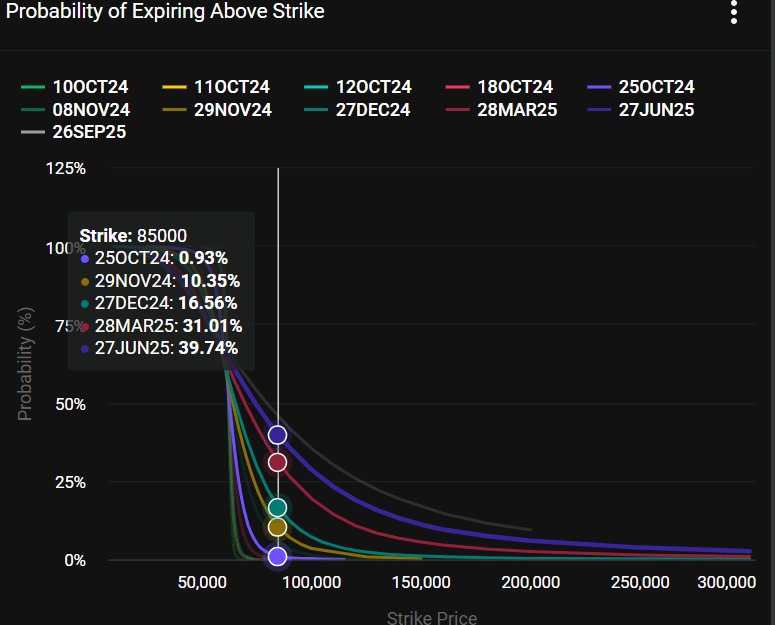

- Choices information projected solely a 16% likelihood of BTC hitting $85K by year-end.

- There was weak market demand and comparatively little community progress.

Regardless of the excessive expectations of a bullish This autumn and end-2024 rally for Bitcoin [BTC], the choices market remained eerily cautious.

Based on Bitwise’s head of alpha methods, Jeff Park, choices markets have been pricing solely a ten% likelihood of BTC hitting $85K by the top of the yr.

“Deribit 12/27 contracts now pricing in only ~10% chance that BTC will hit $85k by year-end (using 20x levered 5k CS pricing), while 7d VRP turned negative yesterday”

At press time, the chances of BTC hitting $85K by December 2024 have been about 16% per Deribit information.

Constructive catalysts for BTC

Nevertheless, Park additionally famous that the choices market outlook may get the goal unsuitable.

He discovered that the 7-day VRP (Volatility Threat Premium), which captures the volatility distinction between the precise (spot) and choices markets, turned unfavourable. This meant that spot market volatility was decrease than choices predicted.

Right here, the identical could possibly be stated for the year-end BTC value prediction from the choices markets. It may overstate or underplay BTC’s outlook.

Park added that the upcoming FTX repayments and ongoing world easing cycle have been optimistic catalysts for BTC.

A number of corporations and analysts have projected BTC value targets by the top of 2024. Bernstein projected $90K by 2024 and $200K by 2025.

Based on Commonplace Chartered Financial institution, the asset may hit $150K by year-end and surge to $250K by 2025.

Nevertheless, some market pundits imagine that the geopolitical tensions within the Center East and U.S. election outcomes could possibly be essential components for BTC within the brief time period.

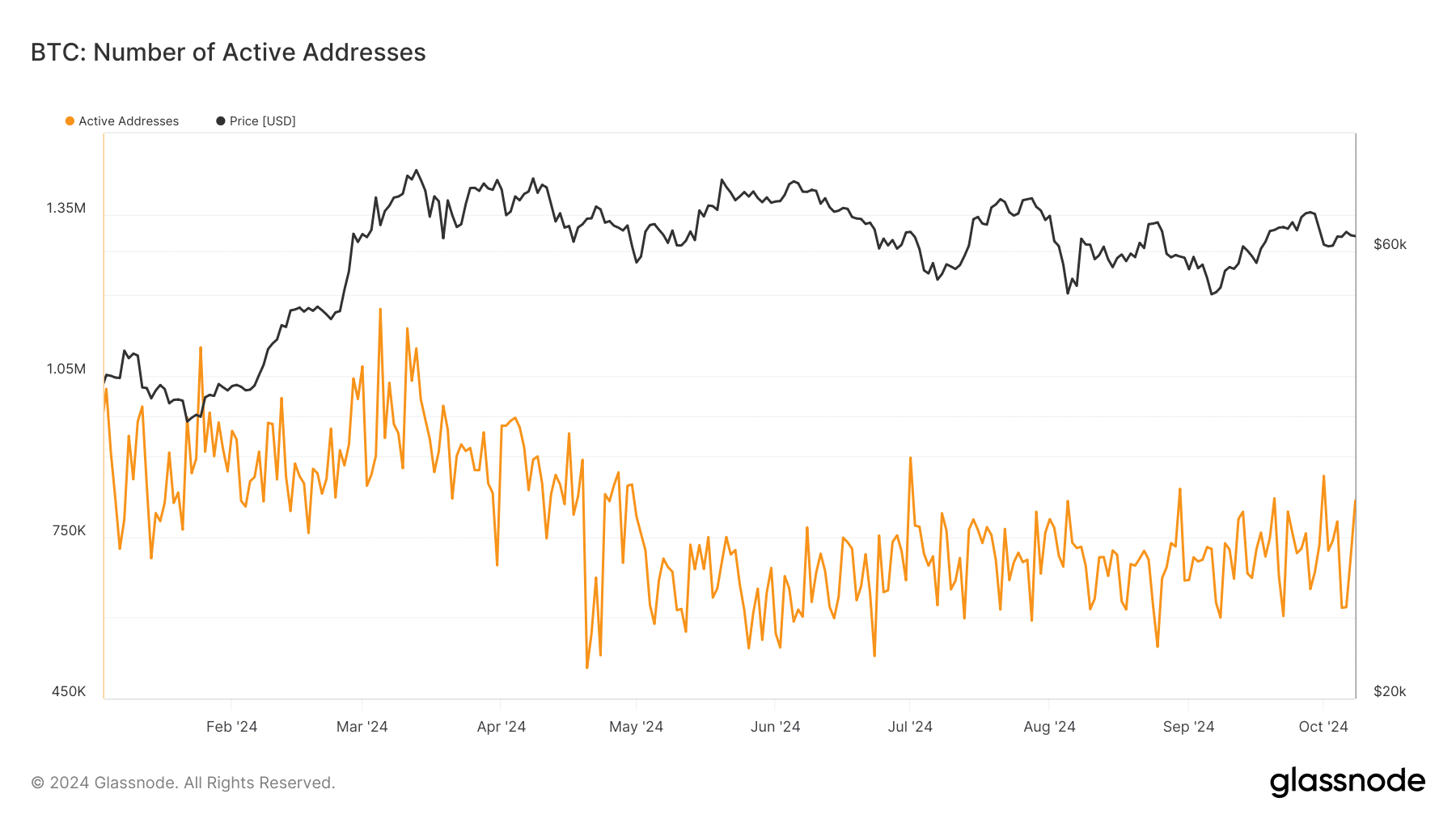

Community progress and demand

In the meantime, based mostly on lively addresses, BTC community progress has been oscillating round 750K since late September.

Nevertheless, it remained beneath 1 million, a degree it surpassed when BTC rallied to a brand new ATH in Q1 2024. This recommended much less market curiosity within the asset in This autumn than in Q1.

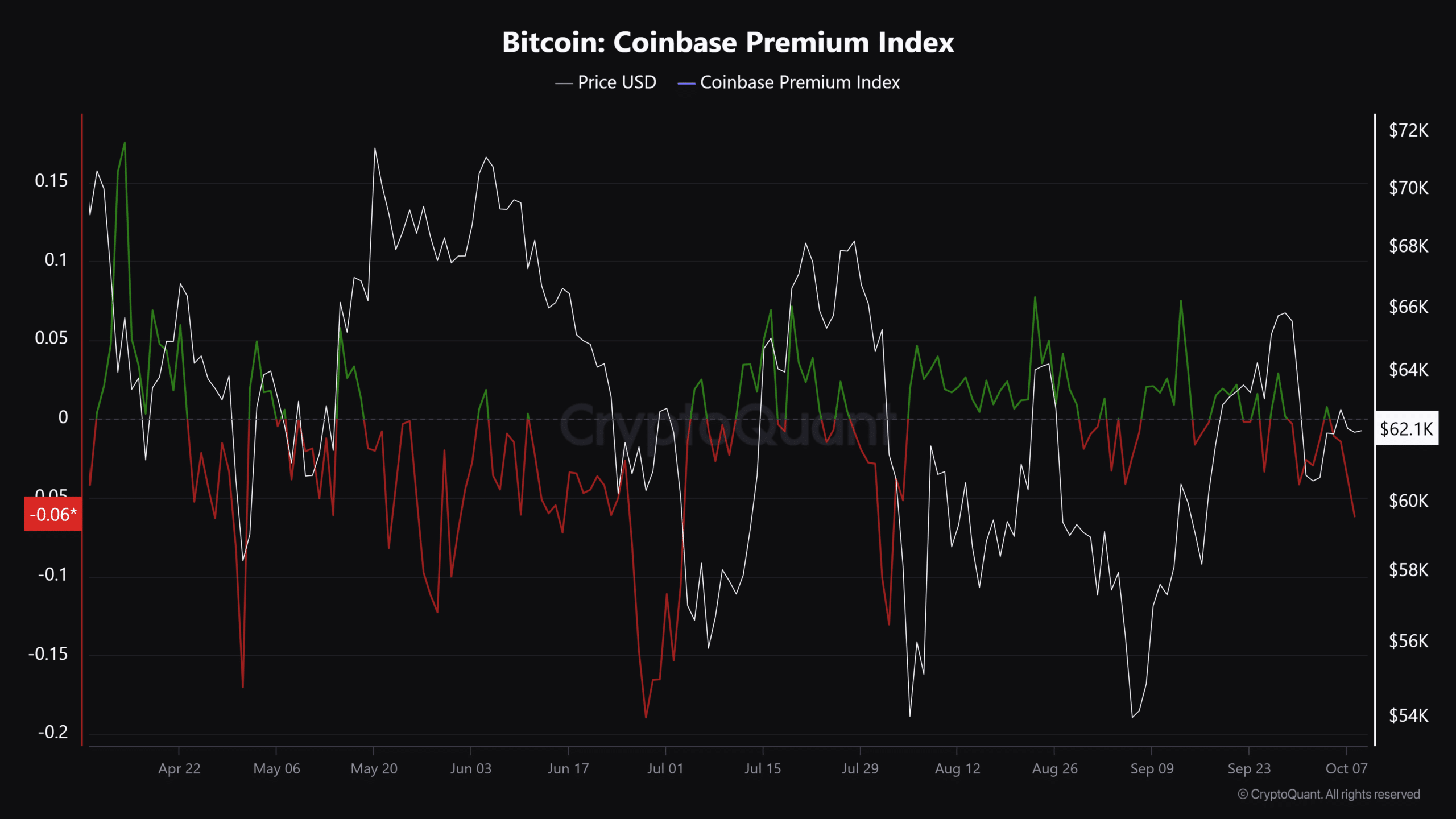

The short-term weak demand in October, particularly from U.S. traders, additionally concurred with the above commentary.

The Coinbase Premium Index, which gauges U.S. traders’ demand, has been pink for the previous few days.

Nevertheless, the short-term holder price foundation level of round $63K was essential assist that would decide whether or not BTC will face a restoration within the brief time period.