- BTC’s lengthy/quick ratio dropped, hinting at a worth correction.

- Technical indicators continued to stay bullish.

Bitcoin [BTC] efficiently crawled above $66k a number of days again, sparking pleasure locally. However the development didn’t final because it once more fell beneath that mark. In actual fact, the most recent knowledge prompt that this simply is likely to be the start of a significant worth correction.

Bitcoin has hazard going ahead

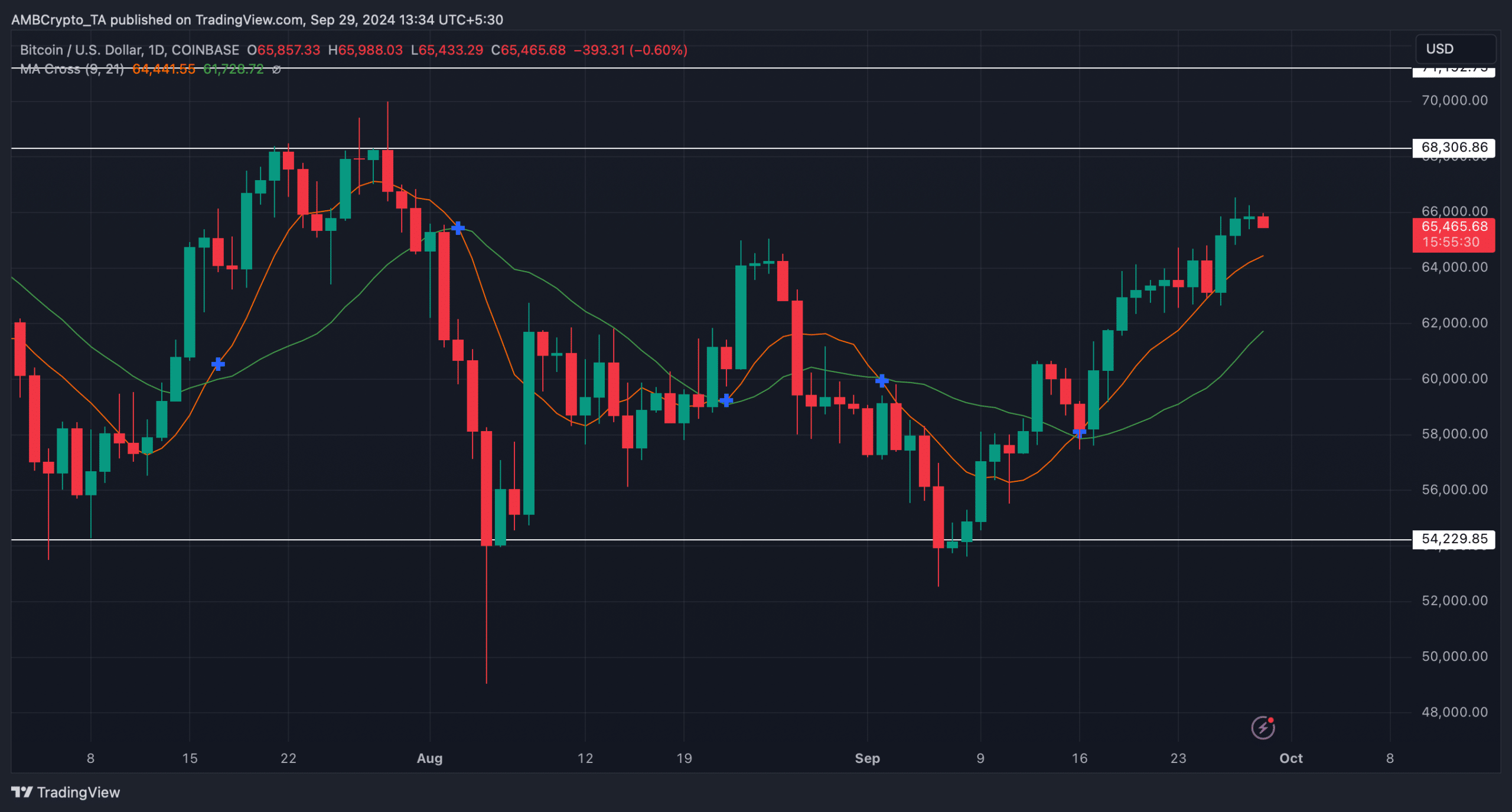

Bitcoin witnessed a worth correction within the final 24 hours, pushing it underneath $66k. To be exact, on the time of writing, BTC was buying and selling at $65,504.34. In actual fact, AMBCrypto reported earlier that there have been possibilities of BTC falling sufferer to a worth correction.

Within the meantime, Crypto Bullet, a preferred crypto analyst, lately posted a tweet revealing a bearish divergence on BTC’s 4-hour chart.

Each time such a divergence seems, it means that the possibilities of a worth correction are excessive. The tweet talked about that in case of the bearish development reversal, then its traders would possibly as properly witness BTC as soon as once more dropping to $60k.

What metrics recommend

AMBCrypto then checked the king coin’s on-chain knowledge to seek out out whether or not additionally they indicated a worth correction.

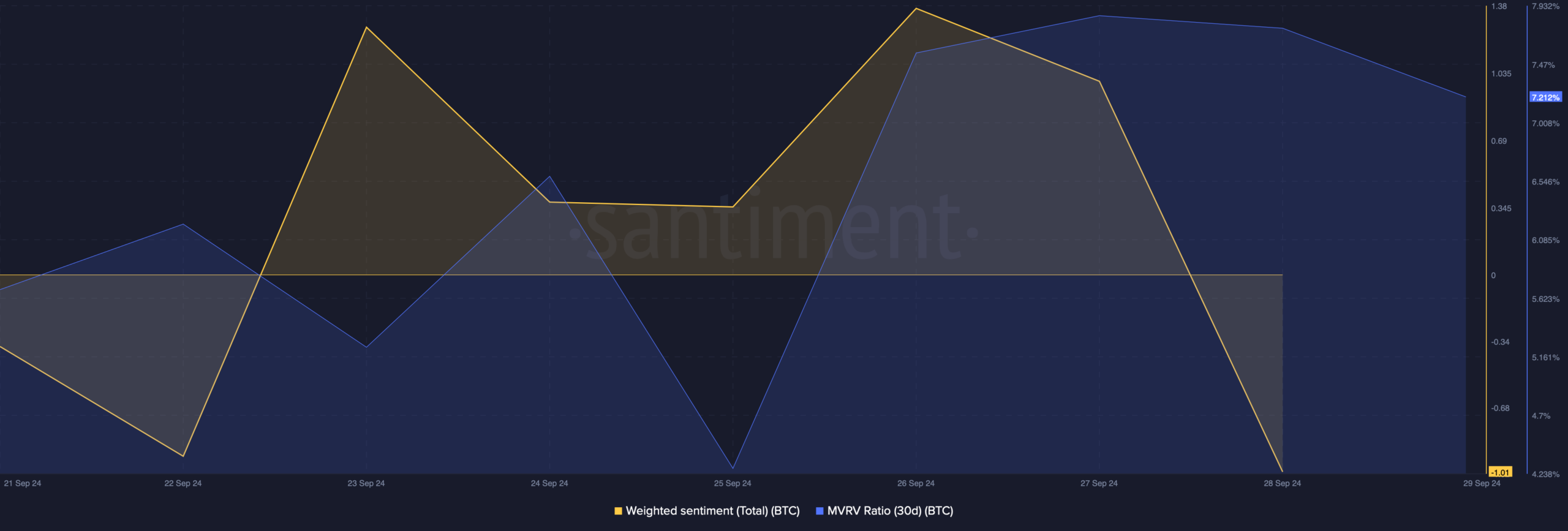

As per our evaluation of Santiment’s knowledge, it revealed that after a spike, BTC’s MVRV ratio dropped barely in the previous couple of days, which could be inferred as a bearish sign.

Market sentiment across the coin additionally turned bearish, which was evident from the drop in its weighted sentiment.

Other than that, AMBCrypto’s have a look at Coinglass’ knowledge additionally revealed a bearish sign. We discovered that Bitcoin’s lengthy/quick ratio dipped. A drop within the metric signifies that there are extra quick positions available in the market than lengthy positions.

This may be thought of a bearish sign because it hints at an increase in bearish sentiment.

Nonetheless, not every little thing was within the bears’ favor. As an illustration, the concern and greed index had a price of 38% at press time. This meant that the market was in a “fear” part.

Each time that occurs, it suggests that there’s a risk of a worth enhance. If that seems to be true, then BTC won’t as properly drop to $60k once more within the close to time period. Due to this fact, we checked the coin’s each day chart.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

As per our evaluation, the 9-day MA was nonetheless properly above the 21-day MA, signaling a bullish benefit available in the market. If the bull rally begins once more, then BTC would possibly first goal $68k.

If the aforementioned evaluation is true, then BTC would possibly fall to $60k once more.