- Bitcoin’s volatility hit a 3-month excessive on the charts

- Shopping for strain on the coin elevated, hinting at a worth hike quickly

As Election Day in america attracts nearer, a number of sectors have responded in a different way. And, crypto wasn’t insulated from all of it both.

Actually, owing to the identical, Bitcoin’s [BTC] worth volatility hit a 3-month excessive. Therefore, the query – Will this have a broader impression on the crypto market?

U.S elections affecting crypto?

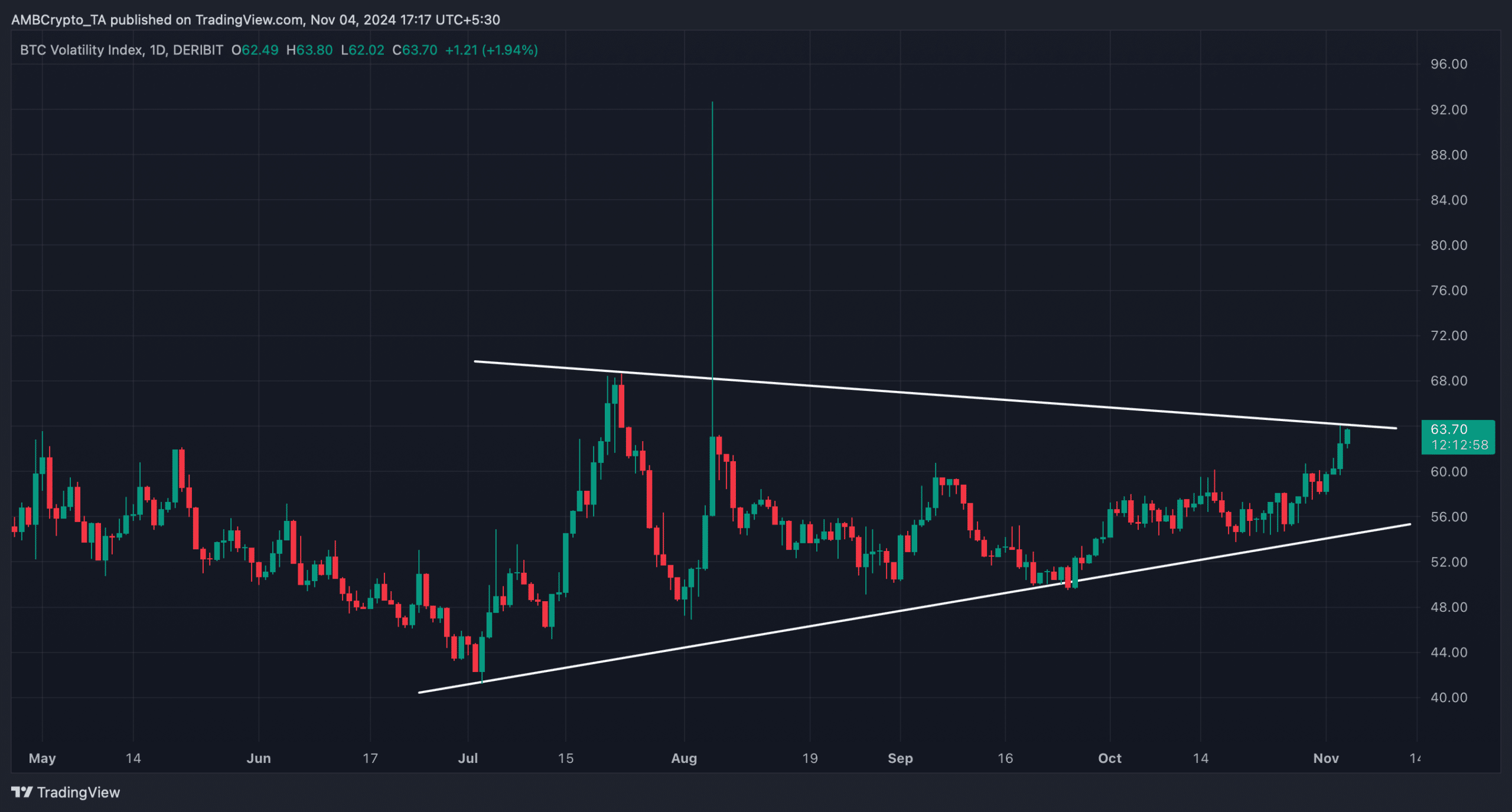

The crypto market’s volatility began to rise forward of the U.S election consequence date. AMBCrypto discovered that the general crypto market’s volatility shot up and hit 66.7, on the time of writing. As anticipated, Bitcoin led this altering development, with BTC’s volatility touching a 3-month-high.

Right here, the fascinating half was {that a} sample appeared on the volatility chart. To be exact, the sample appeared in July and since then, the volatility chart has been consolidating inside it.

On the time of writing, BTC’s volatility was testing the resistance of the sample because it had a worth of 63.72. If the chart jumps above the resistance, then buyers would possibly see extra volatility publish the election outcomes.

Other than this, AMBCrypto additionally discovered that liquidations within the crypto market rose.

The excellent news was that within the case of Bitcoin, most of this liquidations got here from lengthy positions – A bullish signal. This was the case as extra lengthy positions hinted at larger bullish sentiment throughout the market.

Will BTC’s rising volatility push it up?

Since BTC’s volatility has been on the rise, AMBCrypto checked the king coin’s on-chain knowledge to search out out whether or not the end result of this improvement will earn buyers revenue or push them into loss. Our evaluation of CryptoQuant’s knowledge revealed that BTC’s trade reserves have been dropping, that means that purchasing strain on the coin was excessive.

A hike in shopping for strain typically interprets into worth hikes. Actually, over the past 24 hours alone, BTC witnessed a marginal worth hike and was buying and selling at $68.75k.

Nonetheless, not every part was working within the king coin’s favor. BTC’s aSORP revealed that extra buyers have been promoting at a revenue. In the midst of a bull market, it could actually point out a market high.

Moreover, amidst the continued buzz across the U.S elections, buyers aren’t contemplating shopping for BTC, with the identical evidenced by the purple Coinbase premium.

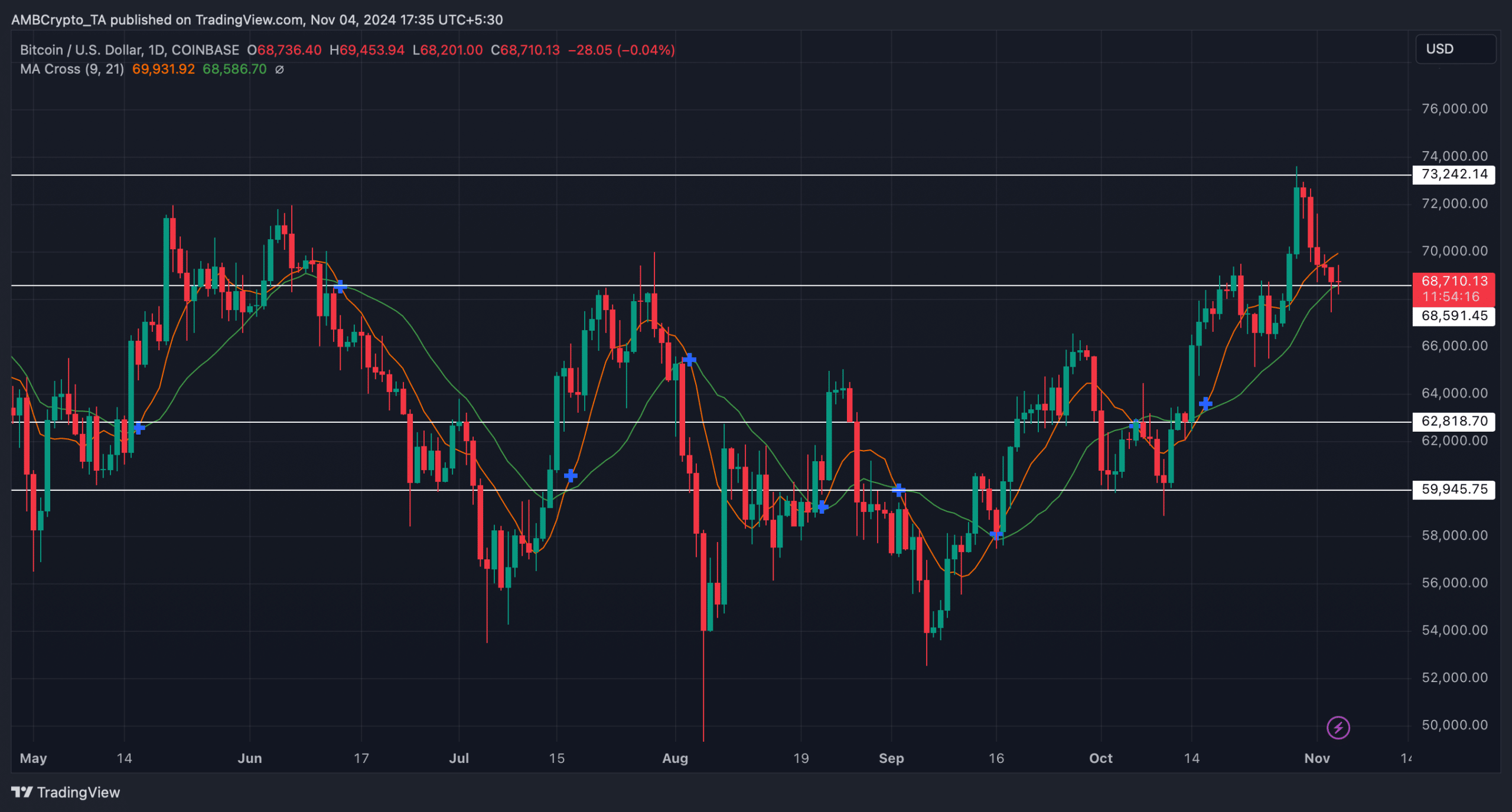

Lastly, we checked BTC’s every day chart to raised perceive what to anticipate. As per our evaluation, BTC appeared to be testing a help degree.

Learn Bitcoin (BTC) Worth Prediction 2024-25

The technical indicator MA Cross recommended that the bulls have been main, indicating a profitable take a look at. Due to this fact, if BTC’s volatility will increase much more, its worth would possibly transfer in the direction of $73k once more.