- BTC has declined over the previous week by 1.67%.

- Bitcoin’s variety of particular person buyers should stay above 54 million for it to rally.

Over the previous week, Bitcoin [BTC] has skilled a big market correction. The correction was accompanied by a pointy decline in buying and selling actions. Notably, buying and selling quantity has declined by 62%, implying much less demand and fewer individuals.

This decline in individuals has left analysts speaking in regards to the significance of particular person buyers for a BTC rally. One in every of them is the CryptoQuant analyst Burak Kesmeci, who has advised that BTC should exceed 54 million particular person buyers to rally.

Why 54 million particular person buyers are crucial

In his evaluation, Kesmeci posited that the indispensable situation for Bitcoin’s bull rally is a surge within the variety of particular person buyers.

In response to him, BTC must exceed 54 million particular person buyers for the crypto to see a value rise. The variety of particular person buyers elevated for 12 months after dropping to 43 million in January 2023.

Over this era, it has elevated to hit 52.4 million, making a 22%. After the approval of ETFs, the quantity declined to 51.6 million in February 2024.

Nonetheless, this quantity noticed a sustained improve throughout the March 2024 rally and peaked at 54.14 million in June. Since then, the variety of particular person buyers has declined.

Traditionally, a rise within the variety of particular person buyers carefully correlates with BTC costs. For example, BTC surged by 300% when the variety of particular person buyers elevated in January 2023.

Consequently, after the variety of particular person buyers peaked in June 2024, the Bitcoin value declined.

Bitcoin’s variety of individuals continues to say no

The evaluation supplied by Kesmeci means that it’s important for the variety of buyers to extend for a BTC rally. This means that new entrants into the BTC blockchain are important for value appreciation. The query is, are new buyers coming into the market?

In response to AMBCrypto’s evaluation, Bitcoin is experiencing a decline within the variety of individuals.

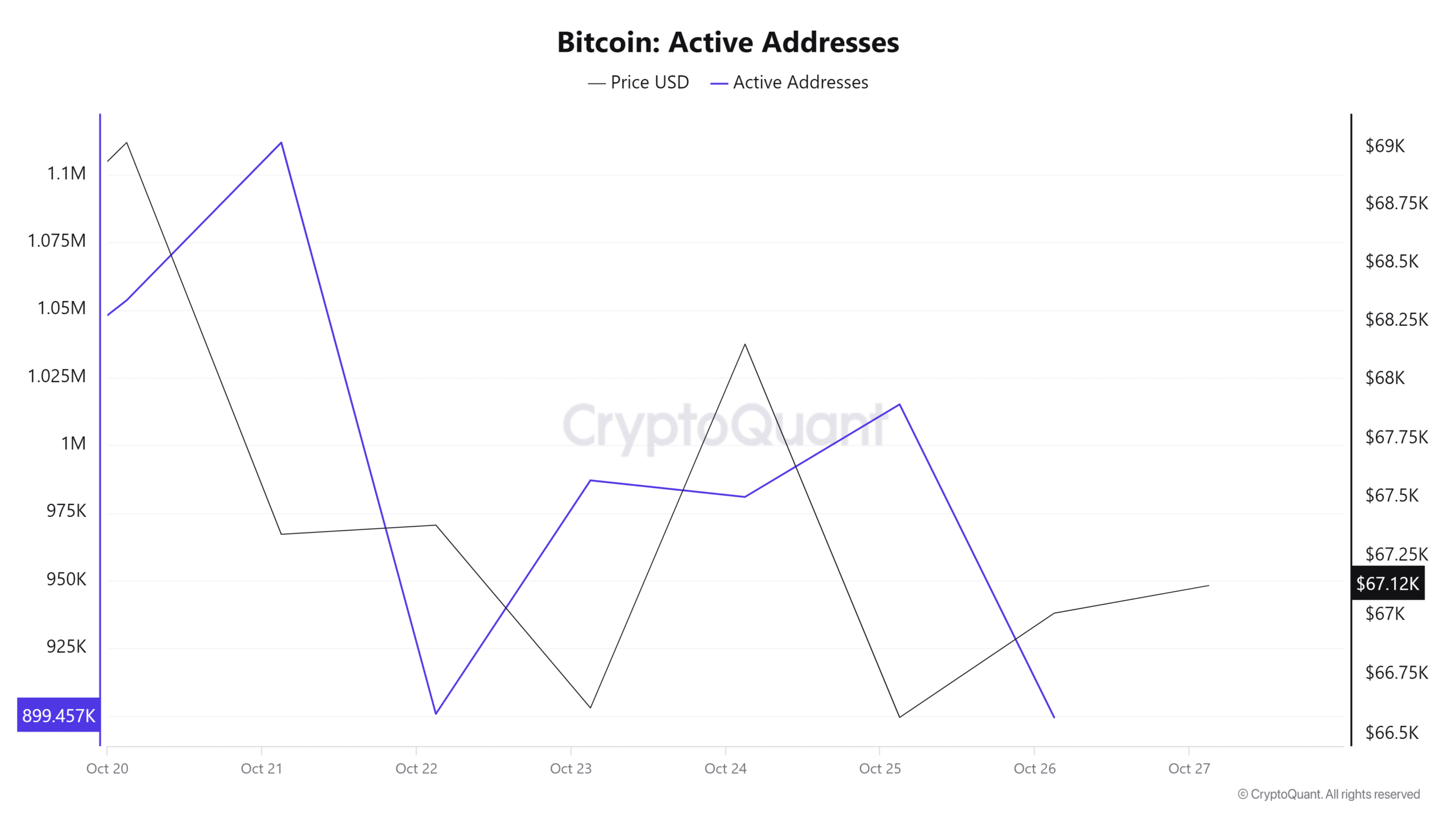

For instance, Bitcoin’s each day lively addresses proceed to say no. Over the previous week, lively addresses have dropped from 1.1 million to 899k. This implies that fewer buyers are coming into the market, signaling a decline within the variety of particular person buyers.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

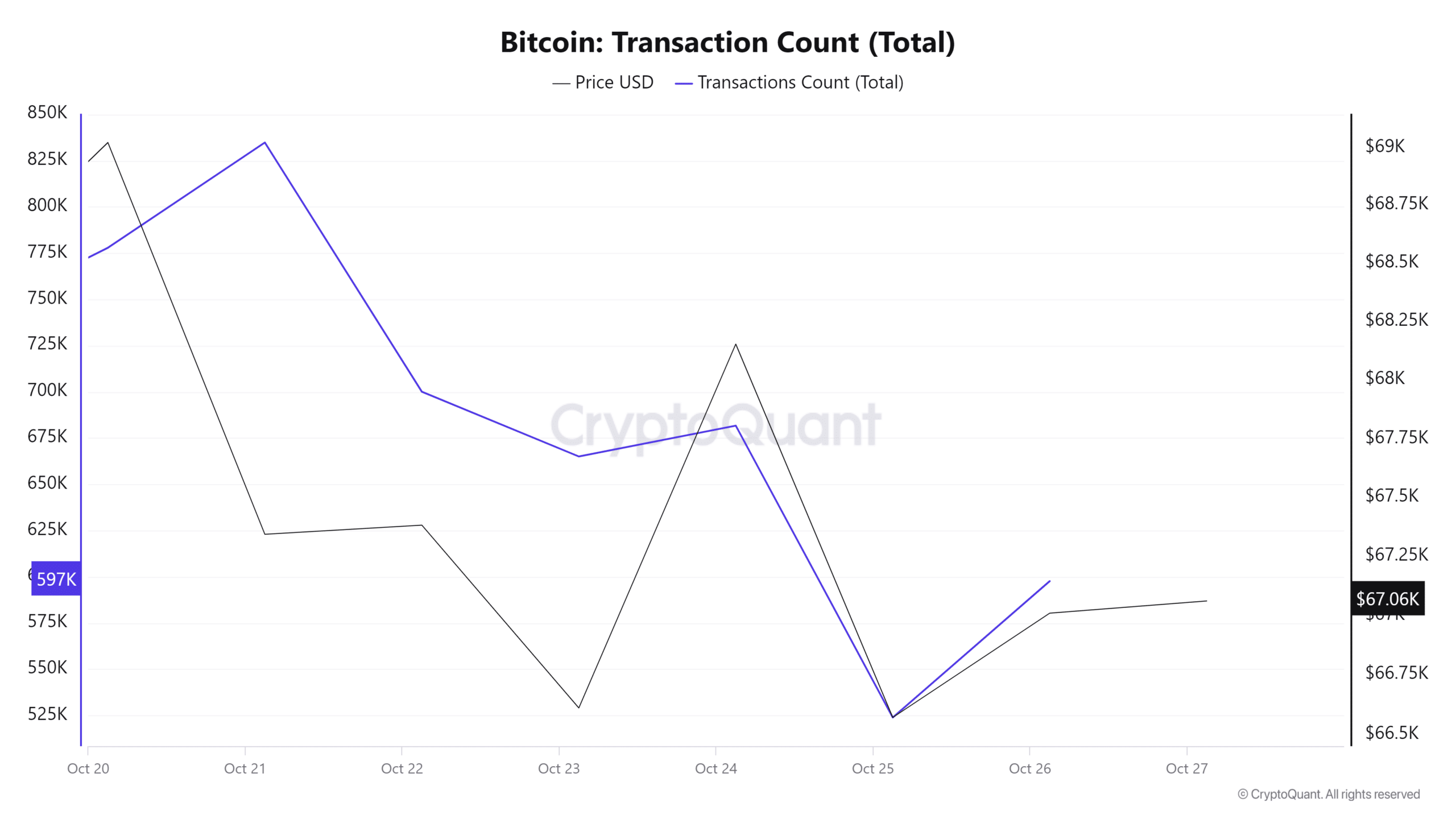

Moreover, Bitcoin’s transaction depend has declined from 834k to 598k over the previous week. This indicated decrease demand for BTC as fewer buyers are utilizing the blockchain.

As noticed above, BTC is experiencing a decline within the variety of individuals. This normally ends in a market correction, as witnessed over the previous week with Bitcoin buying and selling at $67,074 at press time. Thus, if the present pattern persists, BTC may decline additional to $65,757.