- BTC retested $66k following better-than-expected August inflation knowledge

- U.S labor market replace might set the subsequent market course

Bitcoin [BTC] edged greater and retested $66k on Friday following a softer studying from the U.S Fed’s favourite inflation knowledge – The Core PCE Index (Private Consumption Expenditure). This index tracks U.S inflation with out the noise from meals and power value fluctuations.

The August Core PCE index studying got here in higher than anticipated, with a YoY (year-on-year) hike of two.6%. This was opposite to market expectations of two.7%.

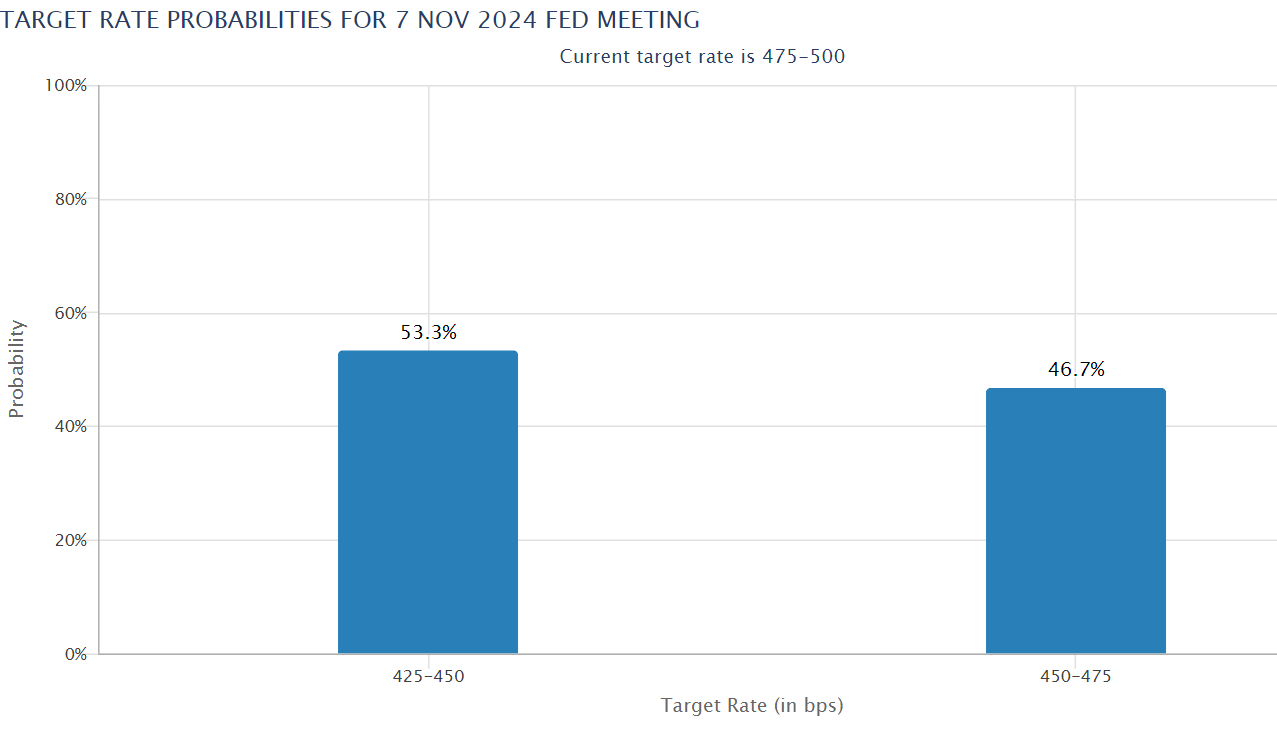

The low inflation knowledge boosted the markets as speculators priced greater odds of one other 50 bps (foundation factors) Fed price reduce in November.

Subsequent market catalyst

The low inflation knowledge meant that the Fed would now concentrate on the U.S labor market’s standing, particularly the unemployment price, when adjusting its tempo of rate of interest cuts accordingly.

Ergo, upcoming U.S labor sector updates will affect the subsequent market course, famous buying and selling agency QCP Capital.

A part of the agency’s weekend temporary on 28 September learn,

“As we head into next week, the key focus will be on upcoming labour market indicators, including JOLTs, ADP, and U.S unemployment rate.”

The important thing updates to be careful for are the JOLTs (Job Openings and Labor Turnover Survey) and employment state of affairs scheduled for 1 and 4 November. Projecting the updates’ potential market affect, QCP Capital added,

“Strong performance in these metrics could bolster the case for a 50bps cut in November, further propelling risk assets.”

If that’s the case, BTC might edge even greater in direction of $70k after the current bullish market construction shift. Particularly after it reclaims the 200-day MA (Shifting Common).

The lift-off might additionally profit Ethereum [ETH]. In truth, ETH has been outperforming BTC for the reason that Fed’s pivot.

So, an additional macro tailwind might prolong ETH’s exceptional restoration on the charts. In truth, in response to market analyst Benjamin Cowen, ETH might hike to the psychological stage of $3000 too.

That being stated, the highest digital property noticed renewed demand from U.S buyers. This week, U.S BTC ETFs noticed $1.11 billion inflows, the most important weekly inflows since 19 July.

The same, however restricted investor urge for food was additionally noticed in ETH ETFs. The merchandise attracted $84.6 million inflows, the most important weekly demand since 9 August. If the pattern continues, the $3k per ETH and $70k per BTC value targets may very well be possible.