- Analyst forecasts a 40% rally for Bitcoin earlier than cycle high.

- The Fibonacci extension ranges present targets of $109k and $132k.

Bitcoin [BTC] noticed a surge in accumulation addresses. The HODL mentality was rising in reputation. Bitcoin addresses which have by no means had an outflow and a minimal of 10 BTC held 1.5 million cash at first of 2024, however at the moment held 2.9 million.

The Bitcoin Rainbow Chart gave ultra-optimistic forecasts for the present cycle, concentrating on $288k or increased. Nevertheless, historic developments confirmed {that a} cycle high could possibly be nearer to $100k this time.

Bitcoin set for one more 40% rally earlier than the cycle high?

Supply: CryptoBullet on X

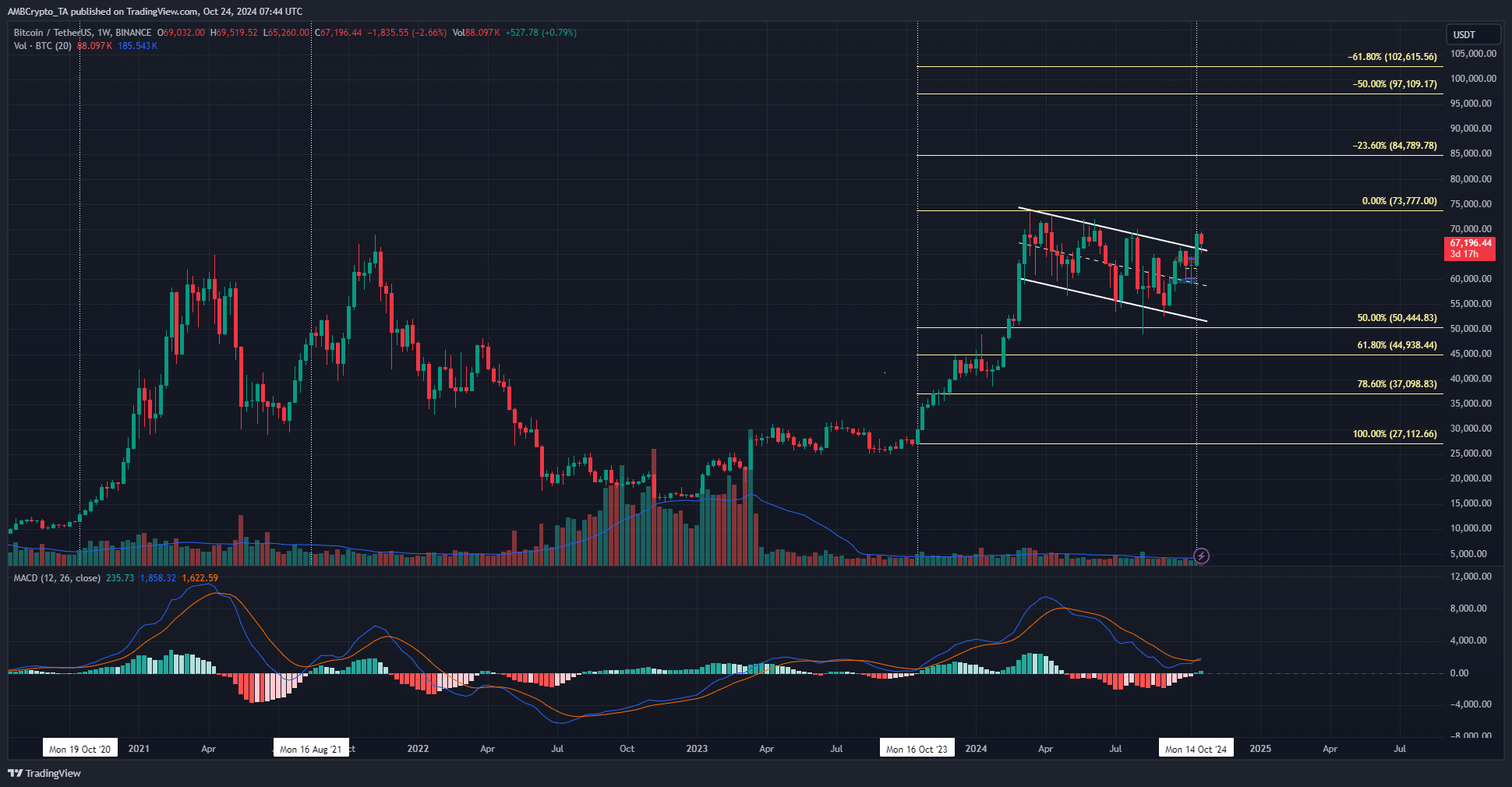

In a put up on X, crypto analyst CryptoBullet famous that the weekly MACD shaped a bullish crossover for the primary time since October 2023. Again then, a rally of 172% occurred inside 5 months.

But, this rally was earlier than the Bitcoin halving occasion. The controversy now is- ought to we anticipate related features, or would the subsequent leg increased find yourself forming a decrease excessive on the MACD, and find yourself being the tip of the bull run?

The analyst favored the latter situation. A multi-month consolidation adopted by a bullish MACD crossover after a vertical rally would doubtless not see triple-digit share features. CryptoBullet prompt on his charts that one other 40% transfer increased can be an affordable goal.

Gauging the present targets for Bitcoin

Historical past rhymes however needn’t repeat. Within the 2017-18 bull run, the weekly MACD bullish crossover noticed a 617% return, and the 2020 one noticed a 468% transfer. The 2023 one gave 172% in return however occurred earlier than the halving date.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

In 2019 and 2020, Bitcoin rallied 190% from the $3.2k lows set 18 months earlier than the halving. It’s doable that the pre-halving run that BTC noticed could possibly be damaged, and that the 40% value extension goal CryptoBullet gave for the subsequent leg could possibly be fallacious.

Nevertheless, as issues stand, it appears to be an affordable expectation. It additionally ties in nicely with the Fibonacci extension ranges plotted on the weekly chart above.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion