-

Restrict Orders

-

Market Orders

-

Cease Orders

- Cease Restrict Orders

Whereas the kind of order you utilize may look like a trivial element, it might probably truly make or break a commerce’s profitability.

What’s a Restrict Order?

In a nutshell, a restrict order is a method to purchase or promote a inventory at your restrict value or higher.

A restrict purchase order for $2.25 means you are prepared to buy the choice contract at any value as much as $2.25. If somebody will promote it to you for $2.20, your order will execute at $2.20.

It really works the identical method on the promote facet. A restrict promote order for $1.50 implies that $1.50 is the bottom value you’ll settle for on your contract.

Sometimes, choice merchants ought to solely use restrict orders and completely different variants of them, as market orders can

Restrict orders are the constructing blocks of economic markets. At their core, exchanges are huge databases of restrict order books with matching algorithms.

What’s a Market Order?

Market orders are orders you ship to the marketplace for speedy execution. This implies accepting one of the best obtainable value primarily based on one of the best bid or provide.

Utilizing market orders is a really aggressive technique and usually solely reserved for these emergencies when you want to exit a market in a panic as a consequence of a mistake.

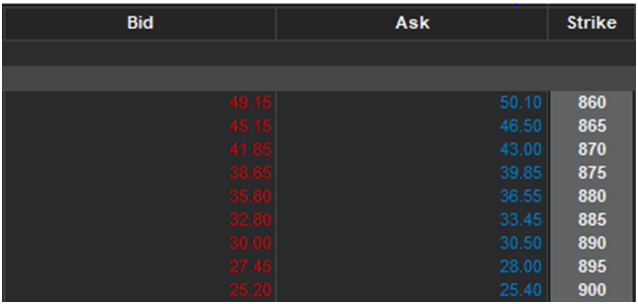

Beneath are the bid/ask spreads for a sequence of Tesla (TSLA) choices:

Submitting a market order to purchase, for instance, the 870 name on this sequence, would most frequently end in you paying $43.00 per contract.

‘No problem,’ you say, ‘I’m prepared to pay $43.00 for these contracts.’

The issue is that market orders are like clean checks to the market. You are telling the market, “I will take any price you give me for this order.” It is like going to an actual property agent and saying, “I want to buy this house, even if the seller revises his price upward between now and when you give him the offer.”

Not so quick, as a result of there are 4 issues with utilizing market orders.

Stale Quotes

Market orders haven’t any mechanism to guard you from high-frequency market makers who change their quotes on the velocity of sunshine. See this 2011 case the place a retail dealer submitted a market order to purchase an ETF buying and selling at $26, solely to see his order executed at $35 as a consequence of market illiquidity.

This challenge of market illiquidity is simply compounded within the choices market. Liquidity is fragmented throughout a sequence of choices contracts. Whereas there are millions of shares to commerce within the inventory market, every inventory can have dozens or a whole lot of various contracts. Few merchants are prepared to take the opposite facet of your trades in a particular choice contract at any given time.

For that reason, you need to by no means use a market order in choices buying and selling. Whereas it is typically advisable to not use them when inventory buying and selling, it’s miles much less dangerous. For those who’re buying and selling a liquid inventory like Apple (AAPL), you may lose just a few cents if the quote you depend on goes stale after sending a market order. However order books are very skinny within the choices market, making certain vital slippage if the quote goes stale.

Intention For the Midpoint With a Restrict Order

The ‘midpoint’ in choices buying and selling is the midpoint between the bid and ask costs. If the bid/ask is $4.00/$6.00, the midpoint of that quote is $5.00.

If the choice has adequate liquidity, the midpoint can usually act as an approximation of its theoretical or “fair” worth. And consequently, market makers or different merchants are often comfortable to commerce with you on the midpoint, particularly should you’re prepared to be affected person.

The distinction between hitting a bid or provide and taking liquidity from the market makes an enormous distinction in a dealer’s profession. It may be the distinction between long-term profitability and breaking even.

Whilst you received’t have the ability to get the midpoint 100% of the time, you may get it usually sufficient that you need to make a behavior out of pricing your orders at or close to the midpoint until you might have a compelling purpose to not.

Broad Bid/Ask Spreads

The bid/ask unfold is the distinction between one of the best bid value and one of the best provide/asking value. In extremely liquid shares like Apple (AAPL) or Microsoft (MSFT), the bid/ask unfold can usually be as small as a penny when simply buying and selling the inventory.

This is not precisely true for the choices market. Not all choices commerce in penny increments. In actual fact, the minimal pricing increment for a lot of choices is $0.05 or $0.10. In accordance with TD Ameritrade, listed here are the present minimal value increments within the US choices market:

|

Contract Worth Vary |

Worth Increment |

|

$0.10 – $3.00 |

$0.01 or $0.05 |

|

$3.00+ |

$0.05 or $0.10 |

Take into account that even for an choice priced <$3.00 having an $0.01 increment, a penny remains to be a considerably bigger proportion of the worth than it’s for a share of inventory like Apple (AAPL) priced above $100.

Possibility Bids and Asks Are Unhealthy Costs

The perfect bid value is mostly properly beneath an choice’s theoretical worth, and one of the best ask above it’s theoretical worth. So sending a market order to the market virtually all the time implies that you’ll be overpaying on your choices or not getting sufficient whenever you promote them.

What To Use As an alternative of a Market Order: Marketable Restrict Order

Maybe submitting a restrict order on the midpoint and patiently ready to be stuffed isn’t an choice. Possibly you’re making an event-driven commerce and you want to get in/out now, or perhaps you forgot to shut your trades and the market closes in 30 seconds. Typically you require immediate liquidity.

So if market orders aren’t an choice, what do you utilize whenever you want immediate execution? Marketable restrict orders.

A marketable restrict order carries all the advantages of a market order with none of the dangers of insane slippage.

Marketable restrict orders aren’t a particular choice in your buying and selling platform. You may create one with only a easy restrict order ticket. You solely want to cost the order on the bid or ask, and the order turns into eligible for fast execution.

For instance, for example you wish to submit a market order to purchase an choice with a bid/ask of $4.50/$4.55. To submit the equal marketable restrict order, you’ll ship a restrict order to purchase the choice one tick above the asking value, on this case, $4.60. On this case, if the quote you are counting on goes stale, then the worst that would occur is that you simply get stuffed one tick above your anticipated value.

Abstract

Seasoned choices merchants by no means use market orders for 4 causes:

-

The quote you’re counting on is perhaps ‘stale‘ when your order makes it to the market, that means you may find yourself paying greater than you anticipate.

-

Typically, a market maker will fill you should you submit a restrict order at or close to the midpoint.

-

Bid/ask spreads are a lot greater within the choices market than within the fairness market.

- The asking (bid) value for any choice is mostly properly above (beneath) the theoretical worth of the choice contract. It is not straightforward to be a worthwhile dealer should you constantly pay an excessive amount of or obtain too little for choices.