- The Coinbase premium hole metric precisely projected one other Bitcoin demand zone

- Bitcoin change flows and whale exercise confirmed that liquidity is as soon as once more in favor of the bulls

Bitcoin may very well be on the verge of one other brief time period rally, regardless of its latest battle to keep up bullish momentum. The primary half of October is nearly executed and whereas there have been excessive expectations for Uptober, a contrarian end result performed out.

The truth that Bitcoin prolonged its draw back this week and even dipped beneath $60,000 might have additional crushed any bullish October expectations. Nevertheless, a latest CryptoQuant evaluation suggests {that a} robust bullish end result remains to be potential within the brief time period and will have already started.

CryptoQuant’s evaluation prompt that Bitcoin is presently in an accumulation part. This assertion was based mostly on the Coinbase Premium Hole metric. Based on the evaluation, a surge in accumulation has been going down each time BTC Coinbase premium dropped beneath -50.

The Bitcoin Coinbase premium hole not too long ago dipped effectively beneath -100, however does this imply there was a number of accumulation too?

Bitcoin demand outweighs promote strain

Bitcoin’s value motion to this point this week aligns with the evaluation.

The cryptocurrency was buying and selling at $63,667, at press time, after bouncing again by over 6% from its weekly low on Thursday. The sharp bounceback confirmed robust demand at and beneath the $60,000 value vary.

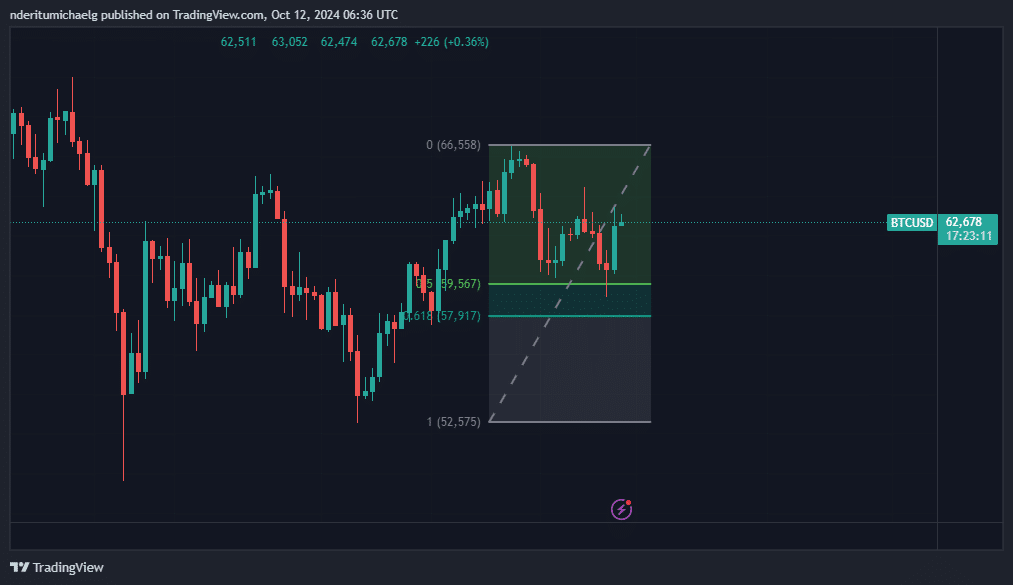

Right here, it’s additionally price noting that robust bullish momentum made a comeback after the worth retested the 0.5 and 0.618 Fibonacci vary. This was based mostly on its lowest and highest value ranges in September.

This means that there’s a excessive chance that accumulation/demand would make a comeback after retesting this zone.

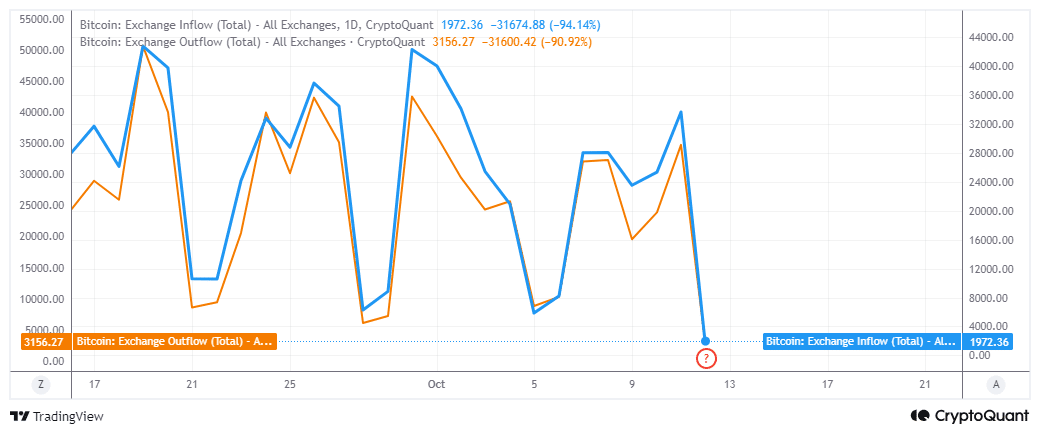

The hole between change inflows and outflows widened following the dip beneath $60,000. Bitcoin change outflows had been notably increased at 3156 BTC within the final 24 hours, in comparison with 1972 BTC throughout the identical interval. This appeared to verify that there was extra purchase strain than promote strain.

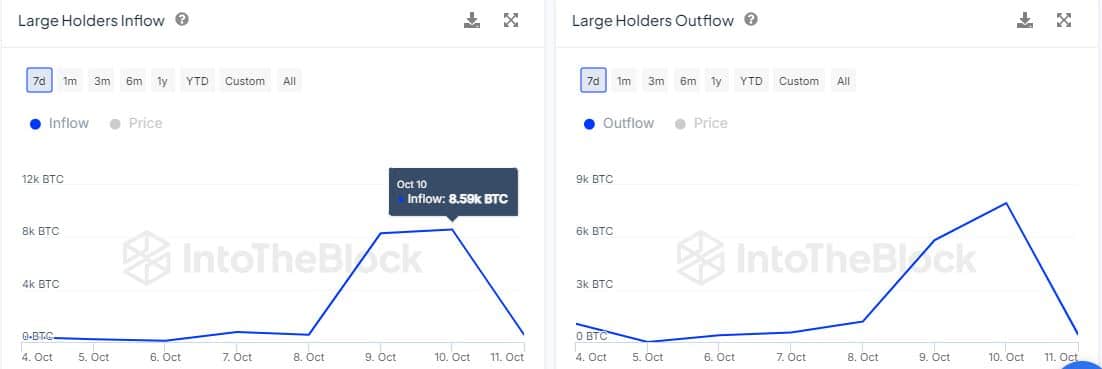

On-chain information additionally confirmed noteworthy whale exercise this week.

We noticed a surge in giant holder flows over the week, with inflows peaking at 8,590 BTC on 10 October. This was considerably increased than giant holder outflows which peaked at 7,960 BTC throughout the identical interval.

Giant holder flows have cooled down barely since then. Nevertheless, inflows had been nonetheless increased than outflows, pointing to web positive aspects by way of whale liquidity.

These findings, collectively, prompt that Bitcoin is likely to be gearing up for one more leg up. Nevertheless, it stays unclear whether or not the present momentum will prolong past the brief time period. For now, the latest bounceback confirmed that sub $60,000 costs should still be thought-about low cost.