- Bitcoin see spikes in slippage as merchants suggested to take warning.

- Bitcoin concentrated liquidation ranges are close to $60K.

Bitcoin [BTC] continues to point out robust momentum, with its worth buying and selling above $63k as of at present. The present market information means that BTC has the potential to maneuver even increased.

Nonetheless, market volatility might enhance resulting from latest spikes in slippage, which might result in short-term reversals. A major stage to look at if Bitcoins stays above it’s $62,500.

If BTC strikes under this stage, a cascade of liquidations might push costs decrease. Regardless of these dangers, Bitcoin’s general upward development stays intact, with potential assist close to the $60k worth zone.

Bitcoin liquidation updates

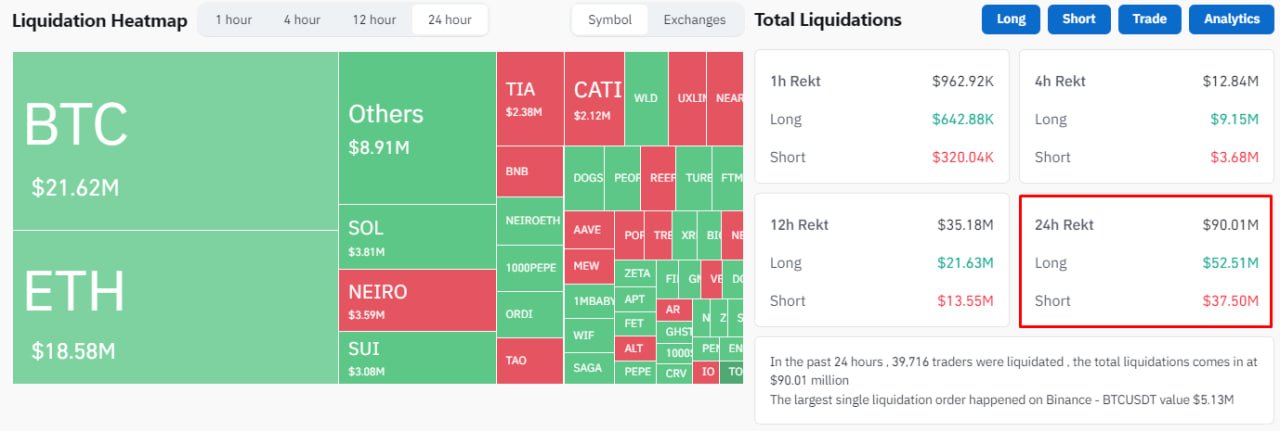

Liquidations proceed to play a vital function in BTC’s worth actions. Within the final 24 hours, Bitcoin skilled a complete of $23.29 million in liquidations, with $16.42 million in longs and $6.87 million in shorts.

The broader crypto market noticed 39,721 merchants liquidated, with complete liquidations reaching $90.03 million. The most important single liquidation order occurred on the Binance alternate for the BTC/USDT pair, valued at $5.13 million.

These liquidations can usually point out potential reversal zones available in the market, offering insights into the place the value may head subsequent.

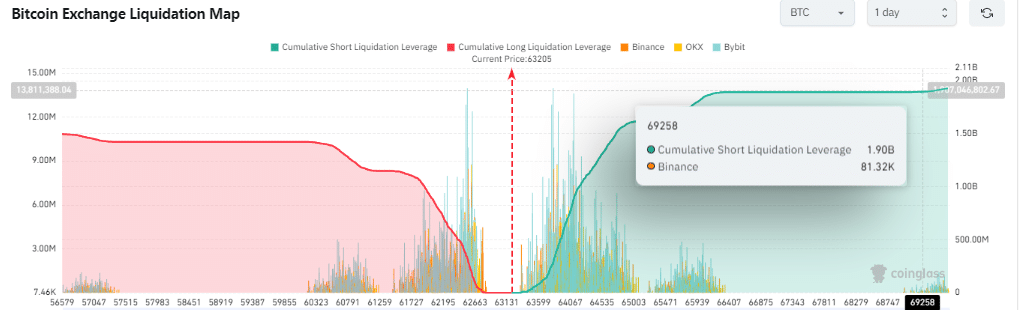

Wanting ahead, if Bitcoin rallies to $69k, an extra $1.9 billion is about to be liquidated, affecting 81,320 trades. The worth is anticipated to achieve for this liquidity stage, although a short-term correction might happen earlier than BTC climbs towards $69k.

Supply: Coinglass

Merchants on social platforms are additionally suggested to take warning, suggesting threat administration of quick liquidations accordingly because the regains market volatility. DeFi Mann publish on X, previously Twitter, learn:

If you have your quick liquidation at 70k handle your threat In any other case the market will handle it for you inside the subsequent 2 weeks

Liquidation ranges focus

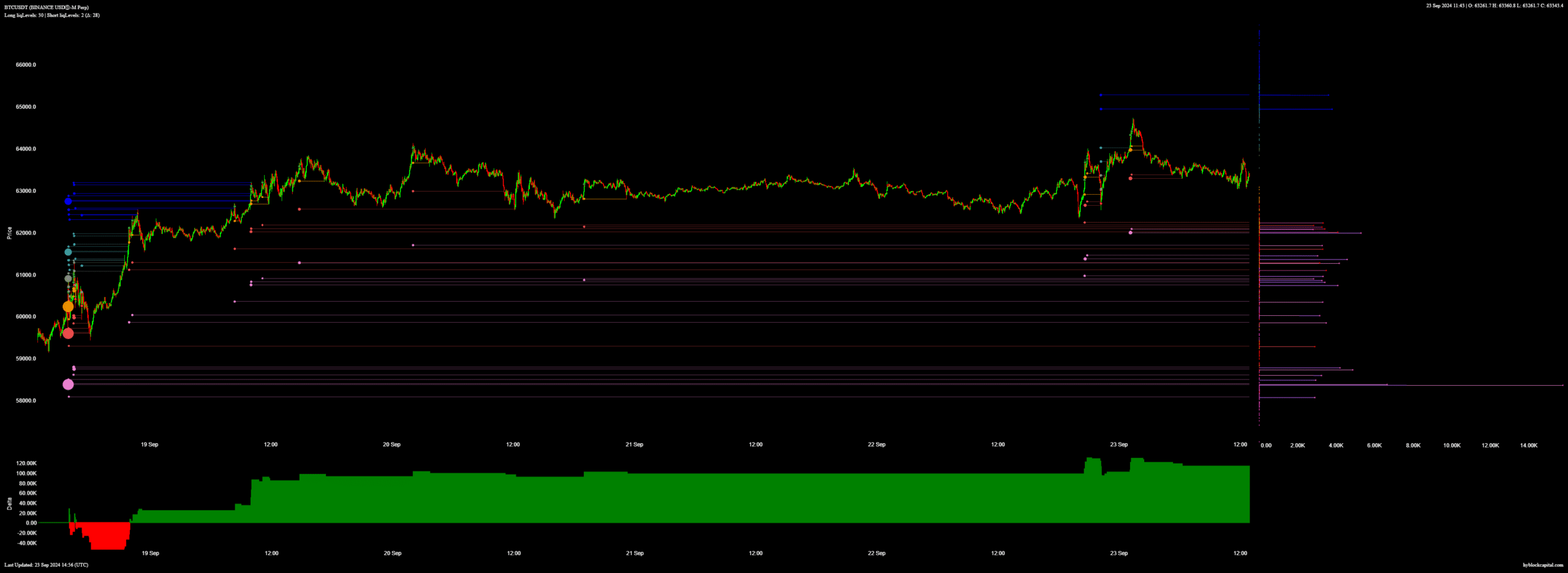

Lastly, for liquidation maps which present the place massive quantities of merchants’ positions could also be liquidated, have highlighted Bitcoin’s key areas of potential volatility.

The very best concentrations of liquidation ranges for Bitcoin are close to $62,500 and $60,000. If costs dip under these ranges, it might set off additional liquidations, resulting in elevated volatility and downward stress.

Learn Bitcoin (BTC) Worth Prediction 2024-25

Supply: Hyblock Capital

Bitcoin stays in a robust place, with the potential to maneuver increased. Nonetheless, merchants must be conscious of the potential for elevated volatility and liquidations, notably if BTC drops under essential ranges like $62,500.

If market circumstances stay favorable, BTC might proceed its upward development, focusing on increased worth ranges within the close to future.