- Stability on BTC accumulation addresses surged 93% in 2024, now holds $194 billion.

- Does the large holding technique sign an additional value rally for BTC?

Based mostly on 2024 traders’ habits, the HODLing technique appears to have grow to be essentially the most preferable Bitcoin [BTC] funding method.

Based on knowledge by CryptoQuant’s analyst Burak Kesmeci, BTC accumulation addresses now maintain 2.9 million cash. That’s price over $194 billion, a virtually 2x (93%) improve from January holdings.

“In January 2024, these addresses held only 1.5 million Bitcoins, yet within 10 months, that amount nearly doubled. They continue to accumulate patiently and boldly without selling off their holding”

Is it a bullish cue?

To place the large accumulation spree in perspective, in 2018, BTC accumulation addresses solely held 100K cash. Quick-forward to the 2021 bull run, the addresses topped 700K cash.

Nevertheless, Kusmeci famous that actual development occurred in 2024, with a whopping 93% bounce from 1.5 million in January to 2.9 million.

Is it a bullish cue, maybe signaling that holders anticipated an additional BTC value appreciation?

It’s price noting that the U.S. spot BTC ETFs debuted in January 2024, and the following optimism may need led to the surge in BTC accumulation addresses holding.

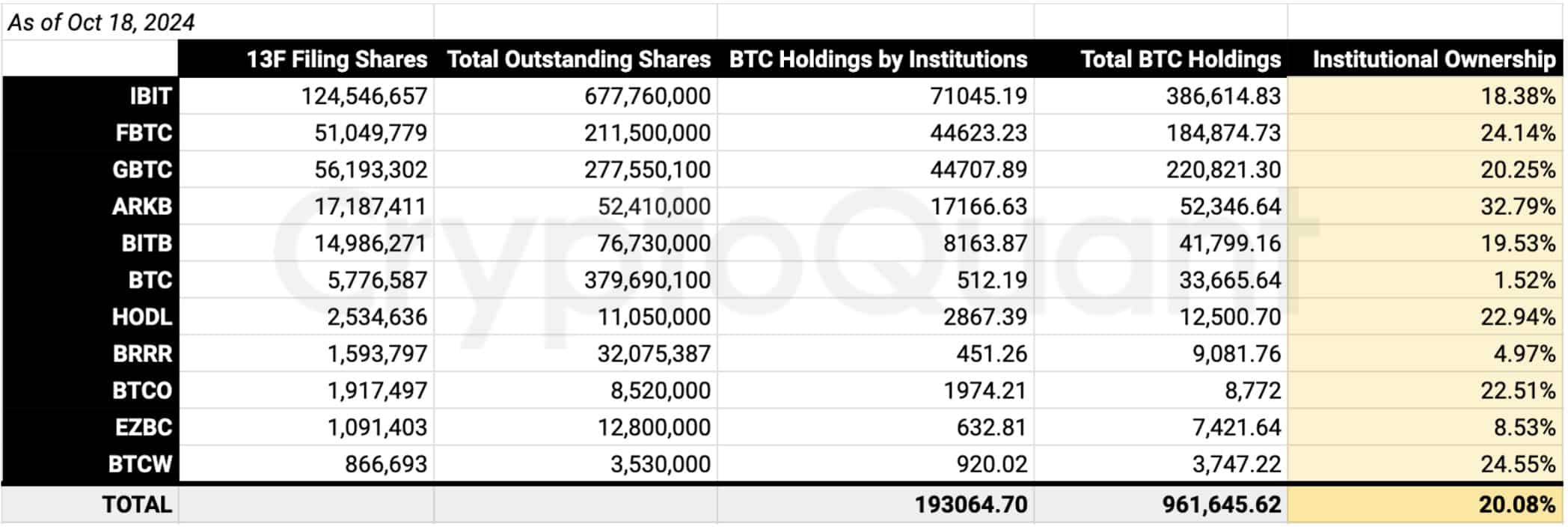

As of the 18th of October, the merchandise held 961K BTC, price over $65 billion.

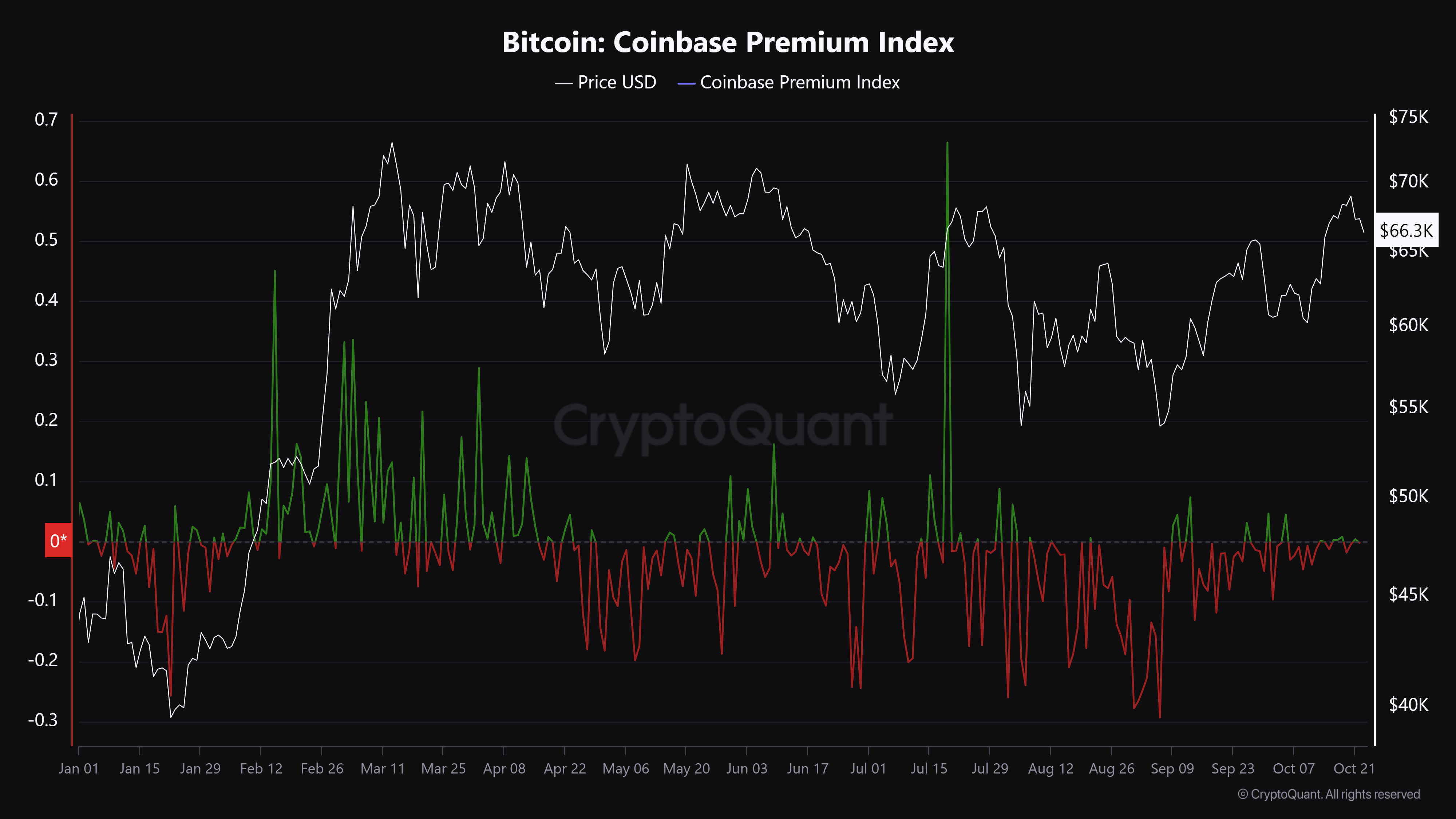

The optimism after the approval of the U.S. spot BTC ETF was evident by a surge in U.S. investor demand for the asset in Q1 2024, as proven by the spikes (inexperienced) within the Coinbase Premium Index.

The renewed optimism noticed BTC hit an all-time excessive (ATH) above $73K in March. Will the pattern repeat?

On the time of writing, the investor curiosity in This fall was decrease than the large demand seen in Q1. That mentioned, BTC was valued at $66.3K, about 11% from the March’s ATH.