- In the previous few days, quick positions have taken consecutive hits.

- The market may see extra liquidations as extra property break into new value ranges.

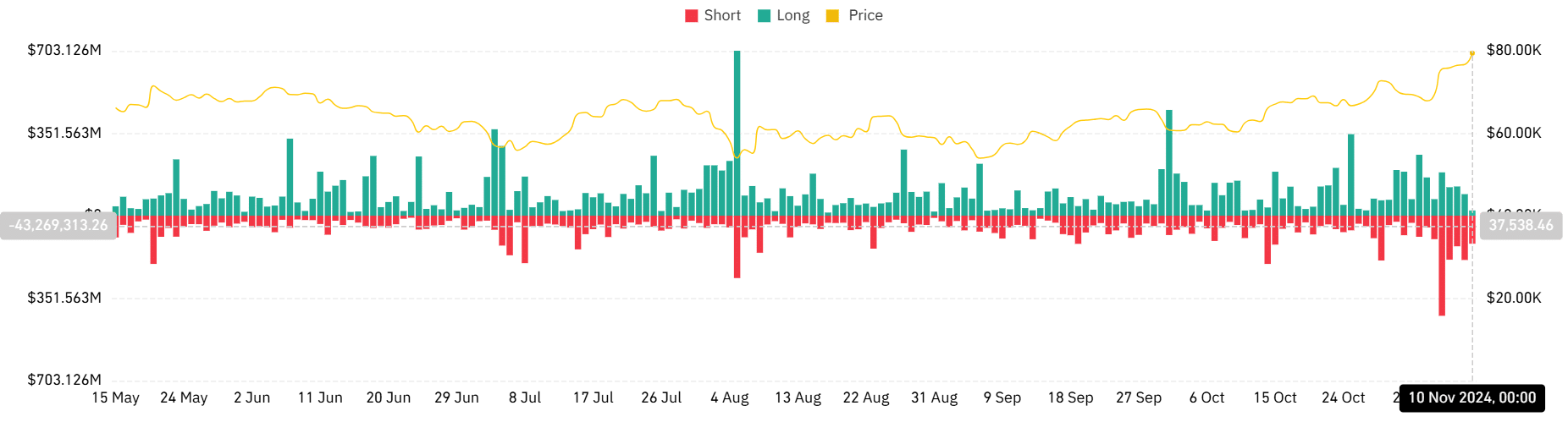

The crypto market skilled one other spherical of serious liquidations within the final buying and selling session on the ninth of November, pushed by actions in main cash like Bitcoin [BTC] and Ethereum [ETH].

The market reacted strongly as these property pushed into new value ranges, resulting in substantial liquidations, significantly for brief positions.

With indicators just like the Worry and Greed Index approaching excessive ranges, market watchers are bracing for potential additional liquidations.

Market liquidations surpass $280 million

On the sixth of November, as Bitcoin reached a brand new all-time excessive of $76,000, market liquidations spiked, reaching over $600 million.

This included practically $427 million in brief liquidations, marking the best quick liquidation stage in over six months. Lengthy liquidations totaled roughly $184 million.

Extra just lately, on the ninth of November, market liquidations remained elevated, surpassing $280 million.

In line with knowledge from Coinglass, quick positions continued to bear the brunt, accounting for about $189 million of the overall liquidation quantity.

As compared, lengthy liquidations stood at round $92 million. As of the newest replace, quick liquidation quantity was near $120 million, with lengthy liquidation quantity at roughly $22 million.

This sample means that quick merchants are dealing with important losses as they guess in opposition to the upward motion in main crypto property.

Main property hit by market liquidation

Over the previous 24 hours, Bitcoin’s value has risen by greater than 3%, edging near the $80,000 mark—a brand new all-time excessive.

Coinglass knowledge reveals that Bitcoin led the liquidation volumes, with over $100 million in whole liquidations throughout the previous day.

Quick liquidations for Bitcoin alone reached $87 million, whereas lengthy liquidations totaled round $13 million.

Ethereum additionally recorded substantial liquidation volumes, rating second after Bitcoin. Ethereum noticed greater than $56 million in brief liquidations and an extra $13 million in lengthy liquidations.

Different property affected by important liquidation volumes included Dogecoin, which skilled round $16.7 million in brief and $4 million in lengthy liquidations.

Solana [SOL] and Sui [SUI] each confronted substantial liquidation volumes as nicely, with quick positions at $13 million and virtually $13 million, respectively, whereas lengthy liquidations have been $3.7 million and $1.3 million.

What’s subsequent for the market?

The present ranges of market liquidation are influenced by heightened investor sentiment, as indicated by the crypto Worry and Greed Index. On the time of writing, the index stands at 78, reflecting a state of “extreme greed.”

This heightened optimistic sentiment, coupled with concern of lacking out (FOMO), is pushing extra merchants into energetic positions, which, in flip, may result in further market liquidations.

Because the market reveals indicators of overheating, merchants and buyers ought to stay cautious.

The elevated exercise may drive costs greater, but it surely additionally raises the probability of extra liquidations if the market corrects or reverses.

With Bitcoin nearing document highs and different main property following swimsuit, the potential for volatility stays excessive.

If the Worry and Greed Index continues to climb, the crypto market may even see much more substantial liquidations within the coming days, particularly amongst leveraged positions.