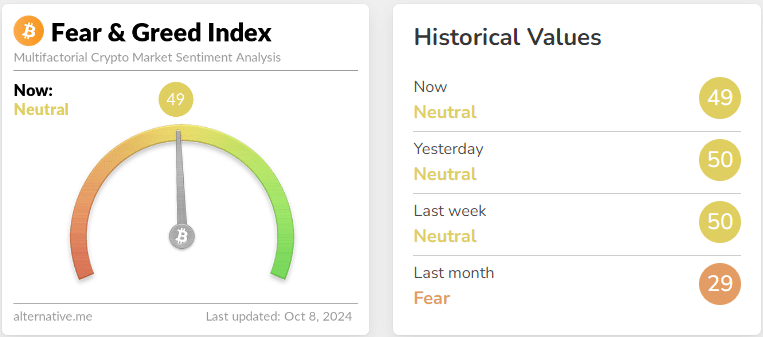

- The crypto Concern and Greed Index was not overextended in both route.

- The Tether Dominance chart has been trending increased since April — bulls would need this to vary.

The crypto Concern and Greed Index confirmed that market sentiment was impartial at press time, which was an enchancment from early September’s fearful outlook.

The current correction from $66.5k to $60k has not damage the market members too badly.

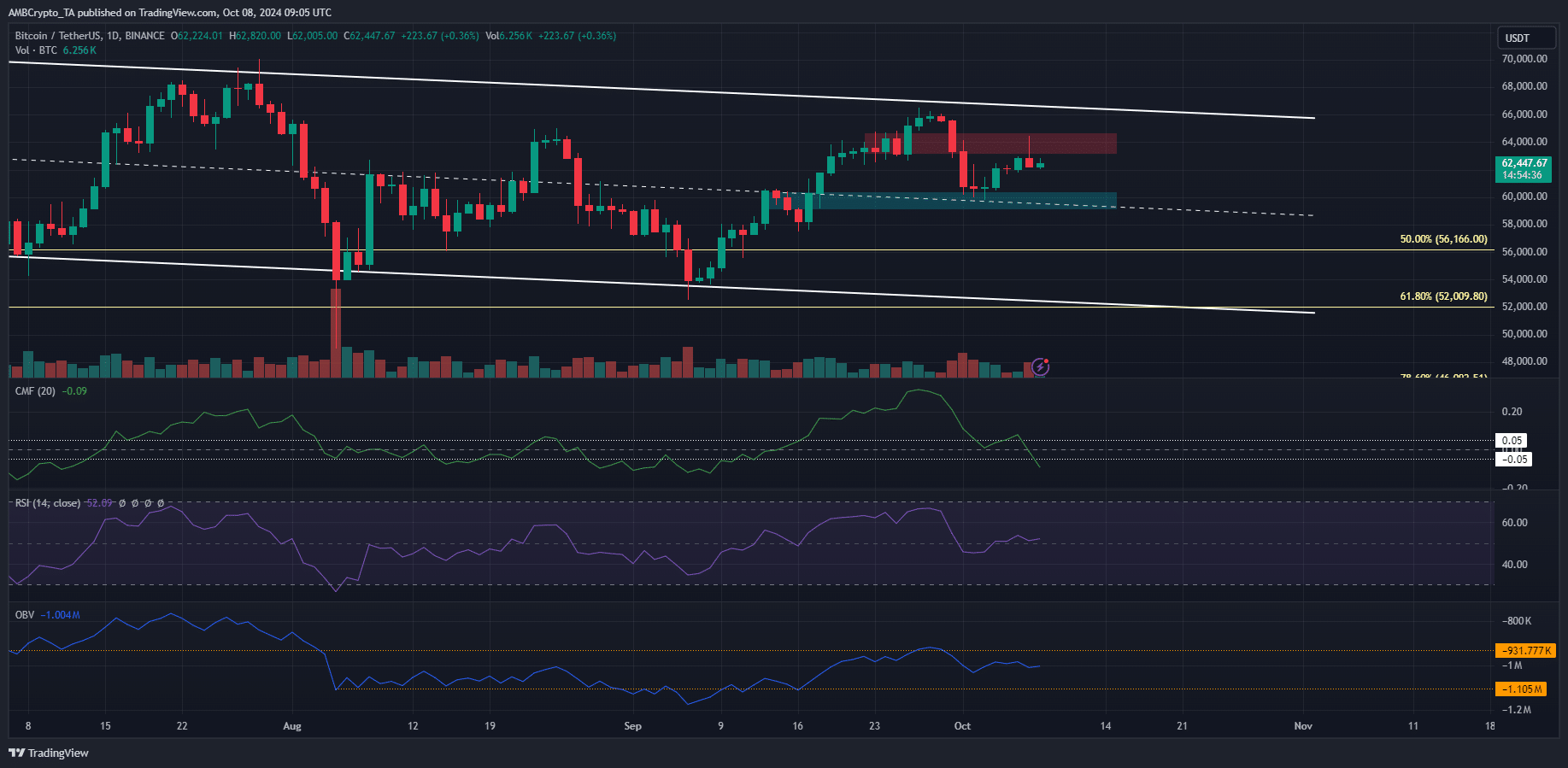

A current AMBCrypto report outlined the liquidation pockets across the worth that might function potential magnet zones. The $66.2k zone remains to be a resistance and a revisit to this space might rebuff the bulls.

However, a large bullish transfer was attainable, primarily based on historic traits.

The place is the crypto market sentiment at

Supply: Various.me

The useful Bitcoin Concern and Greed Index chart confirmed that sentiment was impartial. This was comprehensible given the worth motion of the previous two weeks.

The descending channel (white) noticed its mid-point damaged on the 18th of September. A rally almost reached the channel highs however was rejected. Since then the $64k zone has been flipped to resistance.

The CMF was at -0.09 to point out vital capital circulate out of the market and agency promoting strain. The OBV additionally indicated regular promoting prior to now two weeks, however it has recovered barely.

The RSI espoused a impartial outlook with its studying of 52.

A drop to the $58k-$60k would current a shopping for alternative. A surge past $66k-$67k and a retest of the identical stage as assist would even be an opportunity to go lengthy. The latter situation is prone to shift market sentiment in the direction of greed.

Findings from the Tether chart for BTC traits

The Tether [USDT] dominance pattern is inversely associated to the crypto market. An uptrend on this metric usually means the market is trending downward, and buyers are transferring to stablecoins.

The 5.79% stage is a resistance stage and USDT.D might transfer additional downward within the coming days. A brief-term Bitcoin rally is feasible.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Nevertheless, the metric has trended upward since March, as captured by the ascending trendline.

Till it’s damaged, buyers and swing merchants throughout the crypto market must be conservative with their bullish targets.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion