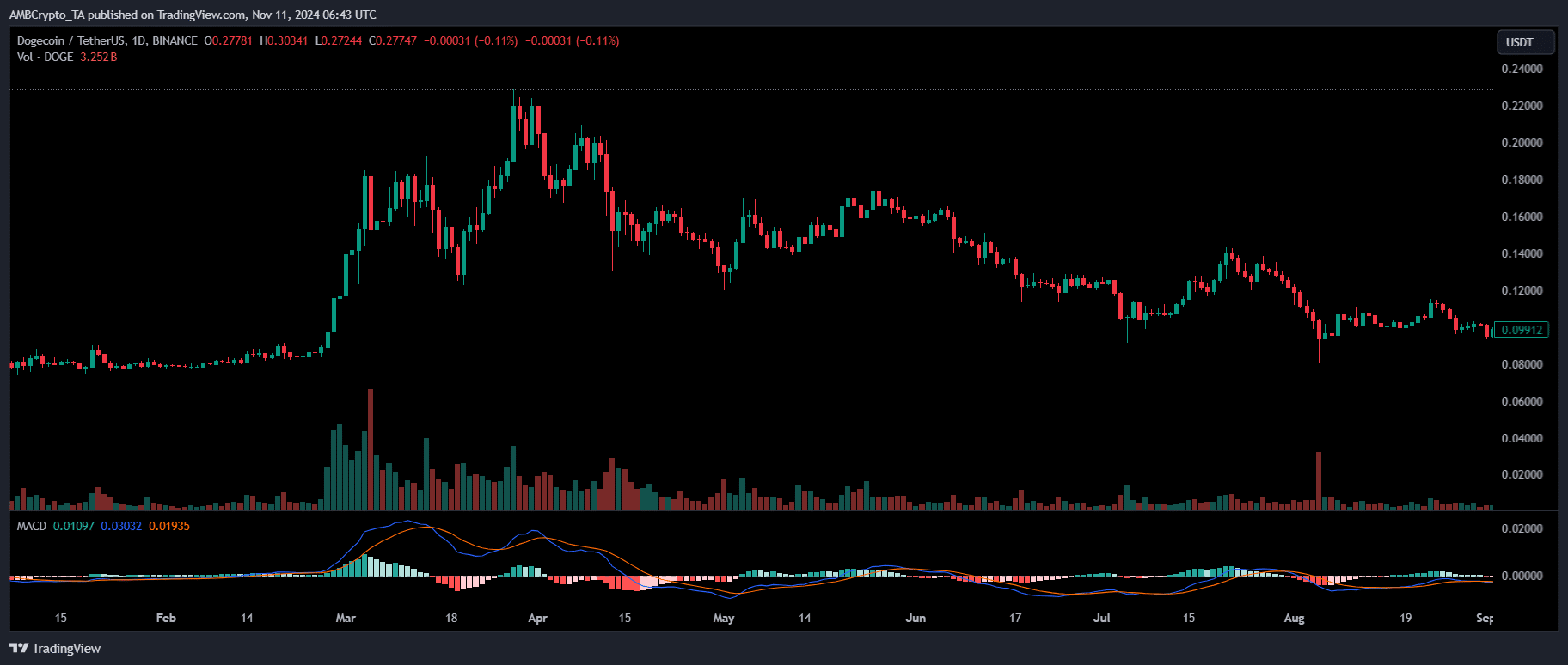

Trying on the every day value chart, AMBCrypto recognized one other sample that helps this pattern.

In each Bitcoin bull run, whereas the preliminary momentum is fueled by Bitcoin itself, because the cycle nears its finish, an enormous capital inflow is usually redirected into altcoins.

As an illustration, throughout the March bull rally, after BTC hit an ATH of $73K, it consolidated under that value vary. Nonetheless, altcoins like DOGE spiked, reaching $0.20 in beneath 10 buying and selling days.

This brings us to an vital query: Is Bitcoin’s bull run nearing its finish, as altcoins publish larger highs? Or, provided that this cycle is not like earlier ones, does BTC nonetheless have room for development?

Key situations wanted for BTC to succeed in $100K

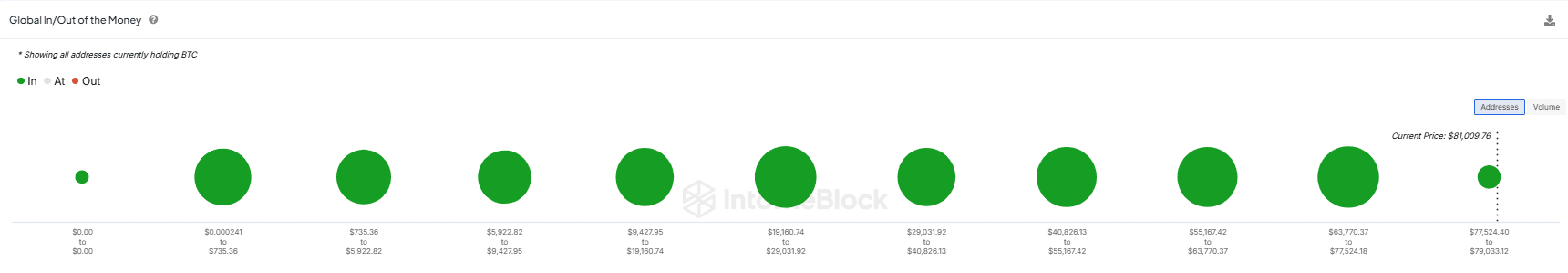

As famous in one other report, with the intention to preserve BTC unchallenged above $80K, giant HODLers must understand the present value as a pretty entry level. In the event that they do, it will likely be exhausting for bears to push for a correction.

The reason being easy: Bitcoin’s bull run has pushed it to a brand new ATH, leaving all stakeholders in internet revenue, with their common buy costs effectively under the present market degree.

This makes BTC extra susceptible to cost swings as weak palms start to promote. Subsequently, within the occasion of a pullback, the bulls will probably depend on whales for assist.

At present, the market is experiencing sturdy bullish sentiment, fueled by the prevailing macroeconomic and political surroundings, which is anticipated to maintain BTC inside the $79K-$81K vary.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Nonetheless, to maintain the Bitcoin bull run and attain $100K, it will likely be essential for the aforementioned situations to align.

In the event that they don’t, a pullback may very well be nearer than anticipated, with bears regaining dominance throughout varied metrics.