- ETH reclaimed $2500 after final week’s Fed pivot and boosted the ETH/BTC pair.

- Per Cowen, ETH/BTC might backside if the pair reclaims the 50-day MA short-term pattern.

The market has proven much less curiosity in Ethereum [ETH] regardless of the debut of US spot ETH ETF in Q3. ETH declined by 25% in Q3 and hit a document low on the ETH/BTC pair, which tracks the altcoin’s relative efficiency to Bitcoin [BTC].

However final week’s Fed pivot tipped the altcoin to reclaim $2500 after rallying for 3 consecutive days.

The upswing was additionally marked by a web influx of $8.2 million previously two buying and selling days for US spot ETH ETFs.

When will ETH/BTC backside?

Nonetheless, crypto analyst Benjamin Cowen was nonetheless cautious about ETH strengthening and an ETH/BTC backside.

Cowen acknowledged that the ETH/BTC backside might stay elusive if the pair fails to reclaim the 50-day Transferring Common (MA), citing 2016 and 2019 traits.

“After #ETH / #BTC broke down in 2016 and 2019, the bottom was in after ETH/BTC got back above its 50D SMA…So as long as ETH/BTC is < 50D SMA, it is still possible for ETH/BTC to go lower.”

However he added that the pair might get well if it bounced above the 50-day MA, which was at 0.04255.

“But once the 50D SMA is surpassed, I think it is more likely than not that the bottom would be in.”

Value motion above the 50-day MA usually indicators a bullish short-term momentum.

In the meantime, some whales had been taking earnings from current ETH worth appreciation. Per Spot On Chain, a well-known whale has offered 15K ETH price $38.4 million on Kraken. The tackle has made two different sell-offs in Q3, every resulting in ETH’s slight decline.

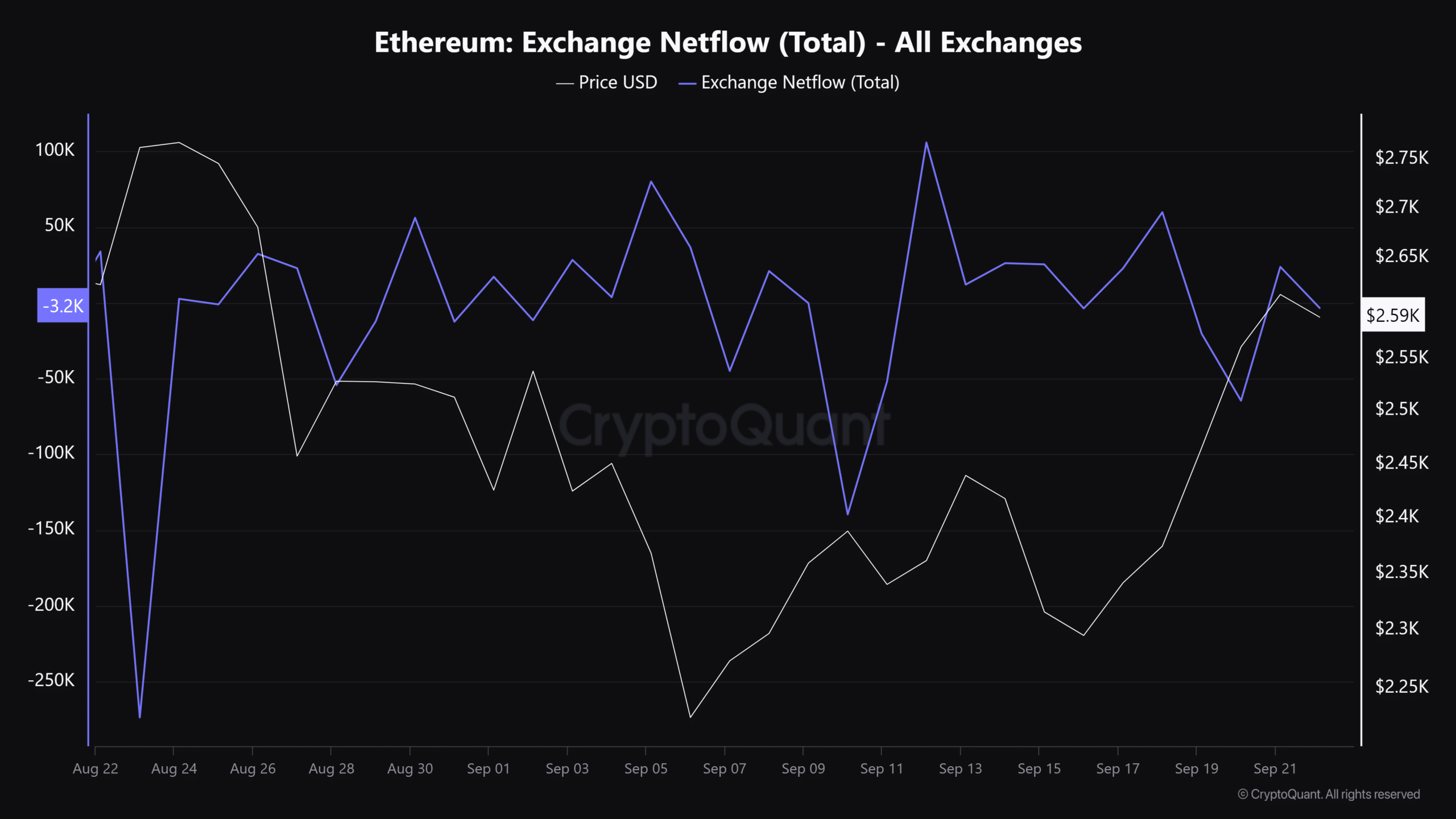

That mentioned, the general change netflow tapered off regardless of the current spike. This steered that promote strain throughout centralized exchanges has eased reasonably. Ergo, this might enable the ETH worth to proceed with the restoration.

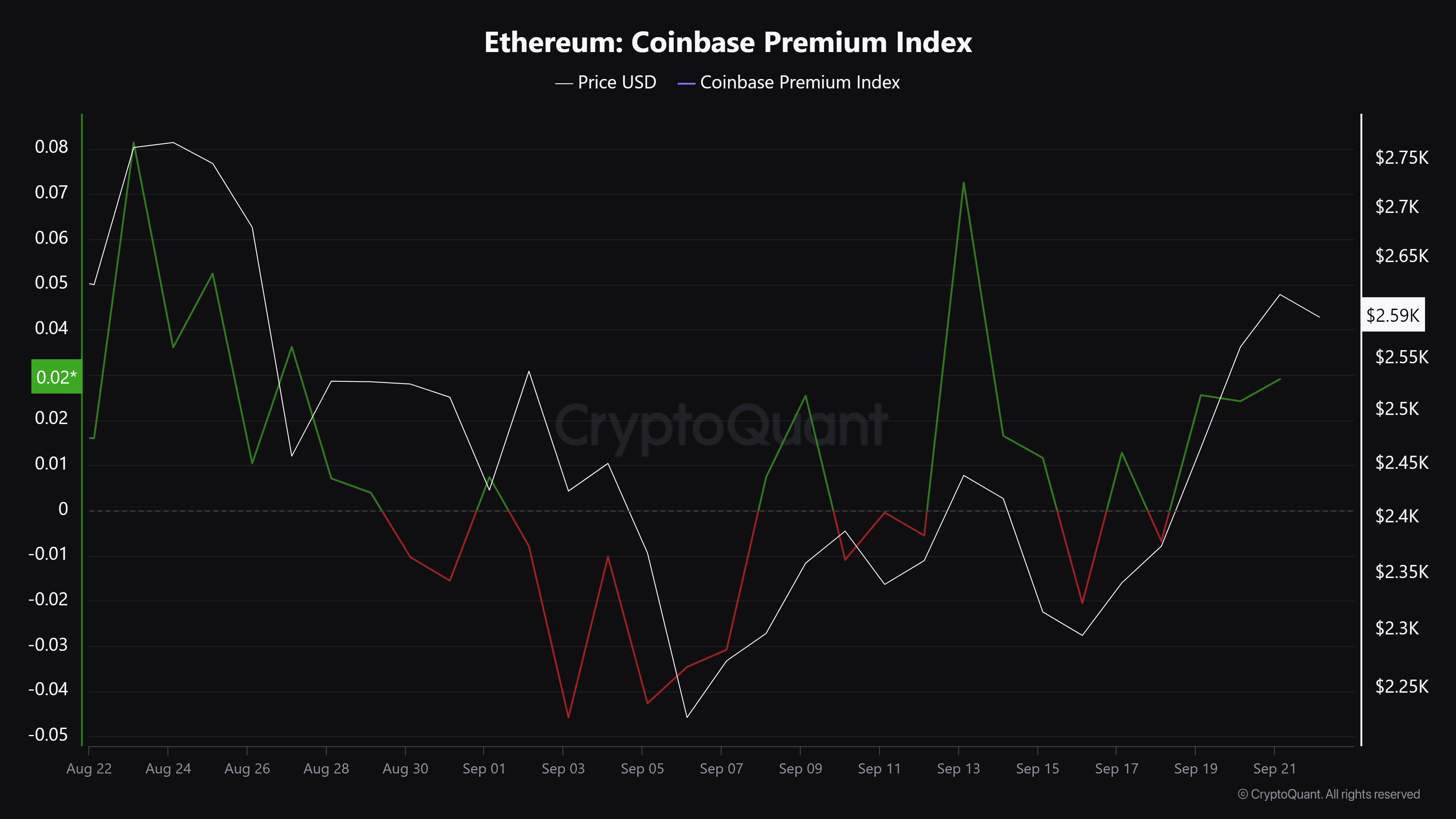

The eased promote strain coincided with elevated demand for Ethereum amongst US traders, as denoted by the Coinbase Premium Index and up to date optimistic US ETH ETF flows.

Nonetheless, it stays to be seen whether or not the ETH restoration will proceed after the euphoria linked to the Fed fee minimize subsided.