- Bitcoin attacked the $70K essential stage however faces rejection.

- Liquidity constructing under $58K sounds alarm on future strikes.

Bitcoin [BTC] is on the verge of breaking above the essential $70K resistance stage however has confronted on the spot rejection because it was buying and selling at $67K as of press time.

With sturdy momentum constructing, BTC is probably going aiming to seize liquidity past this key zone, doubtlessly setting the stage for a brand new all-time excessive. The market is buzzing with hypothesis that Bitcoin may quickly surpass this important worth level.

Because the bull market positive aspects power, buyers are intently awaiting indicators of a deeper correction, with the $67K zone being a key stage to observe. Shopping for the dip may result in important positive aspects if the correction holds.

Liquidity and open pursuits

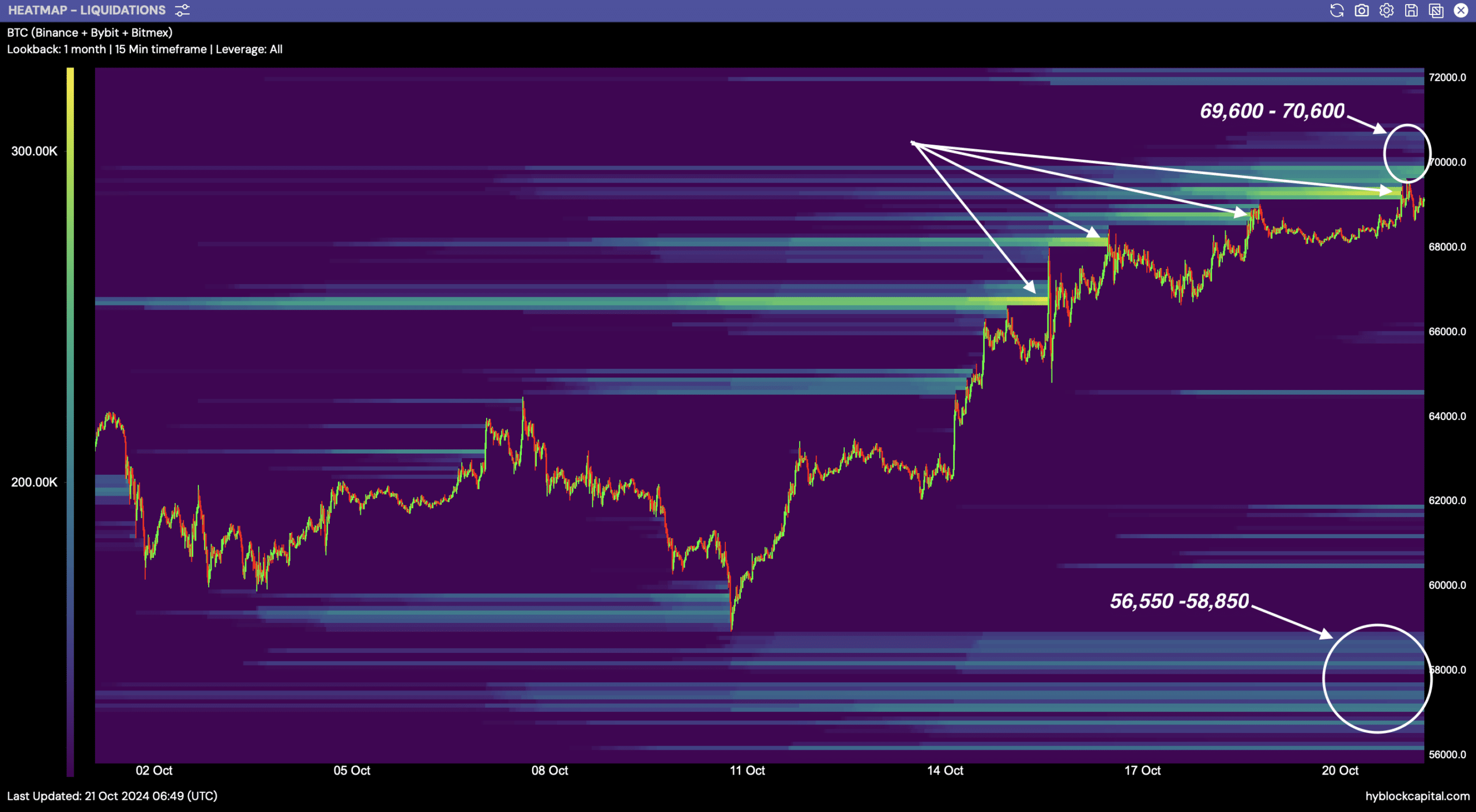

At present, Bitcoin’s recreation of liquidity is a significant focus. A big cluster of liquidity is forming above the $70K stage, whereas one other pool is constructing under the $58K zone.

Analysts count on Bitcoin to tug again to $67K earlier than resuming its upward pattern. If this occurs, BTC may break by $73K, doubtlessly making a brand new all-time excessive.

Nevertheless, a correction could observe as soon as liquidity builds across the $58K stage, presumably inflicting a worth revisit.

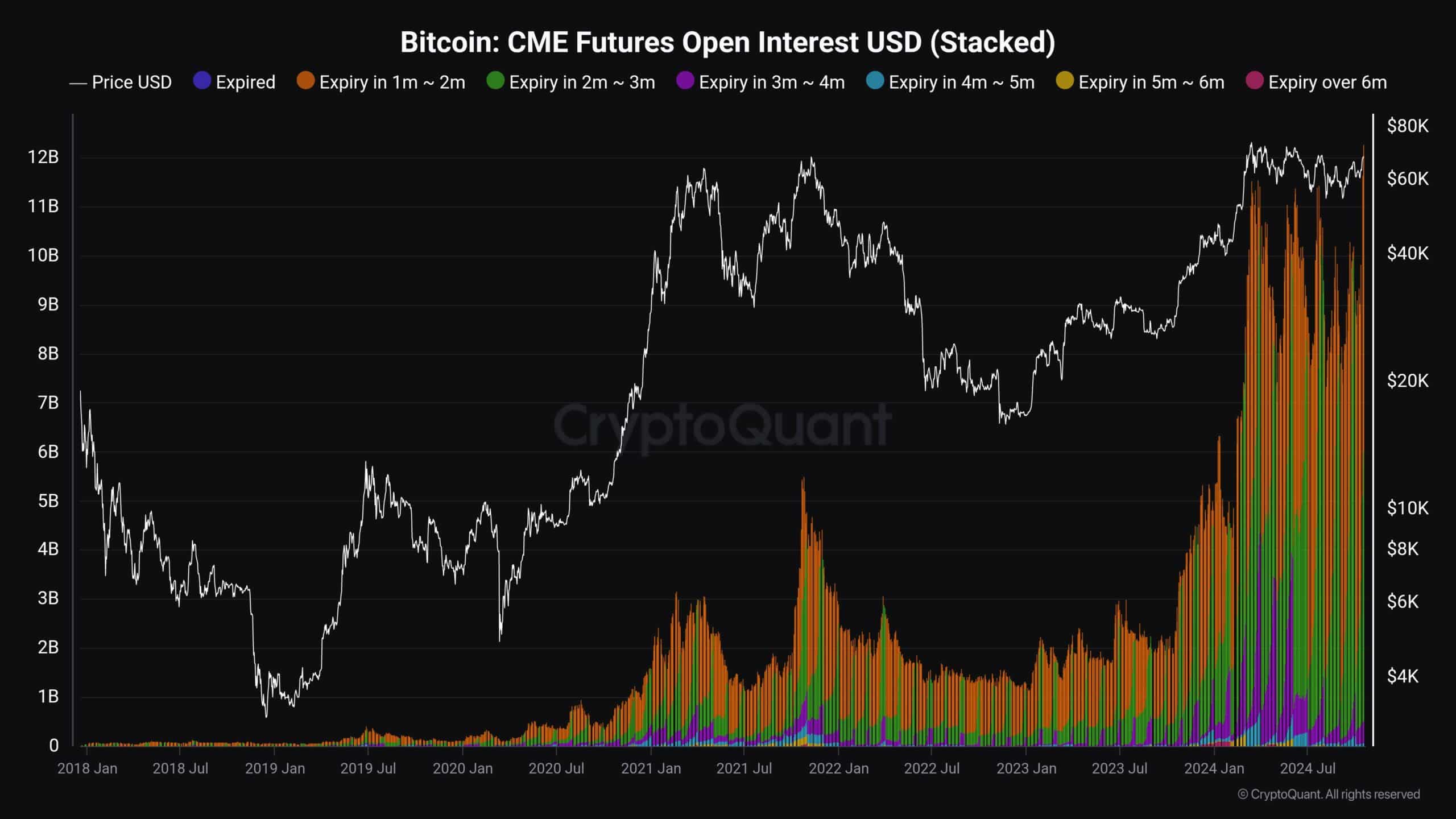

Including to the bullish sentiment, Bitcoin’s CME Futures Open Curiosity has reached an all-time excessive of $12.0 billion. This surge signifies that extra merchants are betting on BTC’s worth going larger.

The futures market performs a major function in influencing Bitcoin’s worth, and this document open curiosity means that Bitcoin is prone to push previous the $70K stage quickly.

The bullish momentum within the Bitcoin futures market is a powerful sign for merchants to observe intently.

Bitcoin spot ETFs resurgence

Moreover, Bitcoin spot ETFs made headlines final week with a major internet influx of $2.13 billion. This marks the third-largest influx in historical past, highlighting sturdy institutional curiosity.

BlackRock’s ETF, IBIT, led the cost, bringing in $1.14 billion, whereas Constancy’s $FBTC secured $319 million. This inflow of capital into Bitcoin ETFs is additional fueling the optimism that BTC’s worth will transfer larger.

Learn Bitcoin’s [BTC] Worth Prediction 2024 – 2025

As compared, Ethereum’s spot ETFs noticed a extra modest influx of $78.89 million, suggesting that BTC stays the first focus for a lot of buyers on this bullish cycle.

As Bitcoin continues to problem the $70K barrier, the market is poised for potential positive aspects. If BTC can break by this stage and maintain, it may sign the start of a brand new upward rally.