- Bitcoin lastly managed to leap above its potential market backside.

- Although shopping for stress was excessive, just a few indicators turned bearish.

After every week of value will increase, Bitcoin [BTC] has as soon as once more turned bearish within the final 24 hours. Nonetheless, this development would possibly change within the coming days as BTC was following a historic development. If historical past repeats itself, then traders would possibly quickly witness a serious value motion.

Bitcoin’s key indicator flashes

AMBCrypto reported earlier that Bitcoin managed to cross $64k just a few days in the past, however the transfer didn’t final. The king coin witnessed a virtually 2% value correction within the final 24 hours, pushing it down again to $63,117.53.

Whereas that occurred, Axel, a well-liked crypto analyst, posted a tweet revealing an fascinating growth. As per the tweet, for the previous six months, volatility has continued to compress, and an alert has appeared on the chart.

Notably, the alert appeared for the fifth time in Bitcoin’s historical past.

To be exact, such alerts emerged again in 2015, 2016, 2017, and 2023 earlier than once more showing in 2024. Traditionally, every time this alert appeared, BTC’s value registered appreciable value motion northwards.

Subsequently, if historical past repeats itself, then traders would possibly count on Bitcoin to start a contemporary bull rally within the coming days.

Is BTC prepared for a value pump?

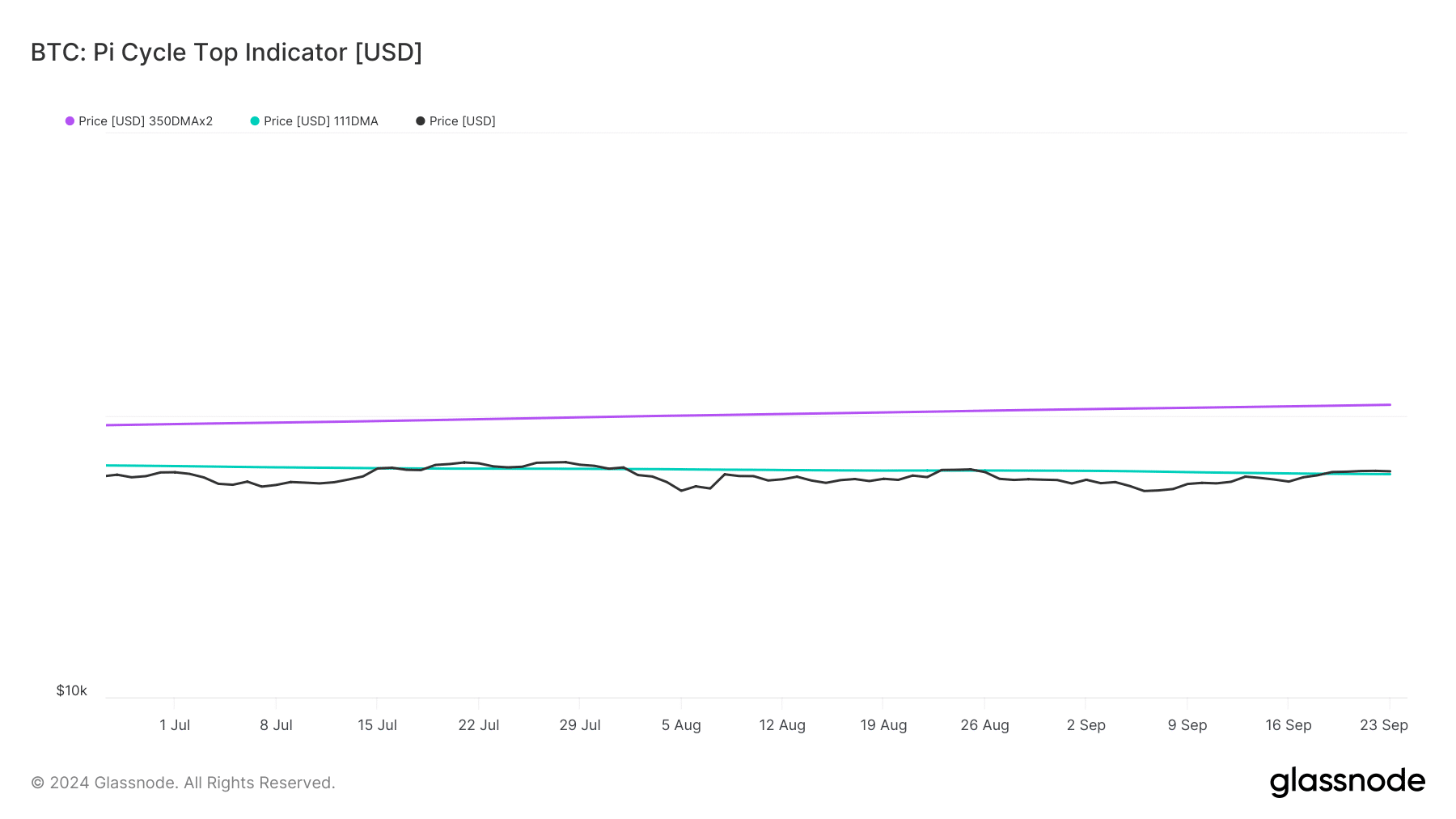

Since historical past indicated a brand new bull rally, AMBCrypto checked Bitcoin’s on-chain metrics to seek out whether or not in addition they urged a value hike. Our have a look at Glassnode’s knowledge revealed that BTC’s value simply jumped above its potential market backside of $61.8k.

If the Pi Cycle High indicator is to be believed, the upcoming bull rally would possibly as nicely push the coin in direction of its potential market high of $109k within the coming weeks or months.

Other than that, AMBCrypto additionally reported earlier that purchasing stress on the coin was excessive, which additionally hinted at a value uptick. Nonetheless, not every thing was within the king coin’s favor.

Our evaluation of CryptoQuant’s knowledge revealed that Bitcoin’s aSORP turned crimson. This clearly meant that extra traders had been promoting at a revenue. In the midst of a bull market, it may possibly point out a market high.

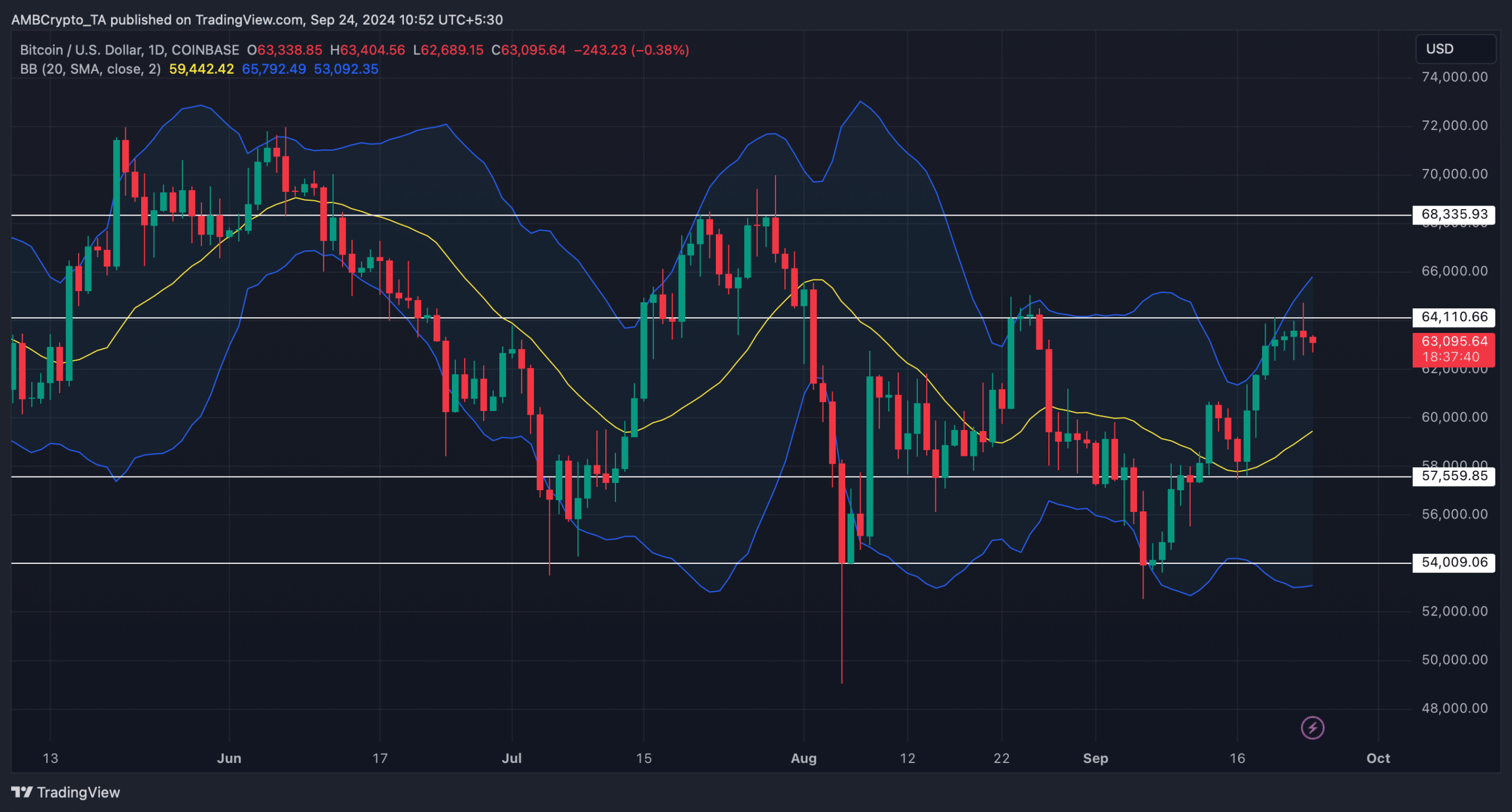

We then took a have a look at Bitcoin’s day by day chart to raised perceive the chance of a bull rally. As per our evaluation, BTC was getting rejected at its resistance of $64.1k.

Moreover, the coin’s value had additionally touched the higher restrict of the Bollinger Bands, which hinted at a value correction.

Learn Bitcoin (BTC) Worth Prediction 2024-25

If a value correction occurs, then BTC would possibly once more drop to $62k. However, in case of a bull rally, it will likely be essential for BTC to go above the $64k-$65k vary, and liquidation will rise sharply there.

Normally, a hike in liquidation ends in short-term value corrections.