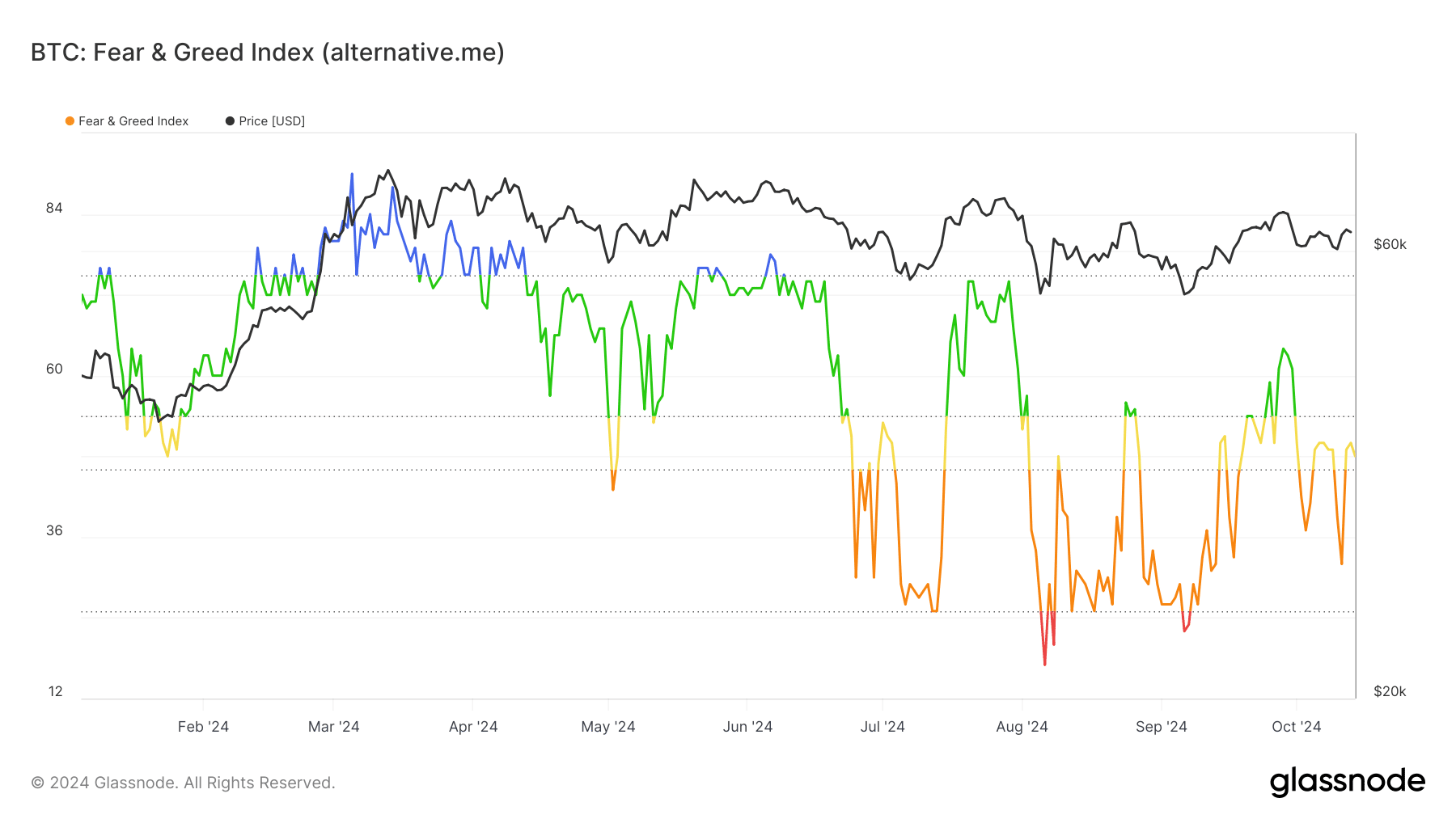

- The Bitcoin worry and greed index has shifted to a impartial rating of 48, indicating balanced market sentiment.

- Bitcoin has damaged previous its 200-day transferring common, at the moment buying and selling round $64,850 after a 3% improve.

The previous few days have been a rollercoaster for Bitcoin [BTC], with its value transferring by means of unstable developments. Nevertheless, latest knowledge means that the market sentiment is starting to stabilize.

The Bitcoin worry and greed index reveals that the emotional response of merchants has shifted from extremes of worry and greed to a extra impartial outlook.

Bitcoin worry and greed index turns impartial

In response to Glassnode, the Bitcoin worry and greed index was 48 at press time, signaling a impartial sentiment available in the market. This marks a shift from the heightened worry and greed that adopted latest value fluctuations.

The index, which gauges market sentiment based mostly on components like volatility, quantity, and social media developments, means that merchants are adopting a wait-and-see method after a interval of intense market actions.

Earlier within the week, on the eleventh of October, the index dropped to 32, reflecting a state of worry amongst merchants. Curiously, this coincided with a Bitcoin value improve to roughly $62,000.

Regardless of this upward value motion, the sentiment on the time remained cautious, doubtless in response to earlier value declines.

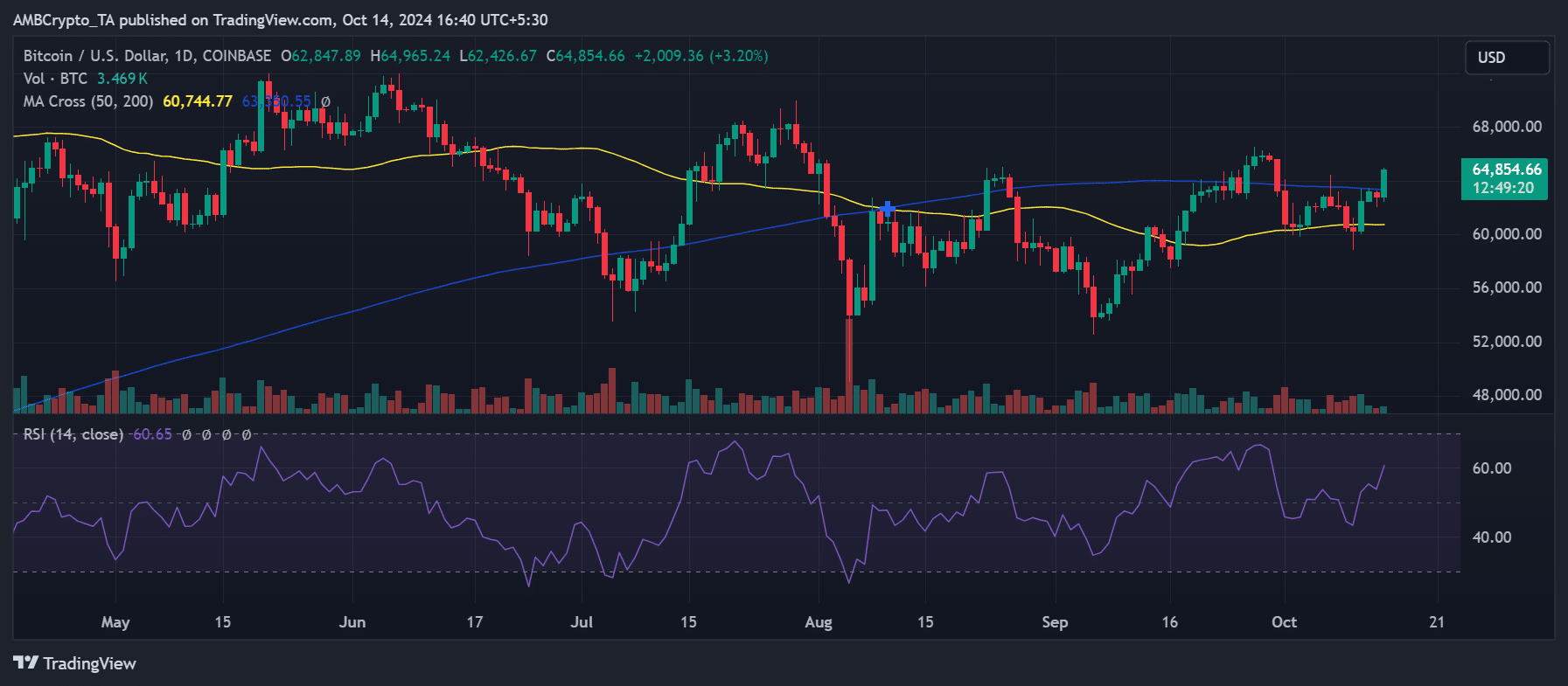

BTC strikes with worry and greed sentiment

AMBCrypto’s evaluation of Bitcoin’s value development revealed that the decline within the Bitcoin worry and greed index on the eleventh of October was a response to prior value motion.

Earlier than the value improve, Bitcoin had confronted a sequence of declines, dropping its worth to round $60,000—a stage beneath its 50-day transferring common (yellow line), which acted as a key help stage.

Nevertheless, the market rebounded on the eleventh of October. Bitcoin noticed a 3% improve that introduced its value again as much as $62,500, pushing it above the 50-day transferring common.

Regardless of this, the value remained below its 200-day transferring common (blue line), a stronger resistance stage.

As of this writing, Bitcoin is buying and selling at roughly $64,850, gaining one other 3%.

This upward development has allowed BTC to interrupt previous the 200-day transferring common, which had served as resistance across the $63,000 value mark.

The mixture of those value actions and the impartial sentiment on the Bitcoin worry and greed index means that the market is in a state of cautious optimism.

Energetic addresses stay secure

Though the Bitcoin worry and greed index mirrored a impartial sentiment, the variety of lively addresses has stayed remarkably secure.

Knowledge from Santiment confirmed that the seven-day common of lively addresses had remained constant, with round 3.5 million lively addresses.

As of this writing, there have been roughly 3.52 million lively addresses, reflecting sustained engagement with the community.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

This regular variety of lively addresses indicated ongoing curiosity from long-term holders, which may function a basis for future value will increase.

Regardless of the shifting sentiment, the soundness in community exercise could also be an indication that Bitcoin’s long-term outlook stays optimistic.