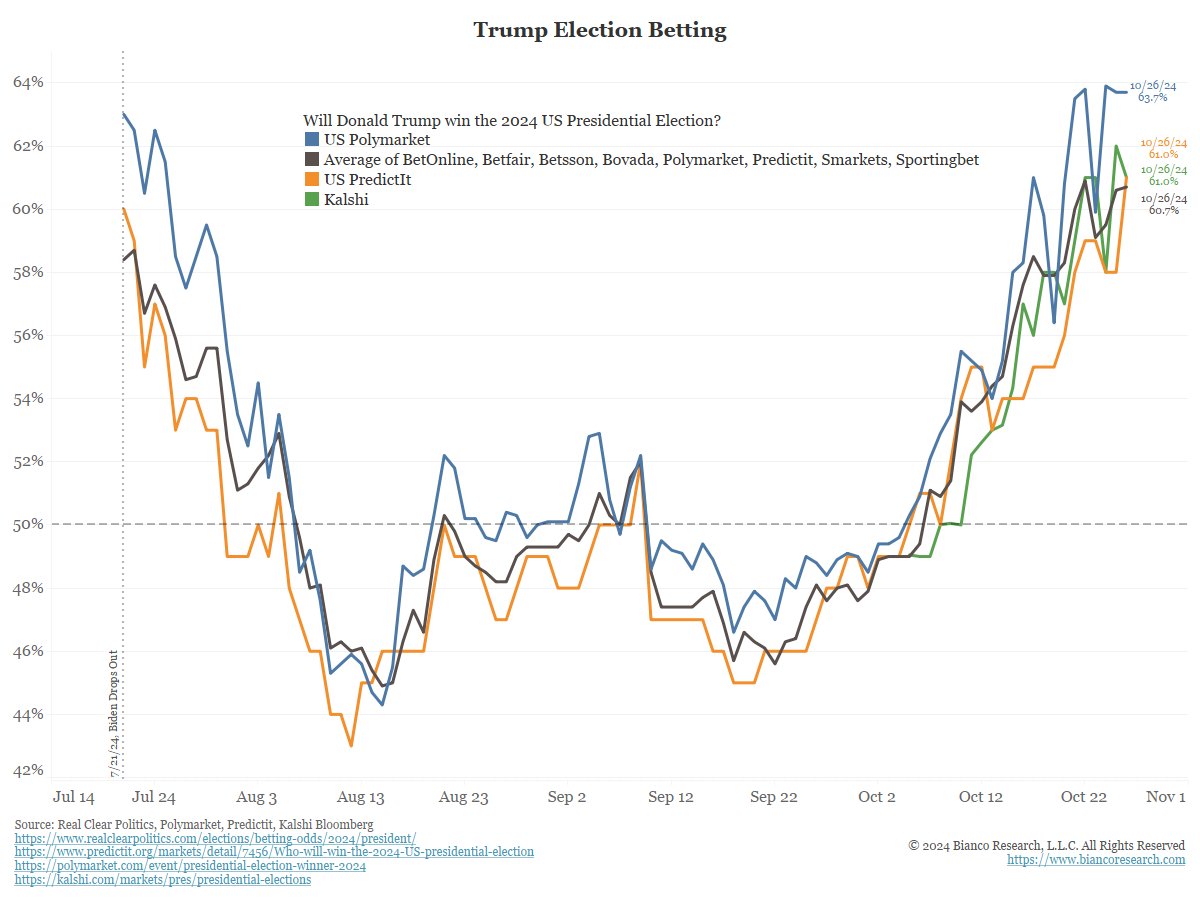

- Trump has maintained a lead over Kamala throughout all prediction websites and fashions.

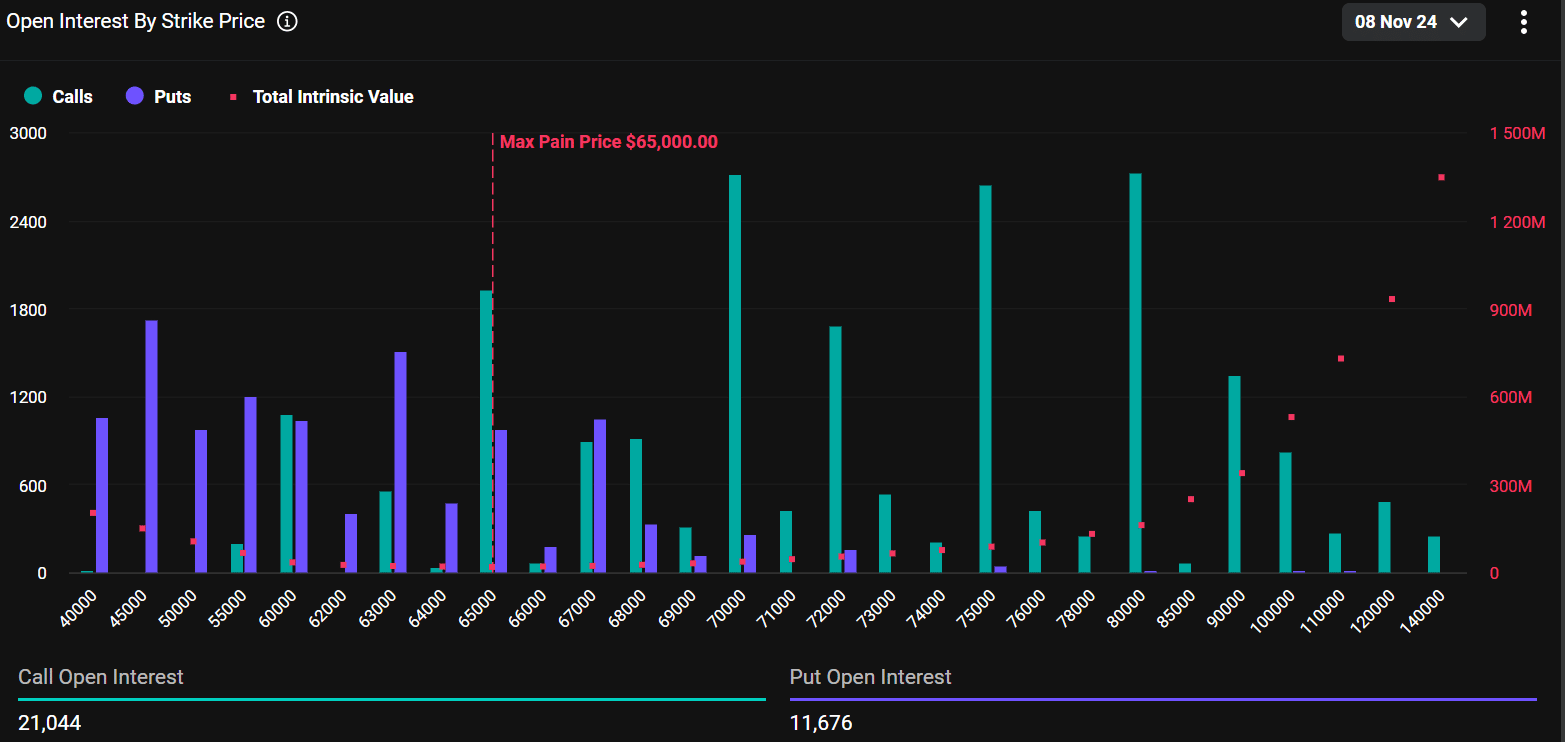

- BTC choices merchants have been closely bullish on the election end result expectations.

All prediction websites and high fashions revealed that pro-Bitcoin [BTC] candidate Donald Trump has the next probability of profitable the upcoming US presidential elections.

In keeping with the newest overview by analyst Jim Bianco of Bianco Analysis, prediction websites like Polymarket, Kalshi, PredictIt, and others have been polling a +60% probability of Trump profitable.

Potential affect on BTC

Though some platforms like Polymarket have lately confronted criticism of alleged manipulation, different dependable fashions leaned in direction of Trump.

Bianco famous that high election fashions, corresponding to Silver Bulletin and two different well-liked fashions, additionally confirmed a excessive likelihood of +50% of a Trump win.

“Silver is not the only one with an election model. Silver Bulletin, FiveThirtyEight, Economist Magazine. They all have Trump in an uptrend of over 50%.”

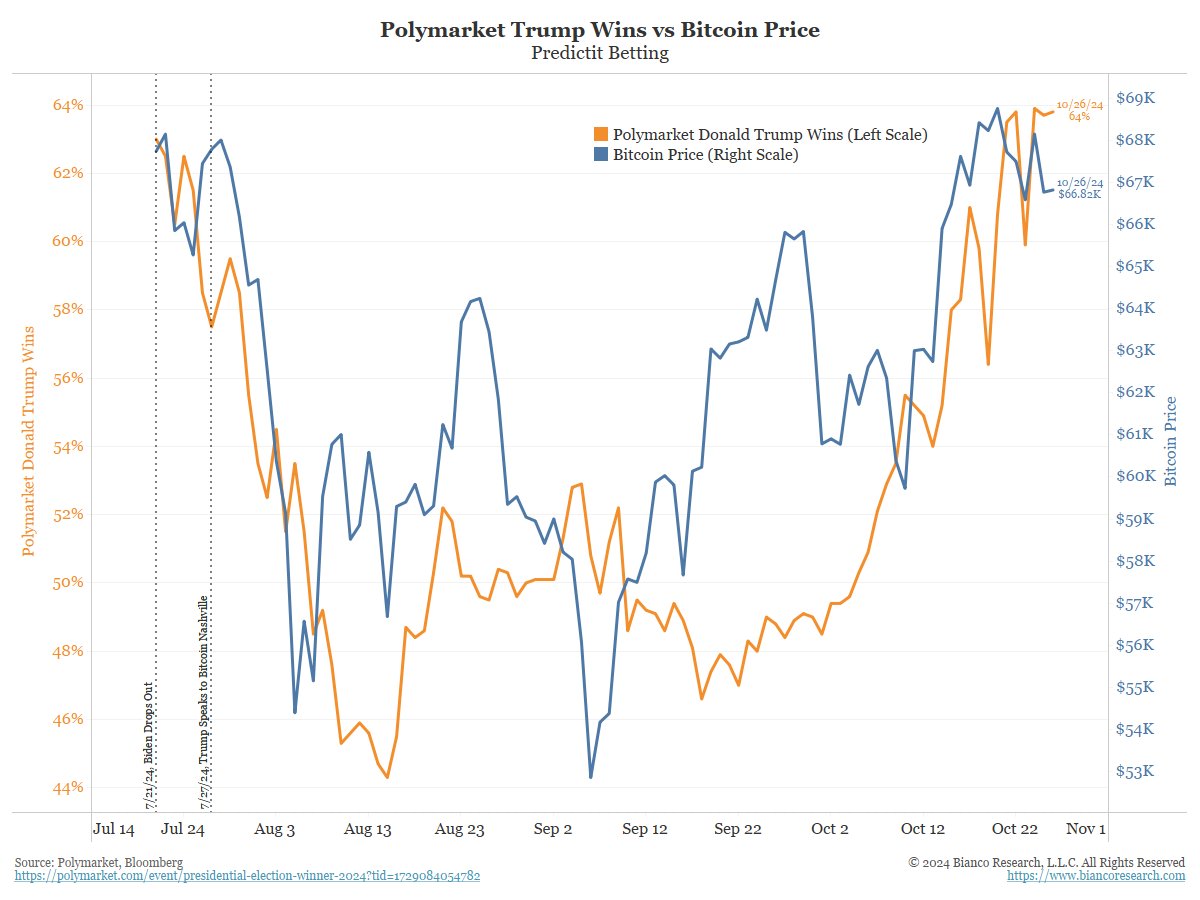

This above expectation has been deemed bullish by speculators in BTC markets.

Notably, BTC exploded prior to now few weeks as Trump’s odds surged and crossed 60% on Polymarket. It pushed BTC to just about $70K. Commenting on the correlation, Bianco termed it an ‘election play,’

“And another election play, although this relationship might be “fraying” in latest days.”

Market positioning

Maybe essentially the most evident affect of the above bullish expectation on Trump’s win was within the BTC choices market. Final week, choices merchants have been pricing a 20% probability of BTC hitting $80K by the top of November.

The sentiment was unchanged at press time. In keeping with Deribit information, there was practically twice as a lot Open Curiosity in name choices (betting worth rally) than in put choices (worth decline) for contracts expiring by eighth November.

Moreover, the put/name ratio (PCR), which tracks choices market sentiment, was at 0.55.

For context, if the ratio is above 1, then there are extra put choices than calls, a bearish sentiment. However, a worth under 1 means dominance of name choices, underscoring bullish sentiment.

That mentioned, the 0.55 PCR studying painted a particularly bullish sentiment within the choices market, maybe attributable to speculators’ assumption that Trump was more likely to win.

Nevertheless, given Harris’s more and more pro-crypto stance too, BTC choices merchants have been assured that the asset may hit a brand new all-time excessive (ATH) no matter who wins the US elections.

Within the meantime, BTC was valued at $67K at press time, about 9% away from its ATH of $73.7K.