- Bitcoin’s $66,200 liquidation degree might set off a $10 billion quick squeeze.

- Additional liquidations at $70,300 and $72,578 might speed up Bitcoin’s upward trajectory.

Bitcoin [BTC] is approaching key liquidation ranges that would set off a sudden quick squeeze and forcibly propel the worth upwards.

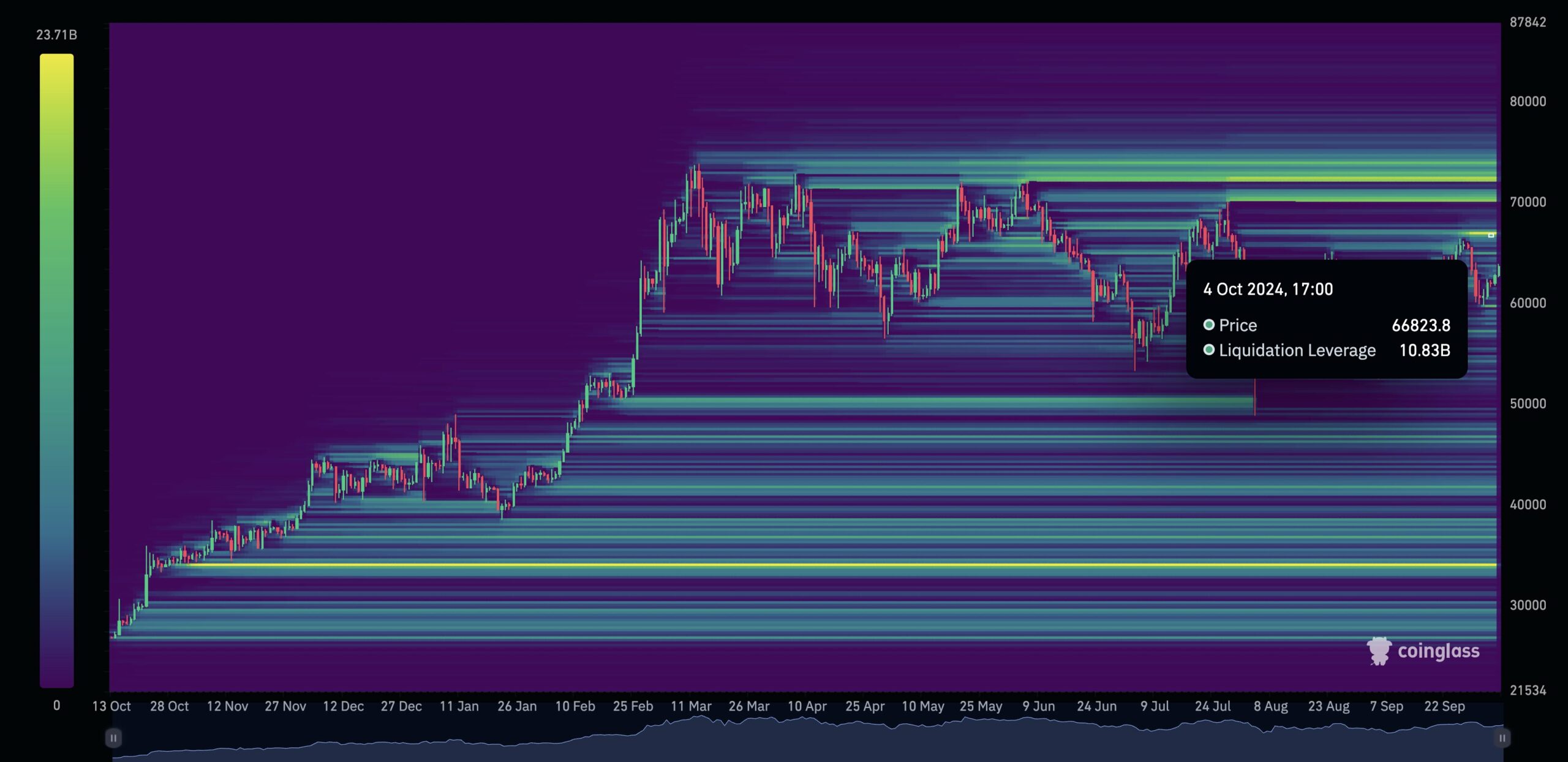

In line with a tweet from a famend analyst, $10 billion price of quick positions is in danger on the $66k degree. Reaching this degree would set a sequence response in place.

Liquidation ranges of $70,300 and $72,578 might also speed up the upward strain, making a powerful case for Bitcoin within the following days.

A brief squeeze could possibly be triggered at $66,200

On the $66,200 degree, $10 billion in brief positions are set to be liquidated, which can successfully convert into spot buys.

This shift might set off a brief squeeze, forcing the market individuals to cowl their positions, therefore rising shopping for strain on Bitcoin.

Such an occasion usually pushes costs increased, making this degree a vital threshold for Bitcoin’s near-term future.

Bitcoin subsequent worth surge might occur at $70,300

If Bitcoin have been to interrupt above the $66,200 degree, the following key degree that will likely be important can be across the $70,300 mark, which can see $16 billion liquidated in brief positions.

That, once more, can be one other wave of liquidations and sure intensify the upward transfer additional into new territory.

These liquidations are likely to have a cascading impact, amplifying the worth motion and flipping bearish positions into compelled buybacks.

Bitcoin ultimate surge

The final important liquidation zone lies at $72,578, with $18 billion in brief positions in liquidation danger.

If Bitcoin reaches that worth, then a 3rd wave of buy-side strain will likely be triggered to additional push the worth upwards.

The market will likely be very risky, and this zone is likely to be the place to begin for a giant rally.

BTC paints a bullish image

For the reason that seventh of September, Bitcoin’s Open Curiosity has been on the rise, an indication of accelerating dealer participation in leveraged positions.

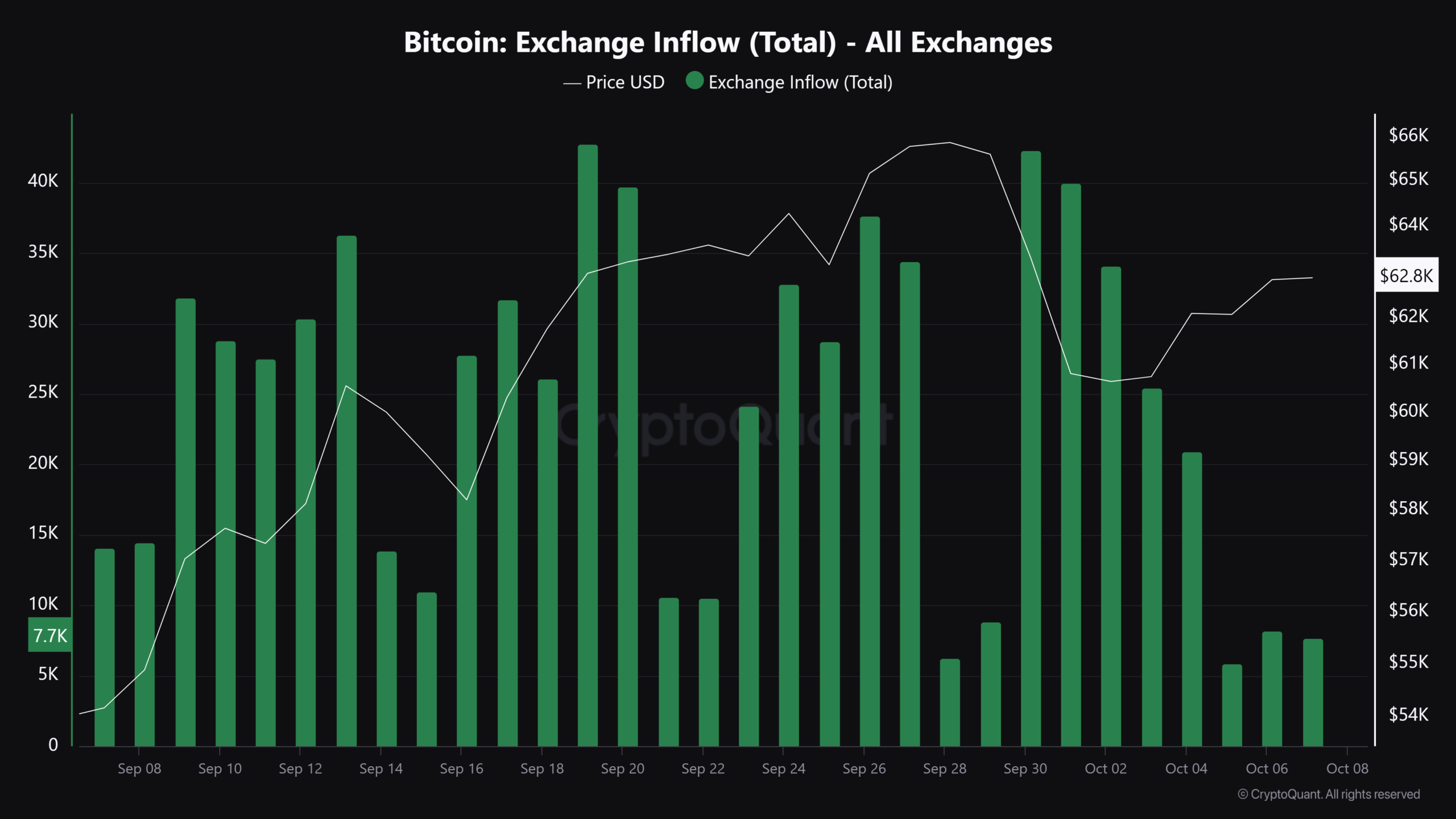

Within the meantime, Bitcoin’s trade inflows witnessed periodic fluctuating spikes within the final one month. At present, the influx is gaining momentum from the current dip.

This is a sign of elevated exercise and curiosity in Bitcoin buying and selling as buyers place themselves for any potential worth actions.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

The market is now on excessive alert with the best way Bitcoin approaches these key liquidation zones.

Such a brief squeeze can propel costs sharply increased, particularly if the anticipated cascading liquidations do find yourself materializing.