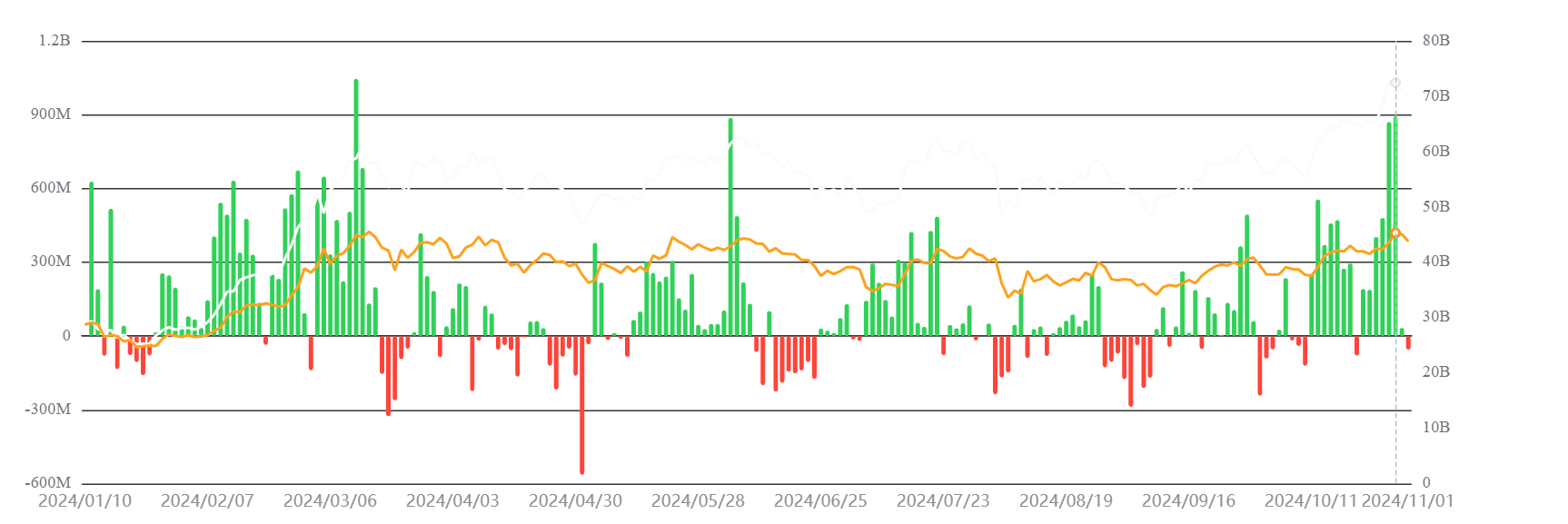

- ETF inflows for the previous week have been the fourth-highest in its historical past

- Throughout this era, BTC’s value crossed $72,000 in an try and cross its ATH

In current weeks, Bitcoin’s market has been carefully intertwined with the inflow of funds into Bitcoin ETFs. October noticed vital exercise as investor curiosity in Spot Bitcoin ETFs continued to mount.

The ETF flows for the week ending 1 November, specifically, mirrored a strongly bullish sentiment, setting a noteworthy development towards earlier weeks.

Bitcoin ETF’s record-setting inflows in current weeks

Knowledge from Sosovalue revealed that Bitcoin ETF flows for the week ending 1 November noticed substantial internet inflows of $2.22 billion. This determine is among the many highest for 2024 – An indication of sturdy demand from buyers.

The market noticed greater inflows in mid-March, with figures of $2.57 billion. Throughout the week ending 16 February too, figures of $2.27 billion have been recorded.

The current inflow is an indication of rising optimism, positioning these product choices as a most well-liked possibility for gaining Bitcoin publicity.

This regular stream of capital is an indication of an increase in confidence from institutional and retail buyers, doubtlessly making a strong demand base for BTC in the long run.

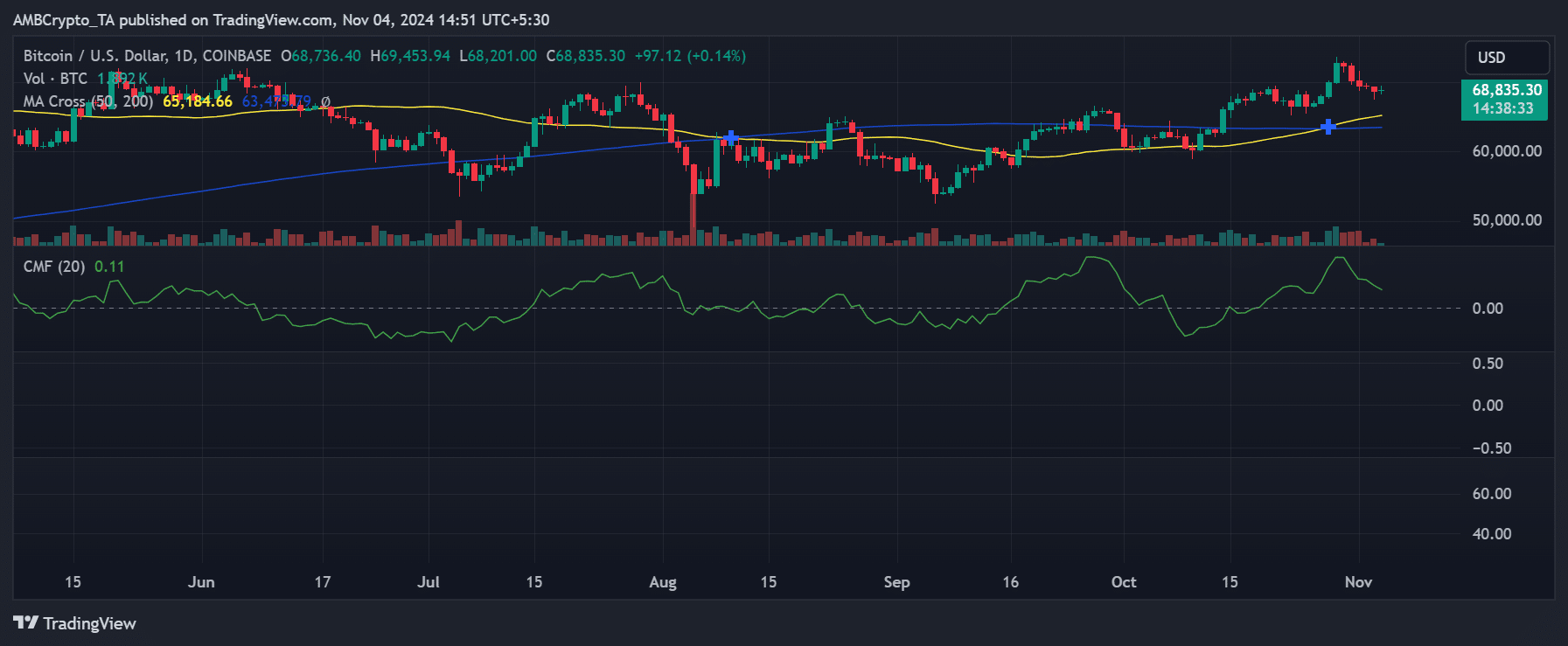

Worth response to ETF inflows

Bitcoin’s current value motion highlighted the affect of ETF inflows. Over the previous week, BTC peaked at $72,724, earlier than barely retracting to round $68,835.30.

This momentum aligned with a hike in ETF funding, suggesting that bullish sentiment from ETFs is influencing Bitcoin’s value. The constructive value development might proceed as extra capital flows into the market, particularly if regulatory circumstances stay favorable.

The correlation between Bitcoin’s value and ETF exercise appears to point that this funding supply might contribute to the present market uplift.

This response could possibly be an early signal that Bitcoin is gaining momentum from ETF-driven curiosity, a development that would persist relying on future regulatory developments.

Are Bitcoin ETF inflows an enduring sign?

Whereas Bitcoin ETF inflows are a promising signal, questions stay about whether or not this development may have an enduring affect on Bitcoin’s value or not. Traditionally, inflows of this magnitude have led to cost rallies. And but, elements like regulation, macroeconomic traits, and liquidity nonetheless affect the broader crypto market.

Bitcoin ETFs are opening doorways for conventional buyers to enter the crypto market extra simply, doubtlessly resulting in sustained value ranges and even additional features. Nonetheless, with this momentum might come short-term volatility as profit-taking will increase.

– Learn Bitcoin (BTC) Worth Prediction 2024-25

For now, the current surge in Bitcoin ETF inflows highlights sturdy bullish sentiment, which has supported BTC’s current value features. Whether or not this curiosity can gasoline a longer-term rally stays unsure. Nonetheless, the sustained ETF exercise is prone to reinforce Bitcoin’s standing available in the market.