- Bitcoin ETFs noticed file inflows amid the broader market’s restoration, signaling investor optimism

- Political shifts are driving digital asset inflows, with Republicans seen as being pro-crypto

Amid a broader market restoration, Bitcoin [BTC] ETFs have been gaining traction recently with important inflows – An indication of a optimistic market development.

Bitcoin ETF replace

In response to Farside Buyers, Bitcoin ETFs recorded collective inflows of $371 million on 15 October.

Main the pack was BlackRock’s IBIT with $288.8 million, adopted by Constancy’s FBTC at $35 million. Moreover, Ark 21Shares’ ARK ETF reported figures of $14.7 million whereas lastly, Grayscale’s GBTC noticed inflows of $13.4 million.

Whereas some ETFs noticed no inflows, none reported outflows. This may be interpreted as reinforcing the rising curiosity in Bitcoin-based funding automobiles.

The truth is, only a day in the past, Bitcoin ETFs recorded their highest single-day web inflows since June – A mixed worth of $555.9 million.

Main this momentum was FBTC which reported $239.3 million inflows – Its largest since 4 June. Moreover, GBTC additionally noticed renewed curiosity with figures of $37.8 million – Its highest since Might and marking its first optimistic inflows in October.

This coincided with Bitcoin buying and selling at $67,823.08 on the charts, following a 3.56% hike in 24 hours and beneficial properties of 9.44% over seven days. As anticipated, this has fueled hypothesis that the crypto could also be gearing up for one more all-time excessive.

CoinShares hyperlinks this to election – However why?

Apparently, CoinShares’ newest report additionally highlighted a notable uptick in digital asset inflows, totaling $407 million—A shift attributed to rising investor curiosity tied to a possible Republican win.

This latest wave of capital is an indication of heightened curiosity in crypto, one pushed by expectations {that a} GOP-led administration may convey favorable regulatory shifts to the business.

The report famous,

“Digital asset investment products saw inflows of US$407m, as investor decisions have likely been more influenced by the upcoming US elections than by monetary policy outlooks.”

The agency supported its evaluation by mentioning that latest inflows align intently with political developments, slightly than financial indicators.

Notably, stronger-than-anticipated financial knowledge had minimal impact on halting prior outflows.

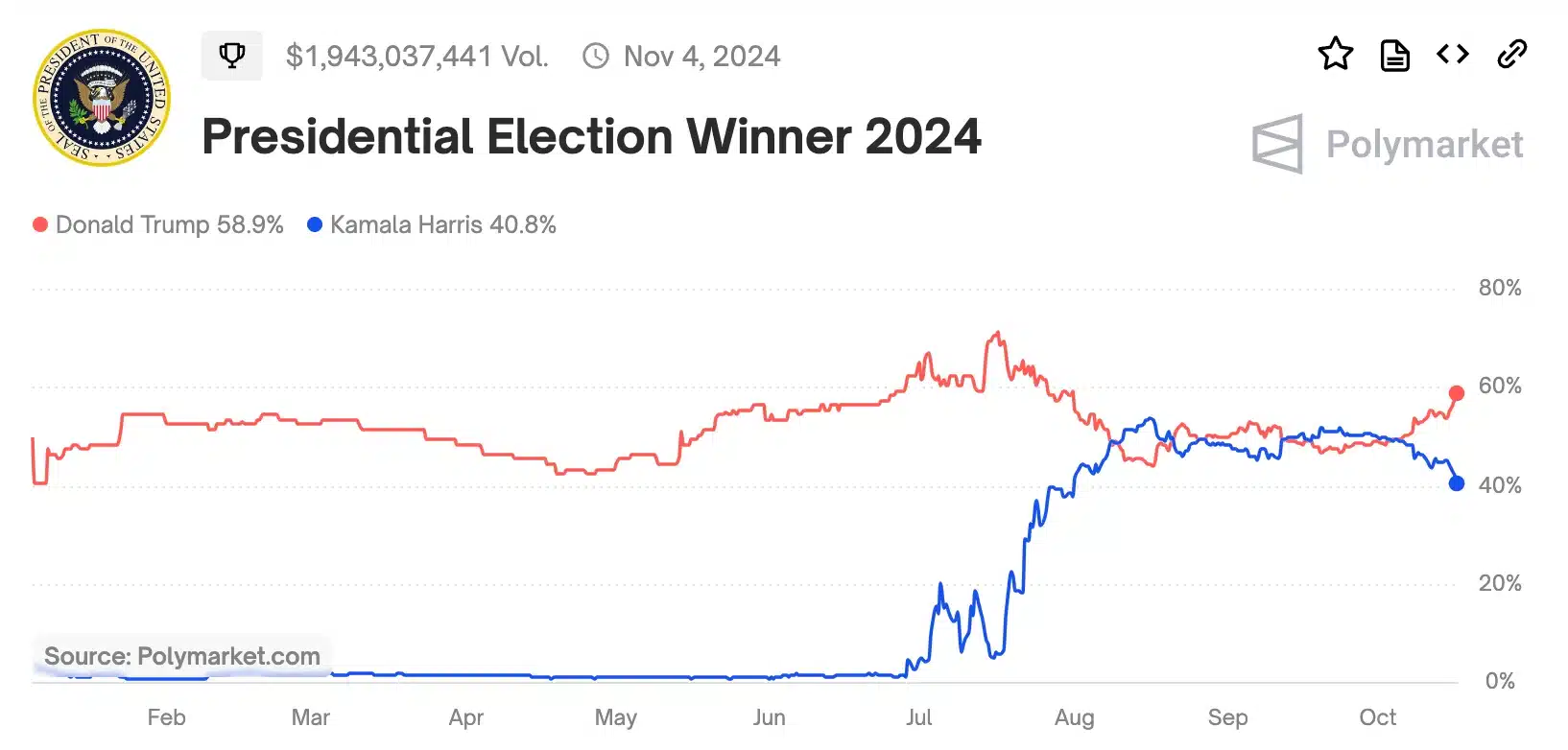

The truth is, in response to CoinShares, this uptick in inflows was adopted by the latest U.S. Vice Presidential debate. Following the identical, polling momentum shifted towards Republicans, seen as being extra supportive of digital asset initiatives.

Execs weigh in…

ETF Retailer President Nate Geraci supported this attitude, highlighting that the outcomes of the U.S. elections may have a significant impression on the digital property business’s future.

He mentioned,

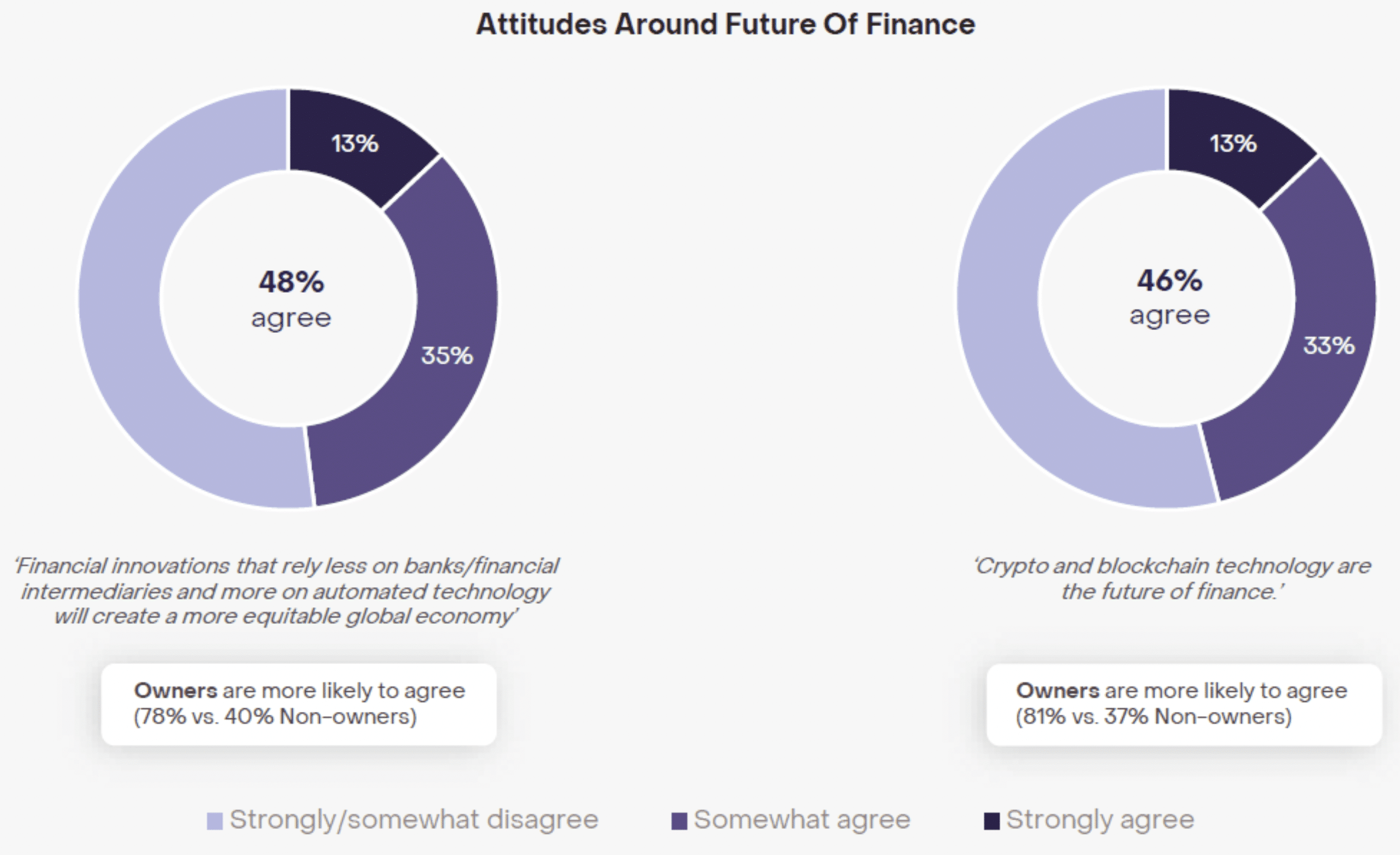

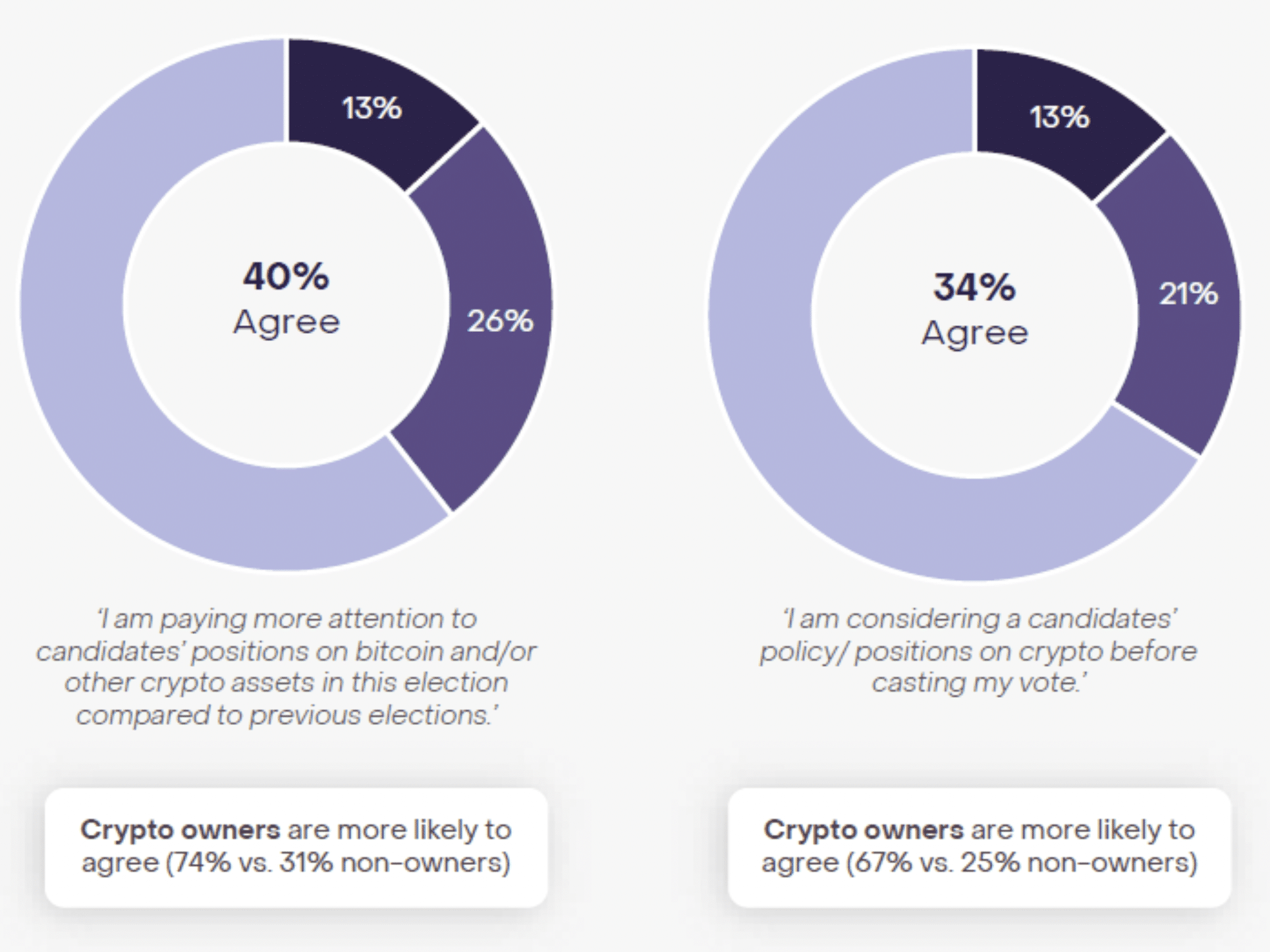

“46% agree that crypto & blockchain are future of finance. 34% said they were considering candidates’ crypto positions before voting.”

Geraci added,

“Becoming mainstream issue.”

Right here, Geraci highlighted insights from a latest Ballot carried out for Grayscale, one analyzing the interaction between cryptocurrency and the upcoming elections.

With Trump gaining traction because the Republican candidate on Polymarket, the ultimate stretch guarantees to convey pivotal developments for the sector.