However if you happen to ask me, the first downside is having a sound buying and selling technique. Many new merchants attempt to skirt by on superficial methods like “sell options for income,” or one thing related and so they merely aren’t buying and selling with an edge.

So on this article we’re going to undergo some easy and easy-to-understand buying and selling methods that merchants with a small account can rapidly begin making use of.

Whereas the emphasis is on simplicity, all of those have sound logical, and in some circumstances, tutorial rigor.

What you’ll discover when studying by way of these methods is most of them make the most of vertical spreads because the device of selection. Vertical spreads are most choices merchants’ bread and butter. Get acquainted with them.

Exploiting Pre-Earnings and Publish-Earnings Announcement Drift (PEAD)

The post-earnings announcement drift is a inventory market anomaly, it’s the tendency for a inventory to development within the course of its earnings shock for 6-9 months following the report.

It’s mainly traders systematically underreacting to good (or dangerous) information in shares.

Even after a number of a long time of this edge being extensively recognized and well-disseminated in tutorial literature and books, the anomaly persists. The rationale why isn’t as necessary as the truth that it’s strong sufficient to construct a buying and selling technique on, and unlikely to vanish in a couple of months or years time.

There’s additionally a well-known tendency for implied volatility to rise within the days and week’s resulting in an earnings launch, permitting the astute dealer to easily purchase choices earlier than the choices, on common, start to rise in IV.

Euan Sinclair proposed a variety of commerce buildings for exploiting this tendency in his ebook Positional Choices Trading, so check out Chapter 5 for extra data.

The idea is comparatively easy, discover a approach to specific a bullish view on a inventory following a constructive earnings shock. Sinclair suggests utilizing bull name spreads, as IVis comparatively low-cost instantly following an earnings occasion.

Shopping for Liquidations in Hedge Fund Resorts

A hedge fund resort is a derogatory phrase for a inventory of which a lot of the public float is owned by hedge funds who’re copying one another or are a part of a hivemind.

These shares can look fairly liquid at a look, but when a kind of funds desires to promote their place, look out under, as a result of the one patrons sufficiently big to soak up it are hedge funds who’re already lengthy as much as their eyes.

As such, a fund needing to liquidate their place to lift money will usually trigger an enormous one-day drop within the inventory, just for it to get well within the ensuing days.

Whereas this isn’t wherever as strong as one thing like a PEAD technique, which you’ll be able to run all through earnings season, this can be a commerce you would possibly see a couple of occasions 1 / 4.

I’m fairly certain there’s a variety of websites that provides you with a listing of the most important hedge fund accommodations like this Yahoo Finance watchlist, however lots of the very best concepts are discovered by simply scanning 13Fs and searching for the identical smaller names. Repeat offenders are names from the Liberty household, that are constantly hedge fund accommodations.

Anyhow, on occasion one in all these will crater 10+% in at some point, maybe over a couple of days. You’ll must be checking for information or filings on a inventory and guarantee nothing has modified. It’s at all times good to do a cashtag search on Twitter as effectively, as sure individuals on Fintwit are so ingrained in sure shares that they’ll virtually let you know the information earlier than it hits the tape.

Upon getting the all-clear that the present value transfer appears to be purely provide/demand pushed, and unlikely to associated to a change within the basic worth of the inventory, solely then are you able to contemplate placing on a place.

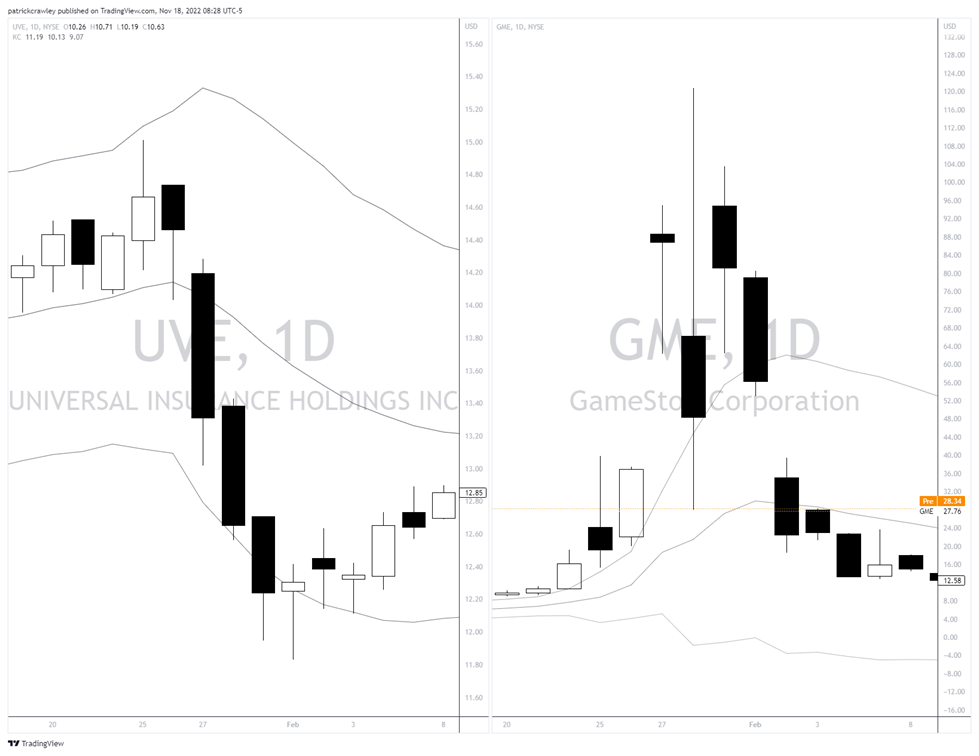

A textbook instance of this sort of catalyst occurred throughout the GameStop-driven brief squeeze mania in January 2021. For example, see the chart of Common Insurance coverage Holdings (NYSE: UVE) in comparison with the chart of GameStop (NYSE: GME) throughout its squeeze :

Remember:

-

UVE had no vital information

-

It was over-owned by hedge funds

- It was fairly thinly traded

As a result of UVE’s decline and restoration was negatively correlated with GME’s volatility, it’s probably, in hindsight, that some hedge fund that bought brief GME or one in all one other handful of names that squeezed again then wanted to lift money and bought their UVE, pushing the value down for a couple of days.

It is at all times simple in hindsight, however within the second, the image is seldom as clear as I painted the above instance. Nothing in buying and selling is.

Shopping for Pullbacks in M&A Targets

The thought of merger arbitrage is easy. An enormous firm bids $10.00/share to purchase a smaller firm, at present buying and selling at $7.00. The smaller firm’s share value shoots as much as, say, $9.80 because the information comes out.

Merger arbitrage merchants or ‘arbs’ will then purchase the goal’s inventory for the ~2% low cost to the deal value and brief the acquirer’s inventory towards it. They lock in a fairly good annualized revenue ought to the deal undergo with no hitch.

Some variation of this state of affairs repeats itself throughout a number of offers.

That’s high-quality, however beneath regular circumstances, merger arb is a yield supplier, nothing too thrilling for short-term merchants, particularly these seeking to construct a small account.

Typically, although, the market doesn’t like a deal. Possibly the acquirer has a nasty status, or maybe regulators are making noise and the value of the goal firm suffers consequently. These are the conditions that may curiosity a short-term dealer.

And the gold normal of this sort of commerce simply occurred again in October, the Elon Musk and Twitter (previously NYSE: TWTR) deal.

One have a look at the value chart of Twitter is all you should inform that this was a scenario with fats margins for merchants if it went by way of:

As you possibly can see, the market didn’t like this deal. Elon Musk wished out of the deal from fairly early on and was doing his finest to kill the deal. And whereas some evaluation and handicapping have been required, if you happen to ask M&A analysts, the eventual final result was clear as day fairly early on.

However even if you happen to knew nothing concerning the deal, that is the kind of scenario the place implied volatility is usually fairly low, as there’s a tighter vary of costs because of the deal overhang. This might mean you can outright purchase calls fairly cheaply.

Within the case of Twitter, for instance, again in July 2022, the January 2023 $52.50 calls have been buying and selling for $0.40, which have been price $1.70 on the conclusion of the deal, in line with Chris DeMuth.

Primarily, the market was providing you with higher than 4-to-1 odds that the deal would shut inside six months.

It’s necessary to notice that the Twitter deal was a house run for M&A merchants. Offers prefer it don’t come by on a regular basis, however there are offers with vital regulatory or shareholder approval hurdles that may generally, momentarily, give you very favorable bets to easily purchase choices with out fussing with extra advanced commerce buildings.

Abstract

This text outlines three potential edges for small account merchants to analysis and undertake facets of:

-

Exploiting Publish-Earnings Announcement Drift (PEAD)

-

Shopping for beat-up hedge fund resort shares

- Shopping for pullbacks in deal targets beneath stress

The primary technique is repeatable, and gives loads of alternatives every earnings season. The second and third methods are much less constant and alternatives come up in clusters.

For that reason, it’s at all times good to have a mixture of completely different methods to implement, because the alternatives supplied by methods varies with time. Focusing an excessive amount of power on one would possibly depart you with a technique that isn’t bearing any fruit.