Based on information from CoinMarketCap, the worth of Ethereum slipped by 10.23% during the last seven days in keeping with the overall market unfavorable motion. This crypto market downturn has been attributed to a number of components together with heightened geopolitical tensions within the Center East and rising liquidations of lengthy positions.

Whereas Ethereum has skilled some rebound within the final day gaining by 3.21%, traders stay unsure of a full value restoration with bearish sentiments raving by the market. Notably, an Ethereum ICO participant has now bought off a considerable quantity of ETH intensifying issues of a chronic downward development.

Ethereum ICO Pockets Continues Promoting Spree, Offloads 40,000 ETH In Two Weeks

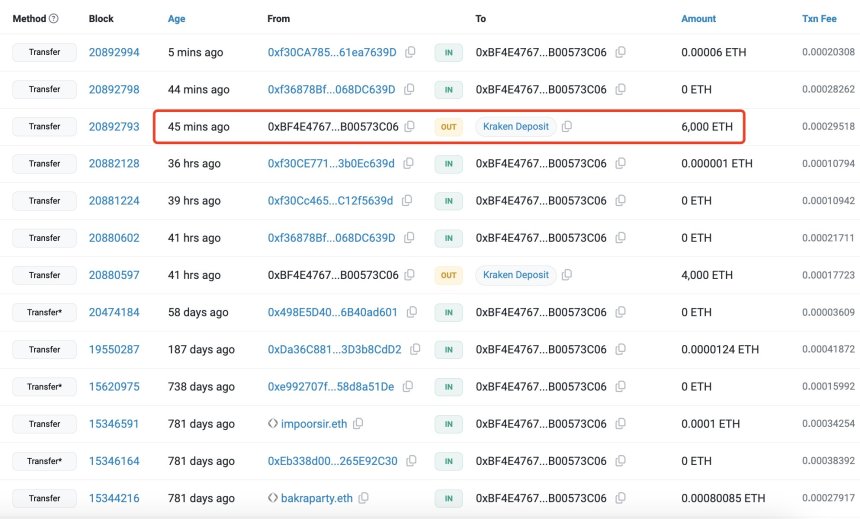

Based on information from blockchain analytics agency, Lookonchain, an Ethereum pockets with the deal with “0xBF4” moved 6,000 ETH value $14.11 million to the Kraken alternate on Friday. Thus far, the deal with has been recognized as an early Ethereum investor who acquired 150,000 ETH valued at $368 million within the asset’s preliminary coin providing (ICO) in 2014.

Information from Lookonchain highlights that is the second ETH sale by “0xBF4” within the final week after the ICO participant initially bought 19,000 ETH, valued at $47.54 million over Wednesday and Thursday. Notably, this ETH whale has transferred out 40,000 ETH value $101 million since September 22, holding a stability of 99,500 ETH valued at $238 million.

Usually, large token offloads by giant holders e.g. whales are interpreted as bearish alerts as they point out a insecurity within the asset’s long-term profitability. Gross sales similar to these seen from “0xBF4” might set off a panic promoting from smaller traders inducing a stronger downward strain on Ethereum’s value.

Associated Studying: Crypto Capo Returns After 2 Months To Predict Ethereum Decline To $1,800, Is It Time To Go Lengthy?

108,000 ETH Moved To Exchanges In 24 Hours

Apart from the pockets deal with “0xBF4”, different traders have not too long ago bought off giant quantities of ETH. Based on analyst Ali Martinez, 108,000 ETH valued at $259.2 million have been transferred to exchanges within the final day. This large sale exercise signifies a heightened sentiment within the ETH market.

Presently, Ethereum trades at $2,399 following its latest value rally. Nonetheless, its every day buying and selling quantity has declined by 17.48% and is valued at $14.61 billion. If bearish sentiments persist, ETH may retrace to round $2,200 at which lies its subsequent vital value stage. Nonetheless, amidst large promoting strain, the altcoin may commerce as little as $1,600.

With a market cap of $291.40 billion, Ethereum continues to rank because the second largest cryptocurrency, with a market dominance of 13.47%.

Featured picture from NullTX, chart from Tradingview