- Riot Platforms reported 65% income progress, however faces challenges in U.S facility expansions

- RIOT inventory dropped by 32% YTD, reflecting market volatility regardless of sturdy operational efficiency

Riot Platforms, a significant participant in Bitcoin [BTC] mining, reported a major 65% hike in year-over-year income. These findings underlined its resilience and progress momentum within the wake of BTC’s newest halving occasion.

Regardless of the sturdy monetary efficiency, nevertheless, the agency has confronted obstacles in its hashrate growth efforts, citing challenges inside its U.S amenities.

Riot Platforms Q3 income report

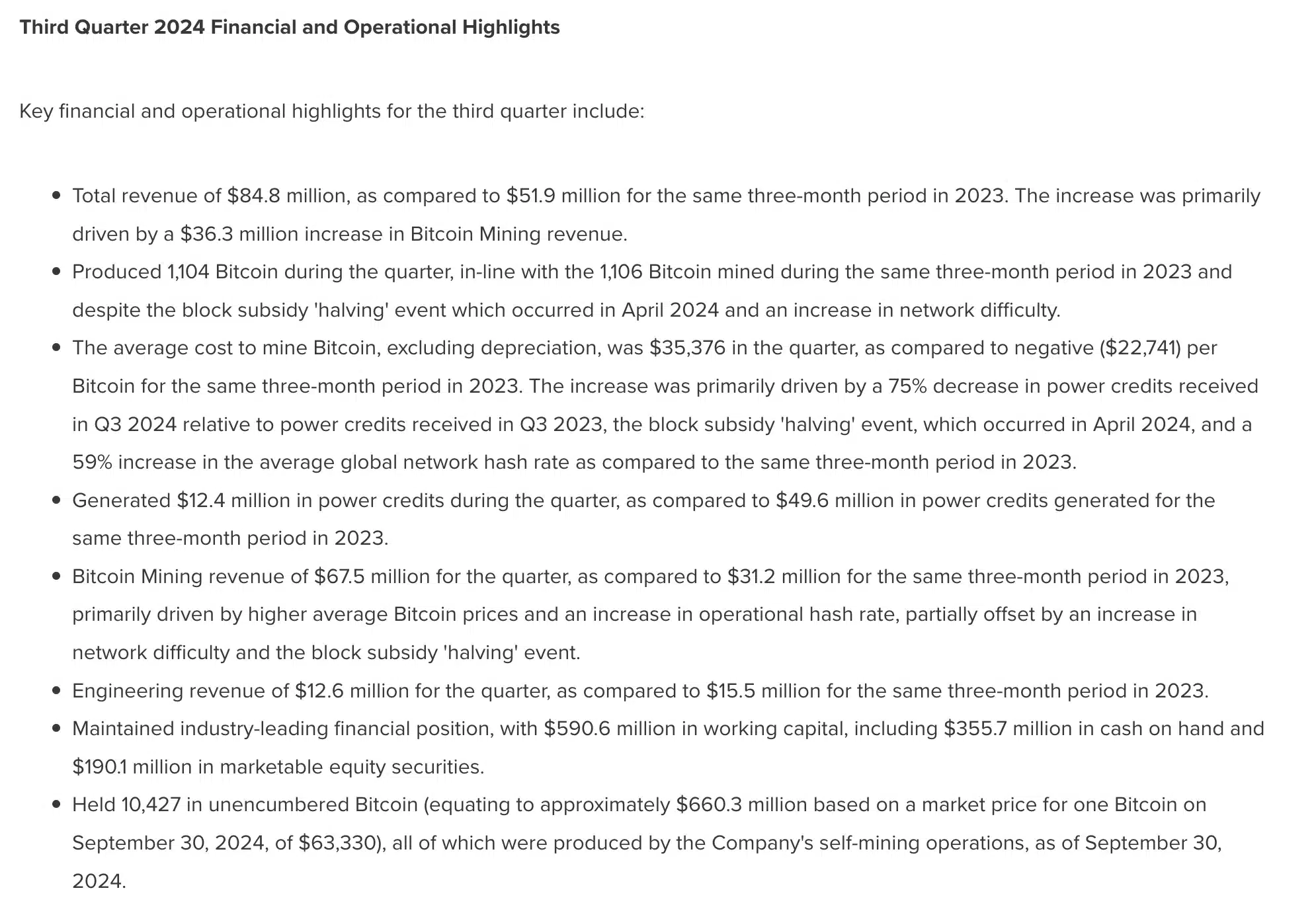

Whereas detailing its Q3 2024 outcomes, the corporate highlighted sustained progress alongside extremely aggressive and low energy prices.

Commenting on the outcomes, CEO Jason Les acknowledged,

“Riot recorded $84.8 million in income this quarter, representing a 65% enhance over the identical quarter in 2023, pushed by a 159% year-over-year enhance in deployed hash charge to twenty-eight EH/s on the finish of the quarter.

He added,

“This significant increase in deployed hash rate allowed us to produce 1,104 Bitcoin this quarter, in-line with our Bitcoin production in the third quarter of 2023, despite the ‘halving’.”

Riot platforms’ Bitcoin mining issue

Riot Platforms reported a quarterly internet lack of $154 million, or $0.54 per share, marking a 92% hike from its losses in Q3 2023. This decline was attributed to lowered energy credit, heightened operational bills, and the consequences of Bitcoin’s halving occasion.

Nevertheless, regardless of these challenges, the agency maintained spectacular power effectivity, with a median mining price of $35,376 per BTC – Practically half the present market worth of round $72,000.

Moreover, CEO Jason Les famous that the corporate’s industry-leading power charges, averaging 3.1 cents per kilowatt-hour, performed a key position in reaching this price effectivity.

That being stated, Riot Platforms closed the quarter with a powerful steadiness sheet, holding roughly $1.3 billion throughout money, restricted money, marketable fairness securities, and reserves of 10,427 Bitcoin.

To know extra, listed below are some key highlights from the report –

What’s subsequent?

As anticipated, CEO Jason Les shared optimism for the agency’s future, emphasizing efforts to spice up energy capability and hash charge in Texas and Kentucky.

These steps would assist help its objective of reaching 100 EH/s in self-mining capability, underscoring its dedication to progress in U.S BTC mining.

In the meantime, the corporate’s inventory (RIOT) has struggled this 12 months, dropping by 3.6% after hours on 30 October to $9.86 and down 32% year-to-date. On the time of writing, with a worth of $10.48, RIOT remained 85% under its February 2021 excessive of over $70.

Thus, regardless of operational progress and better hashrates, the inventory’s decline will be seen as proof of the challenges of a unstable market.