- Crypto shorts suffered a large $147M loss as Bitcoin hit $63K.

- Nevertheless, its resurgence shouldn’t be off the desk.

Bitcoin [BTC] bulls have propelled a breakout, reaching $63K after weeks of consolidation, spurred by Fed price cuts.

Alongside macroeconomic components, BTC spinoff markets have confirmed a squeeze, leading to $147M in losses for crypto shorts.

As BTC approaches the $64K excessive, stakeholders should strategize to push it previous the important thing $70K resistance, because it gained’t be a straightforward job. Why? AMBCrypto investigates.

Unfolding the squeeze

Traditionally, over the previous 180 days since BTC final hit its ATH of $73K in March, bulls have examined the $71K degree 4 occasions. Every time, sturdy resistance held, stopping a brand new ATH.

In keeping with AMBCrypto, Bitcoin should maintain $64K to focus on the subsequent resistance at $68K – examined twice since June. If the bulls succeed, $71K might be inside attain.

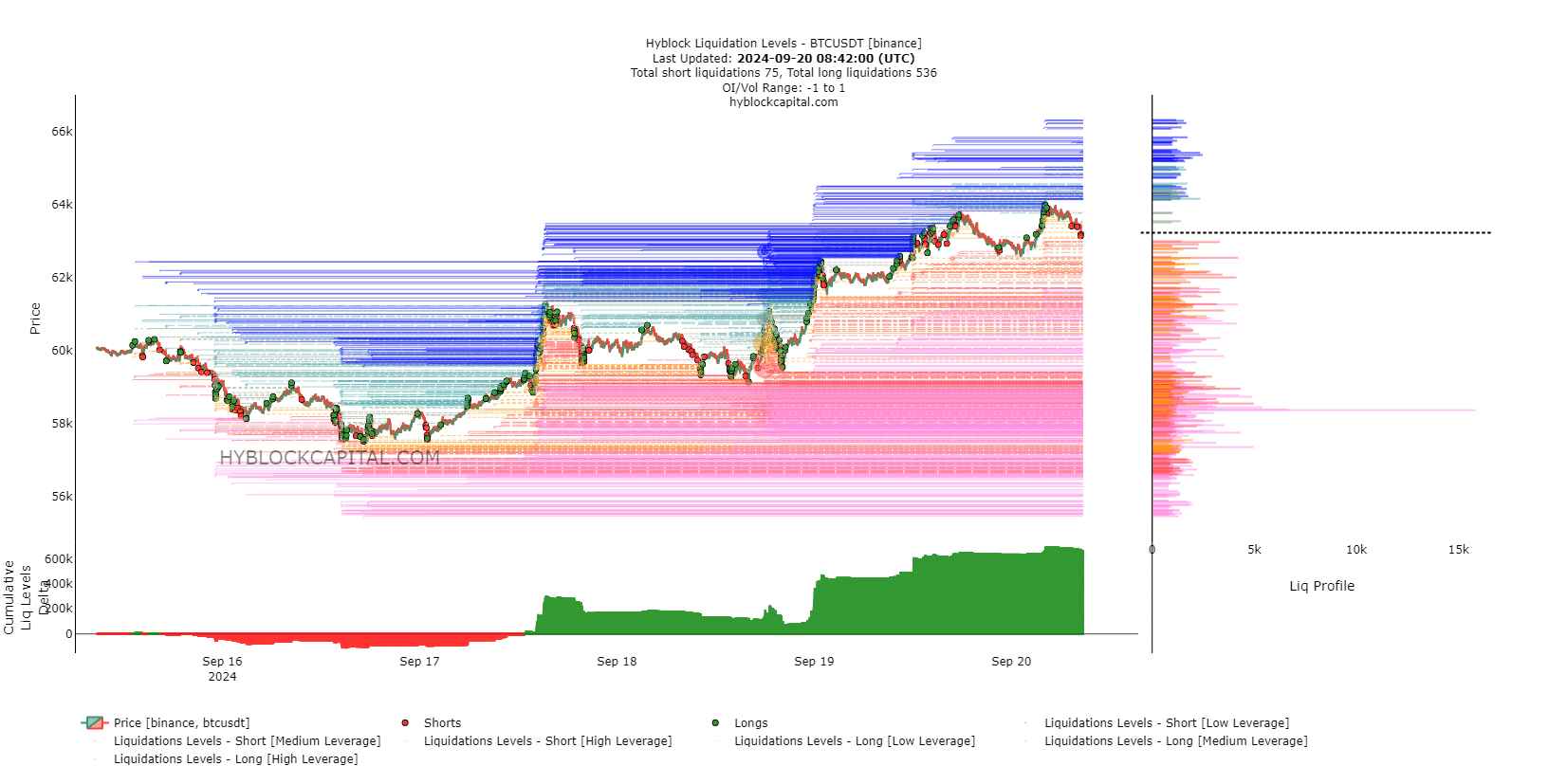

In the meantime, a big spike in Open Curiosity(OI) seemingly contributed to the surge, prompting crypto shorts to shut their positions and leading to $147M in losses.

Notably, the present OI motion mirrors the late-August pattern when Bitcoin examined $64K, suggesting that BTC could also be approaching that worth once more.

Nevertheless, if an analogous pattern unfolds, the probability of a breakout diminishes, as BTC bears may re-enter the market, thwarting one other try at breaking by means of.

In easy phrases, regardless of the speed lower, Bitcoin nonetheless faces vital challenges in testing $64K earlier than a wider breakout may be anticipated. So, had been the losses from crypto shorts resulting from a “short” squeeze?

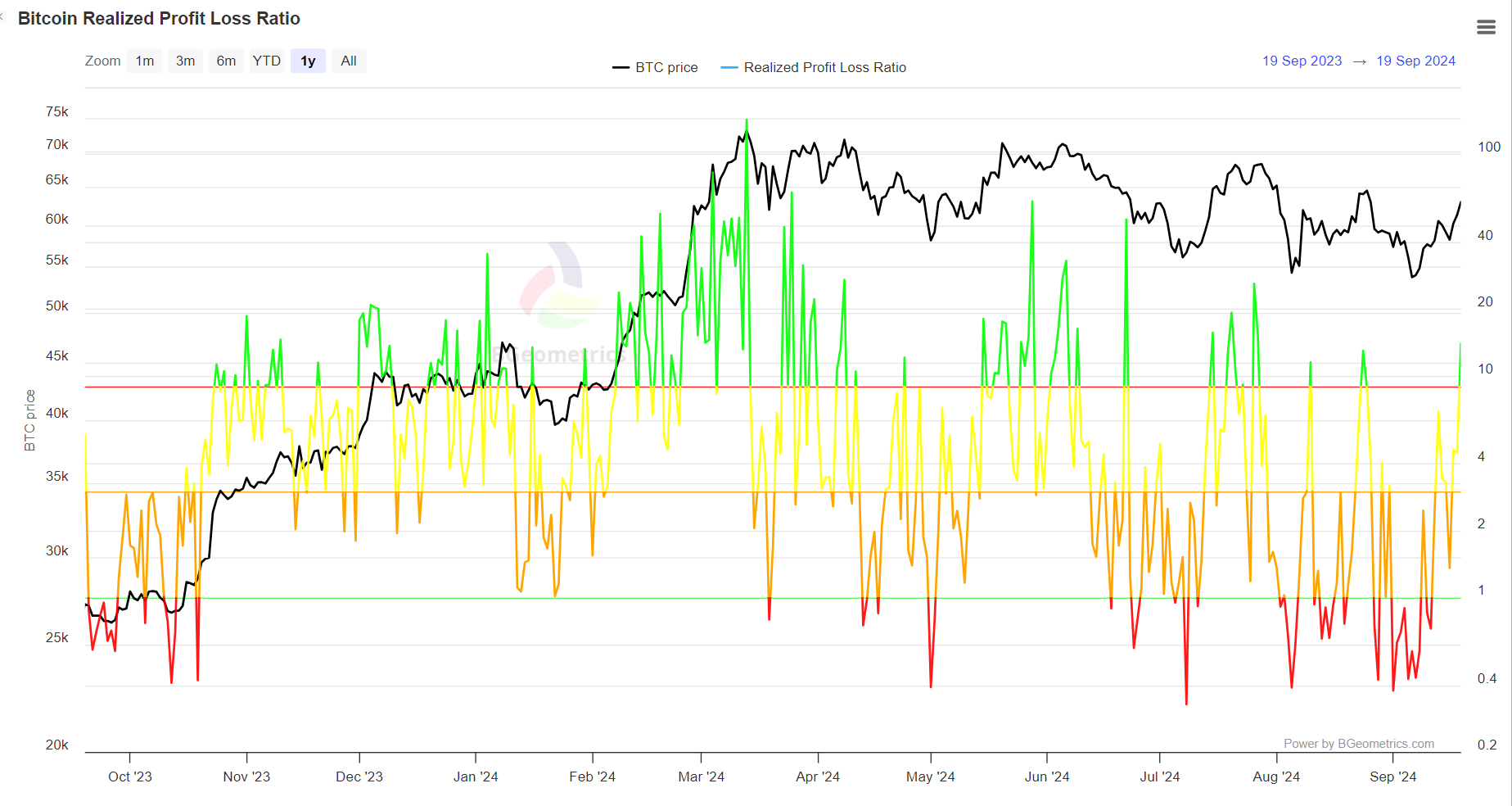

Stakeholders in internet revenue

The chart beneath signifies the positions of stakeholders in response to cost adjustments. At the moment, a good portion of consumers are within the revenue zone, marked by the inexperienced wig.

Traditionally, surges on this ratio have coincided with market tops. Nevertheless, over the past $64K peak, the spike was short-lived as crypto shorts shortly cashed in on their good points.

If this pattern repeats, a breakout may stall as merchants exit earlier than the rally fades, reinforcing the brief squeeze speculation.

Furthermore, if crypto shorts resurge, bulls could have to seize one other alternative to push BTC towards $70K.

BTC may retrace if crypto shorts regain management

Over the previous three days, as BTC surged previous $60K, crypto shorts have retreated, permitting a big inflow of lengthy positions.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Nevertheless, a slight downward pattern may set off huge liquidations if the bulls fail to keep up help. If merchants exit and bulls retreat, a resurgence of crypto shorts may push Bitcoin again beneath $60K.

Traditionally, $64K has acted as each resistance and help, and the opportunity of a breakout hinges on investor technique. Failing to capitalize on the $147M crypto shorts squeeze may see BTC retrace to $55K.