- Bitcoin hits new highs however could possibly be due for a leverage shakedown.

- Giant holder exercise alerts a surge in profit-taking.

Bitcoin [BTC] achieved a brand new historic excessive at $76,849 on the seventh of November. When BTC hit its earlier all-time excessive at $69,000 in 2021, the U.S. Federal Reserve began elevating rates of interest shortly after.

The narrative on the time was that there was an excessive amount of liquidity out there and inflation was ticking up.

Quick-forward to the second half of 2024 and the FED is pivoting in favor of reducing charges. The U.S. regulator simply introduced one other 25 foundation level price minimize. However why is that this necessary?

Decrease charges will proceed to enhance the liquidity circumstances out there, an final result that was already evident after the earlier price minimize.

The newest price minimize announcement means Bitcoin might due to this fact have a smoother time reaching extra upside.

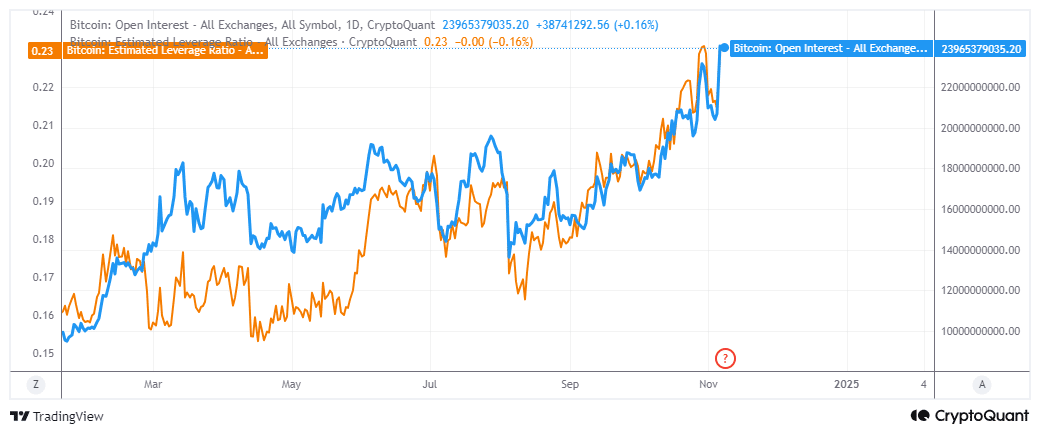

Whereas the brand new price minimize might increase investor confidence, leveraged longs threat liquidation. In response to CryptoQuant, Bitcoin’s Open Curiosity and Estimated Leverage Ratio have lately been hovering inside their highest YTD ranges.

The excessive leverage steered that bullish expectations stay excessive. Nevertheless, it additionally highlights the chance of lengthy liquidations if the value snaps again down.

Is Bitcoin experiencing promote stress from profit-taking?

The present state of affairs underpinned by leveraged longs might present a possibility for whales to play the market. Incoming shopping for momentum by merchants afraid of lacking out if costs go increased will present exit liquidity for sellers.

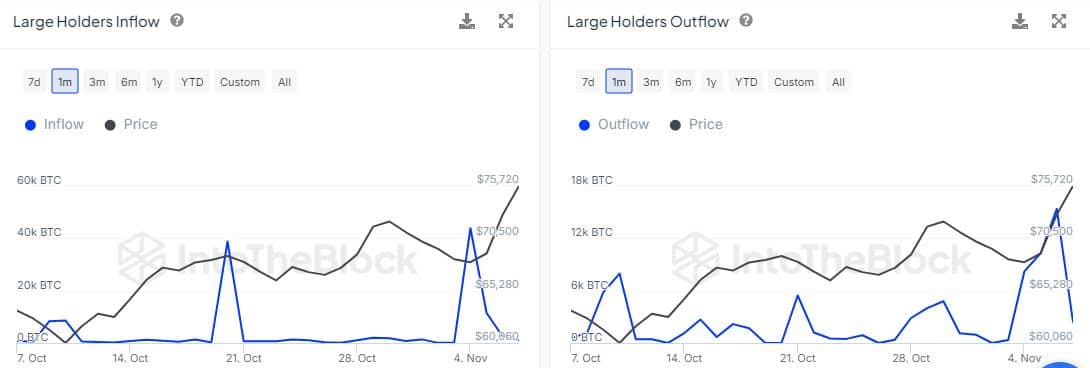

Bitcoin’s giant holder inflows indicated a robust deceleration within the quantity of BTC flowing into whale addresses. The determine dropped from 43,870 BTC on the 4th of November to 1,160 BTC by the seventh of November.

In distinction, giant holder outflows surged to fifteen,370 BTC by the sixth of November. Observe that this determine had dropped to 2,430 BTC on the seventh of October.

The massive holder flows information confirmed that whale shopping for stress dipped significantly within the final 5 days.

Additionally, the extent of outflows from giant holder addresses was increased than inflows, confirming that promote stress from whales was on the rise.

Bitcoin was already overbought within the final 24 hours, thus rising the possibilities of a reversal.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Whereas a bearish final result might happen throughout the weekend, merchants must also contemplate the opposite aspect of the coin.

Excessive optimism might result in restricted draw back as extra folks maintain on in expectation of upper costs. Nonetheless, the excessive degree of leverage steered that BTC was heading for risky instances forward.